Stablecoin Summer Could Trigger a $1 Trillion Emerging Markets Winter | US Crypto News

Standard Chartered predicts stablecoins could trigger $1 trillion in emerging-market deposit outflows, signaling a structural shift in global finance as digital dollars redefine stability.

Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee and take a moment to think about how fast money is changing. What once moved through banks and borders now flows through code and wallets, reshaping global finance in real time. As stablecoins surge across markets, they are rewriting the rules of stability.

Crypto News of the Day: Standard Chartered Warns of Deposit Flight as Stablecoins Reshape Global Finance

Standard Chartered has warned that the global rise of stablecoins could drain as much as $1 trillion from emerging-market (EM) banks over the next three years, as depositors increasingly shift their savings into digital dollar alternatives.

In a new research note, the bank outlines an opportunity–vulnerability continuum across 48 countries, identifying Egypt, Pakistan, Bangladesh, and Sri Lanka among the most exposed to outflows.

According to Geoff Kendrick, Global Head of Digital Assets Research, and Madhur Jha, Head of Thematic Research, the fast expansion of stablecoins is accelerating an already-visible structural trend: the migration of banking functions to the non-bank digital sector.

“As stablecoins grow, we think there will be several unexpected outcomes, the first of which is the potential for deposits to leave EM banks,” they said in an email shared with BeInCrypto.

The team estimates that these outflows, while massive in absolute terms, would represent roughly 2% of aggregate deposits across high-vulnerability economies.

The findings add a new layer of urgency for policymakers. Stablecoins give consumers and corporates access to what is effectively a USD-based bank account without traditional intermediaries.

Based on this, they risk amplifying financial instability in countries already battling weak currencies, high inflation, and fiscal deficits.

The report notes that many of the at-risk countries, including Türkiye, India, Brazil, South Africa, and Kenya, are running twin deficits, a key vulnerability in times of capital flight.

While US legislation like the GENIUS Act aims to reduce risks by prohibiting stablecoin issuers from paying direct yields, Standard Chartered believes adoption will continue regardless.

“Return of capital matters more than return on capital,” the analysts wrote, suggesting that stablecoins’ appeal as a safe digital store of value will persist even without yield incentives.

Stablecoins Redefine Money, Beyond Yield and Cycles

Industry voices say the phenomenon Standard Chartered highlights is not just a speculative rotation. Rather, it is a structural realignment in how global money moves.

Matt Huang, Co-founder of Paradigm, observed that while crypto once thrived in the zero-interest-rate policy (ZIRP) era, the end of that period actually ignited the stablecoin Supercycle.

“People used to joke that crypto was a ZIRP-era phenomenon. Ironically, the end of ZIRP kicked off the stablecoin Supercycle: dollar banks in the cloud, widening spreads vs TradFi, issuers earning billions to fund global distribution,” Huang wrote on X.

Others argue that stablecoins’ dominance stems from solving a more fundamental issue. Raj Brahmbhatt, co-founder and CEO of BlockRidge, noted that stablecoins outlast rate cycles because of their use cases.

Exactly.Stablecoins outlast rate cycles because they solve something deeper than yield: settlement inefficiency.When you replace friction with code, the macro conditions become background noise.

— Raj brahmbhatt

According to digital asset strategist Sam Noble, this growth has positioned stablecoins as crypto’s first true product-market fit.

However, for emerging markets, the same technology enabling inclusion also exposes fragility. As digital dollars flow freely across borders, local banks face a growing risk of disintermediation.

What Standard Chartered calls a potential $1 trillion winter for EM finance may, in fact, mark the next defining chapter in the globalization of money. In such a chapter, liquidity moves at internet speed, while stability depends on code as much as policy.

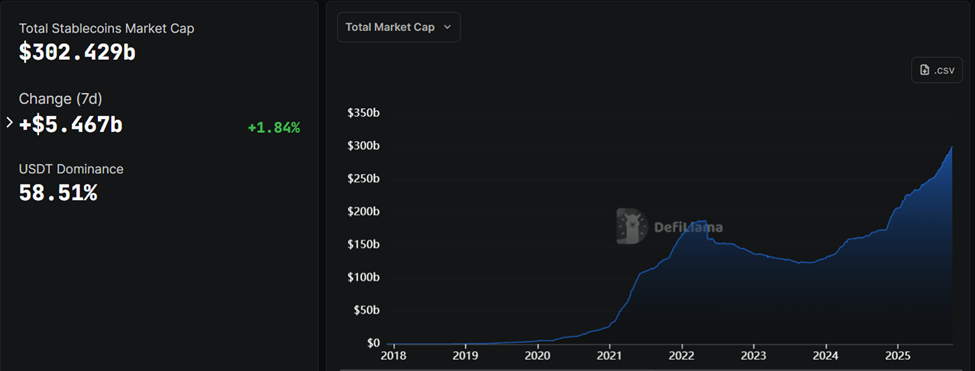

Chart of the Day

Stablecoin Market Cap. Source:

DefiLlama

Stablecoin Market Cap. Source:

DefiLlama

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

- Gold, Bitcoin, and stocks are all booming — Here’s why that’s not a good sign.

- US government shutdown drives record $6 billion crypto inflows.

- DefiLlama bombshell triggers over 10% crash for Aster price amid airdrop fallout.

- BNB price forms new all-time high after 21% rise in a week.

- Bitcoin rally flashes red flags: New highs, but fewer hands are holding the rally.

- Over 15.7 million Pi coins leave OKX as price slides further.

- Cardano price analysis reveals $0.89 breakout level amid whale-retail tug of war.

- Hong Kong’s iron regulator gets three more years to shape global crypto rules.

- Ethereum’s momentum stalls as ETH lags behind Bitcoin – $5,000 target on hold.

Crypto Equities Pre-Market Overview

| Company | At the Close of October 3 | Pre-Market Overview |

| Strategy (MSTR) | $351.63 | $361.45 (+2.79%) |

| Coinbase (COIN) | $380.02 | $389.60 (+2.52%) |

| Galaxy Digital Holdings (GLXY) | $36.16 | $39.14 (+8.24%) |

| MARA Holdings (MARA) | $18.82 | $19.46 (+3.40%) |

| Riot Platforms (RIOT) | $19.44 | $20.42 (+4.38%) |

| Core Scientific (CORZ) | $17.82 | $17.92 (+0.56%) |

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

No wonder Buffett finally bet on Google

Google holds the entire chain in its own hands. It does not rely on Nvidia and possesses efficient, low-cost computational sovereignty.

HYPE Price Prediction December 2025: Can Hyperliquid Absorb Its Largest Supply Shock?

XRP Price Stuck Below Key Resistance, While Hidden Bullish Structure Hints at a Move To $3

Bitcoin Price Prediction: Recovery Targets $92K–$101K as Market Stabilizes