XLM price signals possible bullish reversal after trendline break

After piercing its descending trendline, XLM price is testing key resistance and could be poised for a bullish reversal.

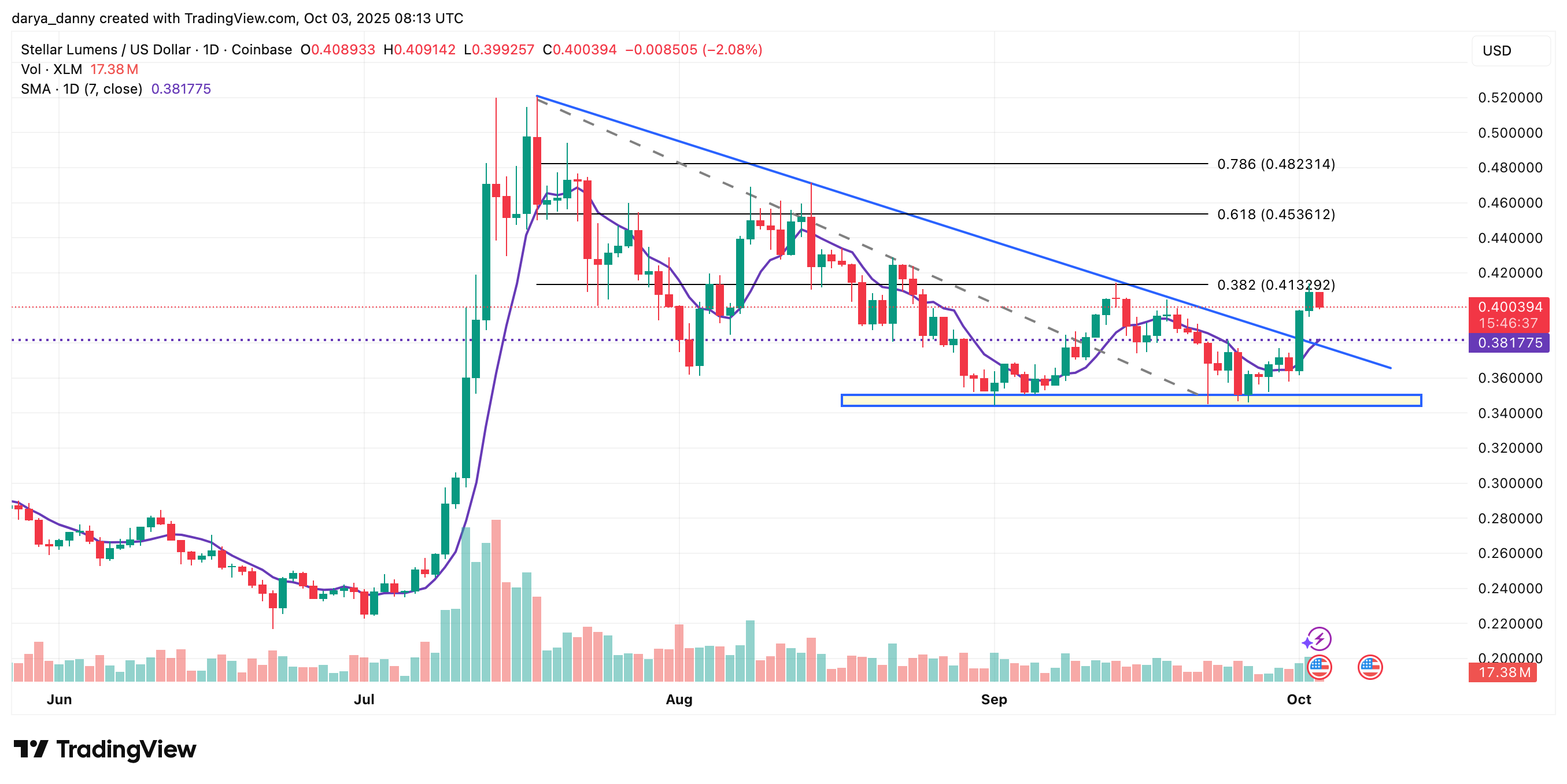

- XLM price is hovering near $0.40, testing the 0.382 Fib retracement and double-bottom neckline at $0.41.

- A confirmed daily close above $0.41 could trigger a breakout toward $0.48, the 0.786 Fib level and major supply zone.

Stellar ( XLM ) price has recently broken above its descending trendline resistance with a strong bullish candle and is now facing a critical test at the 0.382 Fib near $0.41, with price currently hovering around $0.40. Importantly, this zone also serves as the neckline of the bullish double-bottom formation, with the pattern’s lows established in the $0.34–$0.35 range.

A daily close above $0.41 would confirm the double-bottom breakout and strengthen the bullish case, potentially setting XLM on course for a measured move toward $0.48, which aligns with the 0.786 Fib.

However, traders should be cautious of near-term overextension. If rejection at $0.41 holds, XLM price could revisit its breakout area around $0.38, or even fall back toward the $0.34–$0.35 demand zone. A breakdown below this support would invalidate the bullish double-bottom structure and resume downward pressure.

Source: TradingView

Source: TradingView

What’s driving XLM price?

A couple of noteworthy integration developments have emerged this week for Stellar , adding momentum to XLM price technical breakout. Yesterday, the Bitcoin.com Wallet announced full support for XLM and assets on the Stellar network, along with DeFi features such as swaps, liquidity pools, and yield farming . LOAN Protocol has also recently added support for Stellar, enabling users to lend and borrow XLM instantly with LOAN token incentives.

On the institutional side, XLM’s accessibility is getting a boost through ETFs. The recently approved Hashdex Nasdaq Crypto Index US ETF now includes XLM as part of its diversified crypto portfolio. Grayscale has also recently filed for a spot Stellar ETF, which, if approved, could further boost XLM price.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin’s “Silent IPO”: A Sign of Market Maturity and Future Implications

AiCoin Daily Report (November 15)

Surviving Three Bull and Bear Cycles, Dramatic Revival, and Continuous Profits: The Real Reason Curve Became the “Liquidity Hub” of DeFi

Curve Finance has evolved from a stablecoin trading platform into a cornerstone of DeFi liquidity through its StableSwap AMM model, veTokenomics, and strong community resilience, demonstrating a sustainable development path. Summary generated by Mars AI. The accuracy and completeness of this summary, generated by the Mars AI model, are still in the process of iterative improvement.

![[Bitpush Daily News Selection] Financial Times: Tether is considering leading a funding round of approximately $1.16 billion for German tech startup Neura Robotics; the US SEC has issued post-shutdown document processing guidance, and multiple crypto ETFs may be expedited; US Bureau of Labor Statistics: September 2025 employment data will be released on November 20, and October state employment and unemployment data will be released on November 21.](https://img.bgstatic.com/multiLang/image/social/06829a455cc5ced5cafaf4b9bf53d5281763243641786.png)