A sovereign wealth fund in Luxembourg has invested 1% of its assets in bitcoin ETFs.

ChainCatcher news, according to CoinDesk, a sovereign wealth fund in Luxembourg has invested 1% of its assets in bitcoin ETF, becoming the first national-level fund in the eurozone to take such an initiative.

Luxembourg's Minister of Finance Gilles Roth revealed during the submission of the 2026 budget to the Chamber of Deputies that Luxembourg's intergenerational sovereign wealth fund (FSIL) has invested 1% of its assets in bitcoin. Jonathan Westhead, Head of Communications for the Luxembourg Financial Authority, stated that this investment is a practice of FSIL's new investment policy, which was approved by the government in July 2025, aiming to demonstrate Luxembourg's leading position in the field of digital finance.

FSIL was established in 2014 and currently holds $730 million in assets, with most investments in high-quality bonds. After the revised framework, in addition to continuing to invest in the equity and bond markets, FSIL can allocate up to 15% of its assets to alternative investments, including private equity, real estate, and crypto assets. To mitigate risks, the bitcoin investment is made through selected ETFs.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Cathie Wood: The crypto market may have bottomed out, Bitcoin remains the top choice for institutions

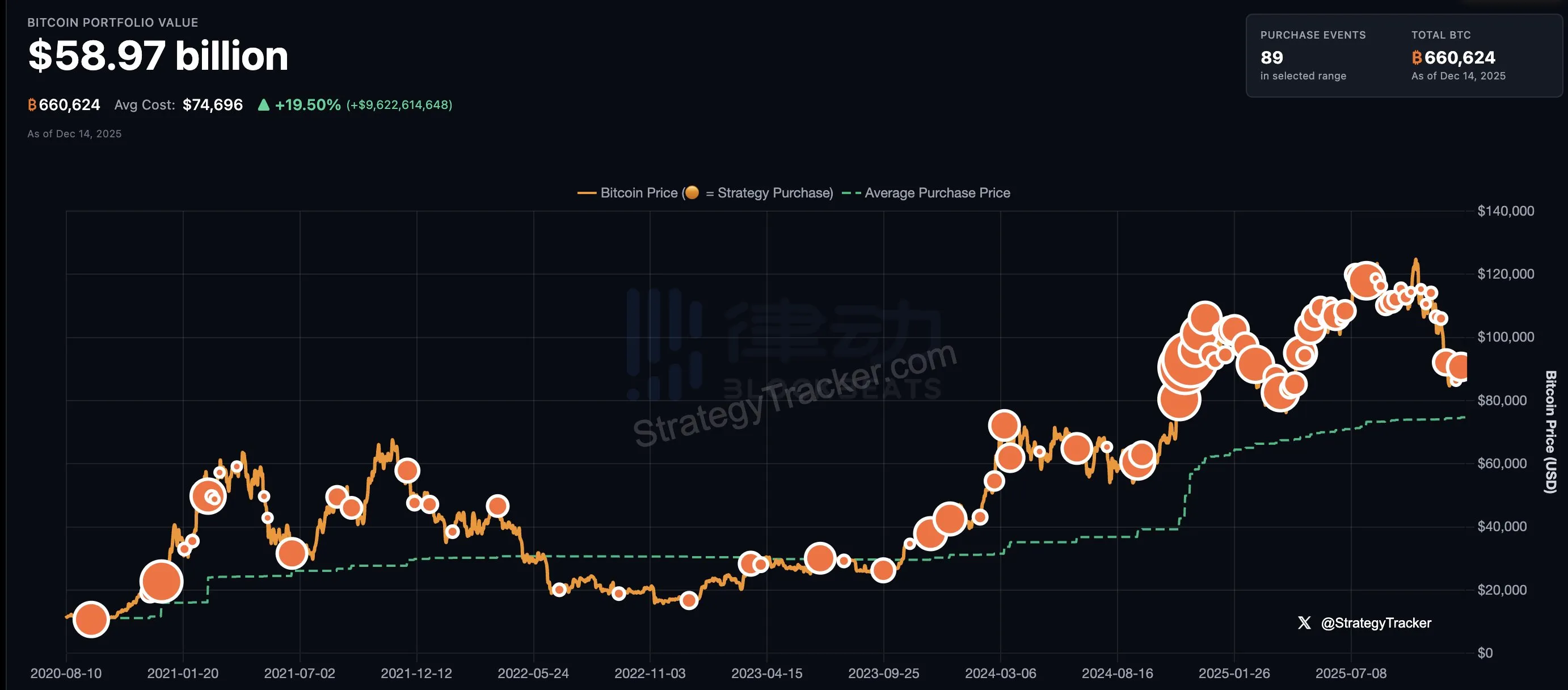

Michael Saylor releases Bitcoin Tracker information again, possibly hinting at another BTC accumulation

Analyst: Bitcoin’s key support level is at $86,000; a breach could trigger a deeper correction

Aevo confirms that the old Ribbon DOV vaults were attacked and lost $2.7 million, and will compensate active users.