The SEC’s Division of Investment Management said it will not recommend enforcement action when registered investment advisers use state trust companies as crypto custodians, provided advisers follow due diligence and safeguards. This guidance expands qualified custody options for client crypto assets while requiring protective procedures.

-

SEC confirms state trust companies can act as crypto custodians when advisers follow specific safeguards.

-

Relief is a limited, staff-level no-action assurance pending formal rule changes to custody requirements.

-

Regulatory debate continues: some policymakers praise the step, while others call for formal rulemaking.

state trust companies crypto custody — SEC staff allows advisers to use state-chartered trust companies as crypto custodians; review safeguards and act accordingly.

state trust companies as crypto custodians: The SEC’s Division of Investment Management issued a no-action assurance saying it will not recommend enforcement action if registered advisers use state trust companies to custody crypto, provided advisers meet due-diligence and safeguards requirements and act in clients’ best interest.

What are state trust companies as crypto custodians?

State trust companies as crypto custodians are state-chartered entities permitted to hold and safeguard digital asset private keys and related custody infrastructure for registered advisers and regulated funds. The SEC staff’s no-action assurance allows advisers to use these entities if they implement written procedures and perform client-focused due diligence.

How can advisers use state trust companies to custody cryptocurrency?

Advisers may rely on state trust companies when they determine, after due diligence, that using such an entity is in clients’ best interests. The SEC staff conditionally limited enforcement recommendations to cases where the trust company maintains custody safeguards, the adviser documents oversight, and fund managers meet custody provisions of the Investment Company Act and Investment Advisers Act.

The Division’s letter frames this as an “interim step to a longer-term modernization of our custody requirements,” according to Division of Investment Management director Brian Daly. The staff emphasized procedures designed to safeguard crypto and criteria for adviser oversight.

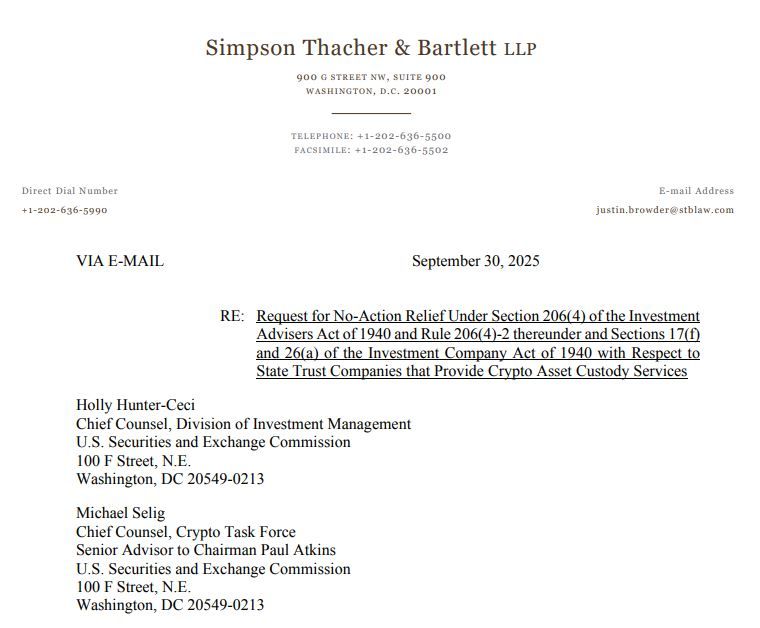

Law firm Simpson Thacher & Bartlett requested assurances from the SEC that state trust companies could custody cryptocurrency assets. Source: SEC

Law firm Simpson Thacher & Bartlett requested assurances from the SEC that state trust companies could custody cryptocurrency assets. Source: SEC

Why did the SEC issue this no-action assurance?

The staff relief responds to industry requests for clarity about acceptable custodians for crypto assets, reducing uncertainty for registered advisers and regulated funds. It signals an intent to broaden custody options while the SEC considers formal rule changes under its regulatory flex agenda.

The current statutory regime requires client assets to be held by qualified custodians. The staff letter indicates proposed rule amendments are forthcoming to modernize custody rules for digital assets.

Who supports or opposes the change?

Supporters note the guidance provides practical clarity. SEC Commissioner Hester Peirce said it ends a “guessing game” and could benefit advisory clients and fund shareholders. Market analysts and some industry participants said the move will expand custody capacity and help adoption.

Critics, including Commissioner Caroline Crenshaw, argued the staff should not make changes through no-action letters and that formal rulemaking with public comment is necessary to preserve statutory protections and fairness among applicants for national charters.

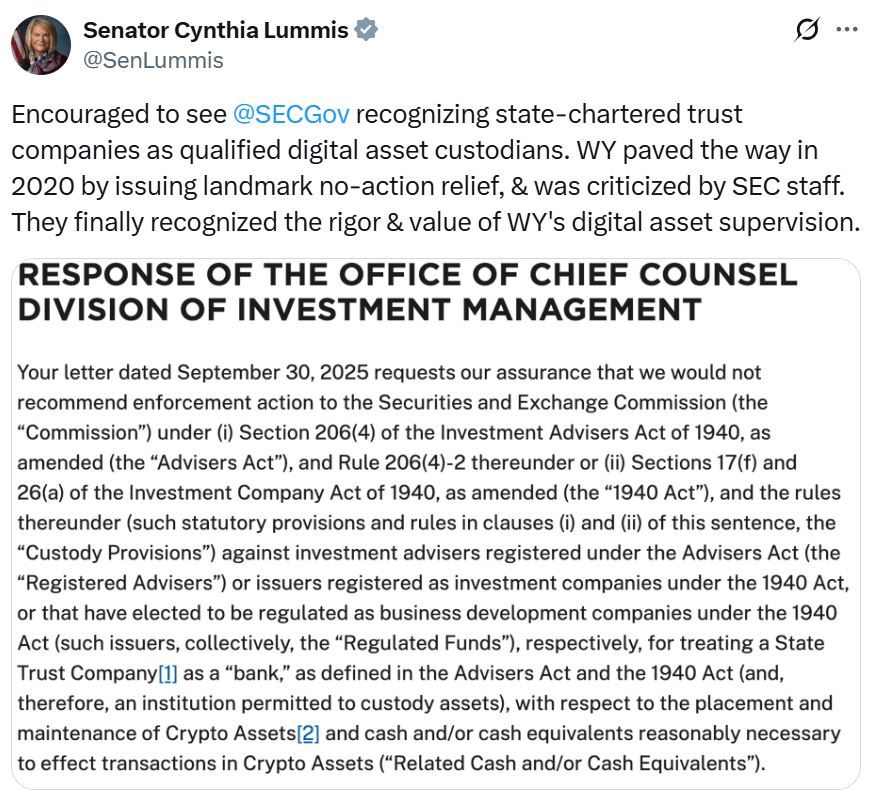

Public reaction included comments from Bloomberg ETF analyst James Seyffart and observers on social media platforms (formerly Twitter). Wyoming Senator Cynthia Lummis also expressed encouragement, citing state-level actions beginning in 2020.

Source: Cynthia Lummis

Source: Cynthia Lummis

Frequently Asked Questions

Are tokenized securities covered by the SEC’s assurance?

Yes. The staff indicated coverage extends to client crypto assets held by registered advisers and crypto asset investments of regulated funds that are subject to custody provisions, including tokenized securities.

Will this immediately create more custodians?

Potentially. By expanding viable custody entities, the assurance may encourage state trust companies to offer custody services. Market participants expect an increase in qualified custodial options over time.

Key Takeaways

- Staff-level relief: The SEC Division of Investment Management will not recommend enforcement action when advisers use state trust companies with proper safeguards.

- Conditions apply: Advisers must document due diligence, oversight, and that custody choices are in clients’ best interest.

- Rulemaking likely: The assurance is an interim step while the SEC considers formal custody rule modernization through proposed amendments.

Conclusion

This staff no-action assurance clarifies that state trust companies can serve as crypto custodians for registered advisers when appropriate safeguards and documented oversight are in place. The move expands custody options now and sets the stage for formal rule updates; advisers should review policies and prepare for forthcoming regulatory changes.

Publication date: 2025-10-07. Updated: 2025-10-07.