Bitcoin Mining Eases Slightly, but Record Hashrate Keeps Pressure on Miners

Mining difficulty recently fell, lowering the effort needed to add new blocks to the Bitcoin blockchain. While a drop in difficulty can provide some relief for miners, earlier in the week, on Tuesday, the Bitcoin network’s hashrate reached a new record high, reflecting the network’s strong computing power.

In brief

- Bitcoin mining difficulty fell 2.7% while the network’s hashrate hit a new all-time high showing growing computing power.

- The next difficulty adjustment is expected to raise mining difficulty further reducing rewards for the same effort.

- Mining firms are expanding into AI and high-performance computing to diversify revenue and use existing infrastructure.

Rising Hashrate Amid Difficulty Changes

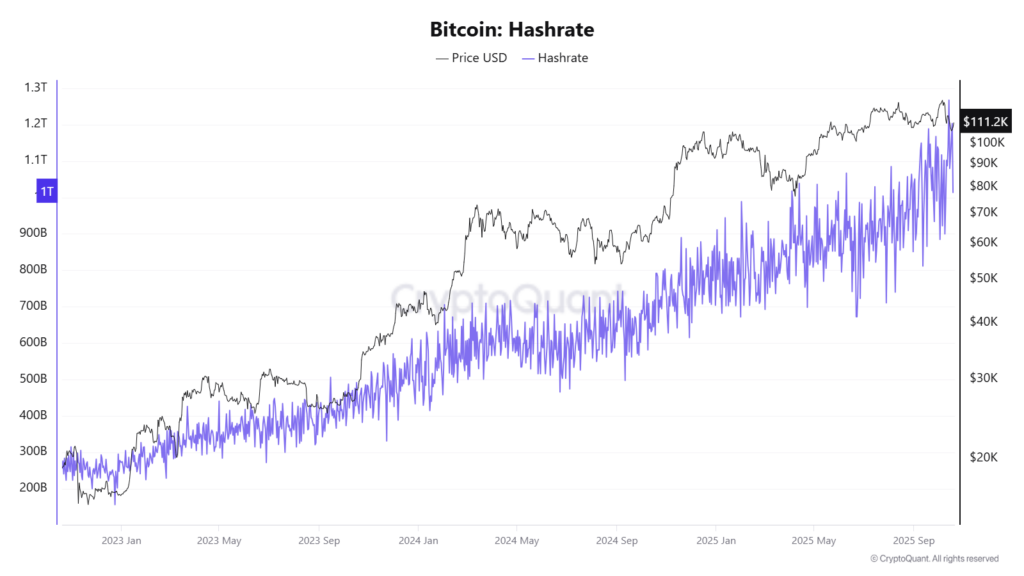

On Friday, Bitcoin’s mining difficulty—the measure of how hard it is to add new blocks to the blockchain —fell by about 2.7%, dropping from over 150.8 trillion to 146.7 trillion. Even with this decline, the network’s hashrate continued to rise, surpassing 1.2 trillion hashes per second and reaching a new all-time high.

The sustained rise in hashrate suggests that miners are investing increasing amounts of computing power to compete for new blocks. This puts additional pressure on miners who are already facing challenges from trade policies, lower block rewards, and growing competition within the industry.

Bitcoin hashrate and price hit new highs, showing strong growth momentum through 2025.

Bitcoin hashrate and price hit new highs, showing strong growth momentum through 2025.

Meanwhile, the next Bitcoin mining difficulty adjustment , expected on October 29, 2025, at 08:14:49 AM UTC, is projected to raise difficulty from 146.72 trillion to 156.92 trillion after 1,474 more blocks are mined. This increase will reduce the amount of Bitcoin miners can earn for the same computational effort, putting the greatest pressure on operations using older equipment or paying higher electricity costs.

Miners with modern, efficient hardware and access to cheaper power will be less affected. Overall, the adjustment will increase competition among miners while maintaining the security of the Bitcoin network.

Bitcoin Mining Firms Adapt Through AI Expansion

As mining rewards decrease, companies are increasingly exploring alternative sources of revenue. Many mining firms, including Core Scientific, Hive Digital Technologies, and Bitfarms, are expanding into AI data centers and other high-performance computing applications. They are repurposing their existing mining infrastructure to support AI workloads, moving beyond cryptocurrency mining alone.

This shift has also led to competition for electricity, as both AI operations and Bitcoin mining are highly energy-intensive. Companies must balance energy usage between these two sectors to sustain operations.

In addition, the mining industry is also navigating challenges from trade policies. Tariffs imposed by the U.S. have raised the cost of mining equipment in certain regions, creating additional strain for affected miners. Should trade tensions between the U.S. and China intensify, sourcing chips and other essential electronic components could become even more difficult, further complicating operations.

Meanwhile, Bitcoin has regained strength , surging past $110,000 after last week’s drop below $105,000. It is now trading above $111,000, up more than 4% in the past 24 hours.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Faces 30% Odds of Hitting $100K in October

CZ Questions AI Trading After DeepSeek Outperforms in Alpha Arena

Bitcoin and Ethereum ETFs Face Major Outflows

Trade War + AI Bubble: When Two Major "Powder Kegs" Converge, Is the Endgame of the Supercycle Already Decided?

The global economy faces risks from feedback loops among policy, leverage, and confidence. Technology supports growth, but fiscal populism is on the rise and trust in currency is gradually eroding. Trade protectionism and speculative AI-driven finance are intensifying market volatility. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved.