Fun Fact: The first DApp on Ethereum was the prediction market Augur

As the first ICO project on Ethereum, Augur's design seems overly futuristic even by today's standards.

Original Article Title: "Fun Fact: The First DApp on Ethereum Was a Prediction Market"

Original Article Author: Eric, Foresight News

While recently organizing which Web3 prediction markets exist, I suddenly remembered Augur. Upon searching for related information, I found that Augur announced its relaunch in March of this year; however, I had no idea when it had stopped operating.

The reason I felt this way is because Augur was the focus of the first article I translated into the field. The article was published on March 19, 2019, and I vividly remember that the requirement at that time was to add personal insights to the translation. I also recall that I used the movie poster for "The Butterfly Effect" as the cover for the article I published on a public account, as my personal interpretation was that prediction markets have the ability to change the future.

I wonder if the viewpoint that arose more than six years ago can be considered prophetic. My perspective on why the current top Web3 prediction markets are approaching a valuation of nearly a billion dollars remains unchanged: when an event is bound to have a deterministic outcome in the future, and when the game around this outcome is mixed with economic interests, the game itself will have the ability and motivation to alter the final result.

The First DApp on Ethereum

Augur is unparalleled in the aspect of being "early." Since Ethereum is a permissionless network, it is difficult for me to confirm whether Augur is truly the first DApp on Ethereum. However, certain things can be affirmed, such as Augur starting its development on the testnet while Ethereum was still in its testnet phase. Augur can be considered the first to genuinely attract attention to an industry that was not yet referred to as "Web3" at the time, leading to the emergence of numerous ecosystem projects. Although Augur officially launched in 2018, it is not unreasonable to refer to it as the "first DApp on Ethereum."

The timing of this event was quite early: Ethereum's genesis block was born on July 30, 2015, while the ERC-20 standard was formally proposed in November 2015. This means that when Augur initially sold REP tokens, REP did not yet comply with the ERC-20 standard.

Regarding the legendary Augur project, which institutional investors actually participated? The author has seen many versions, including well-known institutions such as Founders Fund, Pantera Capital, Blockchain Capital, 1confirmation, Multicoin Capital, but the author has not found a definitive source of information.

Over 8 years ago, on Reddit, the question was asked, "What was the first ERC20 token to run on an Ethereum smart contract?"

In the following discussion, a user with the nickname x_ETHeREAL_x mentioned that Ethereum didn't have a wallet or GUI interface at that time, and transactions had to be done via the Geth client through the command line. However, another user with the nickname adrianclv quickly corrected this statement, mentioning that there was no Geth client at that time, and it should have been Ethereum's co-founder Gavin Wood's CPP Ethereum client.

Building on the Past, Yet a Poor User Experience

Counting from early fundraising, after nearly 3 years, in July 2018, Augur was officially launched.

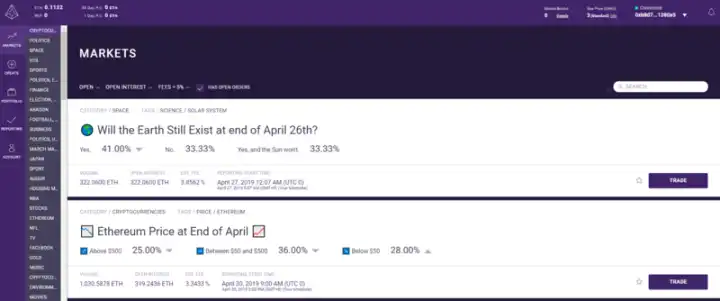

At the time of its official launch, Augur provided a PC desktop application and a web-based application. The reason for launching a PC application was due to the limited number of Ethereum nodes at the time. Using a built-in full node application may have been more efficient. The team behind the Augur ecosystem project Guesser described the design of the desktop application:

The Augur App is a lightweight Electron application that bundles the Augur UI and Augur Node together and deploys it to your local machine. The Augur UI is a reference client (similar to Geth for Ethereum) used to interact with the Augur protocol's core smart contracts on the Ethereum blockchain. The Augur Node is a locally run program that scans event logs related to Augur on the Ethereum blockchain, stores them in a database, and provides the corresponding data to the Augur UI.

While there were also early NFT projects like Crypto Kitties and pure gambling applications like Fomo3D during the same period, Augur was still the "hottest guy" in the industry. Apart from implementing the functionality of prediction markets on-chain, Augur also developed its own decentralized oracle to provide outcomes. This in-house oracle was launched almost a year before Chainlink's oracle went live.

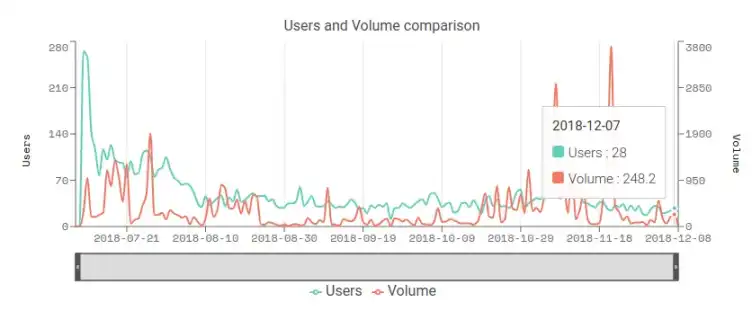

According to DappRadar data, Augur peaked at 265 Daily Active Users (DAU) at launch, but this number dropped to 37 on August 8th and by the end of the year, the daily active users were less than 30. As of December 11, 2018, there were a total of 1635 markets created on Augur, with 11825 orders and a total of 6331 completed orders. During the 2018 U.S. midterm elections, there were over 200 orders executed in a single day. These numbers, which may seem insignificant now, were considered impressive achievements at the time.

Furthermore, if you understand Augur's implementation mechanism, you would find it miraculous that there were still dozens of users trading thousands of orders.

In terms of the poor user experience on Augur, apart from the overall poor user experience factors including MetaMask at that time, Augur itself had fatal flaws in its design. Firstly, Augur did not design arbitrage opportunities like Polymarket to automatically balance probabilities. Instead, one had to match bids and asks one by one. In that era without market makers, you had to find someone with the exact opposite view as yours.

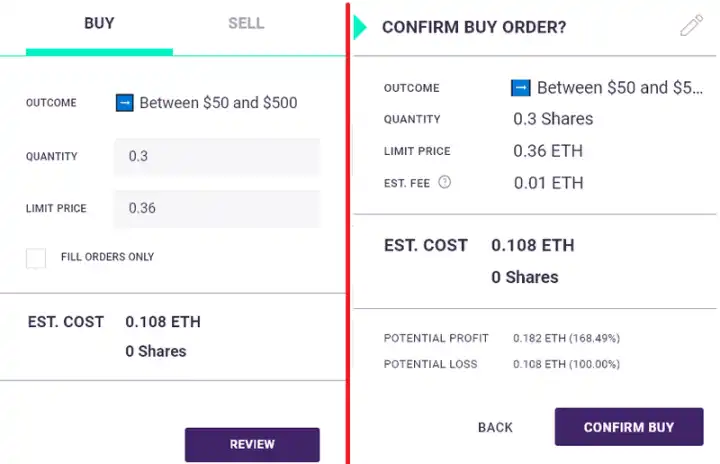

As an example, consider the second market on the trading market interface above, where the bet is on the price of ETH by the end of April (2019). The three options are: below $50, between $50 and $500, above $500. If you choose the second option to place a bet, you will see a page like this:

Users need to select the share and set the price (probability). The numbers in the image represent a bet of 0.3 shares, believing there is a 36% probability that the final price will fall between $50 and $500, with a total cost of 0.108 ETH. Similar to Polymarket, Augur also has an order book, but their order books are entirely different concepts.

The sell order shown in the chart has a minimum price of 0.3605. This does not mean that someone believes there is a 36.05% chance it will not fall within the $50 to $500 range, but rather that they believe there is a 63.95% chance it will not be within the range. So, when you want to place a reverse bet, you need to calculate the probability yourself; otherwise, it is very likely that your order will not be matched. The newly placed order requires a user who precisely believes or is willing to believe that there is a 74% chance it will not be within this range to appear in order for the two sides to successfully match and walk away with the other's chips after the final result is revealed.

The inflexible point is here: Augur only has a "yes" option for each outcome. Users must choose to go long on "yes" or short on "yes".

Augur's permissionless nature has led to the emergence of many invalid markets. For example, the market mentioned above may have its end date set in mid-April, and the results provided by the oracle network support multiple challenges, causing an Augur market that should have settled quickly to drag on for almost 5 months, undergoing countless disputes before finally closing. In such a market environment, coupled with a mechanism that requires finding an evenly matched opponent, only 6331 out of 11825 orders were executed.

Lastly, the fees for using Augur are surprisingly high. In addition to gas fees and fees for users who were early adopters without wallet habits trading through fiat channels, as both the reporters providing results in the oracle network and the market creators need to stake a certain amount of REP, users also have to pay fees to these two parties.

While the fees charged by market creators and reporters are relatively low (1-2%), users must pay multiple layers of fees to use the platform, and the cumulative fees can be quite significant. In Augur, these fees, from low to high, are the reporting fee (0.01%), the market creator fee (1-2%), Ethereum gas fees (depending on the order size), and the fee for exchanging fiat to ETH. Therefore, the total fees for trading on Augur range from 3.5% to 9% or even higher.

Poor wallet user experience, one-to-one matching mechanism, logical flaws, and high fees have made it difficult for Augur to scale up. However, this does not diminish Augur's almost "founder" influence in the Ethereum and DApp development history. The team that developed Augur back then has now become a cornerstone of the industry.

Team Infighting Leads to $150 Million Claim by Ousted Member

Augur, launched by the Forecast Foundation, publicly disclosed that the organization's team members included co-founder and Augur core developer Jack Peterson, co-founder and Augur's Chief Architect Joey Krug, early marketing and community lead Jeremy Gardner, full-stack engineer responsible for frontend and contract integration Stephen Sprinkle, and researcher Austin Williams who authored the appendix to the Augur whitepaper on game theory.

Among them, Joey Krug also took on the role of Co-Chief Investment Officer at Pantera Capital starting in June 2017 and currently serves as a partner at Founders Fund. Stephen Sprinkle, after leaving Augur in 2019, joined ConsenSys as a product manager, then moved to BlockFi as Director of Engineering. Following BlockFi's restructuring in 2022, he transitioned to Coinbase to continue overseeing institutional-level products.

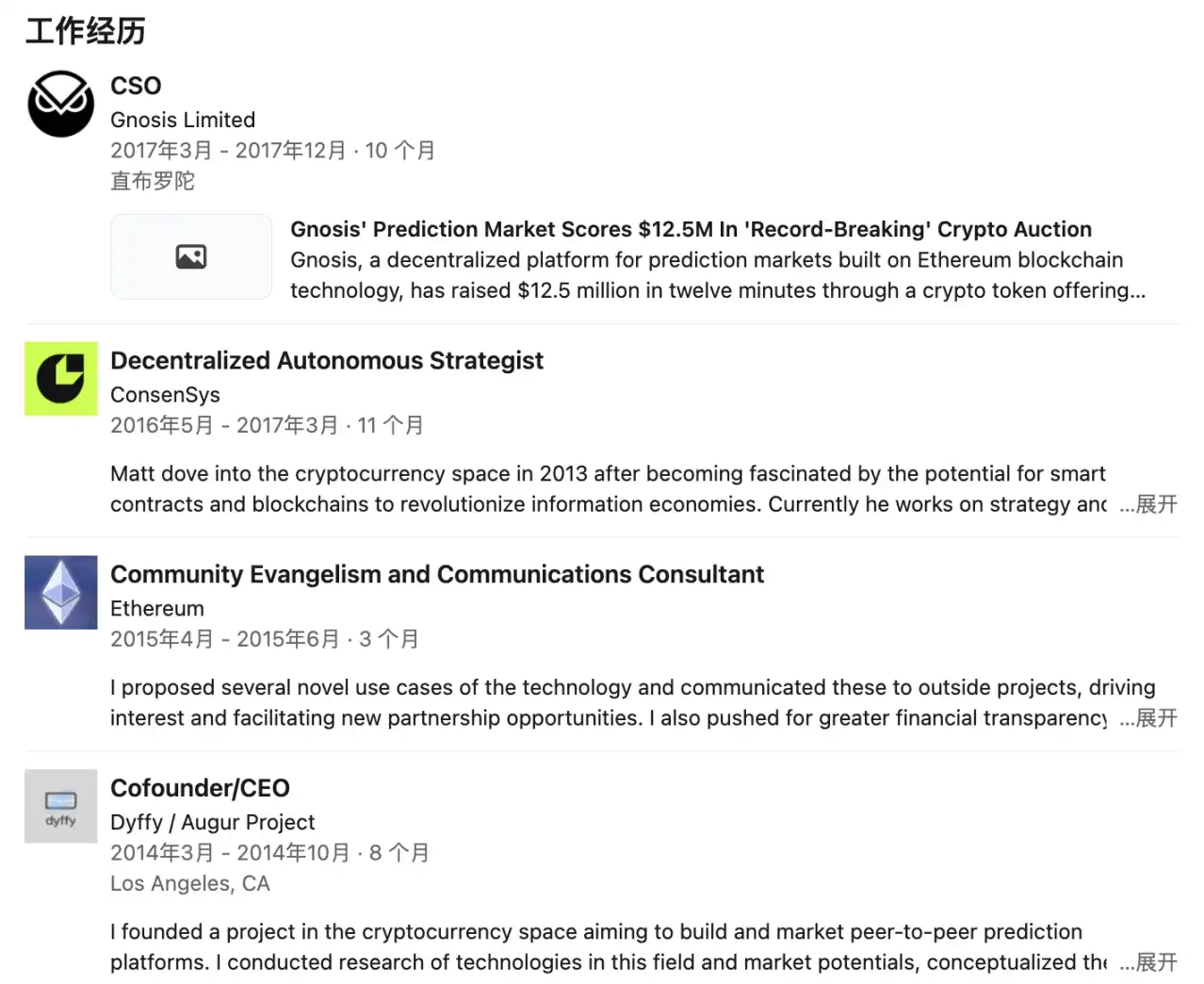

However, according to a lawsuit filed by Matt Liston in 2018, a story before Augur's inception was revealed.

As reported by CoinDesk in 2018, Matt Liston claimed he initially registered a company named Dyffy in Delaware, USA, and hired Jack Peterson. At that time, Liston proposed the idea of developing a prediction market on the blockchain, which Peterson initially did not support.

Later, Liston came across the Truthcoin whitepaper written by Yale economist Paul Sztorc, believing it could be used as a basis to develop a prediction market and issue tokens. Liston successfully convinced Joseph Ball Costello to invest, and also persuaded Peterson to support the on-chain development idea through Paul Sztorc. With this foundation, Liston then hired Joey Krug and Jeremy Gardner, with the latter proposing to name the project Augur.

In the following months, the team continuously argued over technical and business strategy choices, with the end result of the argument being Matt Liston, who orchestrated all of this, being ousted in October 2014. Krug replaced Liston as a director, and Peterson became the CEO. In December of the same year, the Forecast Foundation, a non-profit organization in Oregon, USA, was established.

Matt Liston expressed that he may have wanted to completely sever ties with Dyffy. Under continuous pressure from Costello to refrain from taking legal action against Dyffy and to acknowledge Dyffy's acquisition, exchanging equity for cash or REP tokens, Liston reluctantly signed an agreement. Due to the so-called "specific allocation plan of the ICO being concealed," Liston relinquished a 5% share of his REP tokens, opting to take $65,000 in cash instead. Based on Augur's valuation at the time of the lawsuit, these originally forsaken tokens are now valued at over $20 million.

Against the backdrop of Augur, which had a valuation exceeding $450 million at the time, Matt Liston sought $38 million in general damages and $114 million in punitive damages, totaling $152 million. This amount exceeded one-third of Augur's valuation, making it the "highest claim in the history of cryptocurrency" lawsuit at the time.

Several of Augur's defendants were surprised when Liston reneged on the agreement three years later. Additionally, Jack Peterson and Joey Krug both argued that Liston was not a co-founder of Augur. Krug stated, "Liston has made no contributions to Augur's GitHub repository or any other Augur repository; he is not a co-founder of Augur." Reports indicated that suspicion regarding his true identity led Liston to face unemployment, and his LinkedIn profile showed no new job records since resigning as Chief Strategy Officer of Gnosis in 2017.

According to insider sources cited in the reports, the main cause of the rift was Liston's proposition to develop Augur on Ethereum, while the team insisted on Bitcoin. Interestingly, Augur was eventually launched on Ethereum and became one of the earliest successful major projects after the Ethereum mainnet went live. It is worth noting that there is no further public information on the case's progress. Considering that Augur managed to survive until the end of 2021, this matter will either be resolved amicably or fade away.

Quiet for Three and a Half Years, A New Start

In March of this year, Augur suddenly announced its comeback on X, marking the first tweet from that account since November 18, 2021.

In 2020, Augur launched an updated version of v2, with adjustments in user experience and many other aspects. In July of that year, Forbes published an article calling it a "major leap forward in the decentralized application space." In the article a Forbes journalist stated, "Its functionality is similar to the internet but without the need for a trusted third party. If successful, this significant upgrade will not only be limited to horse race betting without the need for a bookie; it may mark a turning point for the next generation of the internet."

Although Augur saw a single market surpassing $10 million in volume during the 2020 U.S. presidential election, the dazzle of DeFi was too bright, and Augur eventually succumbed during the peak of the roaring bull market in 2021. Perhaps Polymarket's rise to fame brought the prediction market back into the spotlight after nearly a decade, prompting the new team behind Augur to start afresh this year.

The reboot of Augur will be led by two teams: the Lituus Foundation will handle token and operational matters, develop the oracle, while Dark Florists will be responsible for implementing specific prediction markets. The Lituus Foundation describes itself as composed of long-time Augur community members, with currently no information available about its members.

Dark Florists, on the other hand, is a well-established Ethereum development team. Among its key members, Killari cracked the indistinguishability obfuscation developed jointly by the Ethereum Foundation, Phantom.zone, and 0xPARC at Devcon in 2024 and received a $10,000 bounty. Micah Zoltu is renowned for discovering a critical MakerDAO vulnerability in 2019 and is also a developer of EIP-3074 and EIP-2718.

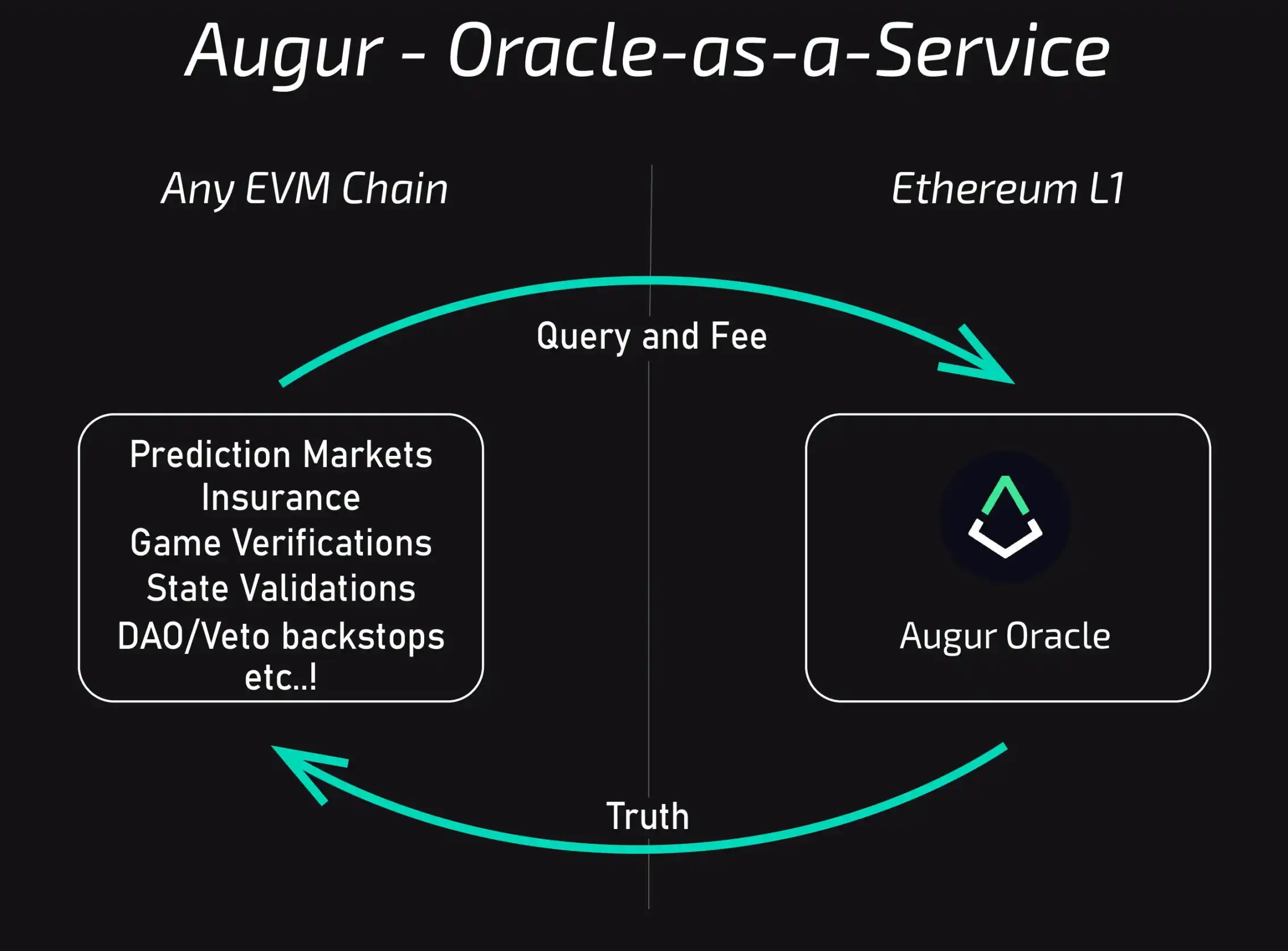

Such a team aims to introduce the "new Augur," not as a purely commercial platform but, in the words of the Lituus Foundation, as a cross-chain decentralized truth machine. The Lituus Foundation intends to separate the oracle from Augur's prediction market and make it modular so that all applications can use the Augur oracle.

Augur was originally designed as a purely decentralized application, not relying on multisig, key management, or backdoors. Even its tokenomics design incorporates original game theory to ensure the platform's normal operation through incentive mechanisms. The new Augur will continue to uphold this spirit. The information we have now indicates that the new oracle will likely be deployed on Layer 2, and the initial prediction markets will be built on AMM.

As of now, the Lituus Foundation has released two progress reports. In the first quarter of the announced relaunch, Lituus increased the REP holdings from 250,000 to 550,000 and deployed $100,000 in liquidity on Uniswap v3, with plans to list on a centralized exchange. The following second quarter will see four key developments:

· Launching a website;

· Oracle research will pursue two complementary approaches, one focusing on consumer prediction markets and the other on enterprise-grade oracle use cases;

· Micah Zoltu initiated a crowdfund to intentionally trigger an algorithmic fork of REP to test Augur's core security model;

· The foundation's buyback scale will expand to 1 million REP.

The algorithmic fork is a very interesting design, with rather complex details. Here is a brief explanation:

In Augur's design, the "outcome" is not predetermined. Augur allows disputes to be initiated by staking REP votes on outcomes. When a dispute reaches a threshold (2.5% of total staked REP), the system will split into two parallel universes, each corresponding to an outcome. REP holders must choose the universe they agree with and migrate their REP holdings to that universe. If staked REP does not reach the threshold in a given time after the dispute begins, participants supporting the initial outcome will be rewarded.

Micah Zoltu launched the crowdfund to raise funds to invest in significantly incorrect outcomes during disputes, thus "sacrificing" a portion of REP to test the feasibility of this mechanism. However, due to this test, the plan to list on a centralized exchange had to be put on hold until after the dispute is fully resolved.

Conclusion

"Time ages all things, but Guang [Li] is forever young, unable to be sealed."

In his article "From prediction markets to info finance" published last November, Ethereum co-founder Vitalik mentioned that he was once a loyal user and supporter of Augur. As Ethereum's first major project, Augur's design now seems overly advanced.

This advancement is not solely due to the mechanism, but the premise of its implementation was too utopian. What were our discussions about prediction markets back then?

· Farmers could set up a prediction market for harvest season weather as a hedge against the potential impact of climate on yield;

· Use prediction markets to establish bug bounties and smart contract insurance;

· Conduct incentivized opinion polling markets and introduce conditional markets to guide policy-making;

· Tokenize RealT (real estate tokens) and establish a trading pair on Uniswap between the RealT token and a token betting on a drop in housing prices in a prediction market to allow hedging positions to earn trading fees;

…

Today's prediction markets are filled with trading and arbitrage, which is one perspective, and currently, it seems to be the only correct one. We have often criticized the lack of innovation in Web3 in recent years, but looking back at the thinking of the OGs from a decade ago, do we really have no room for innovation?

Web3 is like a massive Polymarket; once we were busy opening new markets, enjoying it tirelessly. There was a time when we suddenly began market-making on the order book, using bots to find millisecond probability and non-unity opportunities, and also arbitraging by placing stop-loss and take-profit orders before the market closes. It seems that suddenly everyone lost the courage to open a new market, to bet on a bigger future.

An article I translated six years ago mentioned the "3p theory," which stands for Predict, Prepare, and Persuade the future. At that time, I wrote a paragraph that I had since forgotten: A decentralized prediction market presents all possible parallel timelines before you, giving everyone the right to choose the door to the future they want to step into. The more people participate in the choice, the more likely it will guide time toward a further distance.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Mars Morning News | Ethereum Fusaka upgrade officially activated; ETH surpasses $3,200

The Ethereum Fusaka upgrade has been activated, enhancing L2 transaction capabilities and reducing fees; BlackRock predicts accelerated institutional adoption of cryptocurrencies; cryptocurrency ETF inflows have reached a 7-week high; Trump nominates crypto-friendly regulatory officials; Malaysia cracks down on illegal Bitcoin mining. Summary generated by Mars AI. The accuracy and completeness of this summary are still undergoing iterative updates.

Do you think stop-losses can save you? Taleb exposes the biggest misconception: all risks are packed into a single blow-up point.

Nassim Nicholas Taleb's latest paper, "Trading With a Stop," challenges traditional views on stop-loss orders, arguing that stop-losses do not reduce risk but instead compress and concentrate risk into fragile breaking points, altering market behavior patterns. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.

With capital outflows from crypto ETFs, can issuers like BlackRock still make good profits?

BlackRock's crypto ETF fee revenue has dropped by 38%, and its ETF business is struggling to escape the cyclical curse of the market.

Incubator MEETLabs today launched the large-scale 3D fishing blockchain game "DeFishing". As the first blockchain game on the GamingFi platform, it implements a dual-token P2E system with the IDOL token and the platform token GFT.

MEETLabs is an innovative lab focused on blockchain technology and the cryptocurrency sector, and also serves as the incubator for MEET48.