$16B in Longs Liquidated as Wall Street Sell-Off Extends BTC, ETH, Broader Crypto Market Meltdown

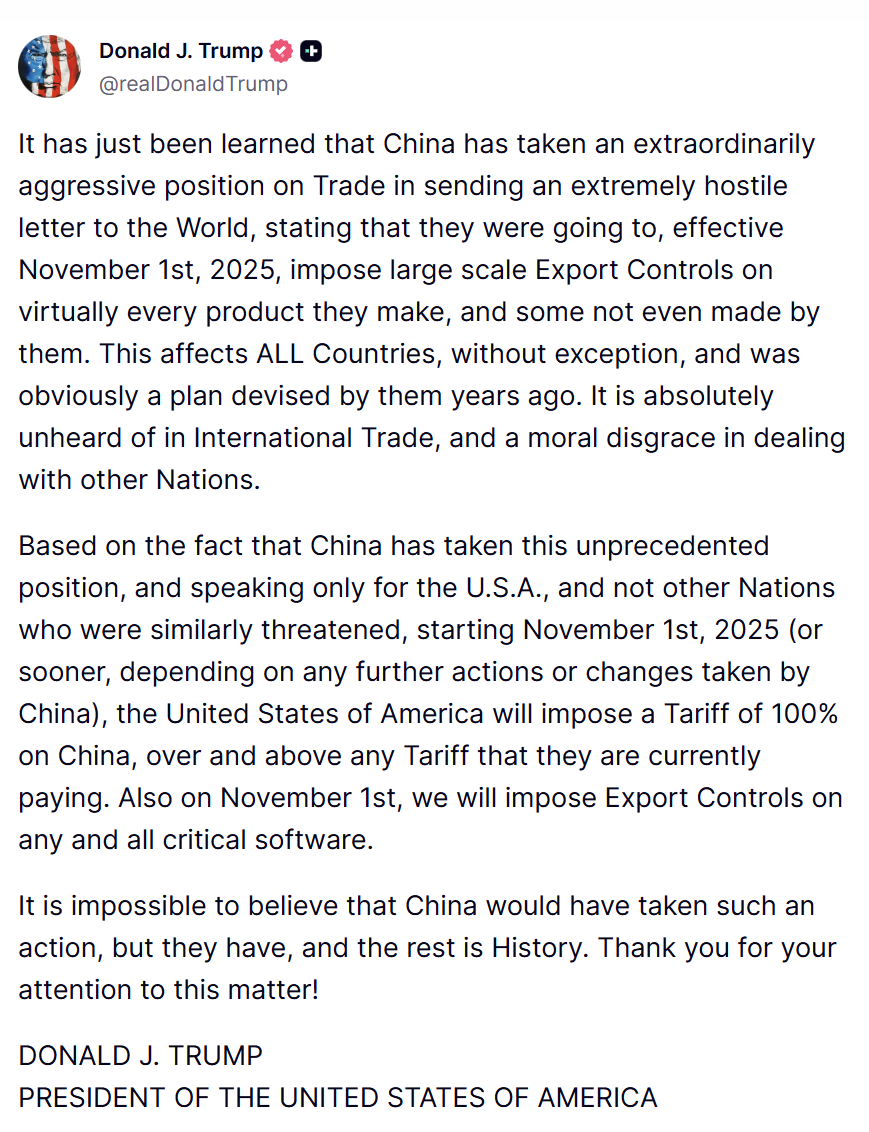

Crypto liquidations continued their rout early morning Asia hours after the broader crypto market continued its plunge hours after U.S. President Donald Trump threatened 100% tariffs on Chinese imports via a Truth Social post, which triggered a global risk-off wave and wiped out more than $16 billion in longs by midday Hong Kong time.

Trader anxiety that a cooling trade war was about to re-ignite sent a macro shock rippling through crypto, triggering one of the largest long declines in prices of BTC, ETH and other digital assets seen all year.

Bitcoin recovered to $113,294 and Ether to $3,844 as the CoinDesk 20 Index slid 12.1%. The world's largest cryptocurrency had fallen below $110,000 briefly, marking a 10% decline over the past 24 hours

Crypto's total market cap dropped to $3.87 trillion, and roughly $16.7 billion of the $19.1 billion in liquidations came from longs, while Ethena’s USDe briefly printed $0.9996, a mild deviation that highlights peg stress when derivatives markets whipsaw.

The Ethena team said USDe minting and redemptions remained fully operational despite the volatility and pointed out that the stablecoin is even more overcollateralized as unrealized gains from short positions are realized.

Adding to traders’ concerns, the U.S. government shutdown has delayed key economic data releases, leaving markets to navigate without official indicators just as trade war rhetoric returns to center stage.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Can the 40 billion bitcoin taken away by Qian Zhimin be returned to China?

Our core demand is very clear—to return the assets to their rightful owners, that is, to return them to the Chinese victims.

Bitcoin Surges but Stumbles: Will Crypto Market Recover?

In Brief Bitcoin fails to maintain its position above $93,000 and faces heavy selling pressure. Altcoins experience sharp declines, with some showing mixed performance trends. Shifts in U.S. spot Bitcoin ETF flows highlight cautious investor behavior.

Qubic and Solana: A Technical Breakthrough by Studio Avicenne