Negative Sentiment Toward XRP Hits 6-Month Peak — History Says That’s Bullish

Negative sentiment towards XRP has hit a six-month high, a contrarian signal that could mean a rally is ahead. Santiment says historical trends show price rebounds often follow periods of extreme fear.

Negative sentiment toward XRP has reached its highest level in six months, a trend that on-chain data platform Santiment believes could signal a price rally.

The firm’s analysis shows that retail investors are experiencing the highest level of fear, uncertainty, and doubt (FUD) since the US “tariff war” in April. Historically, XRP price rebounds have often occurred when market sentiment was at its most negative.

Retail FUD Spikes as XRP Slips in Rankings — A Contrarian Setup?

Santiment’s metric for negative mentions uses a machine-learning-based sentiment analysis model to evaluate text data from sources like social media. The model assigns a positive or negative score to each piece of text (e.g., messages, comments).

A negative mention is counted when a text has a negative sentiment score of 0.7 or higher. The firm aggregates these scores to determine the total volume of negative mentions.

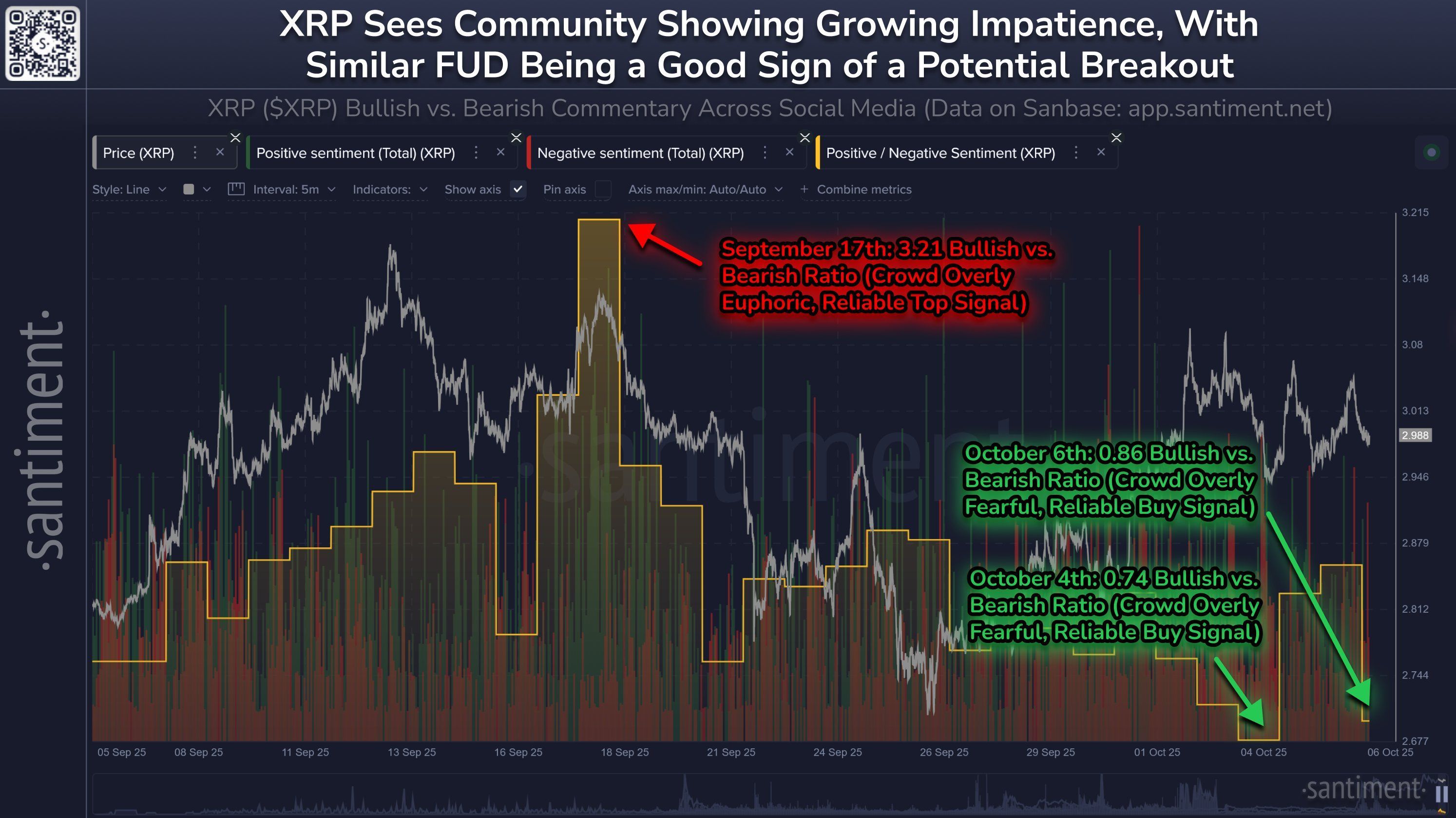

XRP Bullish vs. Bearish Commentary Across Social Media. Source:

Santiment

XRP Bullish vs. Bearish Commentary Across Social Media. Source:

Santiment

According to Santiment’s data, negative mentions of XRP outnumbered positive ones on two of the last three days. Santiment considers this a sign of “crowd fear,” representing the weakest sentiment the asset has seen in the last half-year.

Previous periods of extreme negative sentiment have historically led to buying opportunities for institutional investors, which then drive price rebounds. A similar surge in negative sentiment during the US tariff war six months ago was followed by a strong recovery for XRP after a brief correction.

The ratio of positive to negative mentions for XRP hit a psychological low of 0.74 on October 4. After a slight rebound, it fell again to 0.86 on Monday. Santiment views these periods of higher negative mentions as ideal buying opportunities for XRP, stating that “markets move opposite to small trader expectations.”

Conversely, periods of high positive sentiment are considered an ideal time to sell. For example, on September 17, positive mentions were 3.21 times higher than negative ones. In the eight days that followed, XRP’s price fell by about 14.1%.

The weakening sentiment for XRP is not just reflected in online posts but also in its market capitalization ranking.

“XRP has fallen to #4 in market cap as BNB has surged. I don’t mind as this as the move has come from BNB’s recent strength in the market rather than XRP weakness,” a crypto investor pointed out on X.

BNB climbed over 5% on Tuesday to a market cap of $180.91 billion, while XRP fell about 0.3% to a market cap of $178.89 billion.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

$8.8 billion outflow countdown: MSTR is becoming the abandoned child of global index funds

The final result will be revealed on January 15, 2026, and the market has already started to vote with its feet.

Deconstructing DAT: Beyond mNAV, How to Identify "Real vs. Fake HODLing"?

There is only one iron rule for investing in DAT: ignore premium bubbles and only invest in those with a genuine flywheel of continuously increasing "crypto per share."

Empowered by AI Avatars, How Does TwinX Create Immersive Interaction and a Value Closed Loop?

1. **Challenges in the Creator Economy**: Web2 content platforms suffer from issues such as opaque algorithms, non-transparent distribution, unclear commission rates, and high costs for fan migration, making it difficult for creators to control their own data and earnings. 2. **Integration of AI and Web3**: The development of AI technology, especially AI Avatar technology, combined with Web3's exploration of the creator economy, offers new solutions aimed at breaking the control of centralized platforms and reconstructing content production and value distribution. 3. **Positioning of the TwinX Platform**: TwinX is an AI-driven Web3 short video social platform that aims to reconstruct content, interaction, and value distribution through AI avatars, immersive interactions, and a decentralized value system, enabling creators to own their data and income. 4. **Core Features of TwinX**: These include AI avatar technology, which allows creators to generate a learnable, configurable, and sustainably operable "second persona", as well as a closed-loop commercialization pathway that integrates content creation, interaction, and monetization. 5. **Web3 Characteristics**: TwinX embodies the assetization and co-governance features of Web3. It utilizes blockchain to confirm and record interactive behaviors, turning user activities into traceable assets, and enables participants to engage in platform governance through tokens, thus integrating the creator economy with community governance.

Aster CEO explains in detail the vision of Aster privacy L1 chain, reshaping the decentralized trading experience

Aster is set to launch a privacy-focused Layer 1 (L1) public chain, along with detailed plans for token empowerment, global market expansion, and liquidity strategies.