Bitcoin Price Prediction: Fidelity & Bitwise Fuel Optimism as BTC Nears $120K

Bitcoin Price Prediction: Momentum Builds Near $120K

Bitcoin (BTC) is currently trading just under $119,000, after briefly touching $119,400 earlier in the day. The cryptocurrency has maintained strong momentum this week, consolidating above the $116,000 support zone. The psychological resistance level at $120K is now the key barrier for traders and investors.

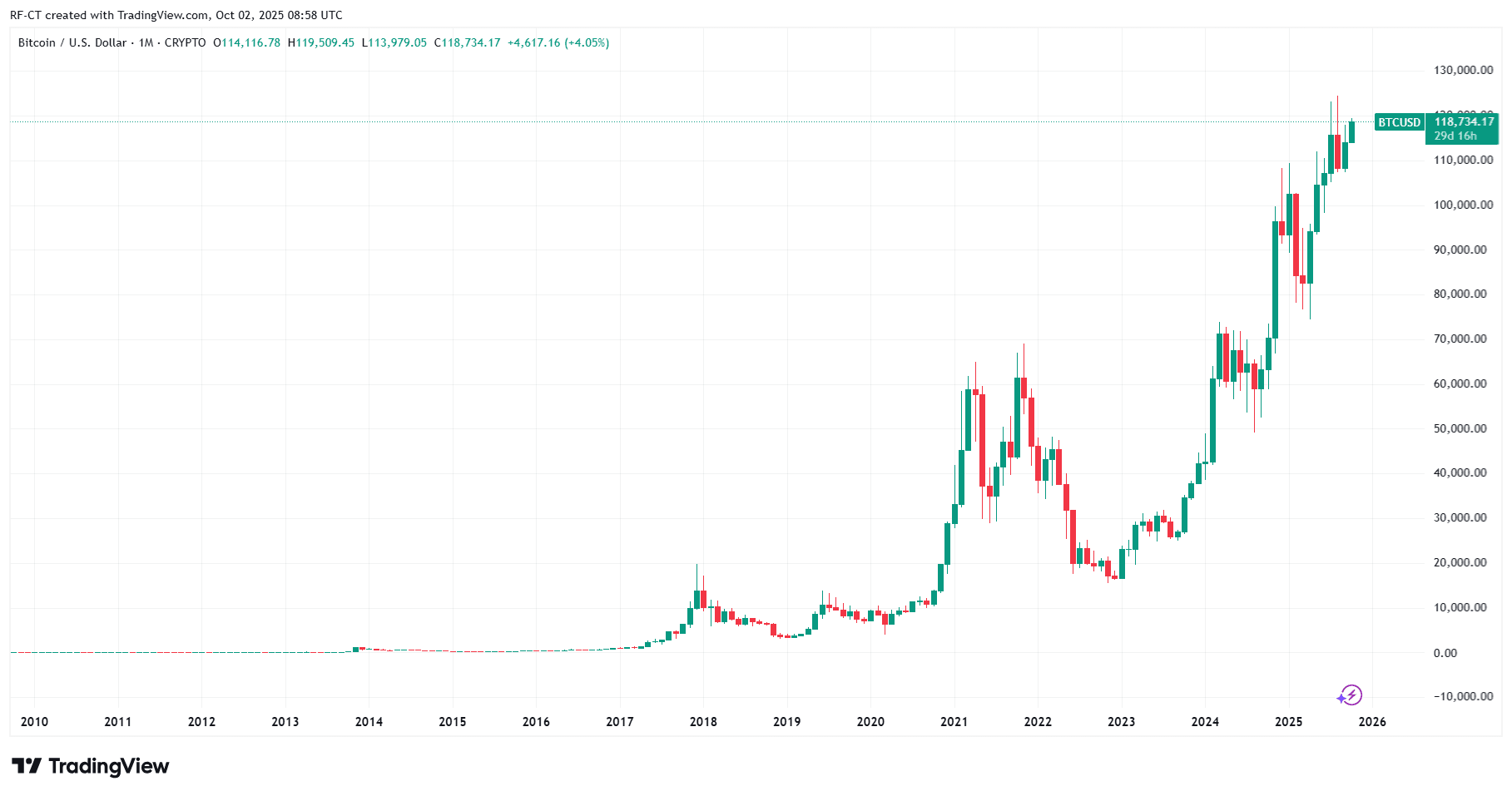

By TradingView - BTCUSD_2025-10-02 (All)

By TradingView - BTCUSD_2025-10-02 (All)

The latest Bitcoin price prediction suggests that if BTC manages to close decisively above $120K, a push toward $122K–$124K could follow. However, failure to hold $116K may drag the price back toward the $112K–$114K range.

Fidelity & Bitwise Buy $238.7 Million in Bitcoin

The big headline boosting market sentiment today is the news that Fidelity Investments and Bitwise collectively purchased $238.7 million worth of Bitcoin. Institutional buying at this scale strengthens confidence in BTC’s long-term potential , especially as these firms are key players in the ETF and asset management space.

This move highlights the ongoing institutional shift into Bitcoin, reinforcing BTC’s position as a digital store of value and making it increasingly attractive to traditional investors.

Technical Outlook: What to Watch Next

- Resistance: $120K remains the immediate resistance. A breakout could open the door to $124K.

- Support: $116K is the first key support, followed by the broader $112K–$114K range.

- Momentum: The RSI and moving averages remain supportive of further gains as long as BTC holds above $116K.

Traders should also keep an eye on spot ETF inflows, as renewed institutional demand has often correlated with upward momentum.

Bitcoin Price Prediction: Short-Term and Long-Term Outlook

- Short-Term: BTC is expected to test $120K multiple times in the coming hours . If broken, bullish momentum could extend quickly.

- Long-Term: Institutional adoption, combined with macroeconomic uncertainty and the upcoming halving cycle, continues to provide strong upside potential.

With Fidelity and Bitwise increasing their exposure, Bitcoin’s narrative as a long-term hedge against inflation and a key asset in diversified portfolios remains stronger than ever.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

$8.8 billion outflow countdown: MSTR is becoming the abandoned child of global index funds

The final result will be revealed on January 15, 2026, and the market has already started to vote with its feet.

Deconstructing DAT: Beyond mNAV, How to Identify "Real vs. Fake HODLing"?

There is only one iron rule for investing in DAT: ignore premium bubbles and only invest in those with a genuine flywheel of continuously increasing "crypto per share."

Empowered by AI Avatars, How Does TwinX Create Immersive Interaction and a Value Closed Loop?

1. **Challenges in the Creator Economy**: Web2 content platforms suffer from issues such as opaque algorithms, non-transparent distribution, unclear commission rates, and high costs for fan migration, making it difficult for creators to control their own data and earnings. 2. **Integration of AI and Web3**: The development of AI technology, especially AI Avatar technology, combined with Web3's exploration of the creator economy, offers new solutions aimed at breaking the control of centralized platforms and reconstructing content production and value distribution. 3. **Positioning of the TwinX Platform**: TwinX is an AI-driven Web3 short video social platform that aims to reconstruct content, interaction, and value distribution through AI avatars, immersive interactions, and a decentralized value system, enabling creators to own their data and income. 4. **Core Features of TwinX**: These include AI avatar technology, which allows creators to generate a learnable, configurable, and sustainably operable "second persona", as well as a closed-loop commercialization pathway that integrates content creation, interaction, and monetization. 5. **Web3 Characteristics**: TwinX embodies the assetization and co-governance features of Web3. It utilizes blockchain to confirm and record interactive behaviors, turning user activities into traceable assets, and enables participants to engage in platform governance through tokens, thus integrating the creator economy with community governance.

Aster CEO explains in detail the vision of Aster privacy L1 chain, reshaping the decentralized trading experience

Aster is set to launch a privacy-focused Layer 1 (L1) public chain, along with detailed plans for token empowerment, global market expansion, and liquidity strategies.