The Key to the Bear-to-Bull Transition: The Second S-Curve of Growth

The second S-curve of growth is the result of structurally normalizing finance under real-world constraints through yield, labor force, and credibility.

The second S-curve is the result of structurally normalizing finance through yield, labor, and credibility under real-world constraints.

Written by: arndxt

Translated by: AididiaoJP, Foresight News

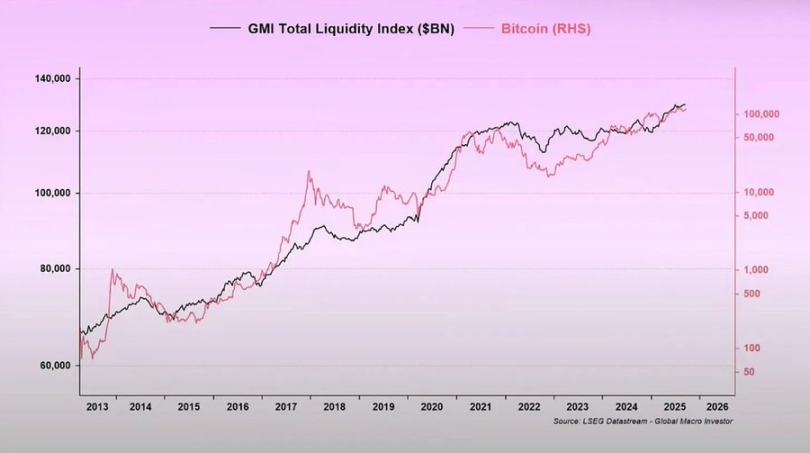

Liquidity expansion remains the dominant macro narrative.

Recession signals are lagging, and structural inflation is sticky.

Policy rates are above neutral but below the tightening threshold.

The market is pricing in a soft landing, but the real adjustment is institutional: from cheap liquidity to disciplined productivity.

The second curve is not cyclical.

It structurally normalizes finance through yield, labor, and credibility under real-world constraints.

Cycle Transition

The Token2049 Singapore conference marked a turning point from speculative expansion to structural integration.

The market is repricing risk, shifting from narrative-driven liquidity to yield data supported by income.

Key shifts:

- Perpetual decentralized exchanges remain dominant, with Hyperliquid ensuring network-scale liquidity.

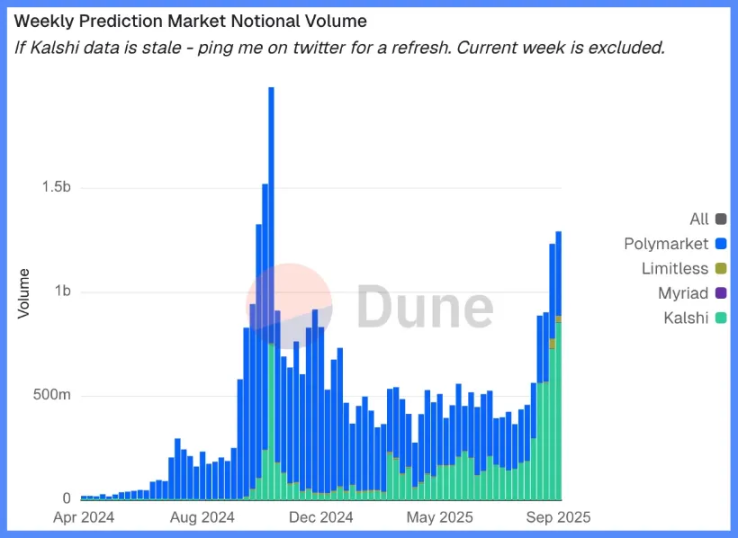

- Prediction markets are emerging as functional derivatives of information flow.

- AI-related protocols with real Web2 application scenarios are quietly expanding their revenues.

- Restaking and DAT have peaked; liquidity fragmentation is evident.

Macro Institutions: Currency Depreciation, Demographics, Liquidity

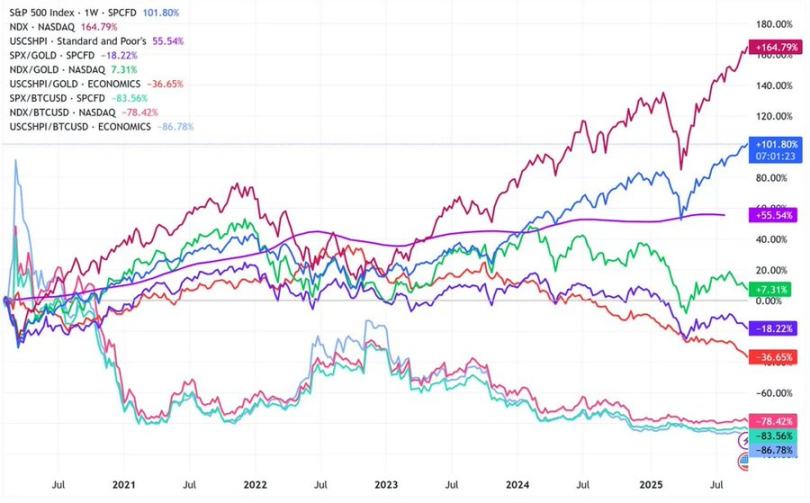

Asset inflation reflects currency depreciation, not organic growth.

When liquidity expands, duration assets outperform the broader market.

When liquidity contracts, leverage and valuations are compressed.

Three structural drivers:

- Currency depreciation: Repaying sovereign debt requires ongoing balance sheet expansion.

- Demographics: An aging population reduces productivity and reinforces dependence on liquidity.

- Liquidity pipelines: Since 2009, global total liquidity—defined as the sum of central bank and banking system reserves—has tracked 90% of risk asset performance.

Recession Risk: Lagging Data, Leading Signals

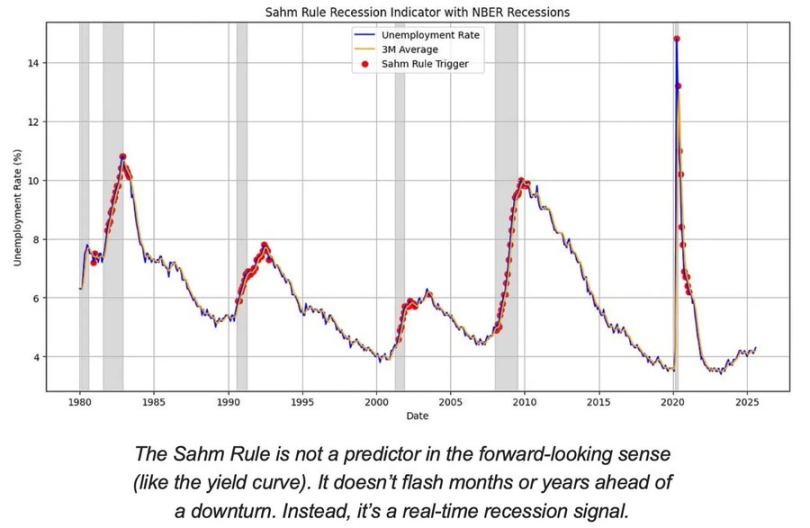

Mainstream recession indicators are lagging.

CPI, unemployment rate, and the Sahm Rule only confirm after an economic downturn has begun.

The US is in the late stage of the economic cycle, not in a recession.

The probability of a soft landing remains higher than the risk of a hard landing, but policy timing is a constraint.

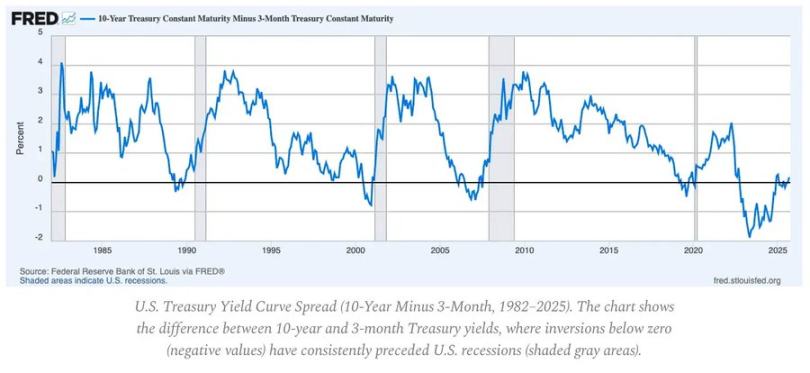

Leading indicators:

- The inverted yield curve remains the clearest leading signal.

- Credit spreads are under control, indicating no imminent systemic stress.

- The labor market is gradually cooling; employment remains tight within the cycle.

Inflation Dynamics: The Last Mile Problem

Goods disinflation is complete; services inflation and wage stickiness now anchor overall CPI near 3%.

This "last mile" is the most complex phase of disinflation since the 1980s.

- Goods deflation now offsets part of the CPI impact.

- Wage growth near 4% keeps services inflation elevated.

- Housing inflation is lagging in measurement; actual market rents have already cooled.

Policy implications:

- The Federal Reserve faces a trade-off between credibility and growth.

- Cutting rates too early risks re-acceleration; keeping them high for too long risks overtightening.

- The equilibrium outcome is a new inflation floor near 3%, rather than 2%.

Macro Structure

Three long-term inflation anchors remain:

- De-globalization: Supply chain diversification increases transformation costs.

- Energy transition: Capital-intensive low-carbon activities raise short-term input costs.

- Demographics: Structural labor shortages create persistent wage rigidity.

These limit the Federal Reserve's ability to normalize without higher nominal growth or a higher equilibrium inflation rate.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Perhaps as soon as next week, the term "RMP" will sweep across the entire market and be regarded as the "new generation QE".

The Federal Reserve has stopped its balance sheet reduction, marking the end of the "quantitative tightening" era. The much-watched RMP (Reserve Management Purchases) could initiate a new round of balance sheet expansion, potentially injecting a net increase of $20 billion in liquidity each month.

Enemies reconciled? CZ and former employees join forces to launch prediction platform predict.fun

Dingaling, who was previously criticized by CZ due to the failure of boop.fun and the "front-running" controversy, has now reconciled with CZ and jointly launched a new prediction platform, predict.fun.

Why is it said that prediction markets are really not gambling platforms?

The fundamental difference between prediction markets and gambling lies not in gameplay, but in mechanisms, participants, purposes, and regulatory logic—the capital is betting on the next generation of "event derivatives markets," not simply rebranded gambling.

2025 Crypto Prediction Mega Review: What Nailed It and What Noped It?

Has a year passed already? Have those predictions from back then all come true?