Bitcoin and Ethereum ETFs surge with $340 million in inflows

- Bitcoin and Ethereum ETFs return to positive territory

- Fidelity leads inflows after strong outflows on Monday

- Investors react to US-China trade tensions

US spot Bitcoin and Ethereum ETFs returned to positive territory on Tuesday after a turbulent start to the week in the cryptocurrency market. According to recent data , the combined funds saw $340 million in net inflows, reversing the strong $755 million outflow seen on Monday.

Bitcoin ETFs recorded $102,6 million in daily net inflows. Fidelity's FBTC led the way with $132,67 million. Other funds, such as ARK 21Shares and Bitwise, also reported positive flows. However, BlackRock's IBIT registered outflows of $30,8 million, accompanied by another $14 million from Valkyrie's BRRR fund.

Ethereum ETFs performed even more impressively, with a combined daily net inflow of $236,22 million across six funds. FETH, also from Fidelity, was the main driver of this result, totaling $154,62 million in new inflows. Funds from Grayscale, VanEck, Bitwise, and Franklin Templeton also recorded significant volumes.

Analysts say the reversal reflects a gradual recovery in institutional appetite, following a weekend marked by one of the largest sell-offs in cryptocurrency history, which wiped out more than $500 billion in market value. The episode intensified after U.S. President Donald Trump confirmed plans to impose 100% tariffs on Chinese imports, sparking strong global volatility.

Vincent Liu, chief investment officer at Kronos Research, noted that Monday's record outflows reflected "the cautious sentiment among institutional investors following the weekend's market meltdown."

Despite the slight recovery, experts point out that the market still faces uncertainties related to the escalation of trade between the US and China.

“We shouldn’t draw too many conclusions from the daily action yet, as we should expect noisy reactions after Friday’s multi-sigma sell-off, and we expect markets to remain choppy as key risks mount as we approach the presumed November 1 tariff deadline,”

said Augustine Fan, head of insights at SignalPlus.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Take Down OpenAI? The Ambition of the Open-Source AI Platform Sentient Goes Beyond That

Historic Shift: Bank of Japan Raises Key Interest Rate to 30-Year High

'We are closer than ever': US crypto czar David Sacks says Clarity Act markup confirmed for January

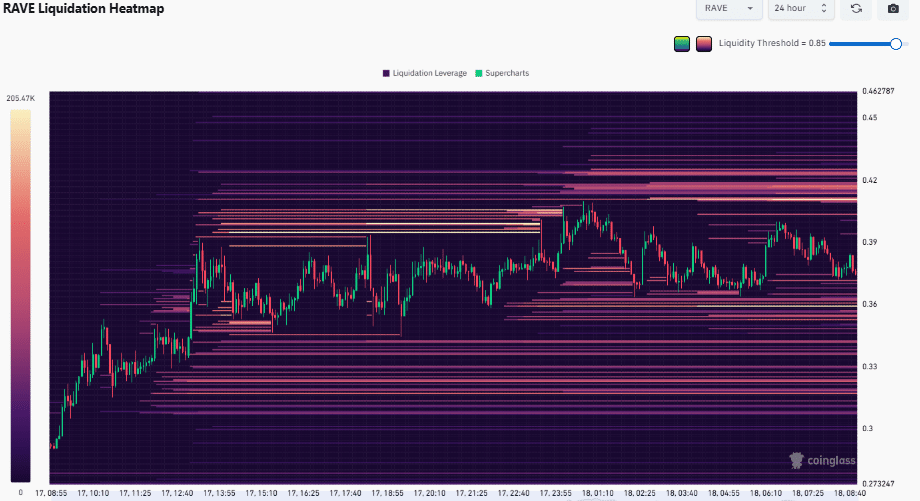

RAVE rallies 29%, but is the post-launch correction already over?