Research Report|In-Depth Analysis and Market Cap of DoubleZero(2Z)

Bitget2025/10/09 09:28

By:Bitget

1. Project Overview

DoubleZero (2Z) is a decentralized protocol dedicated to creating and managing high-performance, permissionless networks to optimize communication for blockchains and other distributed systems. By mobilizing underutilized private fiber resources to build dynamic networking, DoubleZero aims to eliminate existing communication bottlenecks and push performance closer to physical limits.

The project positions itself as an

“N1 Layer” (Network Layer One) — distinct from traditional blockchain L1 or L2 layers — focusing on building dedicated fiber-optic infrastructure to significantly

reduce latency (up to 50%) and

increase bandwidth.

This solution is particularly suited for high-throughput, low-latency blockchains such as

Solana, providing validators with low-jitter direct connections and traffic filtering. The

2Z token adopts a

Proof of Utility (PoU) mechanism, used for network incentives, staking, and governance.

Regarding token allocation,

28% goes to

Jump Crypto,

14% to

Malbec Labs, and

12% to other institutional investors, though some community concerns exist about transparency and internal token control.

The project’s

mainnet-beta launched in 2025, now serving

300+ blockchain validators, with

$28 million raised at a

$

400

million valuation, supported by an

SEC no-action letter for compliance. By innovating at the physical layer, DoubleZero is reshaping blockchain infrastructure, with a current focus on the

Solana ecosystem.

2. Key Highlights

Revolutionary “N1 Layer” Infrastructure

DoubleZero is pioneering a decentralized global physical network that forms the

“foundation of blockchain foundations.” Its goal is to overcome latency, bandwidth, and centralization bottlenecks in public internet communication, enhancing blockchain performance, resilience, and decentralization at scale.

Hardware Acceleration & Physical-Layer Optimization

The project deploys

dedicated hardware (e.g., FPGA accelerators) at network edges, leveraging idle fiber globally. It performs

traffic filtering, rapid data validation, and dedicated routing, effectively

decoupling data verification from block production and transaction execution. This design reduces validator workload, supports

multicast transmission, and strengthens DDoS resistance.

Proof of Utility (PoU) Token Model

DoubleZero introduces a

Proof of Utility (PoU) model, where the native

2Z token powers incentives and network security.

Nodes contributing fiber or hardware earn 2Z.

Validators and users pay 2Z for optimized transmission services.

Smart contracts and SLA frameworks ensure fair and transparent incentives. Through network effects, each node becomes part of a globally resilient, scalable communication fabric.

Cross-Industry Integration Potential

Beyond blockchain, DoubleZero’s network architecture supports

RPC nodes, MEV systems, L2 rollups, and can extend to

CDNs, online gaming, AI model training, and enterprise systems, offering high-bandwidth, low-latency connectivity across industries.

3. Market Outlook

As one of the leading protocols optimizing blockchain communication, DoubleZero has deployed its

Beta mainnet with

300+ validators globally. With a

$

400

million valuation and strong backing in the rising

DePIN narrative, DoubleZero is positioned to become a

core “N1 Layer” infrastructure in Web3.

4. Tokenomics

Total Supply: 10 billion $2Z

Allocation Breakdown:

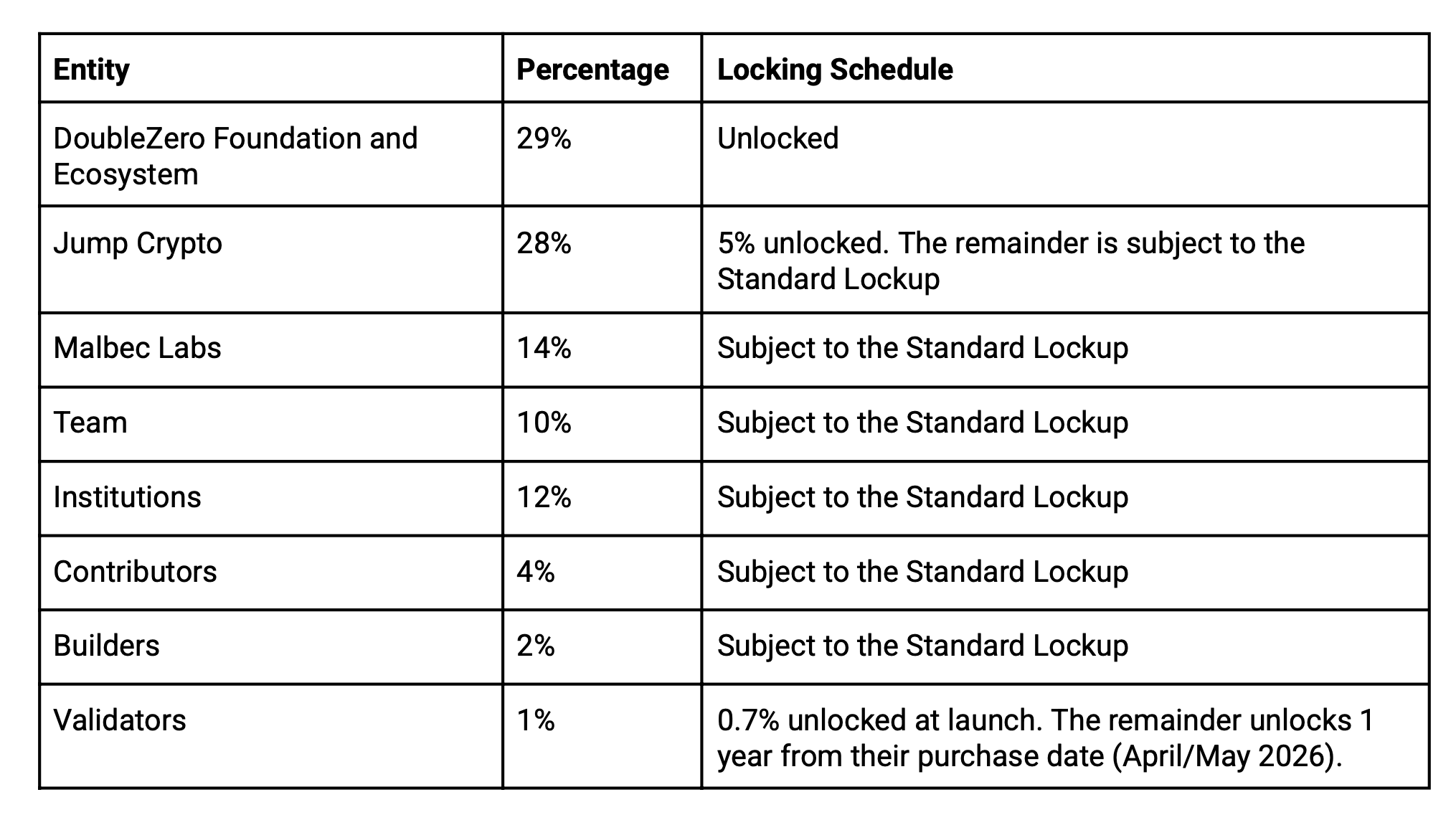

Foundation & Ecosystem: 29% (unlocked)

Jump Crypto: 28% (5% unlocked, remainder standard lockup)

Malbec Labs: 14% (standard lockup)

Institutional Investors: 12% (standard lockup)

Team: 10% (standard lockup)

Contributors: 4% (standard lockup)

Builders: 2% (standard lockup)

Validators: 1% (0.7% unlocked at launch; remainder unlocks ~Apr–May 2026)

Token

Utility:

Network fees: Pay for data transmission and transaction bandwidth.

Incentives: Earned by contributors based on throughput and uptime.

Staking & Governance: Secure the network and participate in decisions.

Cross-chain utility: Supports DeFi, interoperability, and distributed applications.

5. Team & Funding

Core Team:

Austin Federa (CEO) — Former Head of Strategy & Communications at

Solana Foundation, responsible for strategic direction and ecosystem development.

Andrew Reed (CTO) — HFT network expert with deep experience in distributed systems and low-latency infrastructure; leads protocol and hardware design.

Mateo (Matteo) Ward — Specialist in fiber infrastructure and network engineering; responsible for physical links, security, and validator integration.

Nihar Shah — Former Head of Data Science at

Mysten Labs; oversees economic modeling, data analytics, and tokenomics.

Funding:

Total Raised: $28 million

Valuation: $400 million

Lead Investors:

Multicoin Capital and

Dragonfly Capital

Other Participants: Foundation Capital, Reciprocal Ventures, Borderless Capital, Superscrypt, Frictionless, and angels including

Anatoly Yakovenko and

Raj Gokal (co-founders of Solana).

6. Token Unlock & Sell Pressure Analysis

Initial Circulating Supply: ~34% (Foundation 29% + Jump 5%) This is relatively

high for infrastructure projects, suggesting

notable early sell pressure potential.

Short Term (0–3 months)

Risk from

Foundation (29%) and

Jump Crypto’s 5% unlocked tokens.If used for ecosystem incentives or partnerships, tokens may enter circulation quickly.

Risk Level: High

Mid Term (3–12 months)

Standard lockups for

Malbec Labs, Team, and Institutions begin unlocking.If revenue generation or demand remains limited, selling pressure could emerge.

Risk Level: Medium

Long Term (12–24 months)

Validator allocations (unlocking around Q2 2026) are small but ongoing.Combined with staking rewards, could contribute to gradual sell pressure.

Risk Level: Medium-Low

7. Official Links

Website:

https://doublezero.xyz

Twitter (X):

https://x.com/doublezero

Disclaimer: This report was generated by AI and human-verified for accuracy. It is not intended as investment advice.

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

Infighting, scandals, and a stock price plunge: What can DAT rely on to survive?

Bitpush•2025/11/29 03:21

Price predictions 11/28: BTC, ETH, XRP, BNB, SOL, DOGE, ADA, HYPE, BCH, LINK

Cointelegraph•2025/11/29 01:48

Ethereum Privacy’s HTTPS Moment: From Defensive Tool to Default Infrastructure

A summary of the "Holistic Reconstruction of Privacy Paradigms" based on dozens of speeches and discussions from the "Ethereum Privacy Stack" event at Devconnect ARG 2025.

ChainFeeds•2025/11/28 22:25

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$90,714.47

-0.49%

Ethereum

ETH

$3,024.08

+0.54%

Tether USDt

USDT

$1

+0.03%

XRP

XRP

$2.19

-0.03%

BNB

BNB

$884.81

-0.88%

Solana

SOL

$136.95

-1.91%

USDC

USDC

$1.0000

+0.01%

TRON

TRX

$0.2810

+0.33%

Dogecoin

DOGE

$0.1500

-0.57%

Cardano

ADA

$0.4171

-2.10%

How to buy BTC

Bitget lists BTC – Buy or sell BTC quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now