New York Tightens Crypto Custody Rules: Actual Ownership of Digital Assets Remains with Customers Even in Bankruptcy

Jinse Finance reported that the New York State Department of Financial Services (NYDFS) has issued updated guidelines clarifying how licensed cryptocurrency custodians (VCEs) should structure custody arrangements to ensure that the actual ownership of digital assets remains with the clients, even in the event of bankruptcy. This update reflects the surge in demand for virtual asset custody from both retail and institutional clients and reiterates the department's expectations for sound custody and disclosure practices across the industry. The new regulations also set up guardrails for the operational framework of sub-custodians to ensure that client interests are protected throughout the entire asset lifecycle (from deposit and safekeeping to withdrawal and transfer), while minimizing the risk of asset shortfalls in the event of bankruptcy of a custodian or sub-custodian. Equally important, the guidelines reaffirm the department's stance on the permitted uses of custodial client assets. Companies are prohibited from arranging client assets in ways that could compromise clients' ownership or priority in the event of bankruptcy. The US SEC emphasized that the structure of custody arrangements should ensure that clients' beneficial rights remain clear, explicit, and enforceable in the event of bankruptcy. This includes clear and prominent disclosures explaining how assets are held, any third parties involved, and the actual impact on clients in stress events.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

OpenAI report: Enterprise AI applications surge

BlackRock: The wave of capital flowing into AI infrastructure is far from peaking

US crypto stocks opened higher, with MSTR up 2.61% and BMNR up 4.9%.

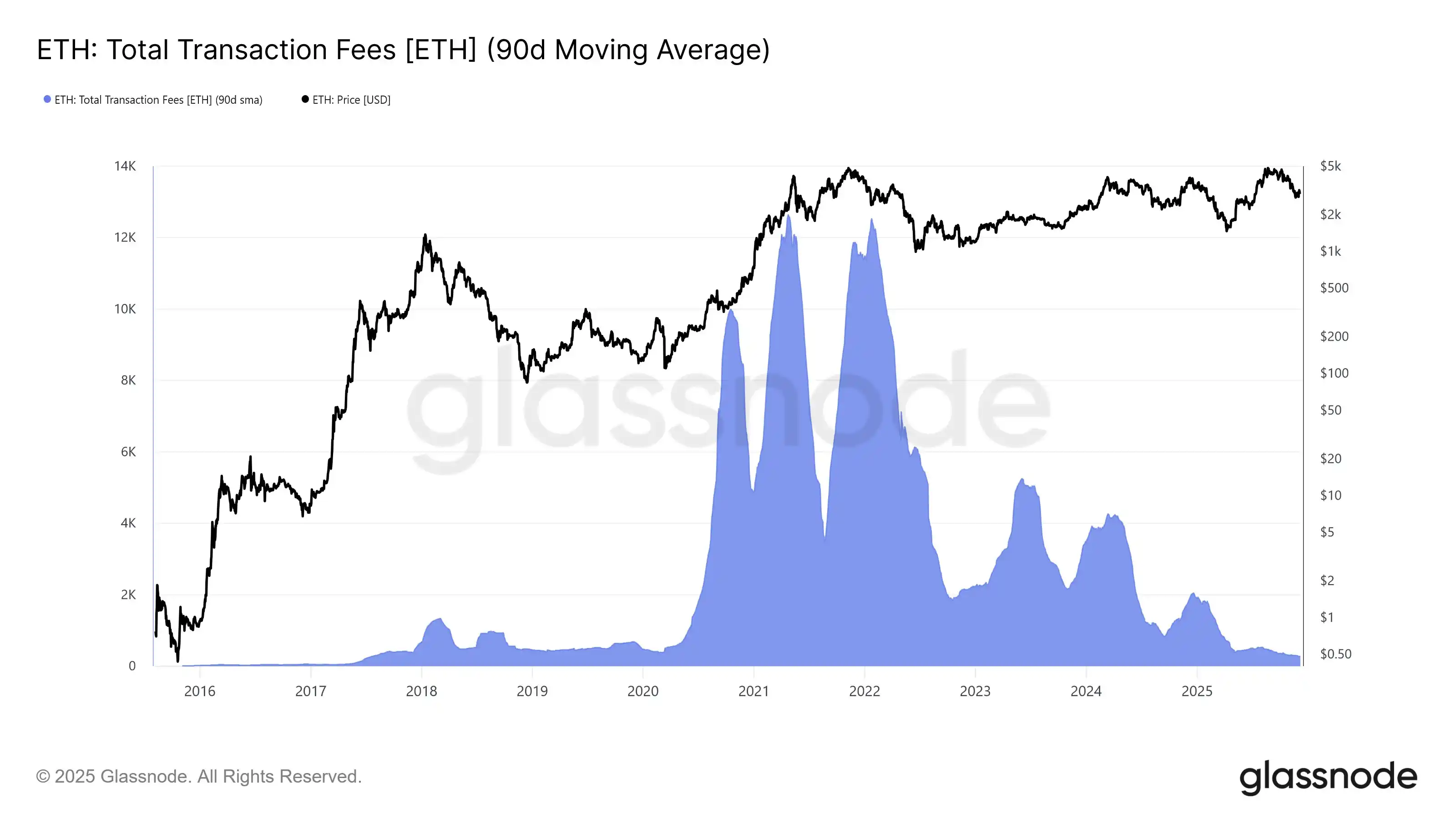

Ethereum network’s average daily total transaction fees hit the lowest level since July 2017