Bitcoin Price Prediction — Can BTC Maintain $122K as Analysts Favor Solana and Ethereum for Upside Momentum?

Bitcoin continues to hold steady above $124,000, building confidence among traders and institutions alike. Alongside major assets like Ethereum and Solana, MAGACOIN FINANCE is gaining attention as another altcoin that could benefit from shifting capital in this bullish phase.

Bitcoin Price Prediction: Can BTC Stay Above $125K?

Bitcoin has risen 0.77% in the past 24 hours to trade around $124,044, marking a 10.59% weekly gain. Analysts link this surge to large ETF inflows, Japan’s pro-stimulus policies, and renewed institutional demand.

Over the past week, spot Bitcoin ETFs brought in $3.55 billion in net inflows, with BlackRock’s IBIT capturing most of it. The inflows have pushed total year-to-date ETF demand above $60 billion, signaling that large institutions continue to accumulate. These funds are helping Bitcoin maintain its strength even as short-term traders take profits.

Japan’s economic policies also played a role. Prime Minister Sanae Takaichi’s new fiscal strategy weakened the yen, which historically leads to higher Bitcoin activity among Japanese investors. As local investors seek assets outside the yen, Bitcoin’s appeal as a hedge continues to grow.

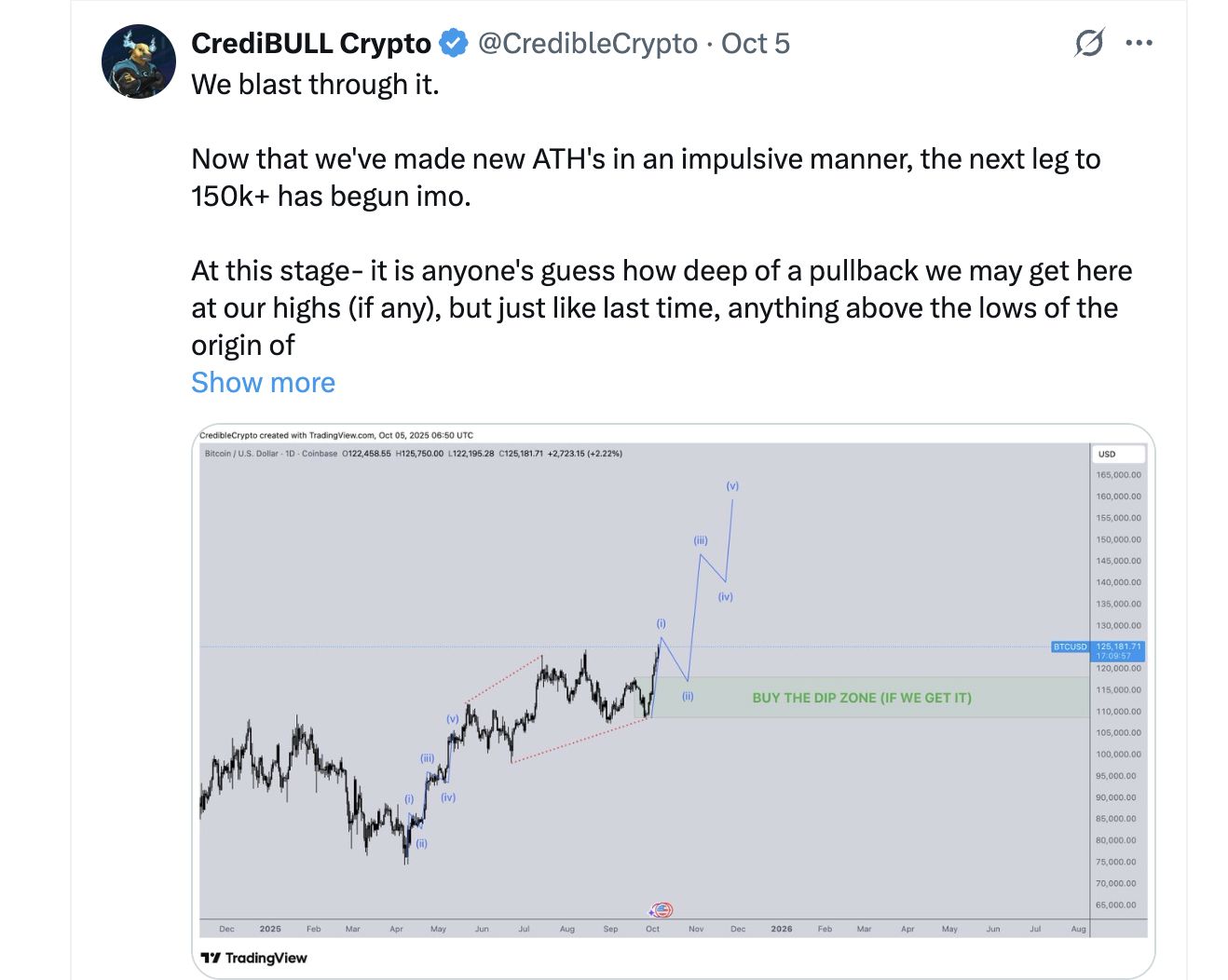

Analysts like CrediBULL Crypto believe that the move past $125K signals the start of the next major leg higher, with $150,000 as the next target.

Others suggest minor dips between $108K–$118K could be brief before another rally begins. Bitcoin’s steady demand from ETFs and macro tailwinds from Japan support a bullish outlook heading into Q4.

Ethereum Price Prediction: ETH Closes Gap with Bitcoin

Ethereum has nearly matched Bitcoin’s yearly performance, gaining over 88% year-over-year, according to new data from CryptoQuant. The gap between both assets has narrowed as Ethereum’s Q3 performance surged.

The price of ETH currently trades around $4,578, up 12% in the past week, compared to Bitcoin’s 10% increase. This parallel growth shows that Ethereum’s market strength is tracking Bitcoin more closely than ever.

Analysts say Ethereum’s ETH/BTC ratio has broken above a long-term downtrend, signaling a potential rotation in favor of ETH. Some traders believe this could be Ethereum’s strongest recovery against Bitcoin since 2017.

Citibank’s recent 12-month forecast places Ethereum’s base target at $5,400 and a bullish case at $7,300, showing confidence in ETH’s long-term path. The bank pointed out that institutional demand, combined with Ethereum’s expanding ecosystem, continues to support its outlook.

As Bitcoin holds the spotlight, Ethereum is proving it can keep pace and even outperform if the broader crypto rally continues into 2026.

Solana Price Prediction: Institutional Demand Builds

Solana (SOL) has become a major institutional favorite this quarter. CME futures open interest has reached an all-time high of $2.16 billion, showing that larger players are positioning for more upside.

SOL’s price rebounded 23% to $235, from a recent low near $195, as institutional trading volumes increased sharply. The timing coincides with expectations around the upcoming SEC decision on a Solana ETF scheduled for October 10.

Inflows into Solana exchange-traded products (ETPs) have also crossed $500 million, led by REXShares’ Solana Staking ETF (SSK). Institutional participation has helped stabilize SOL’s price, while retail traders remain cautious after recent liquidations.

Market watchers note that this mix of strong institutional positioning and lighter retail speculation could allow Solana to sustain its rally without extreme volatility. A breakout above $250 may open the path to revisit highs near $300.

For now, Solana’s price prediction stays bullish as accumulation continues quietly among larger investors, and ETF discussions gain momentum.

MAGACOIN FINANCE: The Altcoin Worth Watching Next

随着比特币、以太坊和 Solana 占据加密市场头条,MAGACOIN FINANCE 也逐渐成为中小市值项目中的关注对象。其价格仍低于 $0.0006,部分市场观察者认为,随着更多利润从大型币种流入新兴项目,该资产有望受益于资本轮动。

当前市场情绪尚未过于贪婪,这一阶段对于提前布局的投资者具有吸引力。如果大型持有者将部分资金配置到 MAGACOIN,哪怕适度上涨,也可能助推其价值快速放大。例如,20 倍的涨幅将使价格达到 $0.012,市场需求变化时,收益积累往往非常迅速。

此外,分析人士普遍认为 MAGACOIN FINANCE 通过了 Hashex 的安全审计,适合寻求长期安全和稳健增长的投资者。

How Traders Can Position Now

分析师认为,比特币持续守稳 $125K 上方对整体市场有着积极影响。不过,大多数投资回报往往来自于中小盘项目较早布局。随着流动性从大型币种向小型资产转移,MAGACOIN FINANCE 有望顺利参与下一轮轮动行情。

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

No wonder Buffett finally bet on Google

Google holds the entire chain in its own hands. It does not rely on Nvidia and possesses efficient, low-cost computational sovereignty.

HYPE Price Prediction December 2025: Can Hyperliquid Absorb Its Largest Supply Shock?

XRP Price Stuck Below Key Resistance, While Hidden Bullish Structure Hints at a Move To $3

Bitcoin Price Prediction: Recovery Targets $92K–$101K as Market Stabilizes