Farage Bets Big on Bitcoin — Will Britain Follow Trump’s Crypto Playbook?

Nigel Farage pledged to make Britain a global crypto hub, proposing a state-backed bitcoin reserve and 10% tax rate, echoing Trump’s 2024 playbook to win support from digital-asset investors ahead of elections.

British politician Nigel Farage has vowed to make Britain a global crypto hub, declaring, “I am your champion”. He unveiled sweeping pro-crypto policies at the Digital Asset Summit 2025 in London.

The Reform UK leader pledged to create a state-backed bitcoin reserve and slash capital-gains taxes to 10%. Reform UK currently holds five seats in the House of Commons, the fifth-largest presence after Labor, the Conservatives, the Liberal Democrats, and the SNP.

Farage’s Crypto Bill Proposes Bitcoin Reserve

Farage’s pledge mirrors the strategy of Donald Trump, who courted digital-asset investors ahead of his 2024 campaign. The populist politician now seeks to rally Britain’s crypto community and challenge Prime Minister Keir Starmer’s Labor government.

Farage outlined his Cryptoassets and Digital Finance Bill during his speech in London on Monday. The plan includes forming a national bitcoin reserve funded by $6.4 billion (£5 billion) in assets seized from criminals. It also introduces a 10% flat tax on crypto gains and bans account closures for lawful digital-asset activity.

“The UK’s financial services have become stagnant,” Farage told attendees. “I want London to be a great trading center again — including crypto.”

His stance contrasts sharply with the Bank of England’s cautious approach. Farage criticized its proposed limits on stablecoin holdings as “frankly ridiculous” and vowed to halt any central bank digital currency (CBDC) rollout, calling it “the ultimate authoritarian nightmare.”

Crypto industry voices welcomed his enthusiasm, which was immediately reflected across social media platforms. The extraordinary nature of the pledge—particularly the promise to buy Bitcoin for the UK’s reserves—sparked reactions that underscored the political weight of the announcement, such as: “With his party currently leading the polls, some speculate whether Bitcoin could become a component of the official UK financial system”.

JUST IN: NIGEL FARAGE PLEDGES TO BUY #BITCOIN FOR UKs RESERVES IF HE WINS NEXT ELECTIONHIS PARTY IS CURRENTLY LEADING IN THE POLLS 🔥 pic.twitter.com/XEtqvn420N

— The Bitcoin Historian (@pete_rizzo_) October 13, 2025

Policy May Redefine UK’s Financial Future

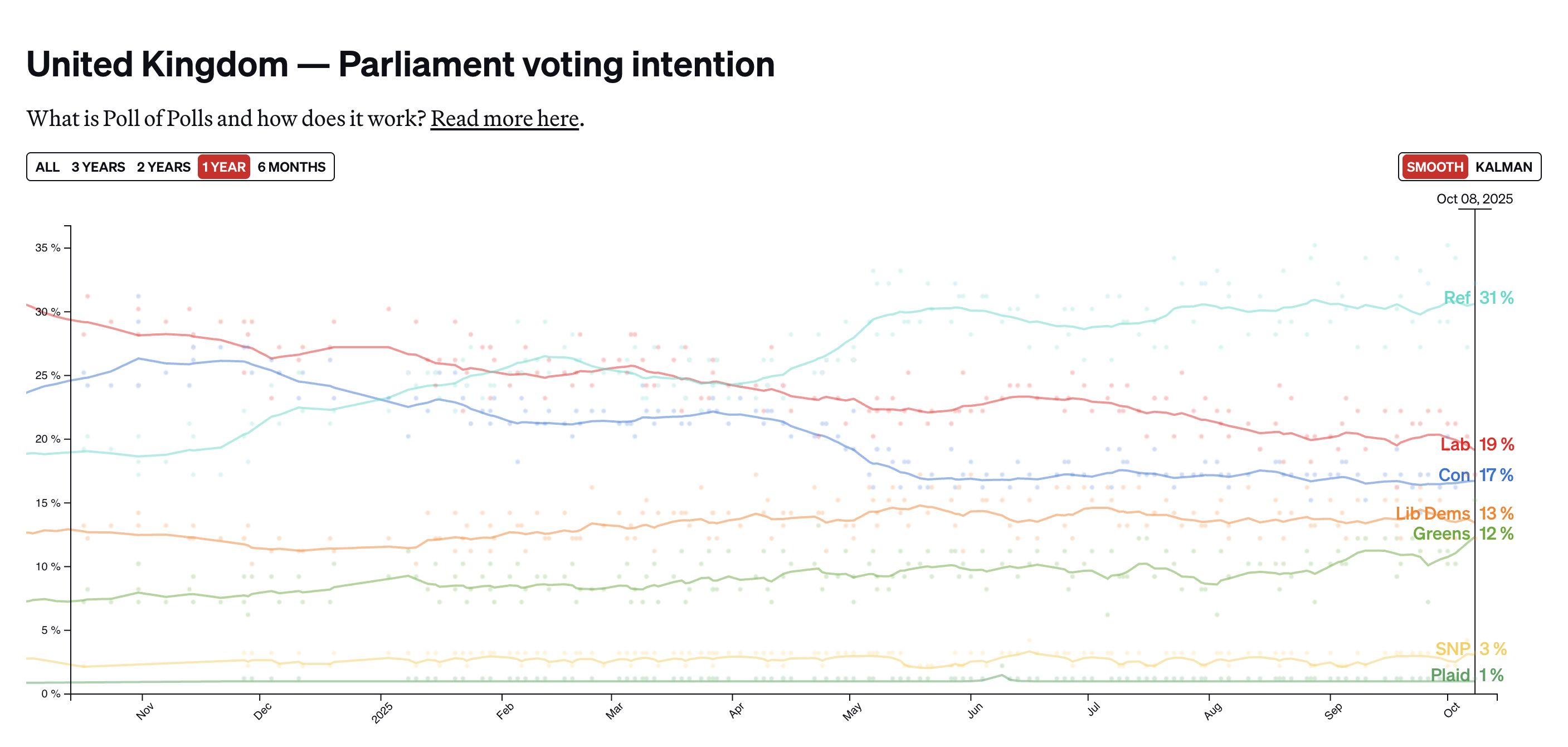

Reform UK now leads national polls, reflecting a shift from Britain’s traditional Conservative—Labor dominance. With the next general election set for 2029, projections suggest Reform could secure a majority if trends continue.

Politico projected Reform UK to win 311 seats — just 15 short of an outright majority — with a 31% vote share in early October 2025. Analysts see this as a collapse of two-party control and a rise in support from voters angry about overregulation and taxes.

United Kingdom — Parliament voting intention / Source:

Politico

United Kingdom — Parliament voting intention / Source:

Politico

Farage’s digital-asset agenda forms a central pillar of this new political alignment. The party’s strategy mirrors Donald Trump’s successful embrace of the “crypto vote” during the 2024 US election, indicating that crypto policy is fast becoming a mainstream electoral issue.

The UK’s crypto community remains dissatisfied with regulation. The Financial Conduct Authority’s “same risk, same regulation” model groups all tokens under speculative risk. The government also cut the tax-free capital gains allowance from $15,500 (€14,400) in 2022 to $3,800 (€3,500) in 2024.

Thank you to all 260,000 members of Reform UK.I now predict that we will be the biggest political party in Britain before long. pic.twitter.com/u8FcshQTzw

— Nigel Farage MP (@Nigel_Farage) October 12, 2025

Farage emphasizes that Reform’s 10% flat tax and simpler rules aim to restore competitiveness and attract digital-asset businesses back to Britain.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stunning $500 Million USDT Transfer to Aave: What This Whale Move Means for Crypto

S&P 500 Index: Why Vanguard Is Bearish on the Index