BNB Hits New High Then Slides — Here’s Why Traders Should Be Cautious

BNB’s record high may be deceptive, as bearish signals and negative funding rates point to waning confidence and a potential pullback toward key support levels.

BNB reached a new all-time high of $1,375 yesterday, driven by the broader market’s attempt to recover from last weekend’s sharp liquidation event.

However, the rally may be showing cracks. The altcoin’s price has dropped roughly 10% today as bullish momentum fades, and on-chain indicators point to bears gaining ground.

BNB Shows Early Signs of Weakness

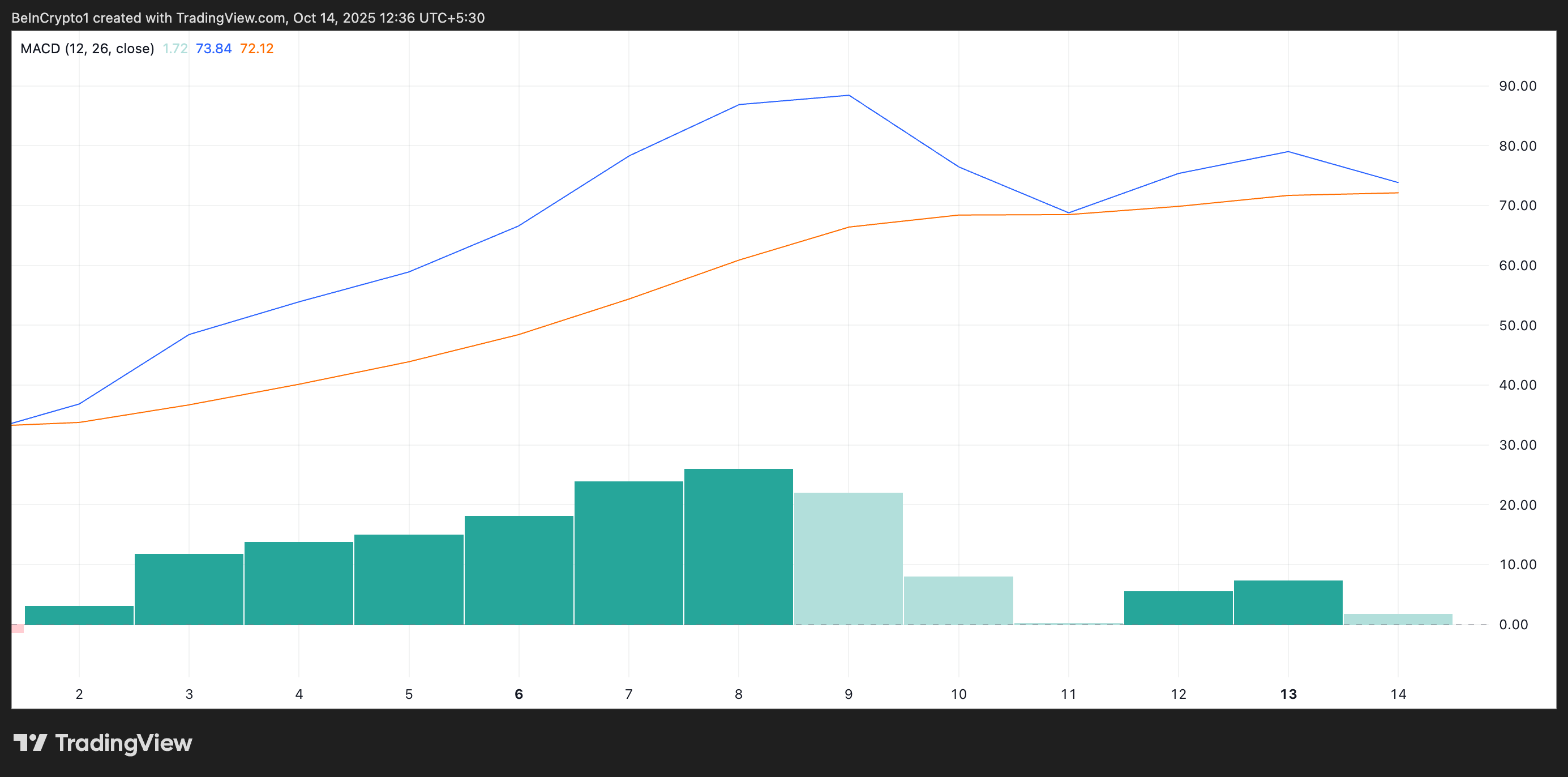

Readings from the BNB/USD one-day chart show that the coin’s Moving Average Convergence Divergence (MACD) is poised to form a bearish crossover, hinting at deeper losses in the near term.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

BNB Moving Average Convergence Divergence. Source:

TradingView

BNB Moving Average Convergence Divergence. Source:

TradingView

The MACD indicator identifies trends and momentum in an asset’s price movement, helping traders spot potential buy or sell signals through crossovers between the MACD (blue) and signal lines (orange).

A bearish crossover occurs when the MACD line dips below the signal line, indicating a weakening in bullish momentum and a possible shift toward downward price movement.

In BNB’s case, this technical pattern suggests that the coin’s recent upward surge may be losing steam, and short-term sellers could begin to dominate market activity.

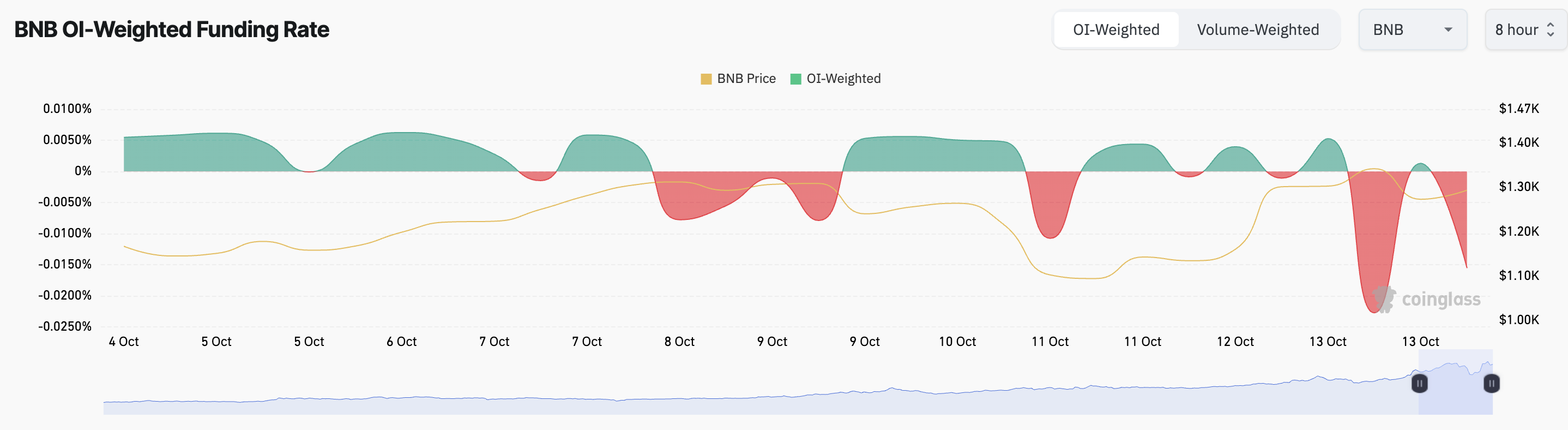

Furthermore, the trend among BNB coin’s derivatives traders is no different, as reflected by its negative funding rate. Per Coinglass, this currently stands at -0.015% at press time, indicating low confidence among traders that BNB’s rally would continue.

BNB Funding Rate. Source:

Coinglass

BNB Funding Rate. Source:

Coinglass

Funding rates are periodic payments exchanged between long and short positions in perpetual futures contracts. When the funding rate is positive, long position holders pay short position holders, which occurs during bullish markets where demand for longs exceeds shorts.

Conversely, a negative funding rate like BNB’s means short position holders pay longs, indicating that bearish sentiment is gaining ground and traders are hedging against a potential price decline.

This points to fading optimism among BNB market participants and increases the probability of a near-term pullback.

BNB’s Rally Pauses, Market Eyes Critical Support Levels

The waning bullish sentiment will continue to impact BNB’s price performance and push it further from its recent peak. If sell-side pressure strengthens, the altcoin risks breaching the support at $1,192 and falling toward $1,048.

BNB Price Analysis. Source:

TradingView

BNB Price Analysis. Source:

TradingView

However, this bearish outlook will be invalidated if new demand enters the market. In that scenario, BNB’s price could reclaim its all-time high and attempt to touch a new peak.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Economic Truth: AI Drives Growth Alone, Cryptocurrency Becomes a Political Asset

The article analyzes the current economic situation, pointing out that AI is the main driver of GDP growth, while other sectors such as the labor market and household finances are in decline. Market dynamics have become detached from fundamentals, with AI capital expenditure being key to avoiding a recession. The widening wealth gap and energy supply are becoming bottlenecks for AI development. In the future, AI and cryptocurrencies may become the focus of policy adjustments. Summary generated by Mars AI This summary was generated by the Mars AI model, and its accuracy and completeness are still in the process of iterative improvement.

AI unicorn Anthropic accelerates IPO push, taking on OpenAI head-to-head?

Anthropic is accelerating its expansion into the capital markets, initiating collaboration with top law firms, which is seen as an important signal toward going public. The company's valuation is approaching 300 billions USD, and investors are betting it could go public before OpenAI.

Did top universities also get burned? Harvard invested $500 million heavily in bitcoin right before the major plunge

Harvard University's endowment fund significantly increased its holdings in bitcoin ETFs to nearly 500 million USD in the previous quarter. However, in the current quarter, the price of bitcoin subsequently dropped by more than 20%, exposing the fund to significant timing risk.

The Structural Impact of the Next Federal Reserve Chair on the Cryptocurrency Industry: Policy Shifts and Regulatory Reshaping

The change of the next Federal Reserve Chair is a decisive factor in reshaping the future macro environment of the cryptocurrency industry.