3 Altcoins That Can Potentially Rally If Bitcoin Hits $150,000

As Bitcoin reaches a record high, data shows XRP, BNB, and Litecoin often follow its momentum—setting up potential rallies if BTC hits $150,000.

Bitcoin broke a new all-time high today, surpassing $125,500, extending its dominant 2025 bull run. As the world’s largest cryptocurrency leads the charge, history shows that several major altcoins often follow its momentum.

Data from the past few years highlights that XRP, BNB, and Litecoin (LTC) have consistently shown strong positive correlations with Bitcoin’s price.

While not always moving in perfect lockstep, these coins tend to rise when Bitcoin rallies. Recent 3-month correlation charts further reinforce this trend.

XRP: Following Bitcoin’s Momentum With Slight Lag

XRP has long displayed a moderate to strong positive correlation with Bitcoin. Historically, its price direction mirrors BTC’s broader market movements, though it often lags slightly.

In 2023 and 2024, when Bitcoin recovered from the post-FTX slump, XRP also rebounded, reflecting a correlation above 0.5 to 0.8 depending on the period.

That pattern repeated in 2025, where, despite independent catalysts like Ripple’s regulatory wins, XRP’s overall trend aligned with Bitcoin’s climb.

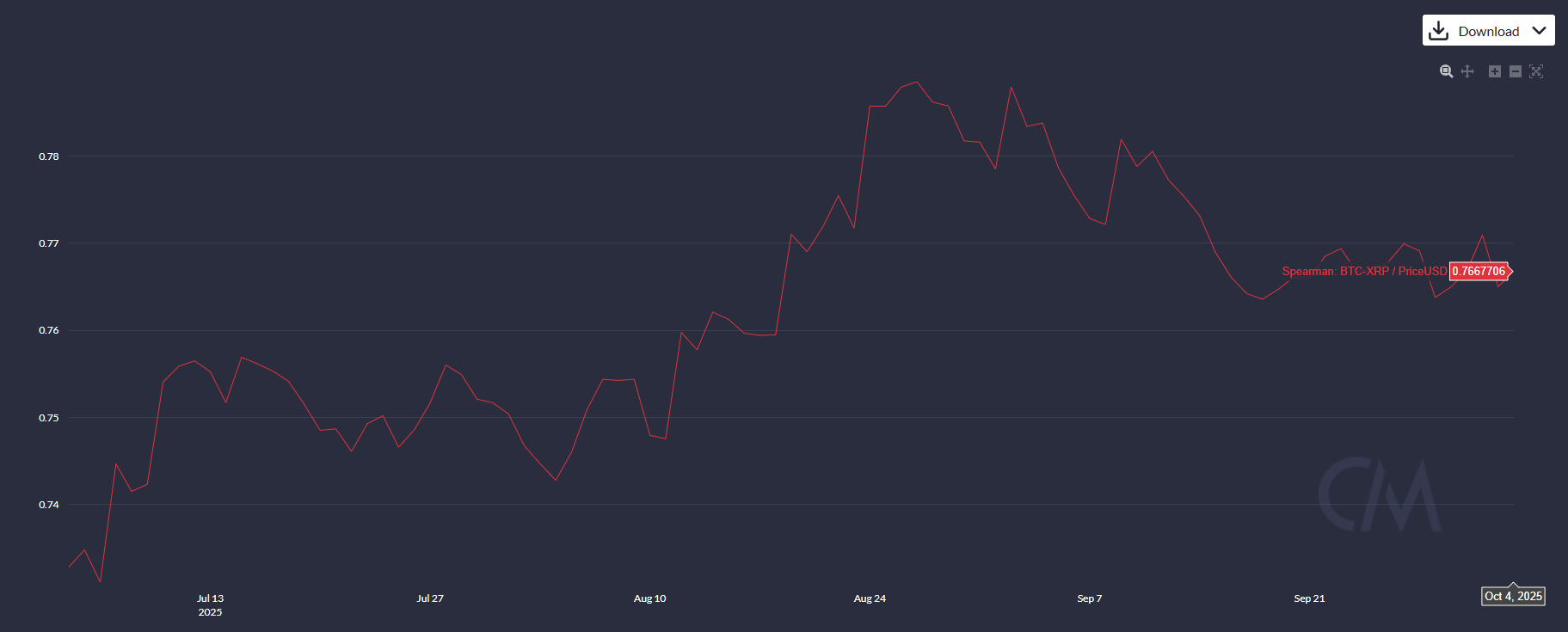

Bitcoin-XRP Price Correlation Over The Past 3 Months. Source:

CoinMetrics

Bitcoin-XRP Price Correlation Over The Past 3 Months. Source:

CoinMetrics

The latest Spearman correlation chart (July–October 2025) shows XRP maintaining an average correlation of 0.76, a strong level of directional alignment. The metric peaked near 0.78 during August’s BTC rally before easing slightly.

This suggests that as Bitcoin aims for $150,000, XRP’s upside potential remains high, particularly if market liquidity deepens around large-cap tokens.

BNB: Exchange Giant Moving In Sync With Market Leaders

BNB’s correlation with Bitcoin has historically been among the strongest in the altcoin market. The token also reached an all-time high yesterday, as BTC also rallied.

Between 2021 and 2024, BNB showed correlations ranging from 0.7 to 0.9 with BTC. During intense rally phases — such as mid-2021 and early 2024 — the figure even touched 0.98, signaling near-lockstep movement.

The current 3-month chart (July–October 2025) confirms this consistency. Correlation strengthened from 0.64 in July to roughly 0.71 in October, tracking Bitcoin’s climb to new highs.

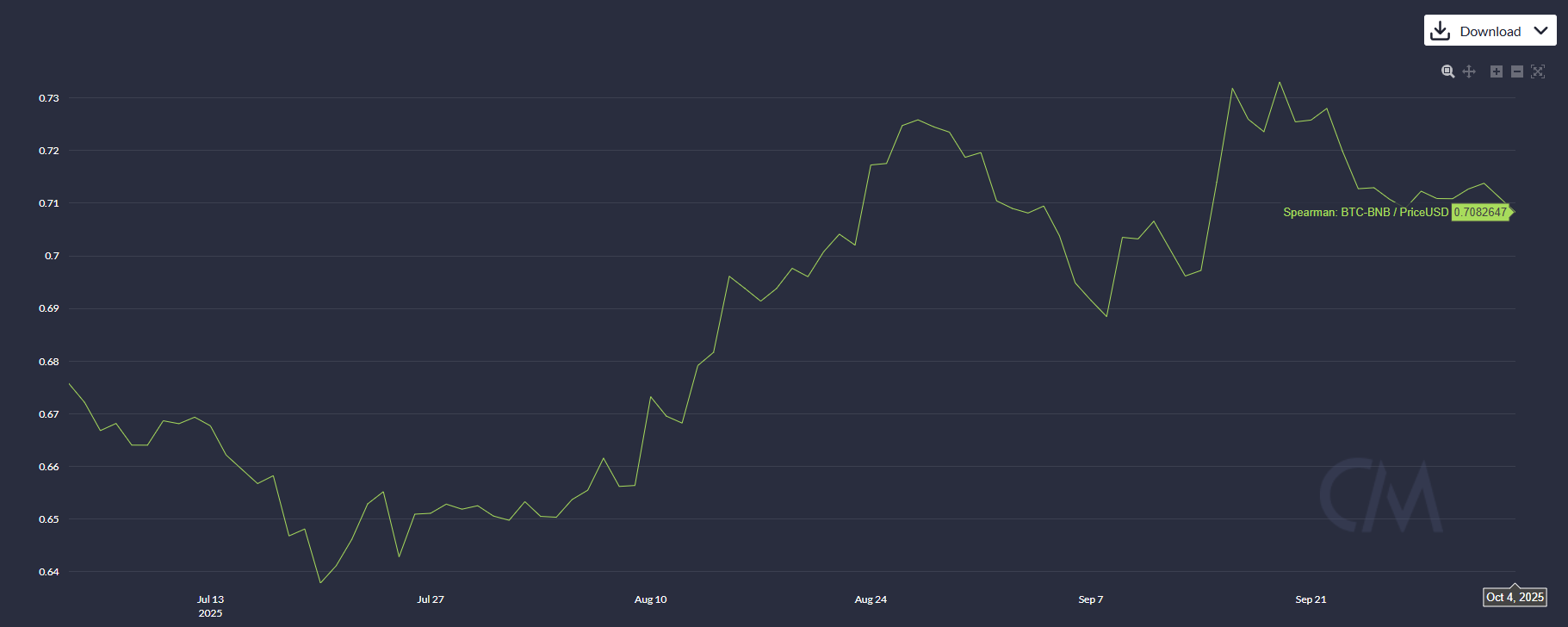

Bitcoin-BNB Price Correlation Over The Past 3 Months. Source:

CoinMetrics

Bitcoin-BNB Price Correlation Over The Past 3 Months. Source:

CoinMetrics

The rise demonstrates renewed investor alignment with top-tier assets and reinforces that BNB’s price direction remains tightly linked to BTC’s broader sentiment.

As the BSC chain sees surging trading volume, a Bitcoin move toward $150,000 could see BNB advance proportionally, especially as exchange activity intensifies during bullish phases.

Litecoin: The Classic Mirror of Bitcoin’s Market Cycle

Litecoin (LTC), one of Bitcoin’s oldest forks, has long been considered a bellwether for broader crypto trends.

Historically, LTC’s price correlation with BTC has stayed strong and stable, averaging between 0.6 and 0.8 over multi-year periods.

During the 2020–2021 bull market, LTC rose in tandem with Bitcoin’s breakout, and even in subsequent corrections, its directional moves remained aligned. Data from 2023 to 2025 confirms that correlation remains durable.

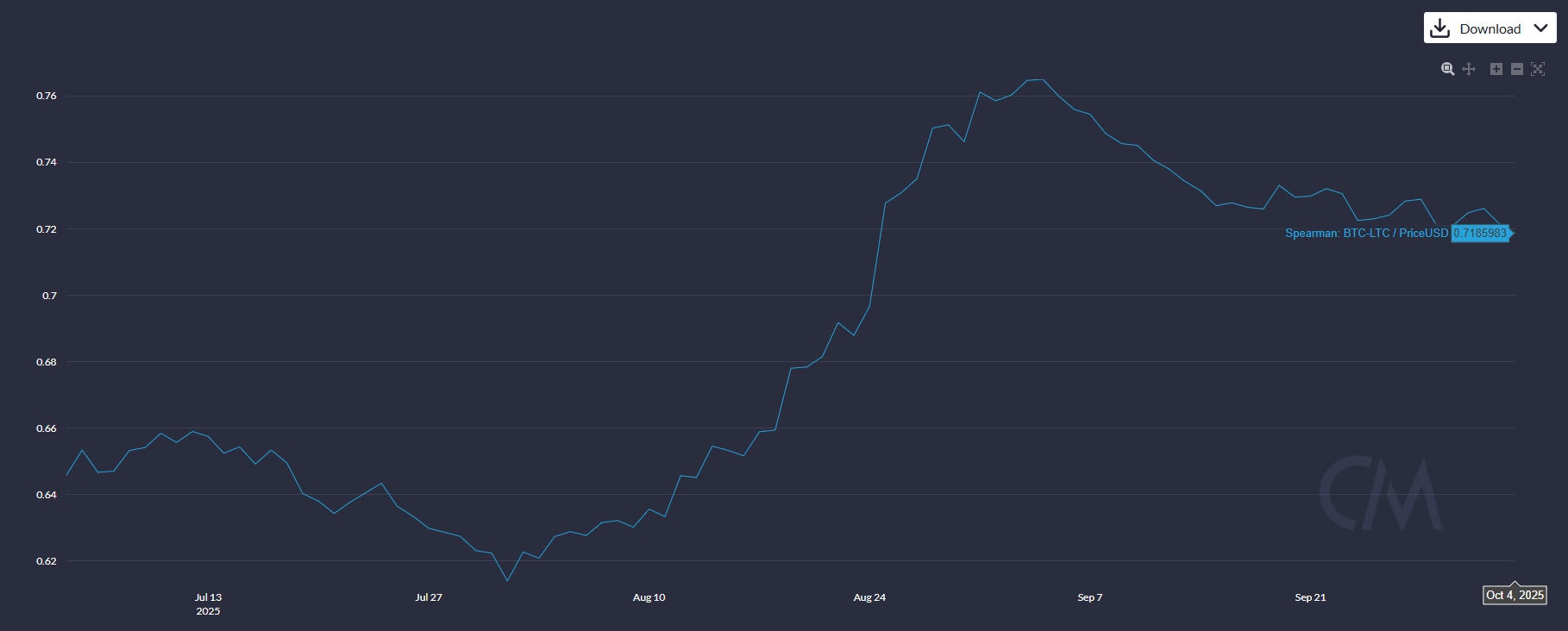

The latest correlation chart (July–October 2025) shows LTC’s Spearman coefficient rising from 0.63 to around 0.72, peaking at 0.76 in late August — almost identical to Bitcoin’s record climb phase.

Bitcoin-Litecoin Price Correlation Over The Past 3 Months. Source:

CoinMetrics

Bitcoin-Litecoin Price Correlation Over The Past 3 Months. Source:

CoinMetrics

This steady co-movement reflects Litecoin’s tendency to shadow Bitcoin’s momentum during macro rallies.

Given its deep liquidity and structural similarity to Bitcoin, LTC could again ride the wave if BTC targets $150,000.

Historically, LTC amplifies Bitcoin’s moves by smaller magnitudes but with high reliability.

If Bitcoin breaches $150,000, historical patterns suggest these three altcoins are positioned to rally alongside it.

These tokens are not necessarily followers, but are key beneficiaries of renewed institutional and retail enthusiasm for BTC.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin battles $50K price target as Fed adds $13.5B overnight liquidity

Bitcoin valuation metric projects 96% chance of BTC price recovery in 2026

Bitcoin's ‘more reliable’ RSI variant hits bear market bottom zone at $87K

XRP ETF inflows exceed $756M as bullish divergence hints at trend reversal