IOSG Ventures: As DeFi integrates with mobile, the next wave of consumer-grade applications is on the way

Original Title: "IOSG Weekly Brief| DeFi and Mobile Integration: The Next Wave of Consumer Applications is on the Way"

Original Author: Max, IOSG Ventures

Key Points TL;DR

Retail investment in traditional finance (tradfi) has already gone mobile (zero commission + app user experience), and this trend is spreading to the crypto sector—retail users are seeking a fast, familiar, low-friction, mobile-native trading experience.

The Hyperliquid tech stack (HyperEVM + CoreWriter + builder code) significantly lowers the development threshold for mobile frontends, while balancing CEX-like execution efficiency with DEX advantages (self-custody, rapid token listing, fewer geographic/KYC restrictions).

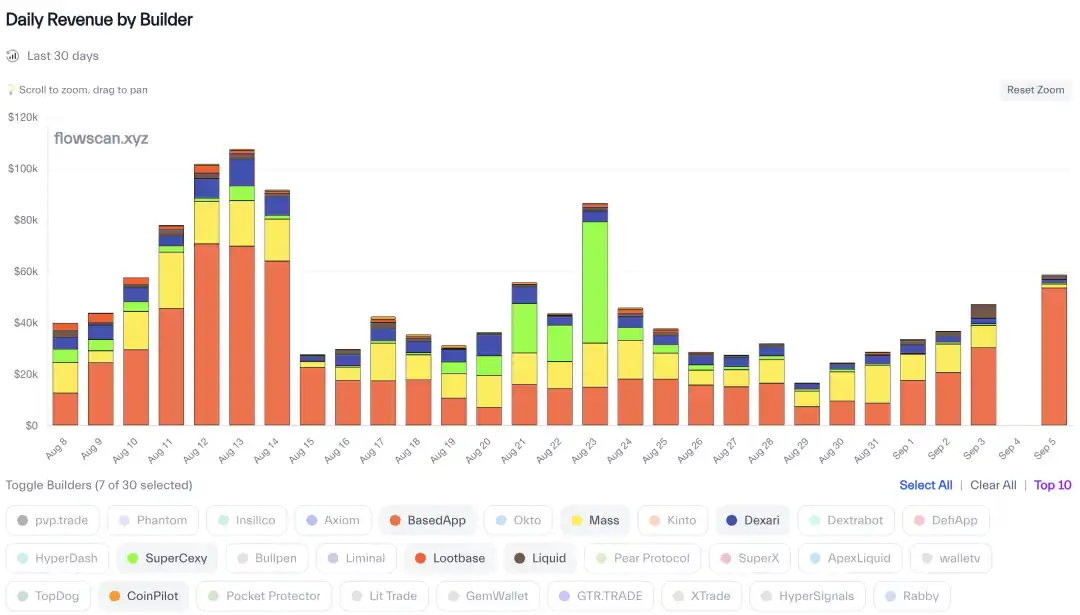

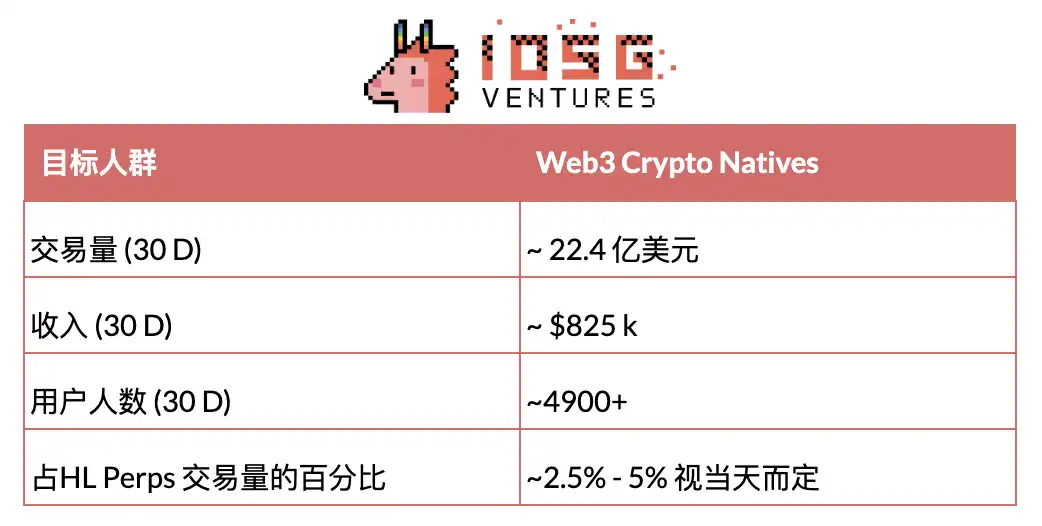

The wave of native mobile applications based on HL has begun: BasedApp, Mass.Money, Dexari, Supercexy. These apps have a daily trading volume of $50,000 (monthly recurring revenue of $1.5 million), accounting for about 3-6% of HL perpetual contract trading volume, targeting different user groups (crypto-native users, Web2 retail users, professional traders).

Why now? "Hyper-speculation" + creator content cycles have raised retail users' risk appetite; mobile apps compress onboarding time, simplify crypto complexity, and add sticky features (copy trading, fiat on-ramps, card payments, money markets, yield tools).

Core arguments:

- Crypto mobile trading frontends benefit from strong tailwinds from Web2 mass audiences and retail behavior.

- For the crypto market to achieve scale and trading volume growth, more crypto-native mobile applications must be provided for mainstream Web2 consumers.

- Compared to Web3 business models, this sector has truly sustainable, scalable revenue characteristics, with extremely low marginal expansion costs.

In recent months, there has been a significant increase in mobile trading + DeFi applications targeting retail consumers, most of which are built on Hyperliquid infrastructure. This article aims to delve into this vertical, analyze the leading applications in the current market, and present related viewpoints.

Background

Overall, retail investor participation in traditional investments has seen huge growth over the past decade. This trend began in 2019, when several large US brokerages dropped stock trading commissions to zero to compete with Robinhood, greatly reducing trading costs for small accounts. The pandemic in 2020 further accelerated this process: lockdowns, stimulus checks, and continually optimized mobile experiences brought millions of newcomers into the market. By 2022, the Federal Reserve's Survey of Consumer Finances showed a significant increase in stock market participation—58% of US households directly or indirectly held stocks, with direct ownership rising from 15% to 21%, the largest historical increase.

The proportion of retail trading in daily market activity continues to stand out: it now accounts for 20-30% of US stock trading volume, far higher than pre-pandemic levels. This phenomenon is not limited to the US; it is also evident globally: the number of investment accounts in India surged from tens of millions pre-pandemic to over 200 million by 2025. Investment channels are also expanding—2024-2025 saw record ETF inflows, and the popularity of fractional shares and mobile brokerage services provides retail investors with more convenient investment tools. The cost shock from zero commissions, the channel shock from mobile trading apps, and the liquidity shock from ETFs have jointly driven retail investors into public markets en masse, making consumer-grade investment apps a major structural force in the market.

Mobile Trading Applications

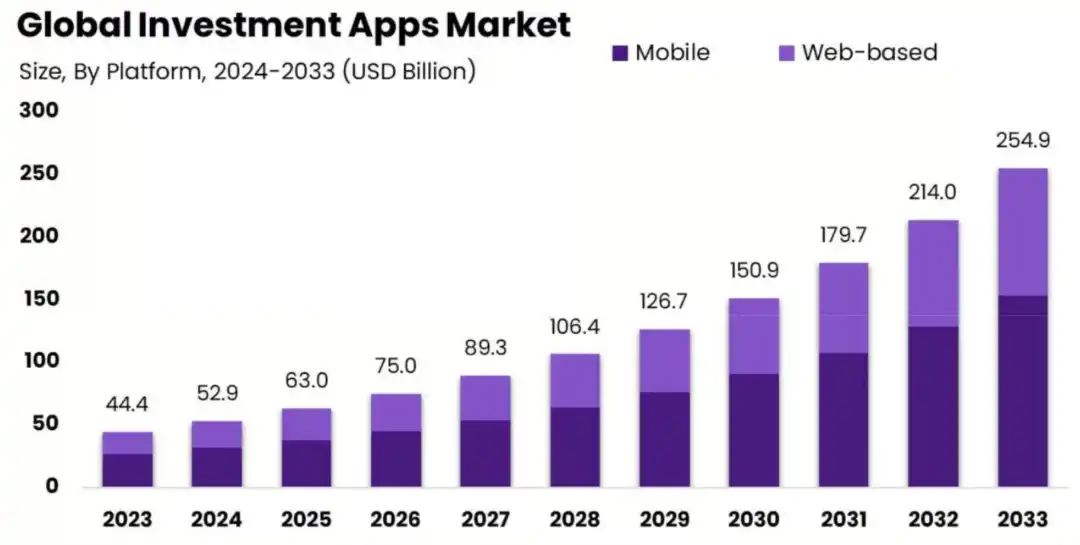

Since 2021, the mobile trading app vertical in the retail trading market has continued to expand, driven by increased mobile device penetration and the rise of a new generation of self-directed investors. The global investment app market is expected to reach about $254.9 billion by 2033, with a compound annual growth rate (CAGR) of 19.1%.

Why are mobile trading apps so favored by retail investors? The main reasons can be summarized in two dimensions:

Socially Driven (Everything Gamified, Gambling-like)

Contemporary social culture is dominated by dopamine cycles, gamification mechanisms, and hyper-speculative behavior. The rise of the creator economy and short video platforms (such as TikTok and YouTube Shorts) has reshaped user behavior patterns, with people seeking instant gratification, and mobile trading apps perfectly meeting this need on multiple levels.

On the social level, communities like Wall Street Bets on Reddit are filled with users showcasing huge profits and losses. Single-day P&L exceeding $100,000 has become normalized, and retail users are becoming desensitized to such amounts. Many users separate their Robinhood account funds from real money, treating their investment portfolios as game chips. Coupled with rising living costs, widening wealth gaps, and negative sentiment toward "involution," many wage earners believe that only "hyper-speculation" can achieve the American dream—seeking outsized returns through extremely high risk.

Mobile trading apps have successfully captured this social culture dividend. By offering short-term options, leveraged products, instant execution, and gamified interfaces, these apps have successfully attracted users from casinos to the stock market. With just a smartphone, users can simultaneously experience dopamine stimulation, gaming pleasure, and speculative excitement.

Application Features

In terms of application features, mobile trading apps have achieved significant optimization on multiple fronts. For onboarding, they have compressed the account opening process from days of tedious paperwork to near-instant online operations. All user flows, from identity verification to trade execution, are integrated into a single interface, allowing users to fully manage their investment portfolios.

On the trading experience side, by eliminating friction points of traditional brokerage models and incorporating new value points such as fractional share purchases and recurring investments, these platforms have lowered both capital and cognitive thresholds. By borrowing consumer design language from mainstream apps, they shorten the trading decision path, while personalized features (such as curated asset lists and portfolio performance analysis) keep users engaged.

Additionally, post-investment features like detailed performance reports and automated tax filing make the experience closer to a full-service financial app where users can do everything, rather than just a trading terminal. On the social side, content elements further lower usage barriers by providing easy-to-share interfaces, promoting social participation and incentives (e.g., usage behaviors driven by WSB forums). These features collectively explain why mobile platforms have become the default investment channel and a lasting driver of retail market participation.

What Impact Does This Have on the Crypto Industry?

The mobile-first application trend has already extended from traditional finance/Web2 markets to the Web3 sector.

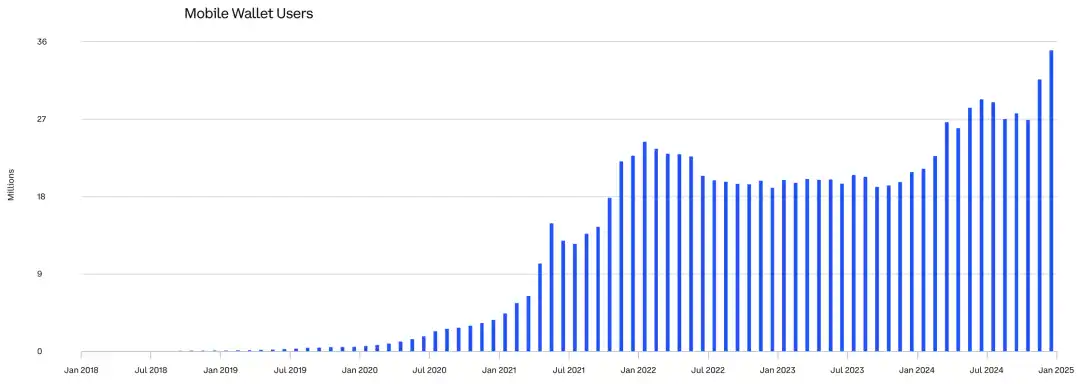

Over the past five years, usage of crypto wallet apps has surged, indicating market demand for mobile-native crypto products. Since trading and yield are innate features of crypto, perpetual contracts and DeFi have naturally become the first areas to be "mobilized."

With the rise of Hyperliquid since the end of 2024 and the launch of its modular, high-performance trading infrastructure, numerous mobile perpetual DEX trading and DeFi frontend products have begun building on HL infrastructure and entering the market.

Why Hyperliquid and DEX?

From a developer's perspective, HyperEVM infrastructure is highly attractive due to the powerful tools it offers. CoreWriter and precompiled contracts allow smart contracts on HyperEVM to interact directly with HyperCore perpetual contract positions, enabling unique use cases and near-instant execution. Builder code provides developers with a clear incentive layer, allowing them to share in fees when users trade through their frontend. These features not only lower the development threshold but also make HyperEVM one of the most developer-friendly platforms, attracting top teams and talent. This is why 99% of crypto mobile trading frontends choose to build on Hyperliquid.

As for why DEX? Traders are generally attracted by the structural advantages of DEXs: broader access by eliminating KYC and jurisdictional restrictions, faster token listings and richer token choices, and self-custody of funds. Previously, CEXs attracted retail users because they greatly reduced market participation complexity: offering multiple trading markets in a single mature web app, with instant execution, low slippage, high liquidity, and integrated wallet management, stable yield, fiat channels, and other auxiliary functions. But users had to bear significant counterparty risk and give up self-custody of assets.

Hyperliquid is the platform that perfectly integrates all of this. This on-chain decentralized trading platform enjoys the structural advantages of DEX perpetual contract platforms while also providing CEX-level liquidity, execution efficiency, and overall user experience. Therefore, it is the ideal liquidity base for building mobile crypto trading applications.

So How Does This Relate to Mobile Wallet Trading?

Thanks to the availability of this modular, high-performance architecture, the development cost of building mobile trading frontends has become extremely low—which is why a large number of related applications are emerging in the market.

Currently, most mobile trading frontends offer similar features centered on perpetual contract trading, but some apps have begun to go beyond perpetuals, offering users more auxiliary products. Overall, these apps generally have the following features:

- Fiat on-ramp channels: support for credit/debit cards, bank transfers, Apple Pay, Google Pay, Venmo, and other deposit methods

- Investment strategy tools: provide recurring investment plans, take-profit/stop-loss functions, and early access to new tokens

- Money market integration: one-stop access to DeFi lending protocols

- Yield generation: earn returns through auto-compounding vaults

- Dapp explorer: search for and connect to emerging decentralized applications

- Debit/credit card services: spend directly using self-custodied funds

The realization of these features is thanks to Hyperliquid infrastructure, which greatly simplifies the development difficulty of the main perpetual contract product, allowing teams to focus on innovation in other derivative areas. Due to the modular nature of the entire ecosystem, most HL-based projects can easily achieve parallel development across multiple domains. Many apps can offer rich features mainly because: 1. Hypercore builder code has a low development threshold; 2. Other protocols are highly willing to integrate.

In addition, major applications mainly compete in user experience/interface design and social brand building. The most promising representatives in the current market include:

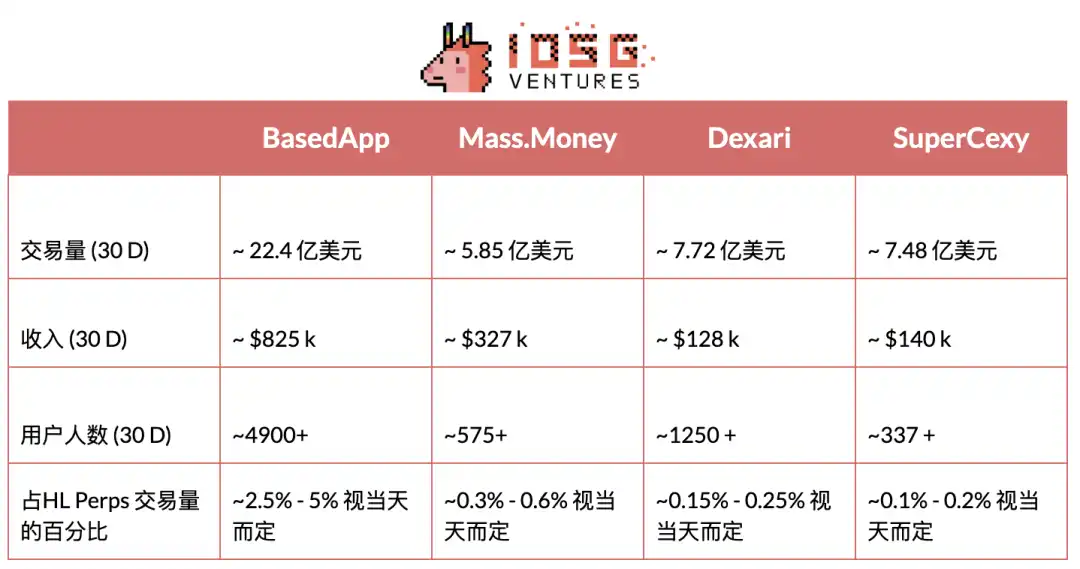

Basedapp

Currently, Based app is the most watched and fastest-growing mobile trading frontend application in the market. In addition to offering perpetual and spot trading, the platform has innovatively launched a debit/credit card solution directly connected to users' trading wallets, supporting payment needs in daily consumption scenarios. Its long-term goal is to transform into an emerging digital bank similar to Etherfi.

Mass.Money

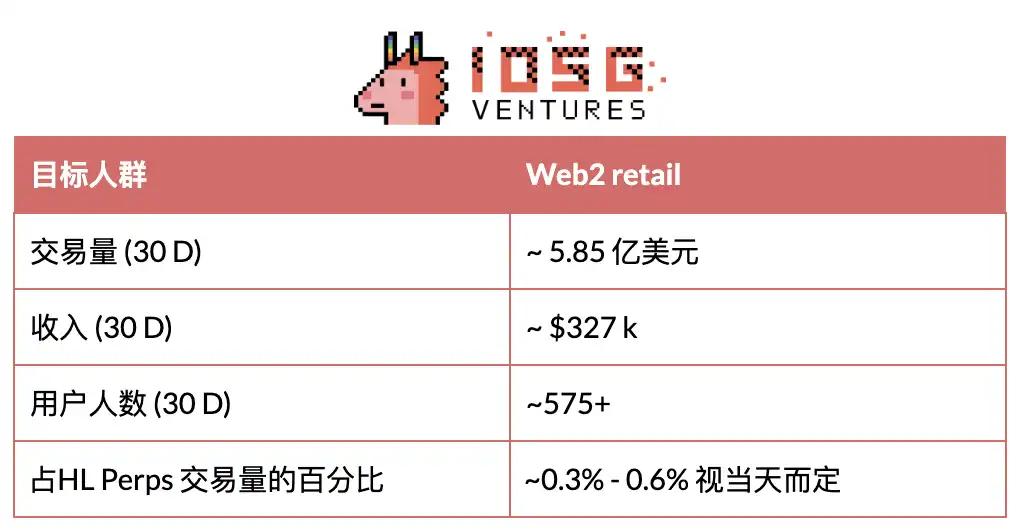

Following closely in the mobile trading frontend competition is Mass.money. Unlike Based app, this platform focuses more on the Web2 retail user group, which is fully reflected in its product design: in addition to standard HL perpetual and spot trading, it also integrates Apple Pay on-ramp, social copy trading, DeFi money market access, and cross-chain EVM spot swaps, among other full-featured services. Its interface design deeply incorporates gamification elements, heavily borrowing from the design language of Web2 consumer apps.

However, due to its higher fee model and broader product suite, its per-user revenue and trading volume are significantly higher than Basedapp.

Dexari

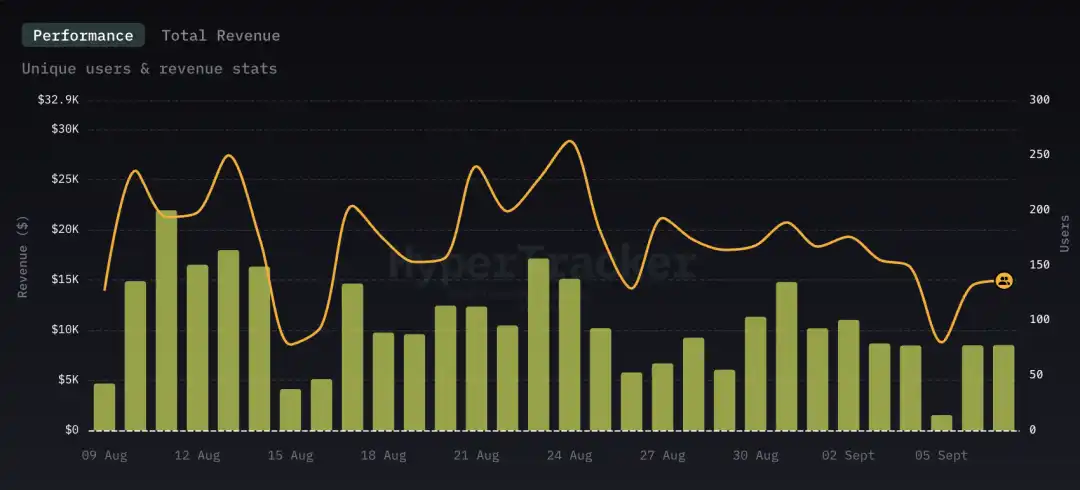

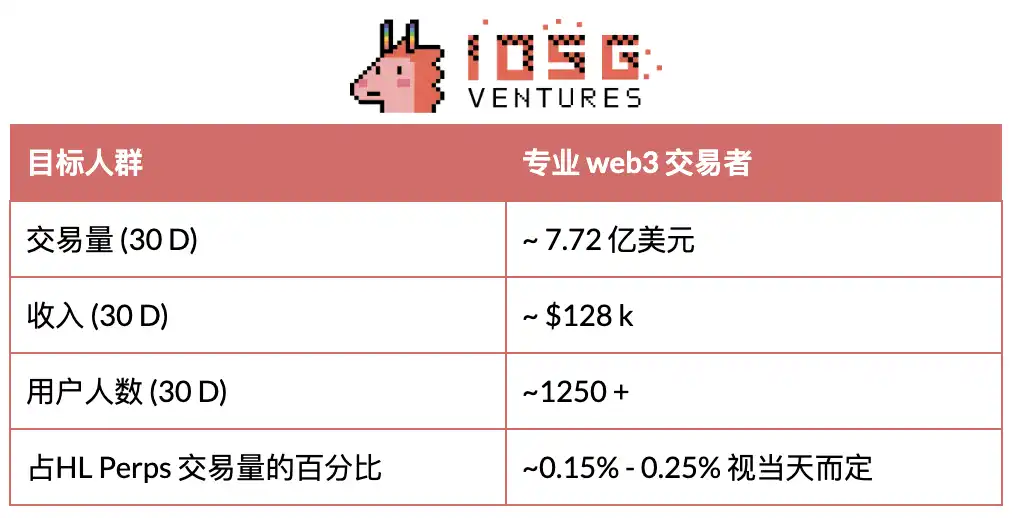

Following Mass.money is Dexari. This is a mobile trading frontend focused on professional traders, purely centered on trading functions. Therefore, its main product features include HL perpetual and spot trading, with user experience and interface design emphasizing asset discovery, analytical tools, and execution efficiency. Their goal is to become the Axiom (professional trading benchmark) of the mobile trading frontend field.

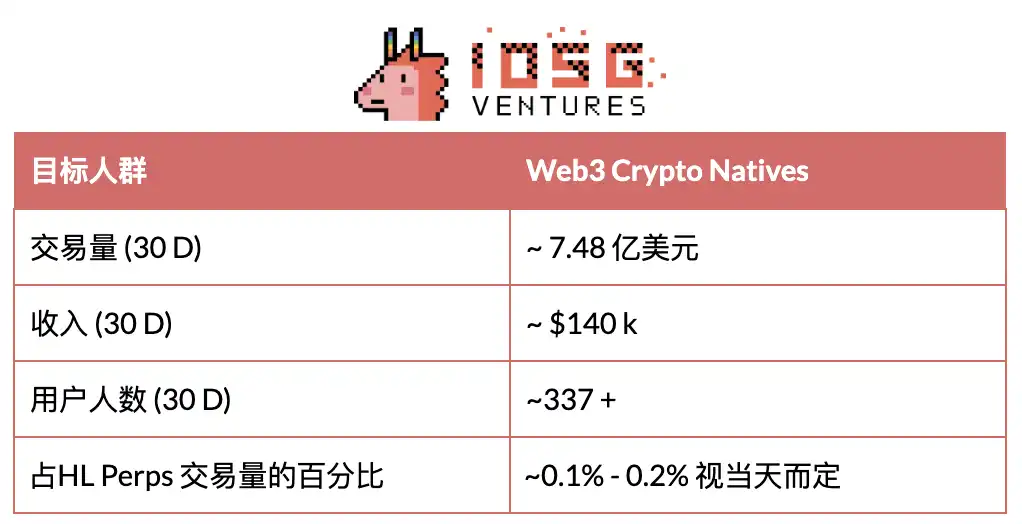

Supercexy

Last but not least is Supercexy. This platform did not choose a pure mobile frontend route, but is also optimizing the web-based perpetual DEX trading experience, aiming to provide a CEX-like user experience but fully based on Hyperliquid infrastructure. Its product suite integrates DeFi staking and money market access services, so the app mainly serves Web3 native traders.

Comprehensive Perspective

Overall Overview

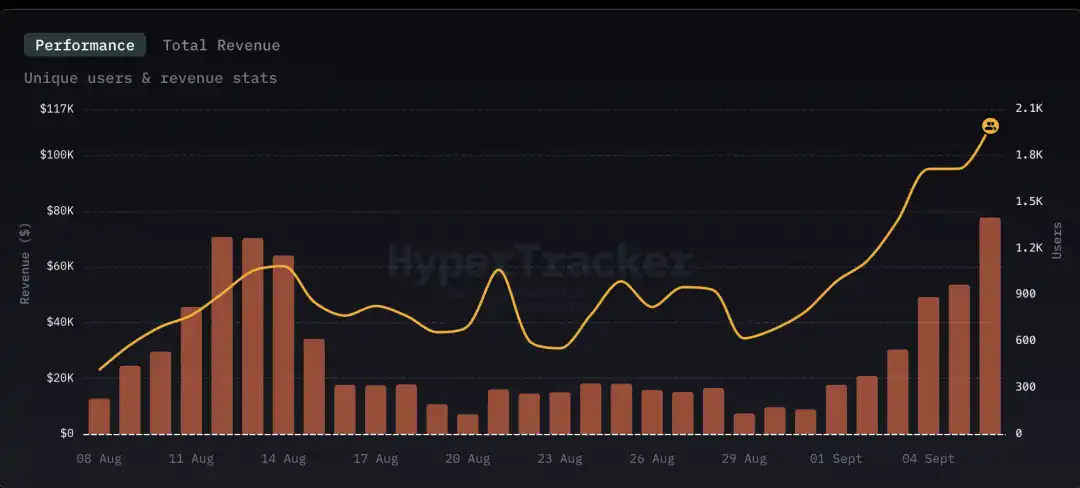

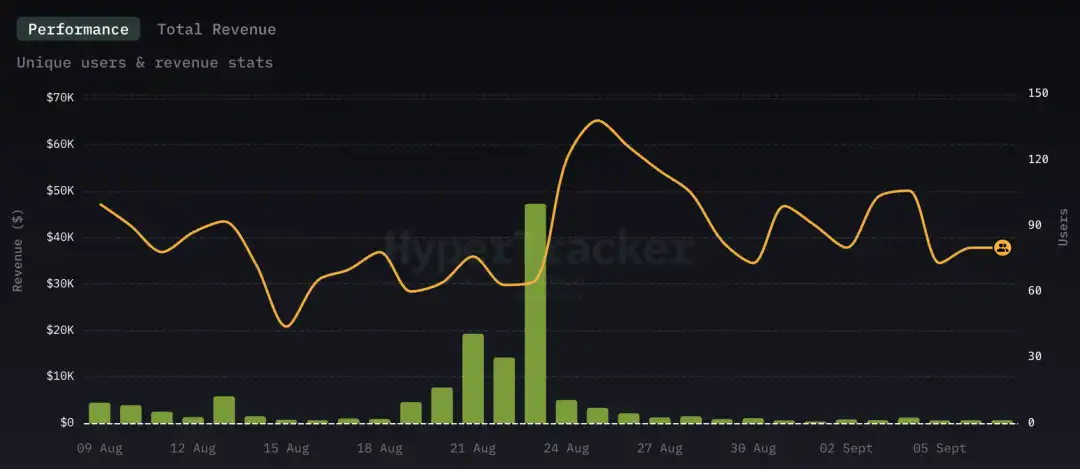

Overall, all related mobile trading frontends (including some unmentioned apps) have a combined average daily revenue of about $50,000, equivalent to about $1.5 million in monthly recurring revenue (MRR). These apps account for about 3%-6% of Hyperliquid's total perpetual contract trading volume. For reference, Hyperliquid's HLP vault accounts for about 5%.

Hyperliquid mobile trading frontend revenue

Summary

Key Points

1. Crypto mobile trading frontends benefit from strong tailwinds from Web2 audiences and retail behavior

The "hyper-speculation" trend in society has fundamentally changed retail consumer behavior. As proven by the growth of Polymarket and Kalshi, most users in the current environment adopt high-risk strategies. With market speculation demand at historic highs, mobile trading apps have become the most direct beneficiaries. As previously mentioned, traditional financial mobile apps like Robinhood, Wealthsimple, and TD Ameritrade have seen significant user growth and adoption, mainly due to their low entry barriers and business models that are happy to promote short-term, high-leverage, gambling-style products to users. Clearly, retail users need easy ways to gain risk exposure and allocate capital, and mobile trading apps are the most reasonable solution.

Crypto mobile trading apps are essentially no different—if they can effectively build product discoverability, they can also benefit from these consumer behaviors. Robinhood, Wealthsimple, and Revolut have all integrated crypto products into their apps as proof. Even with extremely high fees, crypto products within these traditional financial apps still see massive adoption, indicating strong demand among retail users for convenient mobile crypto market access. Without dedicated crypto mobile trading apps, the Web3 market will hand over huge value capture opportunities to Web2 competitors.

2. For the crypto market to achieve scale and trading volume growth, more crypto-native mobile applications must be provided for mainstream Web2 consumers

Since 2023, there has been basically no new retail capital inflow into the market. The current total stablecoin market cap is only about 25% higher than the 2021 all-time high. For any industry, this four-year growth rate is dismal—even as stablecoins enjoy the most favorable regulatory environment and the president strongly supports the crypto industry.

The market needs solutions to attract new retail liquidity, but so far, major barriers to new retail capital entry remain unresolved. The main obstacles are: first, the public perceives that participating in the crypto market requires complex operations; second, there is a lack of truly accessible apps that understand Web2 user needs. Web2 retail users will not use complex wallets or move funds across multiple chains. They need products packaged in familiar ways, offering easy on-ramps and friendly experiences like Robinhood or Wealthsimple accounts.

Crypto mobile trading frontend apps are the solution—they package products in the traditional financial ways familiar to Web2 users, fundamentally eliminating the cognitive threshold of crypto complexity and lowering participation barriers. This is the only effective way for crypto to break out of the Web3 circle and gain mainstream exposure.

3. Compared to Web3 business models, a truly sustainable, scalable, and low-cost real revenue model

Crypto mobile trading frontends mark the beginning of a new generation of Web3 market applications—a more sustainable and compliant development path. Unlike previous traditional crypto products (whether infrastructure or DApps), most projects in the past did not focus on scale expansion or revenue generation, as these were not core incentives. Most founders' North Star metric was to acquire initial users at any cost, regardless of how inefficient or extractive their growth funnel was, then raise venture capital, sell locked tokens OTC, or wait for vesting to end without improving the product. Typical examples include: Story Protocol ($IP), Blast, Sei Network ($SEI).

Crypto mobile trading frontends take the opposite approach: optimizing for scale using existing infrastructure, generating revenue first, and raising funds if necessary. By acting as aggregators of different products and adopting a base fee structure, these frontends have the structural advantage of integrating multiple verticals at extremely low cost, while focusing on user experience interfaces to improve user acquisition and retention. This combination means they can generate revenue from day one and achieve exponential growth as operations continue. The end result is a more sustainable real business and value layer for Web3, replacing the extractive models of the past. This will bring increasing credibility to the entire Web3 industry.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Citibank and SWIFT complete pilot program for fiat-to-crypto PvP settlement.

Pantera Partner: In the Era of Privacy Revival, These Technologies Are Changing the Game

A new reality is taking shape: privacy protection is the key to driving blockchain toward mainstream adoption, and the demand for privacy is accelerating at cultural, institutional, and technological levels.

Exclusive Interview with Bitget CMO Ignacio: Good Code Eliminates Friction, Good Branding Eliminates Doubt

A software engineer's brand philosophy.