Who is consuming Ethereum's loyalty? Core contributors collectively question resource allocation

Author: David, TechFlow

Original Title: An Old Letter Sparks a Loyalty Crisis, Ethereum Foundation Faces Another Wave of Criticism

"I feel like I'm just a useful fool for the Ethereum Foundation."

On October 19, an open letter written a year and a half ago was posted on Twitter, and this sentence quickly ignited discussions in the crypto community.

The author of the letter is not some fringe Ethereum troll, but Péter Szilágyi:

The former lead of the Geth client, which once maintained over 60% of Ethereum nodes, and a core developer who has worked in this ecosystem for a full 9 years.

Does this feel familiar?

If you've followed Ethereum long enough, you'll notice this scenario plays out every few months:

Sudden criticism erupts against the Foundation (EF), the community falls into heated debate, Vitalik steps in to respond, then everything quiets down—until the next blowup.

In 2022, it was about centralization concerns after the Merge; in 2023, it was conflicts of interest among researchers; in 2024, it's the fragmentation of L2s.

Now, the powder keg has been lit by an old letter.

The phrase "useful fool" is like a knife, piercing through a long-maintained illusion and striking a nerve among many Ethereum ecosystem contributors.

Core contributors who rarely criticize publicly, including Polygon founder Sandeep and DeFi godfather AC, stood up one after another; their message can be summed up in one sentence:

We have been let down.

And the specific questions they raised hit the mark: Where did the money go? Why do the most loyal get the least? Who is really controlling the direction of Ethereum?

These questions are nothing new, but when they come from Ethereum's core contributors, the situation and weight may be entirely different.

Let's take a closer look at this letter and see what a technical leader who has worked on Ethereum for 9 years has experienced to describe himself as a fool.

Nine Years of Loyalty, One Letter of Disappointment

On May 22, 2024, when Péter Szilágyi wrote this letter, he was probably caught in a painful cycle.

The letter starts off sincerely. Péter says that over the years, he has become increasingly confused and pained about Ethereum and his role in the Foundation. He tried to sort out his thoughts, hence this letter.

The entire content of the letter reflects the many problems a loyal developer has seen in Ethereum and the Foundation throughout his career.

-

Issue One: Called a Leader, Actually a Useful Fool

Péter bluntly states that he feels the Foundation is using him as a "useful fool."

He explains that whenever there is controversy within Ethereum—such as a researcher taking money from an external company causing a conflict of interest, or a new proposal clearly favoring a specific interest group—the Foundation would have him, the "troublemaker," stand up and oppose it.

Looking through Péter's previous tweets, there is indeed a tone of sharp criticism and candor, often discussing issues within the Ethereum ecosystem; but the content revealed in this long letter suggests these comments were more like a performance to cater to the collective interests of the Ethereum Foundation.

This way, the Foundation can claim externally: "Look, we're so democratic, there are different voices internally too."

But the problem is, every time Péter stands up to challenge those with power or connections, his credibility takes a hit. Supporters of the other side attack him, saying he's blocking progress. Over time, he and the Geth team become seen as troublemakers.

"I can choose to stay silent and watch Ethereum's values be trampled; or speak up, but gradually destroy my own reputation." He wrote, "Either way, the result is the same—Geth will be marginalized, and I will be excluded."

-

Issue Two: Six Years' Salary Only $600,000, High Effort, Low Reward

In Péter's first six years (2015-2021) working on Ethereum, he received a total of $625,000. Note, this is the total for six years, pre-tax, with no equity or incentives. That's about $100,000 per year on average.

During the same period, ETH's market cap went from 0 to $450 billions.

As the person responsible for maintaining the network's most critical infrastructure, Péter's salary may have been lower than that of a fresh graduate programmer in Silicon Valley.

He mentioned that other departments in the Foundation, such as operations, DevOps, and even some researchers, were paid even less.

Why is this? Péter quoted something Vitalik once said: "If no one complains that their salary is too low, it means the salary is too high."

Focusing on technology and not caring much about rewards is indeed the ideal image of some tech geeks and cypherpunks. But the problem is, a long-term low salary culture brings negative consequences.

Those who truly care about protocol development, unable to get good pay within Ethereum, are forced to seek compensation elsewhere.

This leads to all kinds of conflicts of interest: researchers acting as advisors to external projects, core developers privately accepting sponsorships.

Péter bluntly said: "Almost all the Foundation's early employees have left, because that's the only reasonable way to get compensation commensurate with the value they created."

-

Issue Three: Vitalik and His Circle

The sharpest part of the letter is the analysis of Ethereum's power structure.

Péter admits he has great respect for Vitalik himself, but points out a fact:

Whether Vitalik wants to or not, he unilaterally decides the direction of Ethereum. Wherever Vitalik's attention goes, resources follow;

Whatever project he invests in, that project will succeed;

Whatever technical path he endorses, that path becomes mainstream.

Worse, a "ruling elite" of 5-10 people has formed around Vitalik. These people invest in each other, act as each other's advisors, and control the allocation of ecosystem resources.

New projects no longer do public fundraising, but go directly to these 5-10 people. Getting their investment is a ticket to success.

"If you can get Bankless (a well-known podcast) to invest, they'll hype you up on their show. If you can get a Foundation researcher as an advisor, you'll face less technical resistance."

This is reminiscent of the familiar upward management in domestic corporate environments: the key to success is not technology or innovation, but winning over those around Vitalik.

-

Issue Four: Idealism Hurts the Most

At the end of the letter, Péter's tone shifts from anger to sadness. He says he has turned down countless high-paying offers over the years because he believed in Ethereum's ideals.

But now the whole ecosystem says "it's just business." He can't accept this mindset, but also sees no way out.

"I feel that in Ethereum's grand blueprint, Geth is seen as a problem, and I am at the center of that problem."

This letter was written in May 2024. A year later, in June 2025, Péter left the Ethereum Foundation. According to reports, he rejected a $5 million offer from the Foundation and spun Geth off as a private company.

He chose to leave completely, rather than turn his ideals into business.

Chain Reaction, Industry Leaders Speak Out

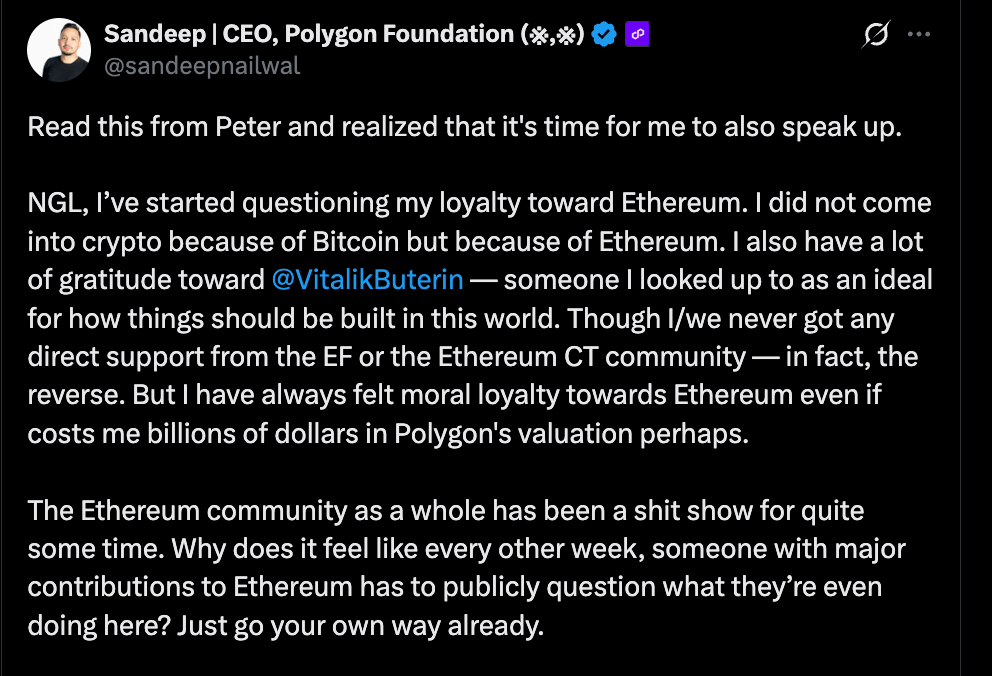

Less than 24 hours after Péter's letter was made public, Polygon founder Sandeep Nailwal couldn't stay silent and quoted Péter's post to share his own feelings.

Polygon is one of Ethereum's largest Layer 2 projects, processing a huge number of transactions and hosting many applications, including the prediction market Polymarket.

It can be said that Polygon has made a huge contribution to Ethereum's scaling.

But Sandeep said the Ethereum community has never truly accepted Polygon.

There's a strange double standard in the market, he wrote. "When Polymarket succeeds, the media says it's an 'Ethereum victory.' But Polygon itself? Not considered Ethereum."

This isn't just about recognition, but real financial loss.

Sandeep was even more blunt, pointing out that if Polygon declared itself an independent L1 instead of Ethereum's L2, its valuation could immediately multiply by 2-5 times.

For example, Hedera Hashgraph, a relatively niche L1 project, has a market cap that actually exceeds the combined total of Polygon, Arbitrum, Optimism, and Scroll—these four major L2s.

As for why not switch to L1, Sandeep said it's out of moral loyalty to Ethereum, even though this loyalty may cost him billions of dollars in valuation.

But what has this loyalty brought?

There are always people in the community saying Polygon isn't a real L2. Growth statistics website GrowthPie refuses to include Polygon's data. Investors don't include Polygon in their "Ethereum ecosystem" portfolios.

In Sandeep's original post, there's a particularly poignant rhetorical question:

"Why is it that every week, there's an Ethereum contributor questioning themselves?"

He mentioned his friend Akshay's story. Akshay originally leaned toward supporting Polygon, but was disgusted by the Ethereum community's practice of attacking successful projects and promoting "political correctness." In the end, he took his talents to Solana, helping build the empire it is today.

Even Polygon's shareholders question his decisions, saying you have a fiduciary duty to Polygon—why sacrifice the company's value for so-called loyalty?

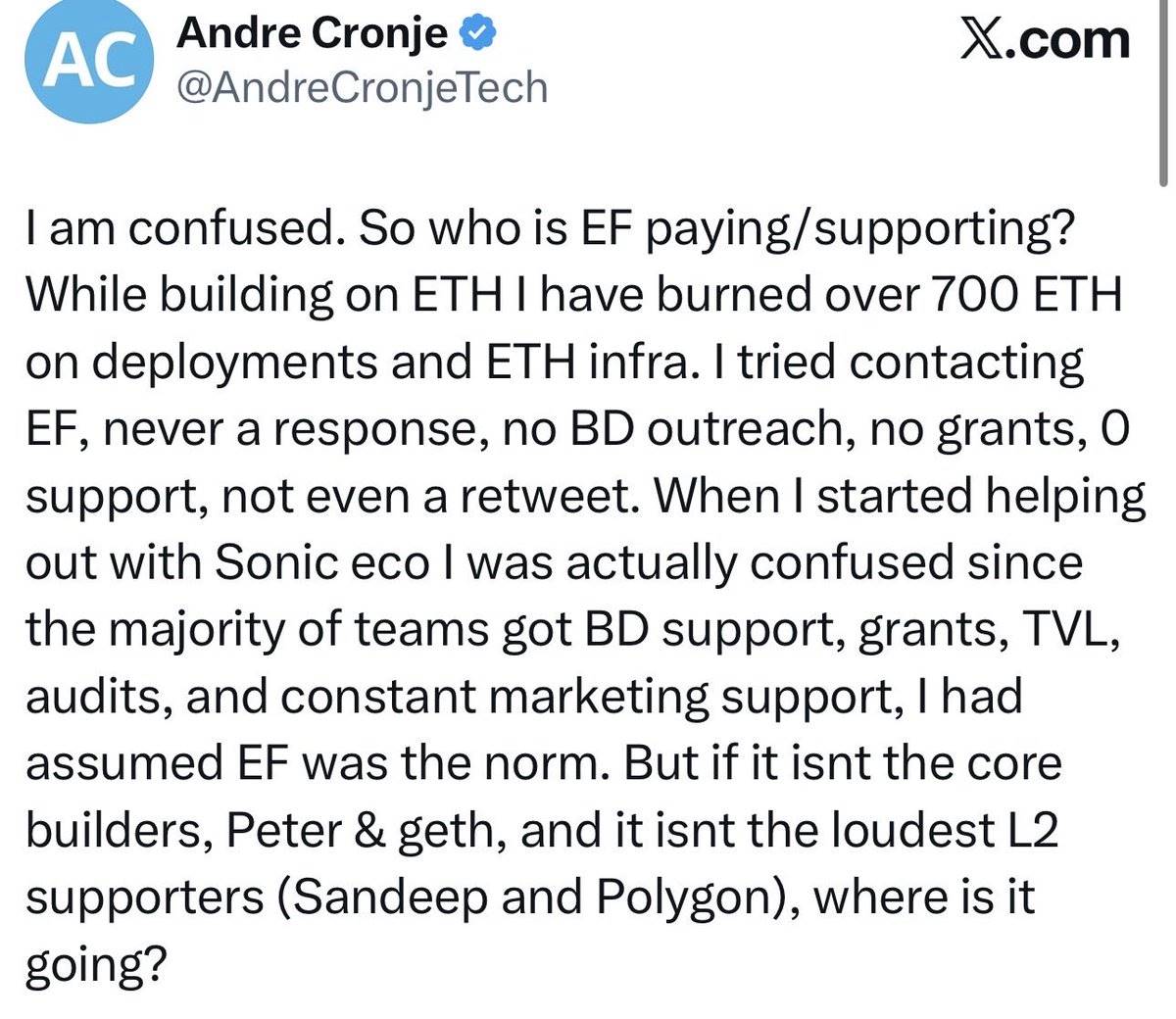

Also speaking out was DeFi legend Andre Cronje.

Andre's post was relatively short but sharp:

"I'm confused. Who is EF actually paying/supporting? When I was building on ETH, just deploying contracts and infrastructure burned over 700 ETH. I tried to contact EF, never got a response, no BD reached out, no grants, zero support, not even a retweet."

700 ETH at current prices is about $2.66 million. All of this was Andre's own out-of-pocket cost.

Even more ironically, when AC started helping the Sonic ecosystem, he was surprised to find that most teams had received BD support, funding, liquidity, and ongoing audit support.

Then, this soul-searching question became even more pointed:

"If the money didn't go to core builder Peter and Geth, nor to the loudest L2 supporter Sandeep and Polygon, where did the money go?"

Vitalik Responds, Dodges the Core Issues

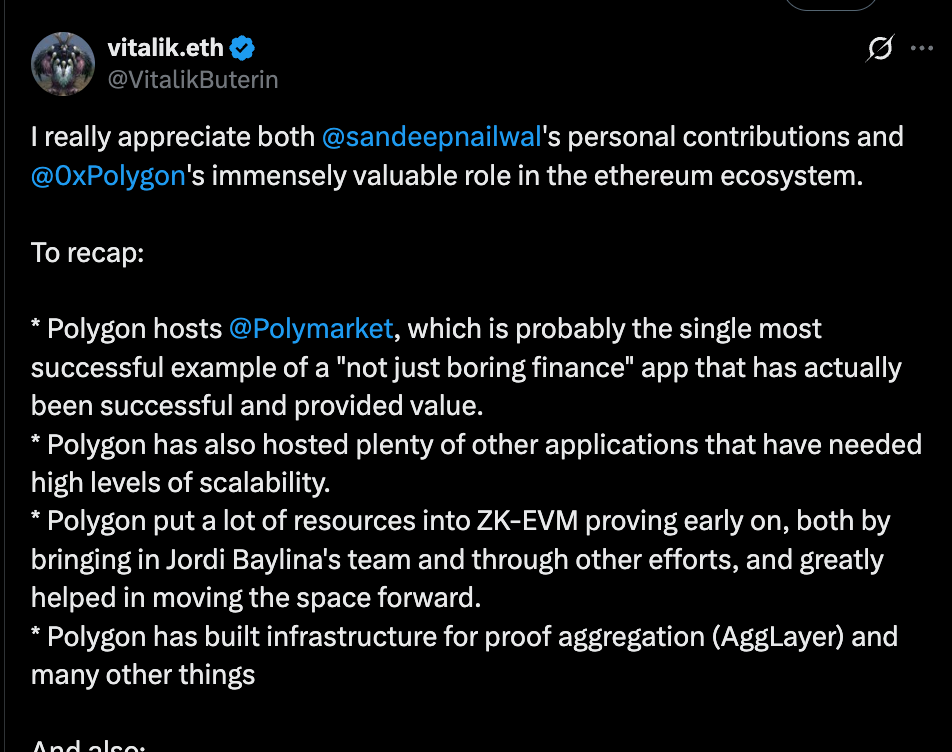

Facing these doubts, Vitalik responded to Sandeep's comments on October 21. His reply was long, mainly including:

-

Detailed listing of Polygon's contributions (hosting Polymarket, advancing ZK technology, etc.)

-

Extensive praise for Sandeep's philanthropy (donating medical resources to India)

-

Thanking Sandeep for returning $190 million in SHIB token proceeds

-

Suggesting Polygon adopt the latest ZK technology upgrades

But if you read carefully, you'll find that on the three core issues—low pay, lack of financial transparency, and the small circle of power—Vitalik didn't mention a single word.

This kind of evasive answer may itself be an answer.

These responses point to a truth everyone can see but no one wants to say out loud: there are serious problems with Ethereum's resource allocation.

The most loyal contributors don't get support, while those good at "playing the game" get plenty of resources. The Foundation sold over $200 million worth of ETH in 2025, but this money clearly didn't go to those truly building the protocol.

Ethereum's Biggest Enemy Is the Ethereum Foundation

The storm triggered by Péter's letter may be overshadowed by new hot topics in two weeks, but the issues it reveals won't disappear.

In fact, this kind of collective outcry against the Ethereum Foundation happens every few months.

For Ethereum today, its biggest enemy is not Solana or other chains, but the Ethereum Foundation itself.

Ethereum has grown from a geek project into an ecosystem worth hundreds of billions of dollars, but its governance structure and culture are still stuck in the early days.

In Péter's words, the Foundation is still managing a huge system that needs "additive thinking" with a "subtractive mindset."

The deeper reason may be that Ethereum has fallen into the typical big company disease.

Problems all big startups face as they grow—bureaucracy, factional struggles, stagnation of innovation—are all present in Ethereum.

The difference is, traditional companies can use equity incentives and management reforms to cope, but as a decentralized project, Ethereum can't admit it's centralized, nor can it truly decentralize.

So the core contradiction we see is: it must maintain the appearance of decentralization, but in practice relies heavily on centralized decision-making.

Vitalik's existence is the embodiment of this contradiction.

On the one hand, the community needs his vision and leadership; on the other, his very presence negates decentralization.

This creates a strange "decentralized theater," where everyone is acting out decentralization, but everyone knows where the real power lies.

The cost of this performance is huge.

As Sandeep pointed out, the Ethereum community outwardly promotes egalitarianism, but the actual small-circle control is more hypocritical than pure capitalism.

At least on Solana or other centralized chains, the rules of the game are clear.

Now, the ball is in Vitalik and the Foundation's court. Their choices affect not only Ethereum, but the direction of the entire crypto movement. Will they continue to maintain the decentralization theater, or bravely face reality?

Time will tell. But one thing is certain: those "useful fools" like Peter won't stay silent forever.

The next eruption may be more than just a letter.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DOJ Exposes $7.8M Crypto Scam Tied To Bitcoin Rodney

Grayscale Signals Bitcoin Could Hit New Highs in 2026 Despite Recent Dip

Will the Bitcoin Cycle Survive American Monetary Policy?