Chamath Palihapitiya’s New $345,000,000 SPAC Rallies After Billionaire Warns Project Not ‘For Most Retail Investors’

Venture capitalist Chamath Palihapitiya’s new special-purpose acquisition company (SPAC) has witnessed a steady uptrend after the billionaire issued a warning to retail investors.

The American Exceptionalism Acquisition Corporation (AEXA) began trading on the New York Stock Exchange last week with Palihapitiya announcing that the blank check company is not intended for retail investors.

“I want to temper retail investors’ involvement with my SPACs. This deal was built for institutional investors. Specifically, 98.7% went to large institutions, each picked explicitly by me. The remaining 1.3% was allocated to retail investors.”

AEXA aims to partner with companies in energy, artificial intelligence, decentralized finance (DeFi), and defense systems.

Palihapitiya says that the SPAC was designed almost entirely institutionally backed because he learned that these vehicles are not ideal for most retail investors.

“They are for investors who can underwrite the volatility, place it as part of a broader structured portfolio and have the capital to support the company over the long run.”

AEXA launched with an initial public offering of 30 million shares valued at $10, but demand for the stock prompted the issuance of an additional 4.5 million shares.

“AEXA was more than 5x oversubscribed with a total of $1.4 billion of demand. As a result, we upsized AEXA to $345 million.”

AEXA closed at $11.59 and is up by 9.24% since its launch on September 30th.

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

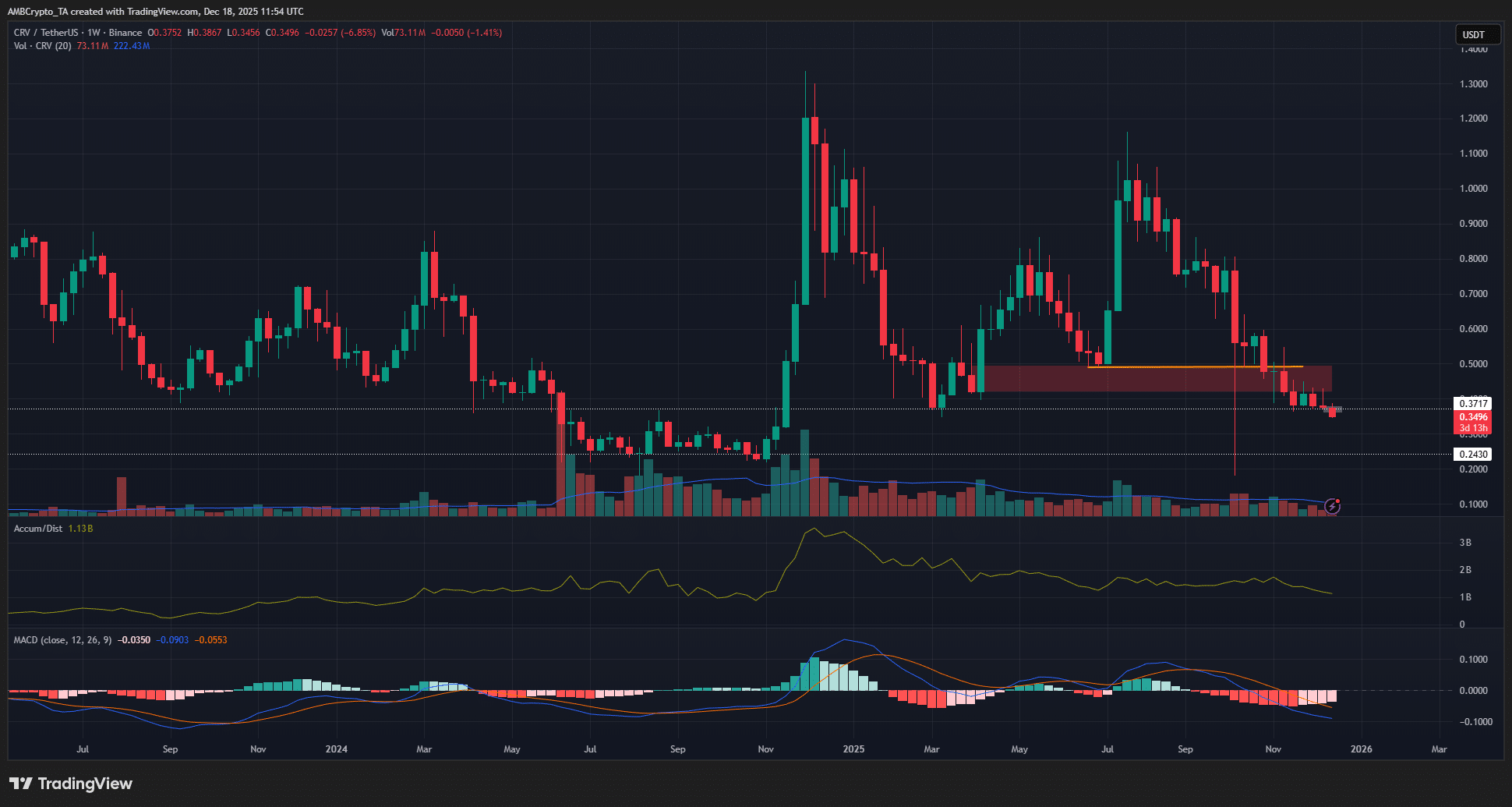

Dissecting Curve DAO’s price action as CRV eyes another support test

Damaging Impact: Cardano Founder Reveals How Trump’s Crypto Moves Hurt the Market

Crucial Alert: CoinMarketCap’s Altcoin Season Index Plummets to a Weak 17