The ECB has signed framework agreements with seven technology providers to build components of a potential digital euro — covering fraud detection, secure payment-data exchange and offline payments — with a possible launch targeted for 2029, pending EU legislation and Governing Council approval.

-

ECB signs framework agreements with seven tech providers for digital euro components

-

Agreements cover fraud and risk management, secure exchange of payment information and offline payment capability.

-

At least one more partner is expected; ECB says contracts involve no payments yet and timeline hinges on Digital Euro Regulation.

Digital euro framework: ECB signs agreements with tech providers for fraud management, offline payments and secure data exchange; possible launch in 2029. Read COINOTAG.

What is the digital euro?

The digital euro is a central bank digital currency (CBDC) under development by the European Central Bank (ECB) intended to provide a secure, widely accessible digital form of central bank money for euro-area citizens. The ECB has concluded framework agreements with technology providers to develop core components while preserving final launch decisions for the Governing Council.

How will the ECB implement the digital euro components?

The ECB announced framework agreements with seven entities and expects at least one additional partner to provide services such as fraud detection, secure exchange of payment information, and software development. Named suppliers include Feedzai (fraud detection using AI) and Giesecke+Devrient (security engineering and offline payment capability).

The agreements are non-payable at this stage and include contractual safeguards that permit scope adjustments to align with the eventual Digital Euro Regulation and any Governing Council decisions.

The ECB said it had reached agreements with seven entities not yet involving “any payment” responsible for components of the digital euro, potentially launching in 2029.

The ECB, in its preparation phase for a possible digital euro, has moved from concept to contracting with technology providers responsible for individual components of a central bank digital currency (CBDC). The framework agreements define roles, deliverables and safeguards without authorizing implementation payments yet.

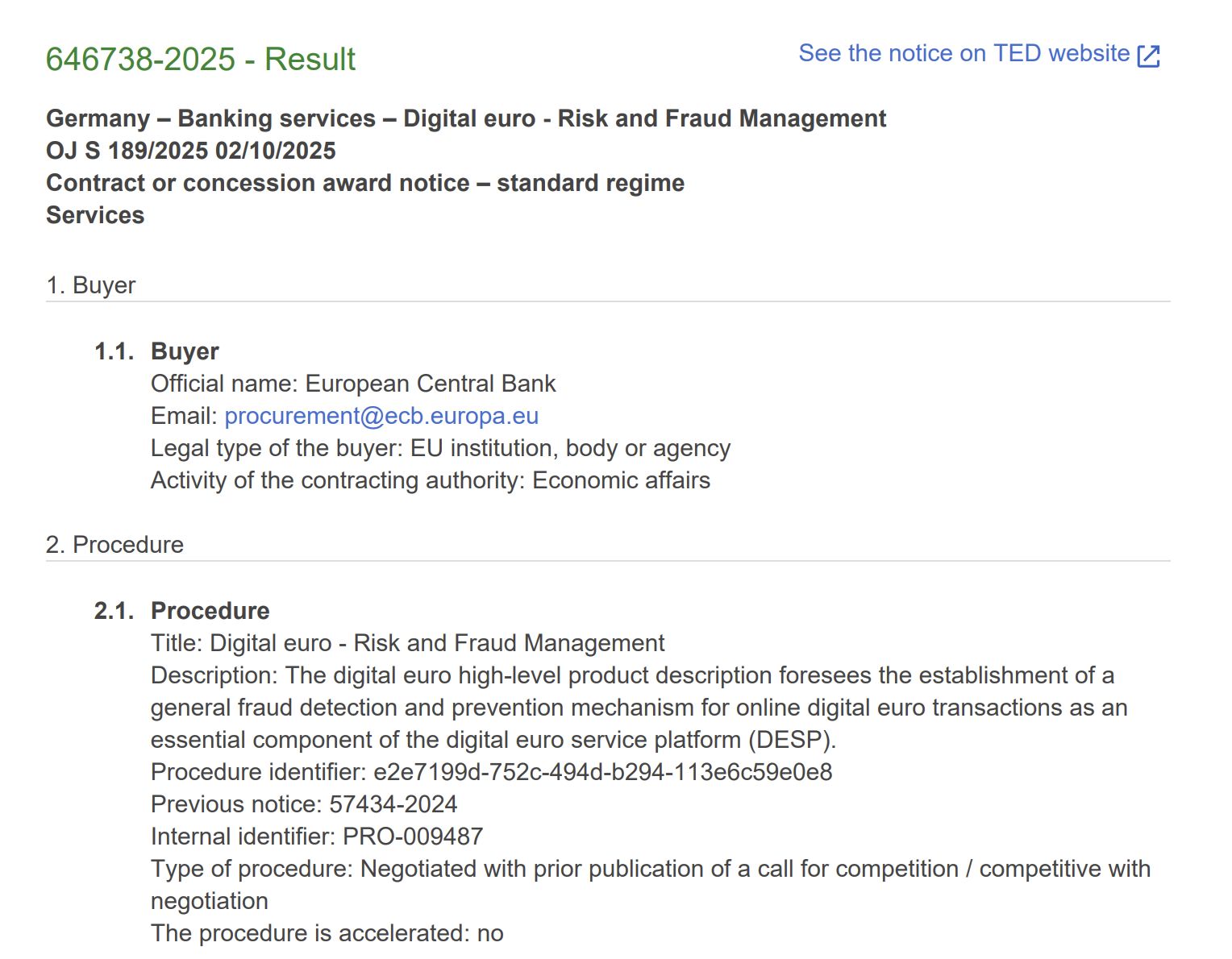

Agreements with technology companies for risk and fraud management of the potential digital euro. Source: ECB

Agreements with technology companies for risk and fraud management of the potential digital euro. Source: ECB

Why are these technology agreements important?

Framework agreements let the ECB map out technical responsibilities early, reducing integration risk and preserving policy flexibility. Providers will plan and prototype elements such as alias lookup, fraud detection, secure payment-data exchange and offline transaction support.

Giesecke+Devrient noted it will work with the ECB to finalise timelines and design under the guidance of the Governing Council and EU legislation.

What services will vendors provide?

- Fraud and risk management: Real-time analytics and AI-driven detection (example provider: Feedzai).

- Secure exchange of payment information: Encrypted data flows and interoperability layers for PSPs and banks.

- Offline payment capability: Engineering allowing users to make or receive digital euro payments without network connectivity.

- Alias lookup: Senders can route funds using an alias rather than PSP account details.

When could the digital euro launch?

ECB officials state that a launch will only occur after the Digital Euro Regulation is adopted and the Governing Council approves the next phase. An ECB official has indicated a 2029 target is possible, subject to legal and policy clearance.

EU regulatory context and stablecoin concerns

EU authorities, including the ECB and European Systemic Risk Board, have been vocal about potential market risks posed by certain stablecoins. Regulators are considering restrictions on jointly issued stablecoins and asking lawmakers to address cross-border regulatory exposure.

ECB President Christine Lagarde has urged EU legislators to act on risks from stablecoins issued under MiCA and by non-EU firms. These regulatory discussions will shape the digital euro’s design and market interaction.

Summary comparison of key components

| Fraud risk management | Detect and prevent illicit activity | Feedzai |

| Security engineering | Platform design and secure hardware/software | Giesecke+Devrient |

| Offline payments | Enable payments without network access | Giesecke+Devrient (engineering) |

| Alias lookup | User-friendly routing without PSP details | Various successful tenderers |

Frequently Asked Questions

Will the framework agreements mean immediate deployment?

No. The ECB states these are framework agreements that do not involve any payments at this stage and allow scope adjustments pending legislation and Governing Council decisions.

Who are some named technology partners?

Named participants include Feedzai for fraud detection and Giesecke+Devrient for security engineering and offline payment capability. Additional successful tenderers will be announced as the process continues.

How does the digital euro affect stablecoin regulation?

EU authorities are intensifying scrutiny of stablecoins to mitigate market risks, which may influence how privately issued stablecoins coexist with a public digital euro.

Key Takeaways

- Framework agreements signed: The ECB contracted seven entities to design digital euro components without any payments yet.

- Core capabilities targeted: Fraud detection, secure payment-data exchange, alias lookup and offline payments are priorities.

- Launch conditional: A 2029 launch is possible but depends on the Digital Euro Regulation and Governing Council approval.

Conclusion

The ECB’s framework agreements mark a significant operational step toward a potential digital euro, assigning technical responsibilities while preserving legislative and governance safeguards. Market participants and policymakers should watch the Digital Euro Regulation process closely as it will determine timelines and implementation scope. For ongoing coverage and analysis, follow updates from COINOTAG.