The SEC’s no-action relief allows advisers to custody client crypto with state-chartered trust companies without facing enforcement, clearing a regulatory hurdle for institutional adoption. This guidance reduces legal uncertainty, supports custodial growth, and speeds integration of crypto services into traditional finance.

-

Advisers can now use state-chartered trust companies for client crypto custody without SEC enforcement risk.

-

Market concentration remains high among ~10 major custodial firms, but regulatory clarity may invite new entrants.

-

Research from 360iResearch projects crypto custody could grow from $2.9B (2024) to $7.7B (2032), accelerating with this guidance.

SEC no-action relief crypto custody: SEC clears state trust custody for advisers, reducing enforcement risk and boosting institutional uptake. Read analysis and next steps.

What is the SEC’s no-action relief for crypto custody?

The SEC no-action relief for crypto custody is a non-binding assurance that the agency will not pursue enforcement against advisers who use state-chartered trust companies to custody client crypto assets. It removes near-term legal uncertainty and encourages advisers to integrate regulated custodial solutions into client services.

How did the SEC arrive at this decision?

The relief followed a request from legal counsel for institutional clients seeking clarity on custody practices. The SEC framed the guidance as a way to reduce enforcement risk for advisers relying on state trust companies while maintaining investor protections. Commissioner Hester Pierce welcomed the shift, noting it reduces regulatory gray areas that could otherwise “definitely hurt investors.”

How will this affect the custodial crypto market?

The guidance is expected to accelerate institutional adoption and expand custodial product development. About 10 major firms — including Coinbase, Anchorage, BitGo, Fireblocks, and Fidelity — currently dominate custody services, which supports compliance but concentrates systemic risk. Research from 360iResearch forecasts the market expanding from $2.9 billion in 2024 to $7.7 billion by 2032, a trajectory likely to move faster with clearer federal-level assurance.

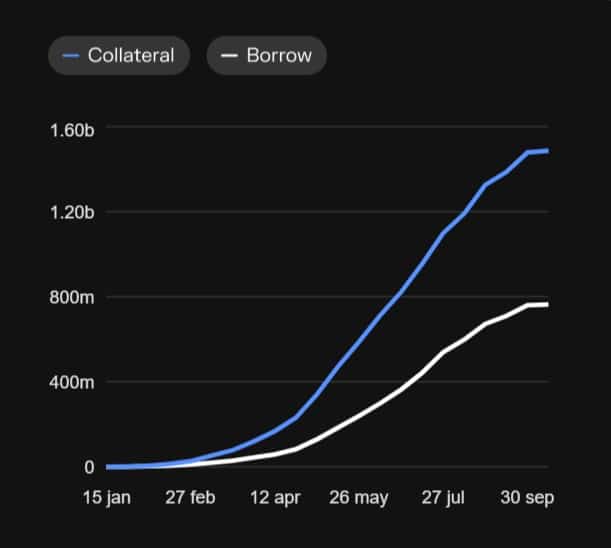

Custodial providers are expanding beyond safekeeping into yield, lending, and tokenization services. Coinbase’s Bitcoin-backed loans surpassed $1 billion after eight months, reflecting growing client demand for asset-backed financial products. Source: 360iResearch. Source: Morpho.

The SEC’s legal clarity reduces frictions for fund managers, venture firms, and wealth advisers who previously hesitated to custody digital assets. As custody becomes a reliable foundation, expect more financial products built on secured crypto holdings, boosting interoperability between traditional and digital markets.

What should advisers and custodians do next?

- Review custody agreements and compliance programs to align with SEC guidance.

- Conduct operational and security audits of chosen state trust custodians.

- Document due diligence and client disclosures to reduce enforcement exposure.

Frequently Asked Questions

Will this lead to more competition among custodians?

Yes. Regulatory clarity lowers market entry barriers, encouraging new state-chartered trust companies and fintech entrants to offer custody services, though large incumbents retain scale advantages.

How should investors interpret this guidance?

Investors should view the guidance as a positive signal for institutional infrastructure, but continue to assess custodian security, insurance, and counterparty risks before allocating assets.

Key Takeaways

- Regulatory clarity: The SEC’s no-action relief reduces enforcement uncertainty for advisers using state trust custodians.

- Market impact: Custody market growth may accelerate from $2.9B to $7.7B by 2032 (360iResearch), spurring product innovation.

- Action items: Advisers should update agreements, complete custodian due diligence, and document reliance on the guidance.

Conclusion

SEC no-action relief for crypto custody provides practical assurance that should encourage advisers and institutions to integrate state-chartered trust custodians into client solutions. By reducing enforcement risk and validating custodial models, the guidance supports market maturation and product innovation. Advisers should act now to align policies and document compliance to capture these opportunities.