JUP Drops 78% With Recovery Signs Emerging From Key Support

JUP faces steep losses but positive catalysts and technical recovery signals suggest potential for a rebound. Execution and community support remain critical.

The JUP market is at a crossroads: on one hand, it is facing strong selling pressure, while on the other, it is supported by positive news and technical recovery signals.

Will JUP soon find a bottom to bounce, or continue its downward slide?

Fundamental Motivation

Jupiter (JUP) has recently announced a series of important developments that could act as medium-term catalysts. The project launched JupNet integrated with BitcoinKit, opening the door for native BTC cross-chain DeFi. If successful, JupNet would allow BTC capital to easily flow into DeFi applications such as lending, yield farming, and multi-chain liquidity, thereby enhancing Jupiter’s practical use case.

At the same time, 21Shares – one of Europe’s most reputable crypto investment product issuers – unveiled AJUP, an ETP-like product enabling direct exposure to JUP. The presence of AJUP helps JUP reduce its dependence on retail-driven flows and increases recognition from traditional markets.

If effectively implemented, these moves will improve the utility of the ecosystem and strengthen Jupiter’s ability to attract institutional capital.

Technical Signals: Bounce Potential from the $0.41 Zone

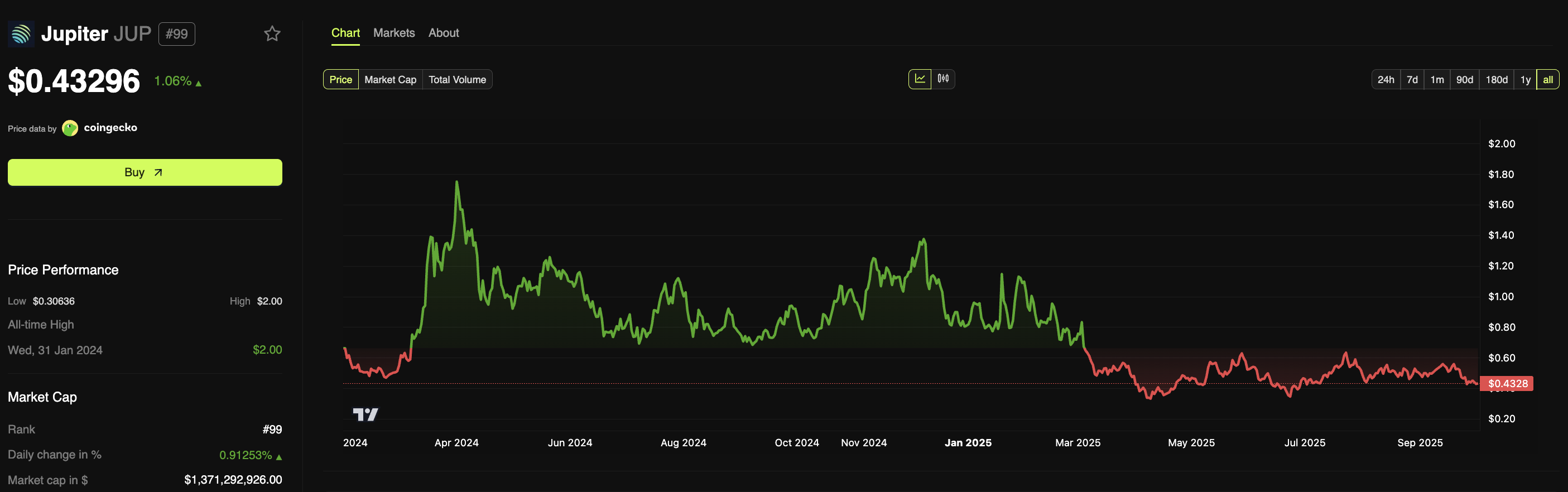

On the spot market, however, JUP has been under heavy pressure as the price plunged from its peak. Data from BeInCrypto shows that JUP has fallen by 78% from its all-time high, marking a steep JUP drop. Trading volumes and liquidity data highlight the scale of sell-offs, while market cap and TVL suggest a gap between price action and on-chain fundamentals.

JUP price action. Source:

BeInCrypto

JUP price action. Source:

BeInCrypto

Technically, short-term charts show JUP bouncing slightly from support around $0.41. Moving Averages near $0.44–$0.45 act as key resistance levels. Indicators such as MACD hint at a bullish crossover, while RSI climbs up from oversold territory. This indicates a fair chance of a short-term rebound.

However, bears still dominate overall momentum. A decisive break above $0.45 could target $0.48 next.

JUP 4H chart. Source:

X

JUP 4H chart. Source:

X

That said, community sentiment plays a crucial role. Partnerships alone may not be sufficient. Many community members call for measures like buybacks or token burns to reduce circulating supply and restore confidence, which could support price action.

“yall needa do some more buybacks and burns or something man. This is pitiful price action. I know yall are making a shit ton and should have a healthy warchest to paint a nice chart to give investors and holders something to believe in.” – X user.

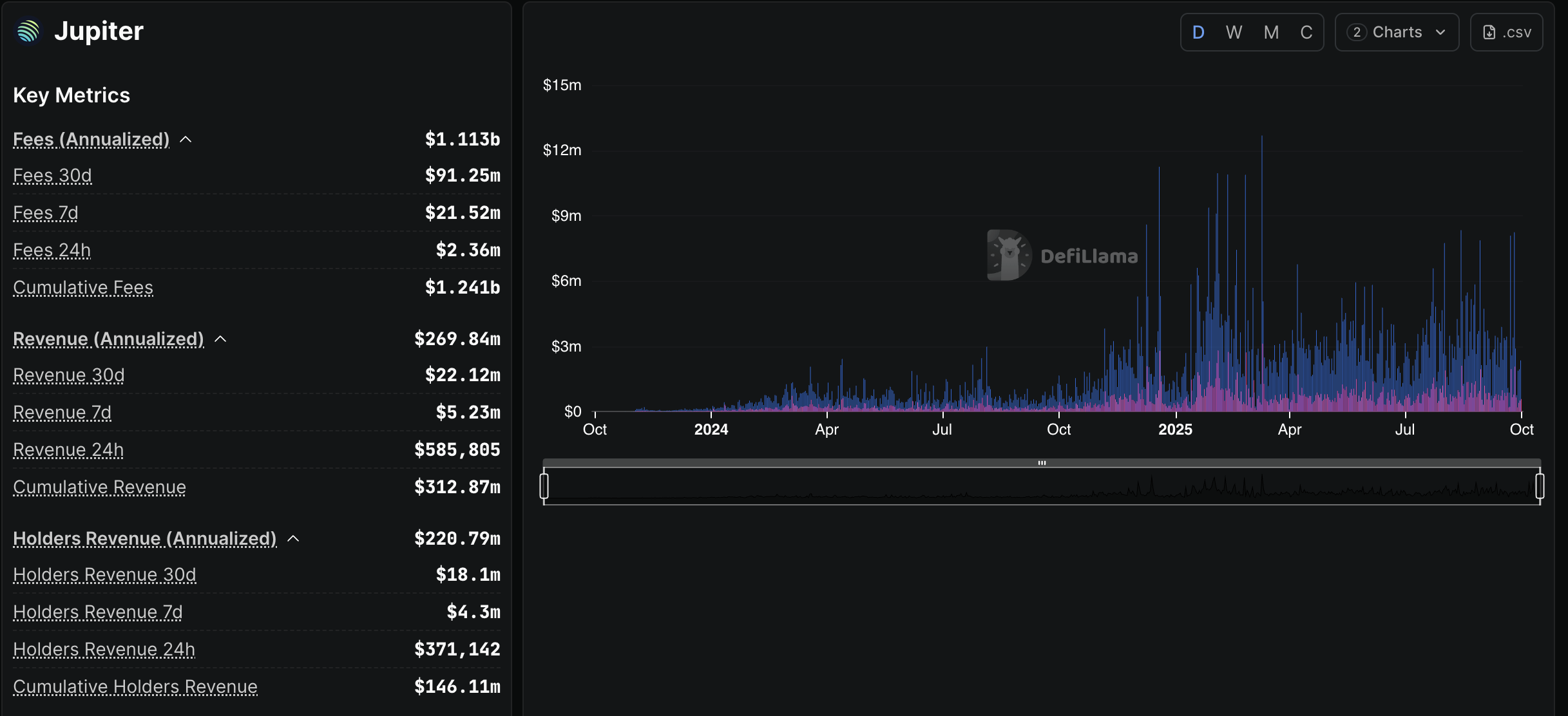

Data from DefiLlama shows that Jupiter is still one of the top four DEX Aggregates in terms of trading volume in the past 24 hours. Cumulative fees and revenue to date are $1.24 billion USD and $313 million USD, respectively.

Jupiter metrics. Source:

DefiLlama

Jupiter metrics. Source:

DefiLlama

Additionally, as reported by BeInCrypto, Meteora’s allocation of 3% TGE to JUP stakers is seen as a smart liquidity move to encourage staking and create sustainable token demand. If liquidity and staking initiatives are executed well, they could ease short-term selling pressure and improve the on-chain structure.

In summary, the path to recovery for JUP is real but not automatic. It depends on whether positive catalysts can be executed effectively, selling pressure subsides, and community confidence is restored through governance measures or meaningful on-chain adjustments.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Privacy’s HTTPS Moment: From Defensive Tool to Default Infrastructure

A summary of the "Holistic Reconstruction of Privacy Paradigms" based on dozens of speeches and discussions from the "Ethereum Privacy Stack" event at Devconnect ARG 2025.

Donating 256 ETH, Vitalik Bets on Private Communication: Why Session and SimpleX?

What differentiates these privacy-focused chat tools, and what technological direction is Vitalik betting on this time?

Ethereum Raises Its Gas Limit to 60M for the First Time in 4 Years

DeFi: Chainlink paves the way for full adoption by 2030