Bunni DEX shuts down after $8.4 million exploit, citing lack of funds

Quick Take Decentralized exchange Bunni said it will shut down operations following a $8.4 million exploit last month. The team said users will still be able to withdraw assets until further notice.

Decentralized exchange Bunni has announced that it is shutting down operations, citing financial constraints following a recent $8.4 million exploit.

In a Wednesday post on X, Bunni said that it does not have enough resources to fund a secure relaunch.

"The recent exploit has forced Bunni's growth to a halt, and in order to securely relaunch we'd need to pay 6-7 figures in audit and monitoring expenses alone – requiring capital that we simply don't have," the team said.

Bunni added that it would take months of business development effort to restore operations, which the project can't afford. "Thus, we have decided it's best to shut down Bunni," the team said.

The platform suffered an exploit last month that resulted in $8.4 million in losses. Its post-mortem revealed that attackers exploited a rounding error in its smart contract withdrawal function.

With the protocol ceasing operations, Bunni said users will still be able to withdraw assets on its website until further notice. The team plans to distribute remaining treasury assets to holders of BUNNI, LIT, and veBUNNI based on a snapshot, pending legal validation. Team members will be excluded from the distribution, according to the post.

Despite winding down the exchange, Bunni noted that it has relicensed its V2 smart contracts from Business Source License to the less-restrictive MIT license, allowing other developers to use its innovations such as liquidity distribution functions, surge fees, and autonomous rebalancing mechanisms.

Bunni said it is cooperating with law enforcement to pursue recovery of the stolen assets. According to Bunni's post-mortem report, the $8.4 million worth of stolen assets have already been laundered through Tornado Cash. The team offers the attacker a 10% bounty to return the remaining funds.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

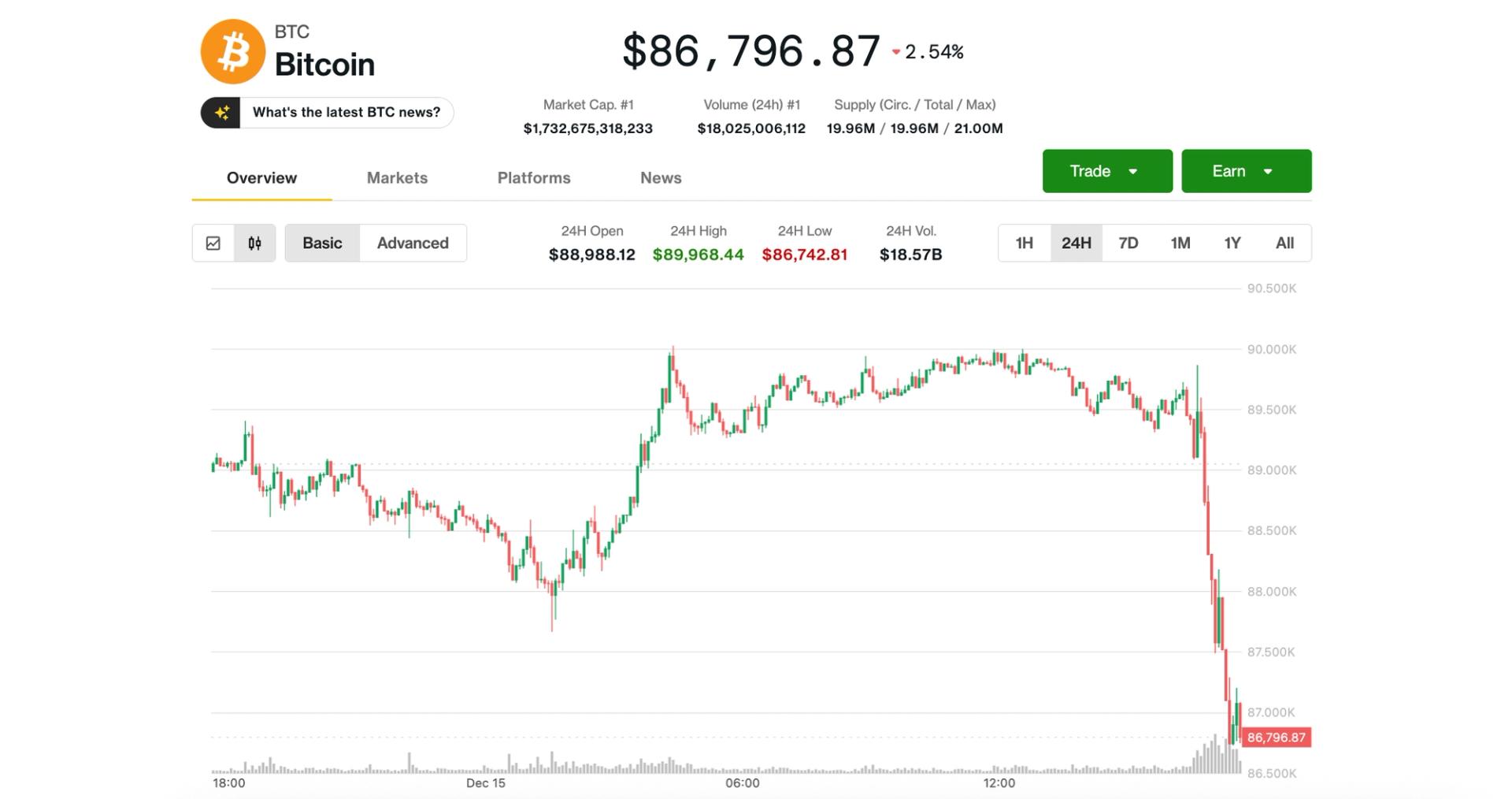

Bitcoin falls below $87,000 as cryptocurrency weakness intensifies

Bitcoin, altcoins sell-off as Fed chair switch-up, AI bubble fears spook markets

From yen rate hikes to mining farms shutting down, why is bitcoin still falling?

The recent decline in bitcoin prices is primarily driven by expectations of a rate hike by the Bank of Japan, uncertainty regarding the US Federal Reserve's rate cut trajectory, and systemic de-risking by market participants. Japan's potential rate hike may trigger the unwinding of global arbitrage trades, leading to a sell-off in risk assets. At the same time, increased uncertainty over US rate cuts has intensified market volatility. In addition, selling by long-term holders, miners, and market makers has further amplified the price drop. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.