Bitwise CIO: Why Does Gold Outperform Bitcoin by Such a Wide Margin?

Don’t envy the surge in gold prices; it may be showing us the future path of bitcoin.

Original Title: Gold's Rise Bodes Well for Bitcoin

Original Author: Matt Hougan, Chief Investment Officer at Bitwise

Original Translation: Jinse Finance

Currently, there are two core questions about bitcoin in the crypto market:

1. Why is gold outperforming bitcoin?

2. Since ETFs and corporations are buying in large quantities, why does the price of bitcoin remain stagnant?

In fact, if we can carefully answer the first question, the answer to the second will also emerge—and this answer paints a highly bullish picture for bitcoin's future.

Next, I will analyze in detail.

Question 1: Why is gold outperforming bitcoin?

Although gold prices have pulled back somewhat, they have surged rapidly this year, with a 57% increase in 2025, moving toward the second-best annual performance in history in US dollar terms. Meanwhile, bitcoin has stalled near the $110,000 mark, with prices roughly flat since May.

This has frustrated investors who view bitcoin as "digital gold," but there is actually a simple explanation: the difference stems from the actions of central banks.

Since the US froze Russia's holdings of US Treasuries after Russia invaded Ukraine, central banks around the world have started to significantly increase their gold reserves. According to data from Metals Focus, central bank gold purchases have nearly doubled since the outbreak of the Russia-Ukraine war, rising from about 467 tons per year to around 1,000 tons now, which is about twice the estimated purchase volume of gold ETPs (exchange-traded products).

Bitcoin, on the other hand, does not enjoy this treatment. Although some central banks are researching bitcoin, none have actually bought it yet. Therefore, if central banks are the main driver behind this gold price rally, it makes sense that bitcoin has not followed gold higher.

This view is not new. Whether it's Morgan Stanley, JPMorgan, or individuals like Mohamed El-Erian, all have pointed out that central bank gold buying is a key driver of the surge in gold prices.

Question 2: Why does bitcoin's price remain stagnant despite large purchases by ETFs and corporations?

How is this related to the second question?

The answer is: very much so.

The biggest mystery in the bitcoin market is why, despite large purchases by ETFs and corporations, the price remains relatively stable. Since the launch of bitcoin ETFs in January 2024, ETFs and corporations have collectively purchased 1.39 million bitcoins, while the new supply from the bitcoin network during the same period is less than a quarter of that amount. Although bitcoin's price has risen 135% since then—a strong performance—many people still wonder: shouldn't it have risen even higher?

I have had the same question: who is selling so much bitcoin? What is preventing it from breaking through the $200,000 mark?

The current gold price rally provides the answer.

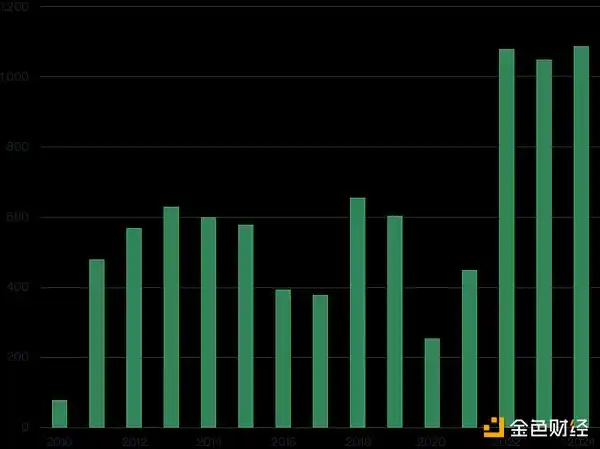

Take a look at the table below, which shows annual gold purchases by central banks from 2010 to 2024. In 2021, central bank gold purchases were 467 tons, jumping to 1,080 tons in 2022, and have remained at this high level since (with forecasts showing 2025 demand slightly below 2024).

Central bank gold purchases from 2010 to 2024 (unit: tons):

Source: World Gold Council

In short, although central bank gold buying is an important catalyst for this year's gold price increase, such purchases did not start this year—they began in 2022.

This also provides an answer for bitcoin's current situation.

When central bank gold purchases began to increase significantly in 2022, gold prices rose slowly: the average price in 2022 was $1,800, rising to $1,941 in 2023 (an increase of only 8%), and to $2,386 in 2024 (an increase of 23%). It was not until this year that gold prices saw an explosive rise, surging nearly 60% to around $4,200.

In other words: central banks started buying gold in 2022, but gold prices only saw a parabolic rise in 2025.

I think the logic is clear: in any market, there is a group of price-sensitive investors—these investors tend to act when prices fluctuate by 10%-15%. When central banks began buying gold in large quantities in 2022 and pushed prices up, these investors took the opportunity to sell their gold as demand increased. But eventually, this selling pressure is exhausted, and then prices rise sharply.

I suspect bitcoin is currently in a similar stage.

As mentioned earlier, since ETFs and corporations began buying heavily in 2024, bitcoin's price has already increased 2.3 times. During this period, price-sensitive holders have seized the opportunity to sell and exit for profit.

But as the gold price example shows, one day this selling pressure will be exhausted. As long as the combined buying by ETFs and corporations continues (which I believe is highly likely), bitcoin will have its own "2025 gold moment."

My advice is: be patient.

Don't envy the explosive rise in gold prices; instead, see it as a sign—it may be showing us the future path of bitcoin.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin: The Cornerstone of the New Digital Civilization

Is the Halving Myth Over? Bitcoin Faces Major Changes in the "Super Cycle"

Gain Insight into Cryptocurrency’s Promising Future for 2026

In Brief The next major crypto bull cycle will start in early 2026. Institutional investors and regulation drive long-term market confidence. Short-term shifts show investors favoring stablecoins amid volatility.