XRP Selling Hits 3 Year High As Whales Dump $5 Billion In 4 Days

XRP faces intense selling after whales offloaded $5 billion, driving prices to $2.44. A rebound above $2.54 is needed to restore bullish sentiment.

XRP is struggling to recover from last week’s market crash, with its rebound momentum dampened by weak investor support and growing selling pressure.

Despite broader market stabilization, XRP holders continue to offload their assets, intensifying the bearish sentiment and slowing the altcoin’s path to recovery.

XRP Holders Move To Sell

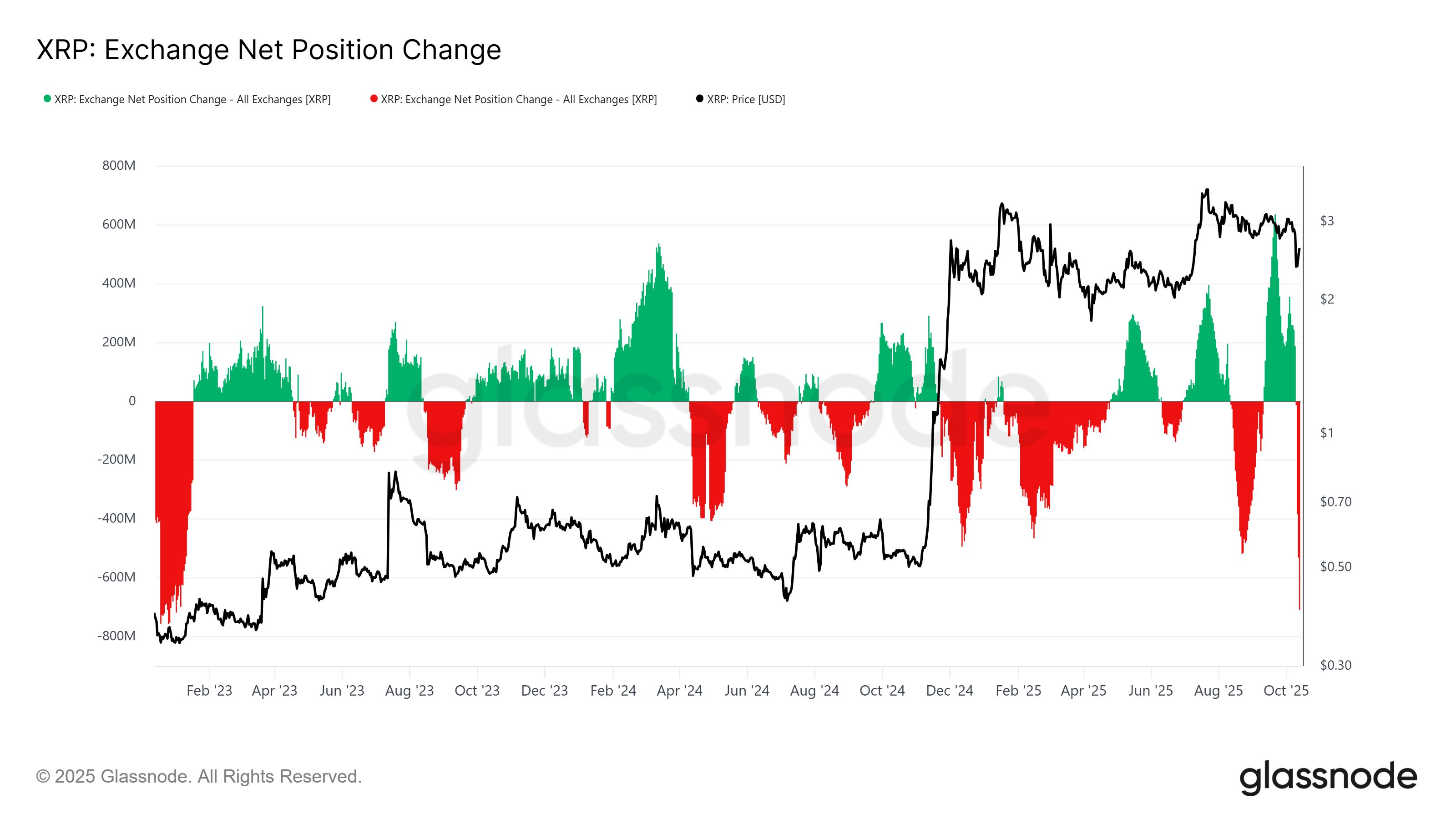

Although the crash occurred nearly four days ago, XRP investors continue to sell at unprecedented levels. Data from the exchange net position change indicates that selling volume is the highest recorded since December 2022. The persistent offloading suggests panic selling among investors, driven by the lack of a visible recovery in the token’s price.

This sustained selling pressure could hinder XRP’s ability to regain momentum. With confidence fading, buyers appear hesitant to reenter the market. The continued outflow of tokens from investor wallets to exchanges highlights the prevailing fear that further losses may still lie ahead, limiting upward potential.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

XRP Exchange Net Position Change. Source:

Glassnode

XRP Exchange Net Position Change. Source:

Glassnode

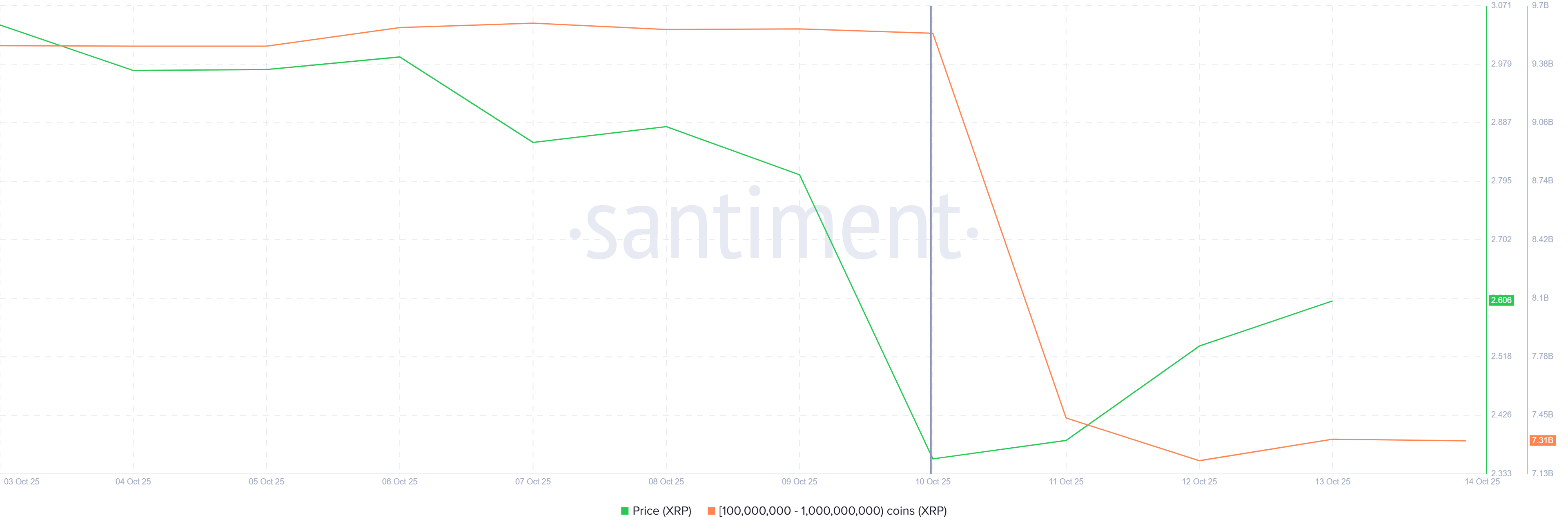

Whales have been major contributors to XRP’s recent price decline. Addresses holding between 100 million and 1 billion XRP have reportedly sold over 2.24 billion tokens worth more than $5.4 billion since the October 10 crash. This massive sell-off has intensified downward pressure on the market.

Such large-scale liquidation by whales signals deep skepticism regarding XRP’s near-term performance. Institutional and high-value investors exiting positions suggest a lack of faith in the token’s ability to stage a meaningful rebound.

XRP Whale Selling. Source:

Santiment

XRP Whale Selling. Source:

Santiment

XRP Price Has To Bounce Back

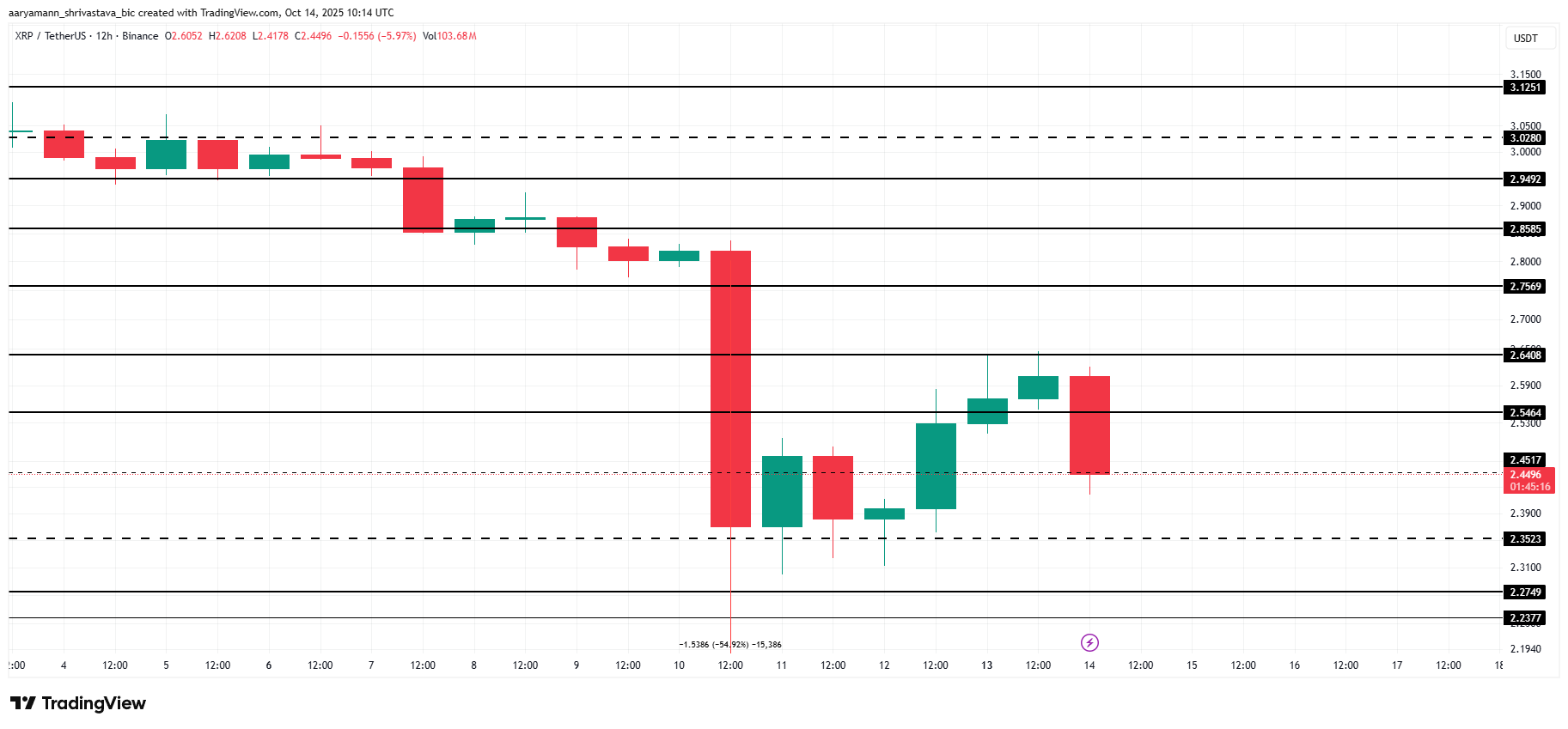

At the time of writing, XRP trades at $2.44, hovering just below the $2.45 support level. If bearish momentum persists and investor confidence weakens further, the altcoin could slide to $2.35 or even $2.27 in the coming days.

This would make recovery increasingly challenging for XRP, which needs to climb back toward $2.85 to reclaim its recent losses. Sustained selling activity, particularly from large holders, could delay this process and push prices lower.

XRP Price Analysis. Source:

TradingView

XRP Price Analysis. Source:

TradingView

However, if selling pressure eases and investors begin accumulating once again, XRP could rebound. A push above $2.54 and $2.64 could pave the way toward $2.75, signaling renewed market optimism and invalidating the bearish outlook.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Economic Truth: AI Drives Growth Alone, Cryptocurrency Becomes a Political Asset

The article analyzes the current economic situation, pointing out that AI is the main driver of GDP growth, while other sectors such as the labor market and household finances are in decline. Market dynamics have become detached from fundamentals, with AI capital expenditure being key to avoiding a recession. The widening wealth gap and energy supply are becoming bottlenecks for AI development. In the future, AI and cryptocurrencies may become the focus of policy adjustments. Summary generated by Mars AI This summary was generated by the Mars AI model, and its accuracy and completeness are still in the process of iterative improvement.

AI unicorn Anthropic accelerates IPO push, taking on OpenAI head-to-head?

Anthropic is accelerating its expansion into the capital markets, initiating collaboration with top law firms, which is seen as an important signal toward going public. The company's valuation is approaching 300 billions USD, and investors are betting it could go public before OpenAI.

Did top universities also get burned? Harvard invested $500 million heavily in bitcoin right before the major plunge

Harvard University's endowment fund significantly increased its holdings in bitcoin ETFs to nearly 500 million USD in the previous quarter. However, in the current quarter, the price of bitcoin subsequently dropped by more than 20%, exposing the fund to significant timing risk.

The Structural Impact of the Next Federal Reserve Chair on the Cryptocurrency Industry: Policy Shifts and Regulatory Reshaping

The change of the next Federal Reserve Chair is a decisive factor in reshaping the future macro environment of the cryptocurrency industry.