Zcash Drops 17% After 4-Year High, Shorts Pile In—Squeeze Setup?

ZEC price has pulled back 17% after reaching a four-year high, but this dip might be a setup — not a signal of weakness. With social mentions dropping to zero and traders heavily shorting Zcash, the stage could be set for another upside breakout above $255.

Zcash (ZEC) hit a four-year high just two days ago, strongly braving the wider crypto market crash that pulled most coins down. However, things haven’t been the same since. Over the past 24 hours, the ZEC price has dropped more than 17%, trimming part of its massive rally.

Even with that dip, the coin still trades 54% higher week-on-week, showing there’s plenty of action left. But a key metric has now dropped to zero, making some traders wonder if the rally is already over. That may not be the case. Technicals suggest this could just be a cooling phase — one that might set up another breakout soon.

Social Buzz Fades, but the Flag Pattern Holds Firm

Social dominance, which tracks how much Zcash is mentioned in crypto conversations, fell sharply after peaking on October 10, the same day prices topped out near $249.

Zcash Social Mentions:

Zcash Social Mentions:

As online chatter faded, the ZEC price also slipped — but that doesn’t necessarily spell the end of the move.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter .

ZEC’s current structure mirrors what happened in early October, when a bull flag pattern appeared before a breakout. The social dominance metric dropped sharply during that formation as well. Also, the social metric dropping to zero isn’t uncommon for Zcash. Similar levels were tested during early October, a timeframe that aligned with rising prices.

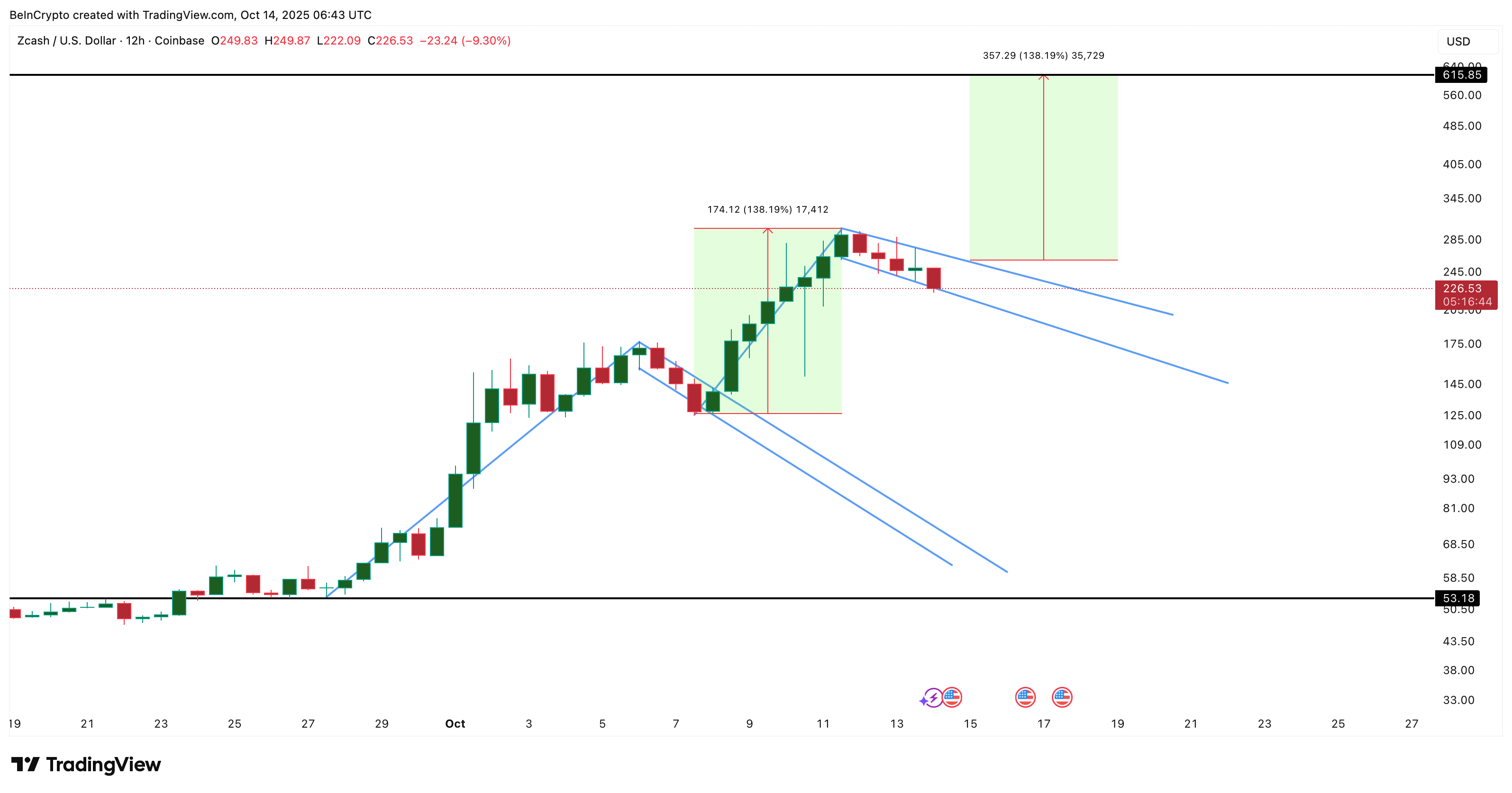

Key ZEC Price Fractal:

Key ZEC Price Fractal:

A similar flag is forming again, suggesting that this correction (parallel social metric dip) could simply be a reset inside an ongoing bullish setup. Adding to that setup, derivatives data show a potential contrarian catalyst emerging.

Short Bets Build Up — and a ZEC Price Breakout Above $255 Could Change Things

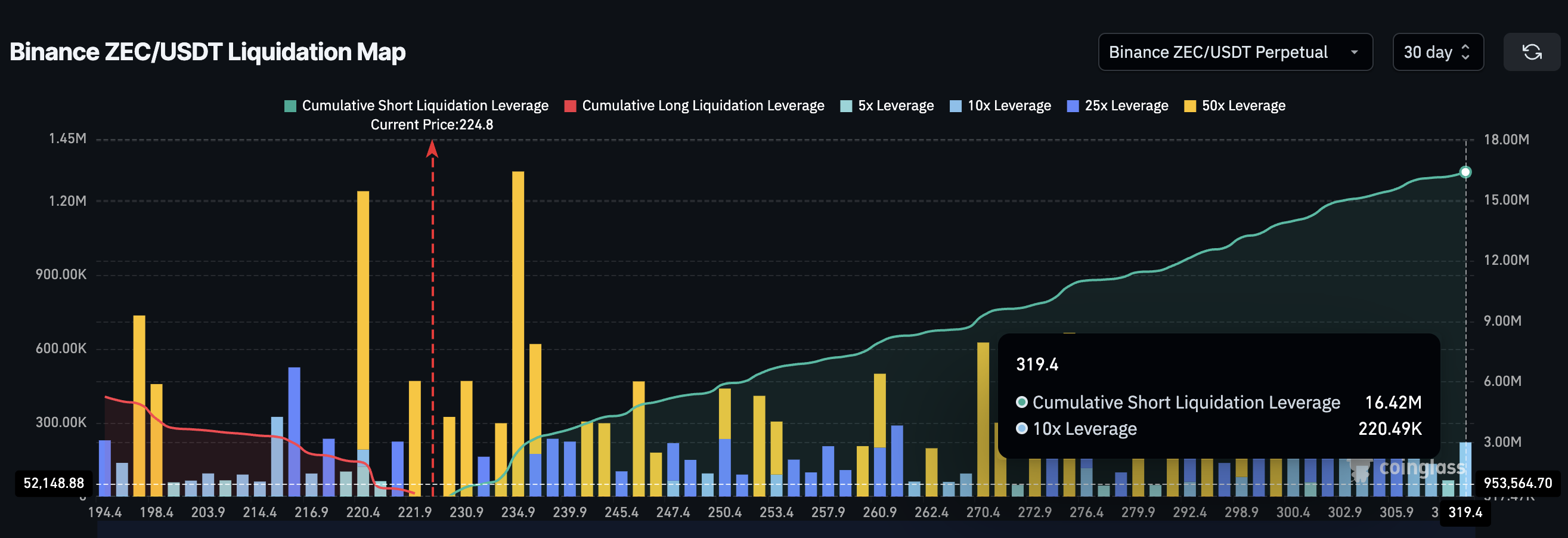

According to Binance’s 30-day liquidation map, the ZEC/USDT pair shows a heavy short bias. More than $16.4 million in short leverage has been built below current levels, compared to $5.2 million in long positions.

This means most traders are betting against Zcash — and when short interest gets crowded, even a small price rise can trigger short liquidations, forcing prices even higher. An event commonly termed “short squeeze.”

Short ZEC Leverage Building Up:

Short ZEC Leverage Building Up:

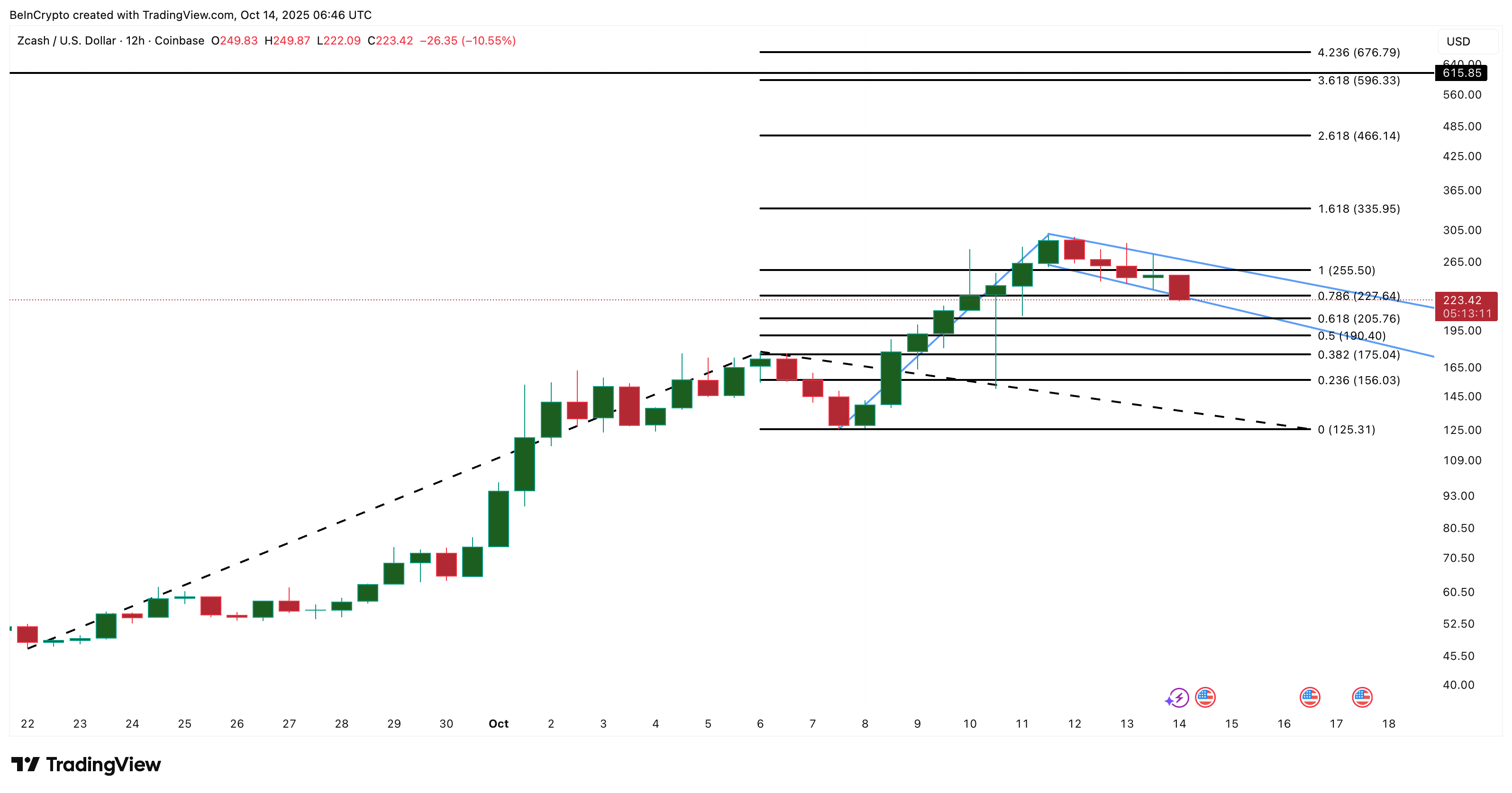

On the charts, the ZECprice trades around $223, consolidating inside a flag pattern.

A 12-hour candle close above $255 could confirm a new breakout, targeting Fibonacci extension levels at $335, $466, and $596, with an extended projection near $615 (the projected target if the ongoing flag and pole breakout holds).

Zcash Price Analysis:

Zcash Price Analysis:

However, a fall below $190 could slow momentum, while losing $156 would invalidate the bullish structure entirely.

With social chatter quiet, derivatives leaning short, and the pattern still intact, the Zcash (ZEC) price may be setting up for another surprise upside move.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Economic Truth: AI Drives Growth Alone, Cryptocurrency Becomes a Political Asset

The article analyzes the current economic situation, pointing out that AI is the main driver of GDP growth, while other sectors such as the labor market and household finances are in decline. Market dynamics have become detached from fundamentals, with AI capital expenditure being key to avoiding a recession. The widening wealth gap and energy supply are becoming bottlenecks for AI development. In the future, AI and cryptocurrencies may become the focus of policy adjustments. Summary generated by Mars AI This summary was generated by the Mars AI model, and its accuracy and completeness are still in the process of iterative improvement.

AI unicorn Anthropic accelerates IPO push, taking on OpenAI head-to-head?

Anthropic is accelerating its expansion into the capital markets, initiating collaboration with top law firms, which is seen as an important signal toward going public. The company's valuation is approaching 300 billions USD, and investors are betting it could go public before OpenAI.

Did top universities also get burned? Harvard invested $500 million heavily in bitcoin right before the major plunge

Harvard University's endowment fund significantly increased its holdings in bitcoin ETFs to nearly 500 million USD in the previous quarter. However, in the current quarter, the price of bitcoin subsequently dropped by more than 20%, exposing the fund to significant timing risk.

The Structural Impact of the Next Federal Reserve Chair on the Cryptocurrency Industry: Policy Shifts and Regulatory Reshaping

The change of the next Federal Reserve Chair is a decisive factor in reshaping the future macro environment of the cryptocurrency industry.