Ethereum Surpasses $4K Amid Increased Market Volatility

- Ethereum’s breach of $4,000 sparks market attention.

- Korean retail activity intensifies, boosting volatility.

- Institutional buy-ins suggest long-term interest.

Ethereum (ETH) surged past $4,000 with a 3.15% increase before settling between $3,870–$3,920. Institutional “buy the dip” behavior played a role, and the “Kimchi Premium” reflected South Korean retail enthusiasm impacting price swings.

Points Cover In This Article:

ToggleInstitutional and retail reactions to Ethereum’s price dynamics highlight broader market liquidity and volatility .

Ethereum Price Surge and Market Volatility

Ethereum’s recent breach of the $4,000 mark before stabilizing reflects ongoing market volatility. The price action between $3,870 and $3,920 indicates active market engagement, especially from Korean retail traders and institutional investors.

“Increased liquidation, amounting to $233 million, underscores the financial impact on the Ethereum market, alongside $4.3 billion sector losses. Retail and Korean traders propelled activity, while institutional actions stabilized volatility,” stated a Market Analyst on the dynamics.

The impact on Bitcoin as funds withdrew $536 million highlights interconnected market dynamics and confidence challenges. Thus, Ethereum’s movements significantly influence altcoins and DeFi protocols.

Korean and Institutional Involvement

High activity indicates institutional investors’ strategic moves, with significant “buy the dip” signals. The absence of direct statements from founders suggests a market-led rather than a developer-driven event.

“The Kimchi Premium has spiked to 8.2%, reflecting intense FOMO among retail traders in South Korea and contributing to the price swings,” stated a source from Holder.io .

Historical data shows an 8.2% rise in the Kimchi Premium, signaling potential corrections. Similar trends from 2024-2025 suggest such phases often trigger rebounds post-market corrections.

Long-term Projections for Ethereum

Institutional accumulation during decreased prices indicates confidence in Ethereum’s long-term resilience. While volatility impairs short-term holders, long-term stakeholders maintain a dominant position, holding 12% of the total supply.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana DEX Jupiter Unveils JupUSD, Returning Native Treasury Yield to Users

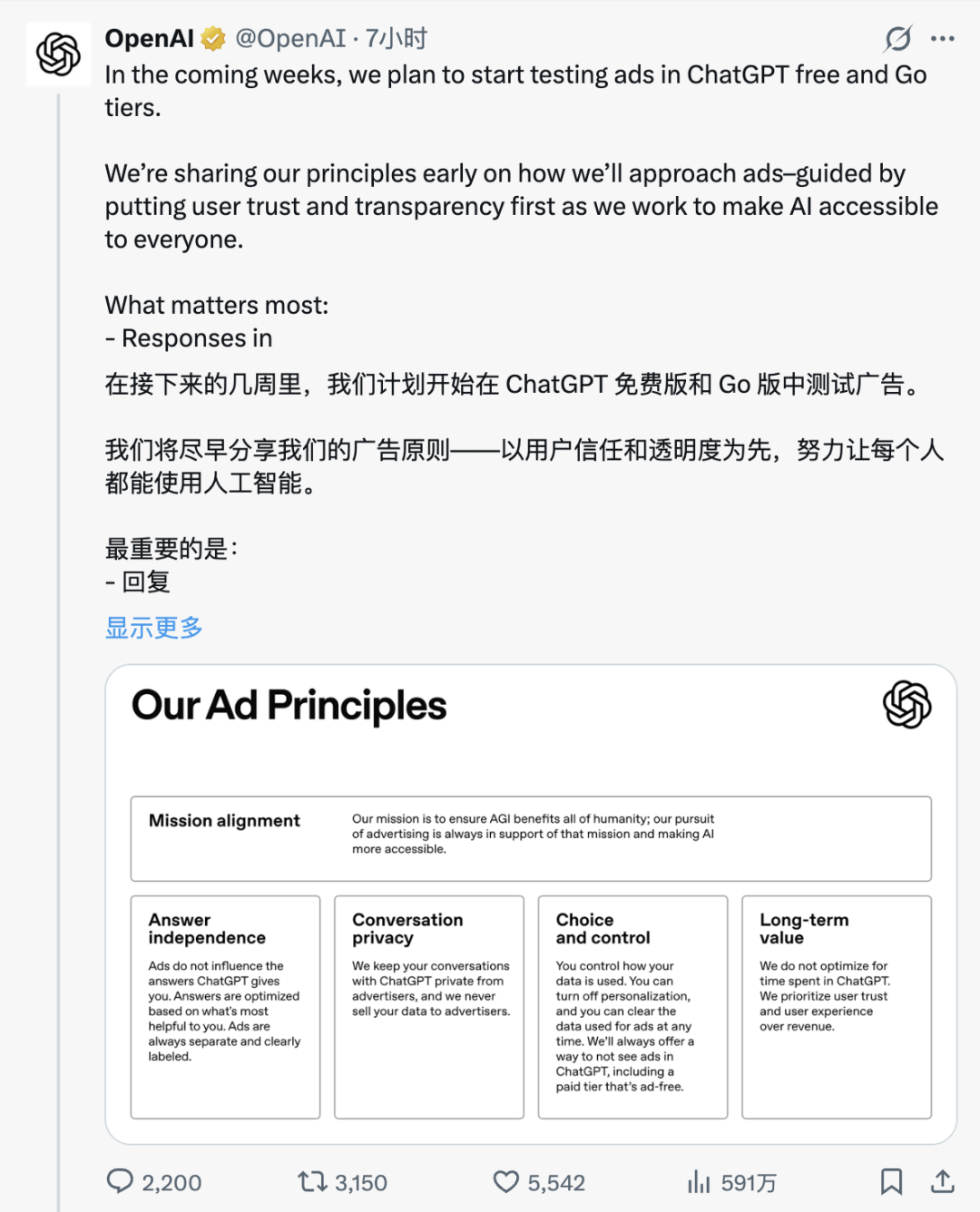

ChatGPT suddenly announces ads, $8 subscription plan can't avoid them

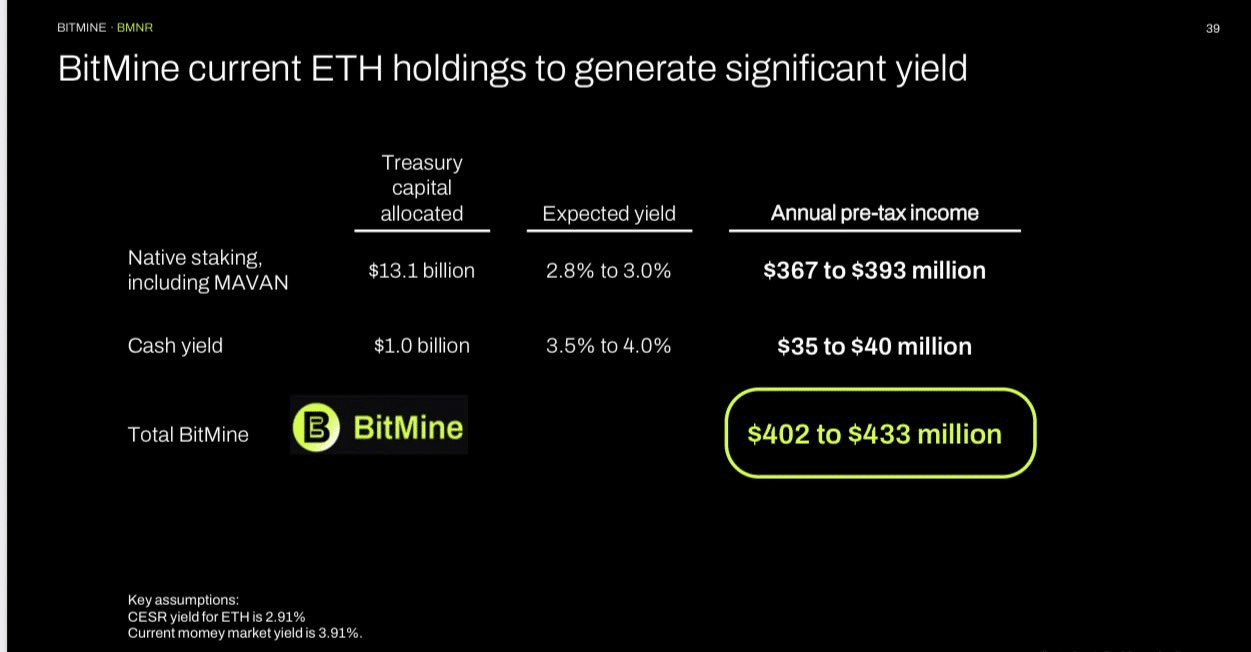

From $3.5K to $12K? Here’s why BMNR’s Ethereum forecast makes sense