Ethereum is entering a critical phase as it pushes higher after its recent correction, with analysts pointing to key resistance levels and potential outperformance against Bitcoin in the coming weeks.

The second-largest cryptocurrency is currently trading near $4,376, with technical momentum indicators showing signs of recovery. The Relative Strength Index ( RSI ) has bounced from oversold territory, signaling renewed buying interest after weeks of decline.

Analysts See ETH Outperformance Ahead

Crypto trader Michaël van de Poppe suggested that Ethereum may soon lead the market once Bitcoin’s current bounce slows down. According to him, the sequence could unfold with Bitcoin first making a short-term rally, followed by a pullback, giving Ethereum the chance to accelerate. This shift, he argues, could also lift the broader altcoin ecosystem.

He highlighted Ethereum’s performance against Bitcoin as a key signal, noting that the ETH/BTC pair has held up well despite recent corrections, which could pave the way for stronger momentum in October.

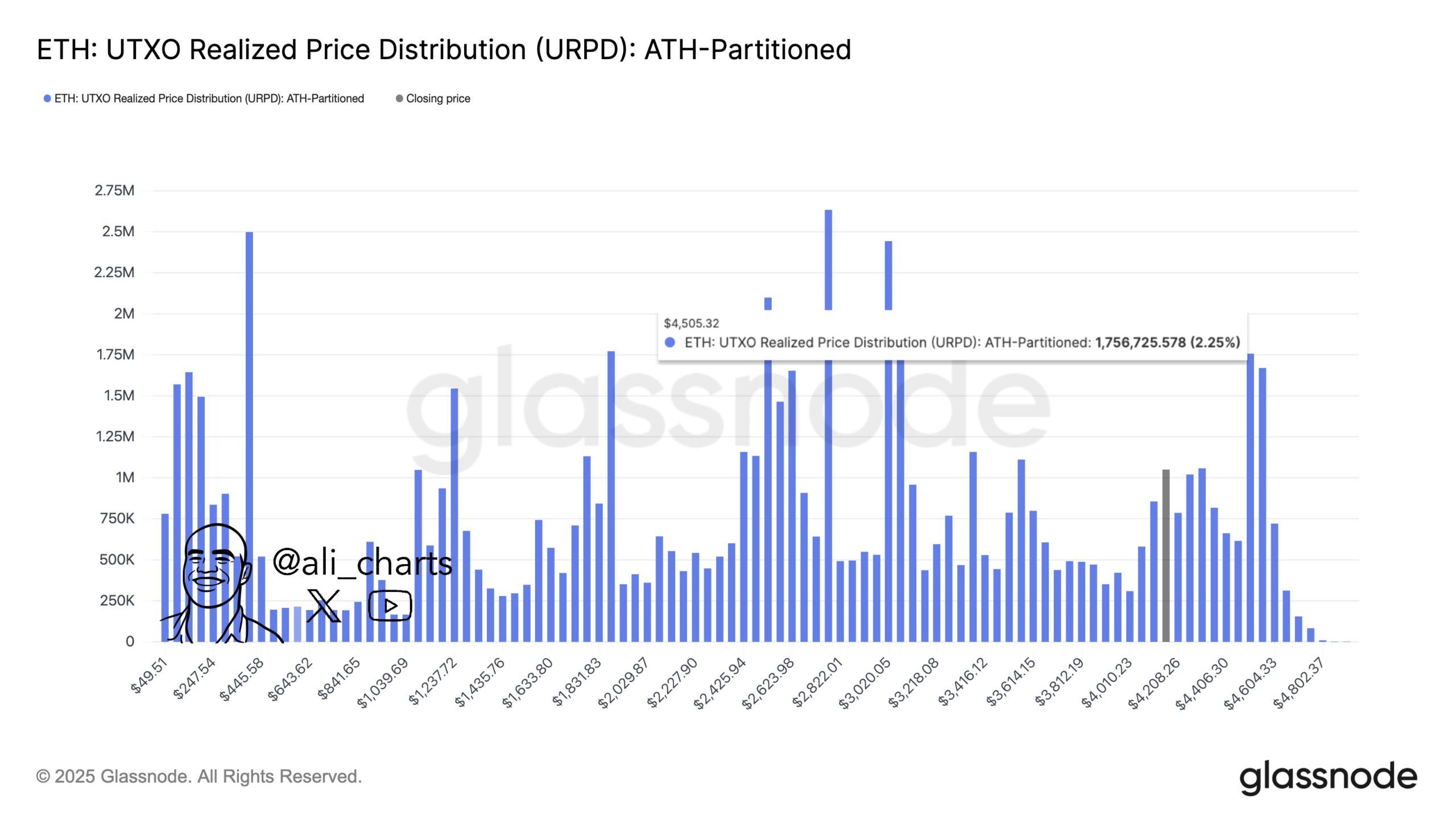

Resistance at $4,505

Market analyst Ali emphasized that $4,505 is the crucial price barrier for Ethereum. On-chain data from Glassnode shows this level as one of the most heavily traded zones historically, meaning ETH must break through it convincingly to sustain its rally.

If Ethereum manages to clear $4,505, analysts believe the asset could retest previous highs and potentially extend its gains, especially with the market entering the final quarter of 2025, a period historically favorable for crypto.

For now, traders are closely watching whether Ethereum can build on its recovery and confirm a breakout above resistance, setting the stage for another strong move in the weeks ahead.