Bitcoin ETF daily trading volume exceeds $7.5B

Key Takeaways

- Bitcoin ETF daily trading volume exceeded $7.5 billion, signaling record institutional participation.

- Spot Bitcoin ETFs grant exposure to Bitcoin and have seen cumulative inflows rise since US regulator approval.

US-listed spot Bitcoin ETF daily trading volume surpassed $7.5 billion today, reflecting heightened institutional interest in the regulated crypto investment vehicles.

Spot Bitcoin ETFs, investment products that provide direct exposure to Bitcoin’s price, have attracted institutional interest since their approval by US regulators. Major asset managers like BlackRock have driven cumulative inflows to record highs as of early October 2025.

The surge in trading volume underscores the broader trend of traditional finance integrating crypto assets for portfolio diversification. Major financial institutions have increasingly incorporated spot Bitcoin ETFs into their offerings, enhancing accessibility for both retail and institutional investors.

Asset managers behind these ETFs have collaborated with crypto custodians to ensure secure and compliant operations, bolstering trust in the products during periods of market volatility.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BTC Weekly Watch: Has the Market Code Emerged? Dynamic Take-Profit Strategy Suggestions Included

Monad airdrop query goes live, almost all testnet users “get rekt”?

This article analyzes the results of the Monad airdrop allocation and the community's reactions, pointing out that a large number of early testnet interaction users experienced a "reverse farming" situation, while most of the airdrop shares were distributed to broadly active on-chain users and specific community members. This has led to concerns about transparency and dissatisfaction within the community. The article concludes by suggesting that "reverse farmed" airdrop hunters shift their focus to exchange activities for future airdrop opportunities.

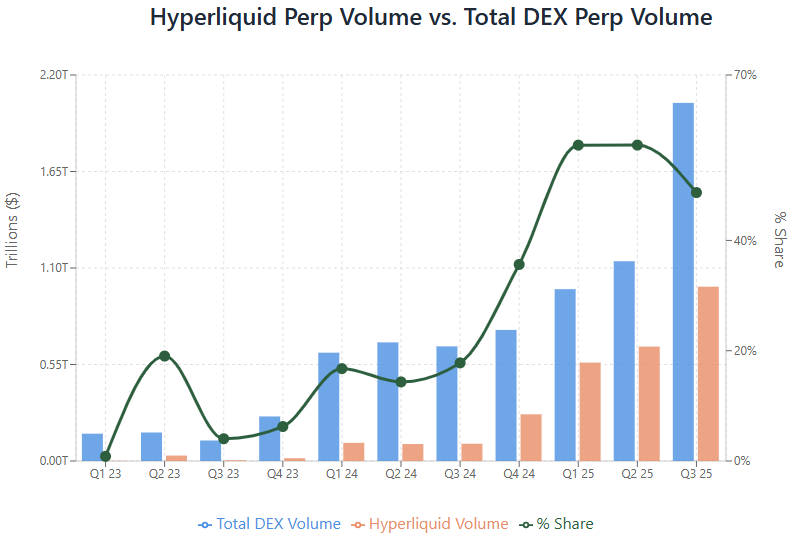

Arete Capital: Hyperliquid 2026 Investment Thesis, Building a Comprehensive On-chain Financial Landscape

The grand vision of unified development across the entire financial sector on Hyperliquid has never been so clear.

S&P Index Adjusted as Expected: Key Observations on Timing and Scope of the Adjustment!