Inception Capital’s David Gan Sees the Next Phase of Crypto: Building the Automated Financial System

As the digital assets market matures beyond speculation, David Gan, Founder and General Partner of Inception Capital, is placing his conviction on one transformative shift: the rise of an automated financial system. This is where capital, yield, and asset logic operate continuously, autonomously, and without friction. Speaking at Korea Blockchain Week and Gamma Prime’s Tokenized

As the digital assets market matures beyond speculation, David Gan, Founder and General Partner of Inception Capital, is placing his conviction on one transformative shift: the rise of an automated financial system. This is where capital, yield, and asset logic operate continuously, autonomously, and without friction.

Speaking at Korea Blockchain Week and Gamma Prime’s Tokenized Capital Summit 2025, Gan framed this shift as the new battleground for value creation in digital finance.

The end of passive money

Gan describes the concept as simple but transformative.

“In the future, we’ll move away from today’s fragmented banking layers such as intermediaries, wires, and clearing systems, and into a world where financial services are automated, agent-driven, and always on.”

In Gan’s view, the future of finance is one where money no longer sits idle. Every inflow, whether from payroll, yield, or transaction revenue, can be automatically deployed into optimized strategies or rebalanced across asset pools in real time.

Instead of manually managing savings or investments, individuals and institutions will interact with autonomous, composable financial agents that intelligently allocate capital around the clock.

He believes that traditional financial rails such as SWIFT, intermediary banks, and local clearing systems will gradually be replaced by on-chain networks that operate continuously, transparently, and globally.

The outcome, he says, will be a composable financial layer where asset management, payments, and custody merge into a single self-operating system.

As more assets gain digital representation, from real estate and collectibles to intellectual property, Gan expects a structural redefinition of how value is custodied, traded, and banked on-chain. In his view, this shift will not simply digitize existing systems but create an environment that is faster, more liquid, and inherently interoperable.

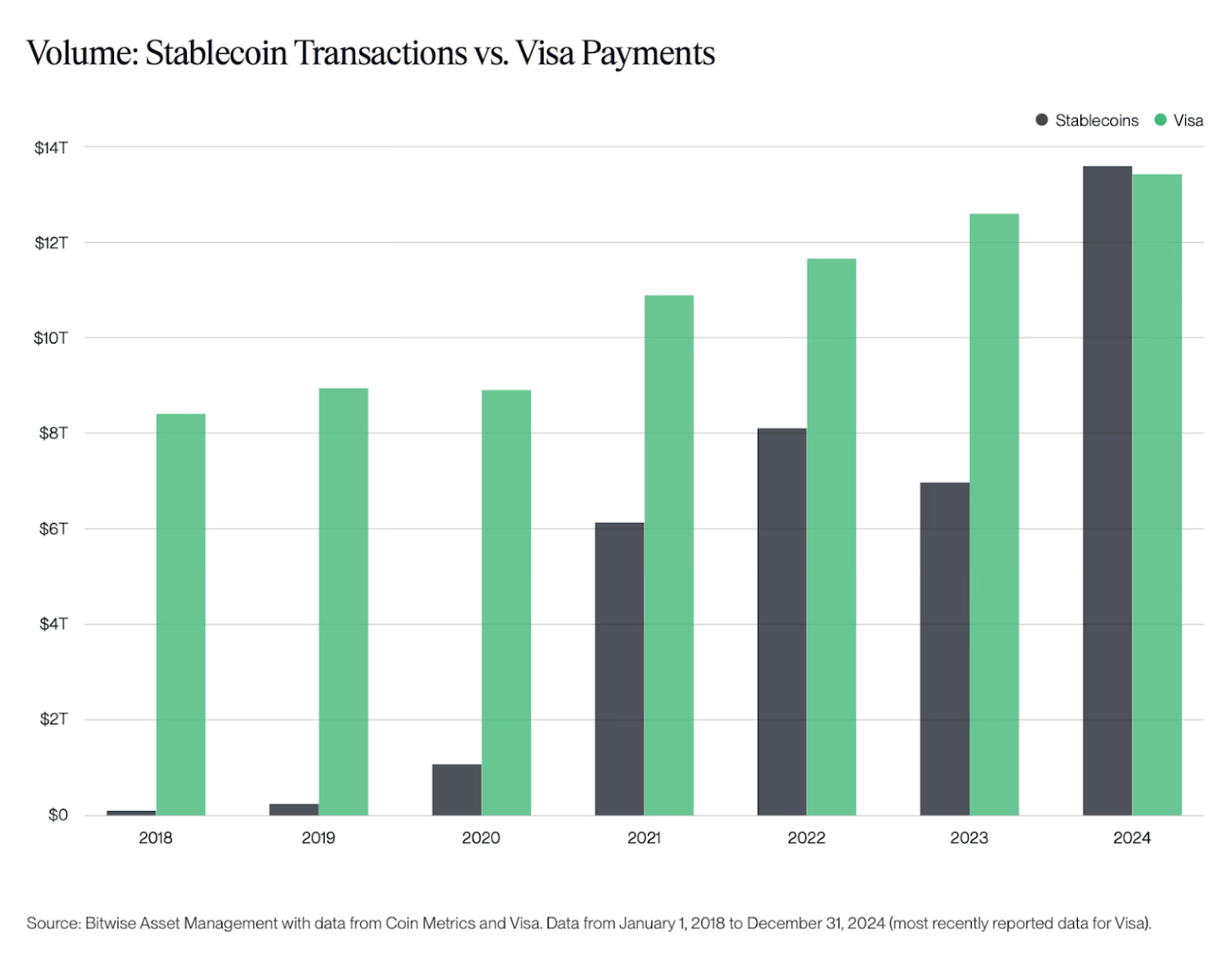

This vision of automation is grounded in real data. According to Bitwise Asset Management, stablecoin transfer volumes surged into the multi-trillion-dollar range in 2024, now rivaling or exceeding Visa’s annual settlement throughput while operating at sub-1 percent transaction costs and 24/7 real-time speed.

For Gan, this marks a clear signal that the rails for an automated financial future are already here and that the intelligence layer is what comes next.

Stablecoins Volume Exceeding Visa’s Annual Settlement in 2024:

Bitwise

Stablecoins Volume Exceeding Visa’s Annual Settlement in 2024:

Bitwise

From tokenization to intelligence

Stablecoins have already proven that programmable money can move frictionlessly and efficiently across borders. The logical next step is the tokenization of assets, extending this programmability to everything from real estate and collectibles to intellectual property.

For Inception Capital, this convergence between liquidity and representation marks a pivotal moment. As value becomes digitally native and continuously tradable, the automated financial system begins to take tangible shape, connecting capital and assets through a unified on-chain architecture.

At the Tokenized Capital Summit 2025 hosted by Gamma Prime, David Gan noted that real-world assets are not a separate category but part of the inevitable digital migration of everything with value.

“All of these assets, whether traditional or on chain, are ultimately going to be digital assets,” he said. “The real value lies in creating better marketplaces, enabling global liquidity, and giving investors worldwide the same access to financial primitives that Americans already enjoy.”

Gan also sees AI and crypto as natural complements in this evolution. AI provides the intelligence layer, learning, optimizing, and executing financial actions, while crypto supplies the trust, transparency, and settlement infrastructure that makes automation possible. Together, they form the foundation of what he calls the self-operating financial stack.

David Gan @ Tokenized Capital Summit Token 2049

David Gan @ Tokenized Capital Summit Token 2049

A maturing industry built for real utility

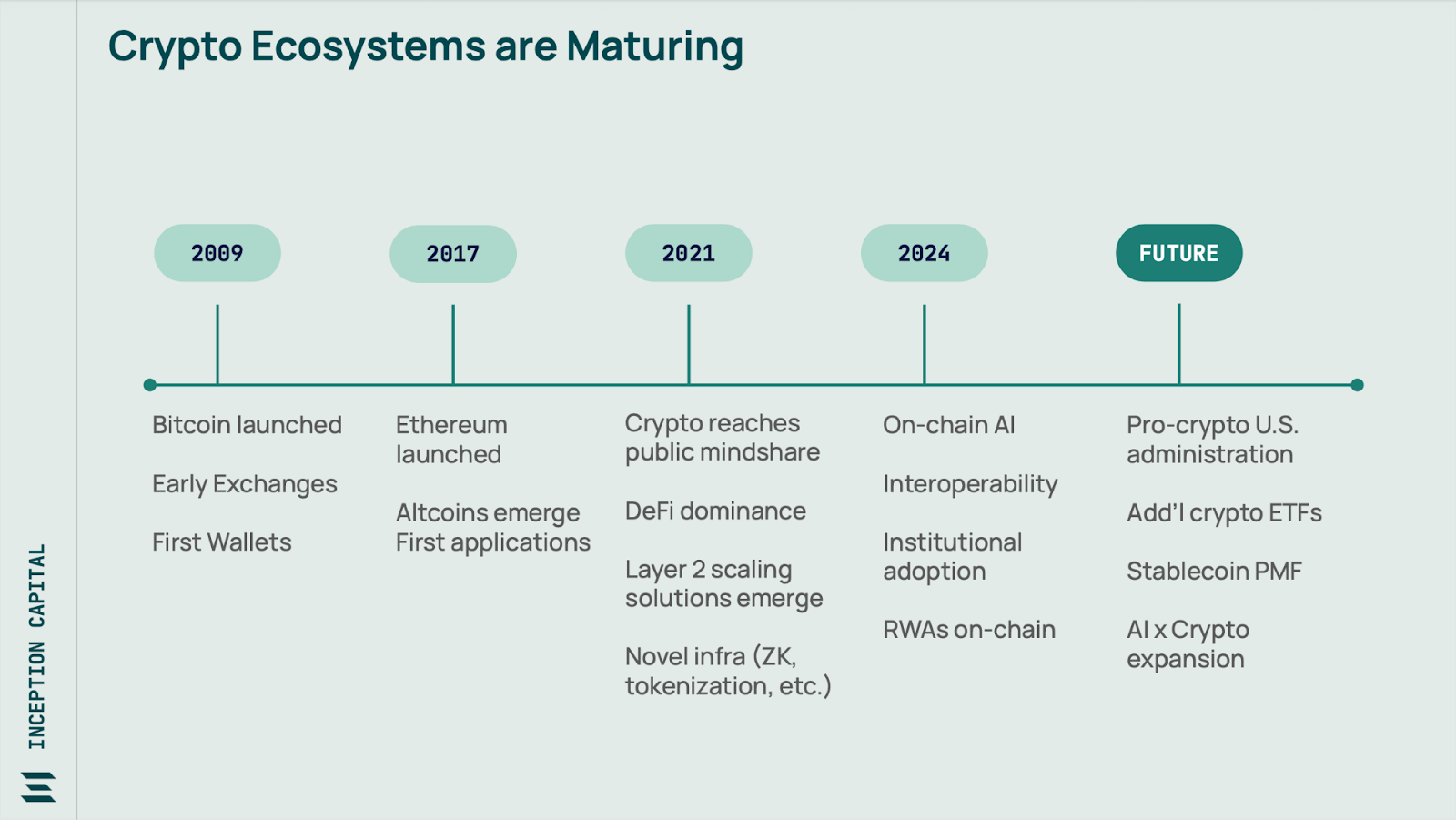

Gan argues that the crypto industry has finally reached an inflection point. The infrastructure phase, focused on building blockchains, bridges, and wallets, is largely complete. The next wave will center on applications that integrate seamlessly into everyday financial life.

Regulatory progress is helping accelerate this transition. With frameworks such as the U.S. GENIUS Act, Europe’s MiCA, and Hong Kong’s Stablecoin Ordinance, the industry is beginning to operate within clearer boundaries, reducing the uncertainty that once defined the space.

Inception’s perspective on how crypto ecosystem is maturing

Inception’s perspective on how crypto ecosystem is maturing

“After years of volatility and uncertainty, we now have the foundation for institutional adoption,” Gan said. “What’s left is to build the intelligence layer on top, systems that make finance run by itself.”

Inception Capital’s approach

Founded in 2021 and backed by Galaxy Digital, Animoca Brands, and Bill Ackman, Inception Capital manages over 80 million dollars across its venture and fund-of-funds strategies. The firm has invested in more than 40 early-stage projects at the intersection of digital assets and frontier technology.

Gan’s approach is to identify emerging inflection points early, before they become consensus. His track record includes early investments in Circle (before “stablecoin” was even a term), Ondo Finance (before “RWA” became a trend), and MegaETH Labs (before high-throughput L2s gained traction).

Today, that same forward-looking lens is focused on automated finance, the systems, agents, and rails that will make the global economy operate autonomously.

“We’re not chasing narratives,” Gan said. “We’re backing the builders who make finance work without friction, who are turning the promise of blockchain into real-world financial automation.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Price predictions 11/28: BTC, ETH, XRP, BNB, SOL, DOGE, ADA, HYPE, BCH, LINK

Ethereum Privacy’s HTTPS Moment: From Defensive Tool to Default Infrastructure

A summary of the "Holistic Reconstruction of Privacy Paradigms" based on dozens of speeches and discussions from the "Ethereum Privacy Stack" event at Devconnect ARG 2025.

Donating 256 ETH, Vitalik Bets on Private Communication: Why Session and SimpleX?

What differentiates these privacy-focused chat tools, and what technological direction is Vitalik betting on this time?