James Wynn’s memecoin play turns as YEPE insiders sell

On-chain analytics indicate that insiders are starting to sell YEPE, which prominent trader James Wynn promoted.

- YEPE, memecoin tied to James Wynn, fell 25% after insiders started selling

- At launch, insiders likely controlled more than 60% of the token, on-chain data shows

- So far, insiders have made $1,4 million in profits, and still hold more than 50% of the supply

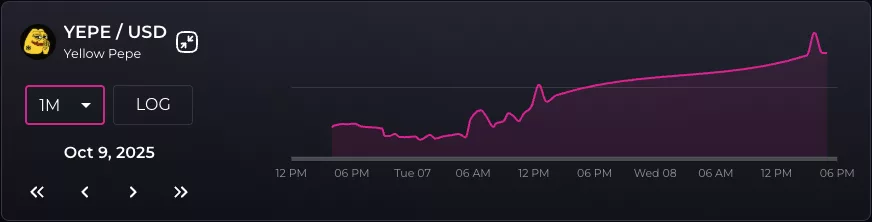

Memecoin season, especially on BNB, seems to be coming back. But with it, there’s also an explosion of questionable projects. On Thursday, October 9, Yellow Pepe, also known as YEPE, linked to James Wynn, saw a significant correction after apparent insiders started selling.

The BNB-based (BNB) memecoin dropped 25%, from 0.4% to 0.3%, after gaining more than 400% in just days since its launch. Likely the main driver of its rally was the endorsement of a high-profile trader, James Wynn, known for his ultra-leveraged trades, leading both to giant gains and losses.

Yellow Pepe (YEPE) price action since its launch | Source: Bubble Maps

Yellow Pepe (YEPE) price action since its launch | Source: Bubble Maps

In an X post, Wynn shared the token’s address, claiming that “YEPE is flying,” and that the “market has spoken”. Predictably, this led to his followers investing in this new memecoin.

YEPE token shows red flags since launch

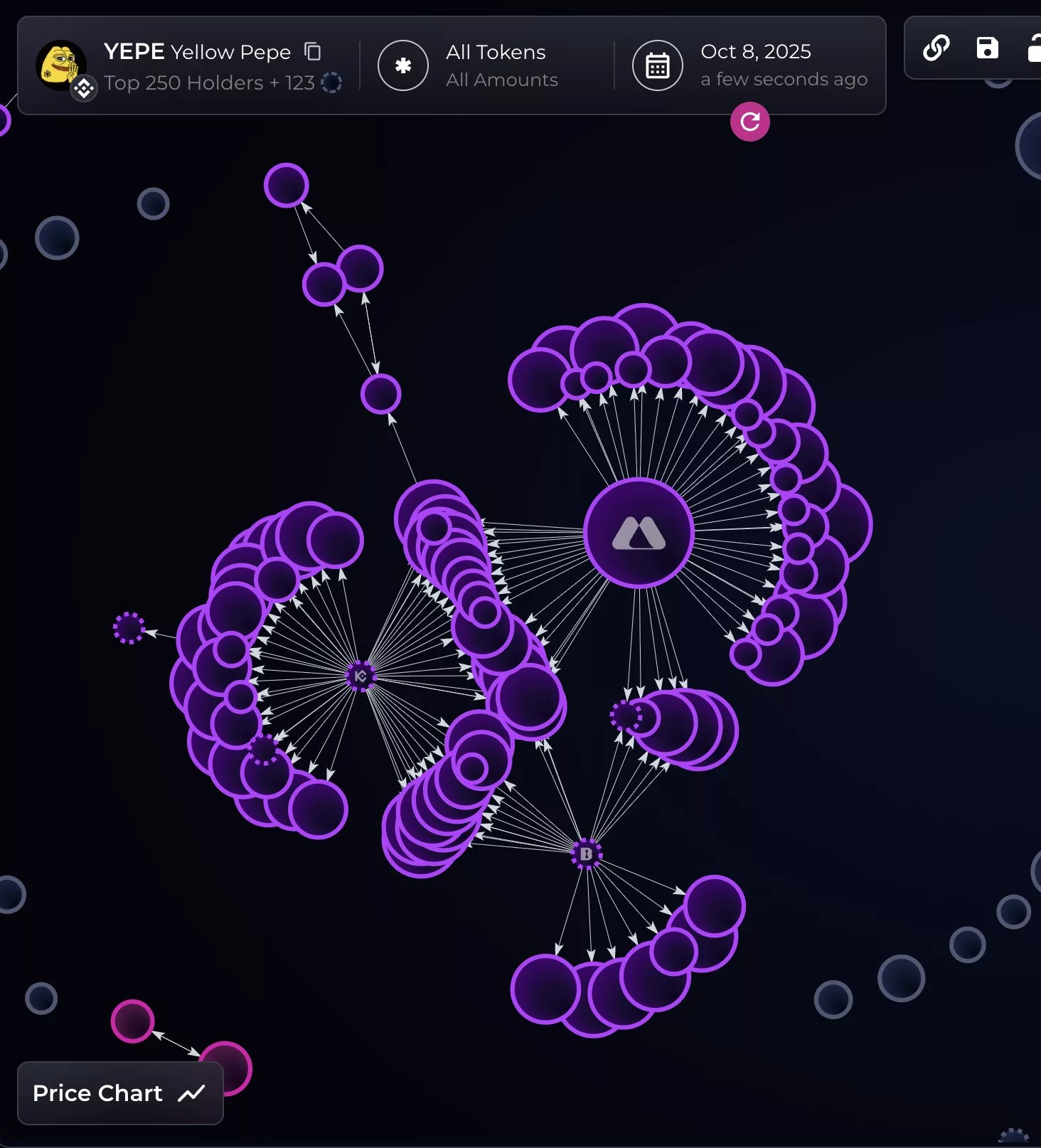

Still, the token displayed red flags from its launch. Blockchain analytics platform Bubble Maps revealed on October 5, the day of its launch, that insiders held 60% of YEPE. Such a high concentration is usually a red flag and can lead to significant pressure on the price as insiders start selling.

YEPE wallet nodes, indicating potential insider wallets | Source: Bubble Maps

YEPE wallet nodes, indicating potential insider wallets | Source: Bubble Maps

Predictably, this is exactly what happened. On October 8, insiders started dumping their YEPE positions, making $1.4 million in profits by the next day. What’s more, despite this selling spree, insiders still hold more than 50% of the token’s supply, according to Bubble Maps.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

With retail investors leaving, what will drive the next bull market?

Bitcoin has recently plummeted by 28.57%, leading to market panic and a liquidity crunch. However, long-term structural positives are converging, including expectations of Federal Reserve rate cuts and SEC regulatory reforms. The market currently faces a contradiction between short-term pressures and long-term benefits. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved.

Tether's "son" STABLE crashes? Plunges 60% on first day, whale front-running and no CEX listing spark trust panic

The Stable public blockchain has launched its mainnet. As a project associated with Tether, it has attracted significant attention but performed poorly in the market, with its price plummeting by 60% and facing a crisis of confidence. It is also confronted with fierce competition and challenges related to its tokenomics. Summary generated by Mars AI. The accuracy and completeness of the content are still being iteratively updated.

Hassett: The Fed has ample room to cut interest rates significantly.

From "Crime Cycle" to Value Reversion: Four Major Opportunities for the Crypto Market in 2026

We are undergoing a “purification” that the market needs, which will make the crypto ecosystem better than ever before, potentially improving it tenfold.