ChainOpera AI’s COAI Tops Market Gainers, But Skeptics Cry ‘Scam’

ChainOpera AI’s COAI token rocketed over 70% amid growing hype, but concerns over ownership concentration and legitimacy now divide the market — highlighting the thin line between innovation and speculation in crypto.

ChainOpera AI’s native token, COAI, has surged over 70% in the past 24 hours, emerging as the market’s top gainer.

As the coin continues to gain momentum, the market appears divided — while some remain bullish on the altcoin, others are raising concerns about the project.

COAI Price Skyrockets as Traders Turn Bullish on the Altcoin

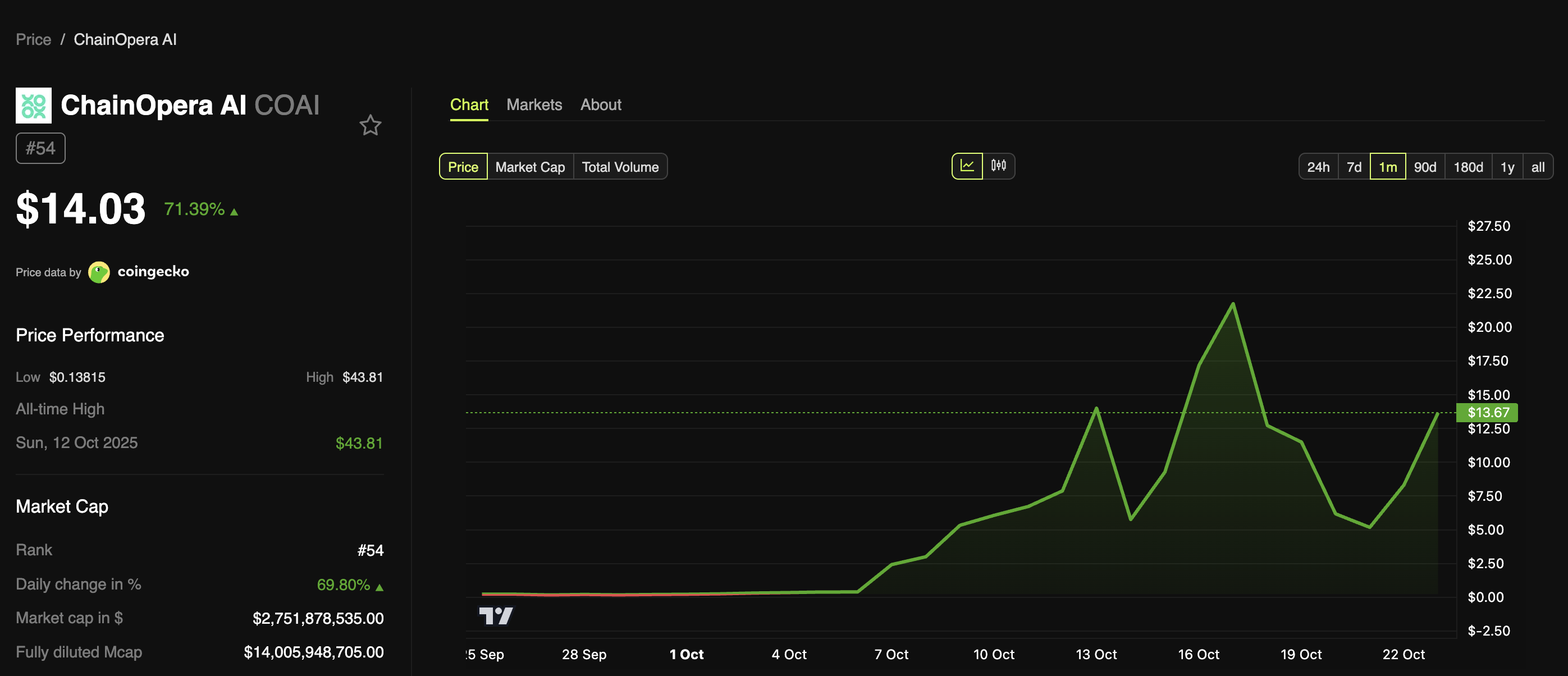

The COAI token has staged a major comeback after experiencing a post-all-time high correction. BeInCrypto Markets data showed that the altcoin has pumped 71.39% over the past 24 hours, outperforming the broader crypto market.

COAI’s performance placed it as the highest daily gainer among the top 300 coins on CoinGecko. Furthermore, 77% of the traders maintain a bullish stance on the token. At the time of writing, it traded at $14.

ChainOpera AI (COAI) Price Performance. Source:

ChainOpera AI (COAI) Price Performance. Source:

In addition to price, COAI is also seeing broader investor adoption. Despite only being a month old, the token has drawn over 50,000 holders.

“Thanks for the love of our community. Now COAI has more than 50000 holders!” the team posted.

Furthermore, the token has also captured massive interest from the community. Data from analytics platform LunarCrush shows the COAI was mentioned 2,393 times in a single day, marking a 1,308% jump from its usual daily activity.

COAI’s Social Mentions. Source:

COAI’s Social Mentions. Source:

A recent analysis of over 2,000 COAI posts indicated that sentiment was driven by three themes: trading opportunity (35%), the Bitget listing (30%), and ChainOpera’s focus on decentralized AI (20%).

“Traders see $COAI as a potential investment opportunity, with many posts highlighting the potential for gains and the project’s focus on AI…..The project’s focus on AI and its integration with blockchain is seen as a positive factor, with many users promoting it as a potential ‘next big thing.'” LunarCrush stated.

Experts Warn COAI Could Be the Next Major Crypto Scam Amid Rapid Rise

Despite COAI’s sharp rise, skepticism remains. Data highlighted that ten wallets hold 87.9% of tokens, raising centralization concerns. Previously, blockchain analytics firm Bubblemaps claimed that a single entity is behind half of the top-earning COAI wallets.

“I thought COAI was just another hype coin, but turns out it was worse- a full on scam in motion. Fake product with a made-up AI story. Fake decentralization….And CEXs helped it by listing this garbage. Retail gets dumped on while insiders walk away rich. It’s time this space stops rewarding frauds,” an analyst remarked.

Another analyst, Viktor, drew parallels between COAI and MYX Finance (MYX), calling the former ‘the top scam of October.’

“I am very much of the opinion that the scale of the scams that are allowed on Binance and Bybit perps is now unprecedented, after seeing M, MYX, AIA and COAI all happen in two months,” he wrote.

While proponents see COAI as a promising project at the intersection of AI and blockchain, critics warn it could be another short-lived hype or worse — a coordinated scam. As debates intensify, only time will tell whether COAI proves its legitimacy or fades as just another cautionary tale in the crypto market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Government Shutdown While the White House is Being Renovated: Who is Paying for Trump's $300 Million "Private Banquet Hall"?

U.S. President Trump has approved the demolition of the White House East Wing to build a large banquet hall funded by private donors, including Trump himself and several companies from the technology, defense, and crypto industries. This move has sparked controversy and criticism for allegedly using power to raise funds. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.

Powell Turns Hawkish: December Rate Cut Far from Certain, Government Shutdown May Force Fed to Hit the Brakes | Golden Ten Data

The Federal Reserve has cut interest rates by another 25 basis points and announced the end of quantitative tightening in December. During the press conference, Powell emphasized the necessity of "slowing the pace of rate cuts," prompting the market to quickly adjust its expectations and causing risk assets to decline across the board.

Bloomberg: $263 million in political donations ready as the crypto industry ramps up for the US midterm elections

This amount is nearly twice the maximum SPAC Fairshake invested in 2024, and slightly exceeds the total spending of the entire oil and gas industry in the previous election cycle.

PEPE Price Chart Signals Oversold Zone Reversal as RSI Turns Upward