87-Year-Old Wall Street Giant Joins Crypto ETF Race With SEC Filing

T. Rowe Price’s crypto ETF filing signals a major shift among traditional finance giants. As over 150 similar applications await SEC approval, the stage is set for a new era of institutional adoption once regulatory delays clear.

T. Rowe Price, a mainstay of investment management, has filed with the Securities and Exchange Commission (SEC) to launch an actively managed crypto exchange-traded fund (ETF) that will provide exposure to multiple digital assets.

This high-profile move arrives during a period marked by regulatory delays, but traditional financial institutions are eager to advance. An increasing number of ETF filings signals the growing urgency and changing attitudes across the industry as legacy firms position themselves for the future of crypto investing.

T. Rowe Price Files to Launch Active Crypto ETF

T. Rowe Price is a legacy asset manager founded in 1937. The firm currently oversees $1.77 trillion in assets. On October 22, it filed a Form S-1 registration with the SEC to launch the T. Rowe Price Active Crypto ETF.

As per the filing, the proposed ETF will hold multiple digital assets, ranging from 5 to 15. The initial ‘Eligible Assets’ list includes: Bitcoin (BTC), Ethereum (ETH), Solana (SOL), XRP (XRP), Cardano (ADA), Avalanche (AVAX), Litecoin (LTC), Polkadot (DOT), Dogecoin (DOGE), Chainlink (LINK), Bitcoin Cash (BCH), Hedera (HBAR), Stellar (XLM), and Shiba Inu (SHIB).

The T. Rowe Price Active Crypto ETF aims to outperform the FTSE Crypto US Listed Index over the long term (generally one year or more).

“The Sponsor will employ an active investment strategy that is intended to try to ‘beat’ the Index. In seeking to outperform the Index, the Fund may not invest in the crypto assets that comprise the Index (Index Constituents) in the same proportions as the Index. In seeking to outperform the Index, the Fund may invest in one or more Index Constituents in excess of or below the weight assigned to such Index Constituents by the Index, invest in one or more crypto assets that are not Index Constituents, or may not invest in one or more crypto assets that are Index Constituents,” the filing reads.

Nate Geraci, President of NovaDius Wealth Management, underlined the strategic logic driving T. Rowe Price’s move. He emphasized that firms can no longer afford to ‘hope crypto goes away’ and are building exposure to avoid missing out.

“This isn’t ‘tradfi co-opting crypto’…You have to think deeper than that. A firm founded in 1937 is now building out the full infrastructure to handle crypto trading & manage a crypto ETF. That has to happen before they move towards tokenizing securities,” Geraci added.

Furthermore, Eric Balchunas, Bloomberg’s senior ETF analyst, suggested that competition among major financial firms to claim their share of the crypto ETF market will continue increasing.

“T Rowe Price just filed for an Active Crypto ETF. They are a Top 5 active manager by assets (mostly mutual funds). Did not expect it but I get it. There’s gonna be land rush for this space too,” he posted.

Over 150 Crypto ETF Filings Await SEC Nod Amid US Government Shutdown

Meanwhile, T. Rowe Price’s submission joins a rising tally of crypto ETF filings. Recently, Balchunas highlighted that 155 crypto ETP filings are awaiting approval from the SEC.

There’s now 155 crypto ETP filings tracking 35 different digital assets. Could easily end up seeing over 200 hit mkt in next 12mo. Total land rush. Here’s the list by coin, amazing work from @JSeyff

— Eric Balchunas (@EricBalchunas) October 21, 2025

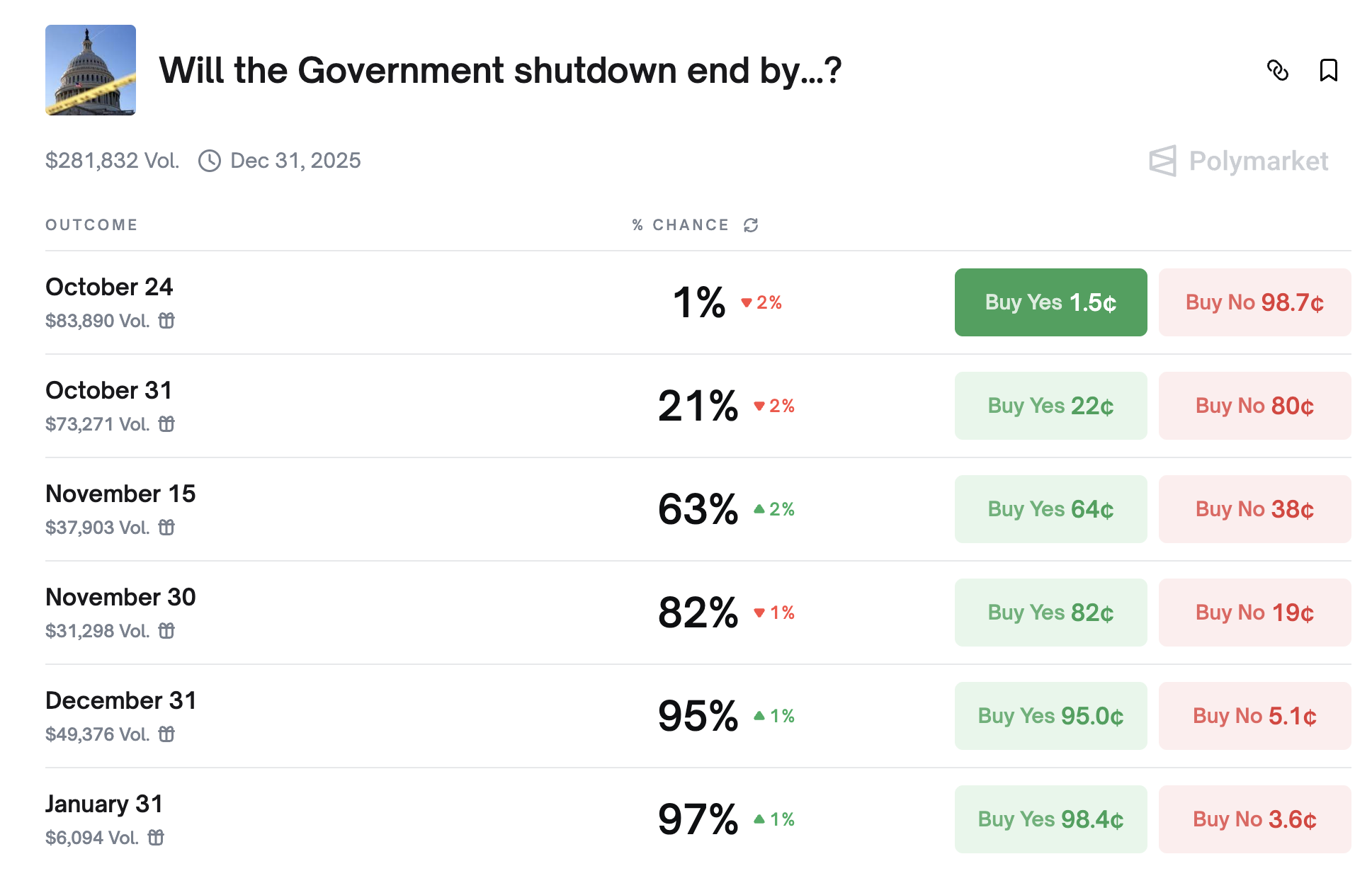

However, crypto ETF approvals are paused due to the ongoing US government shutdown. Traders on Polymarket, a prediction platform, now assign a 63% chance that Congress will resolve the impasse by November 15. At the same time, the odds for later dates are much higher.

US Government Shutdown Ending Odds. Source: Polymarket

US Government Shutdown Ending Odds. Source: Polymarket

If operations resume, market watchers expect the backlog of ETF applications to move forward, potentially bringing in a new capital influx for cryptocurrencies.

“A resolution that soon would be very bullish for crypto, as ETF approvals are expected to roll out right after the shutdown ends,” Bitcoinsensus posted.

Thus, as the market awaits the shutdown’s resolution, anticipation continues to build. Once operations resume, it remains to be seen whether the government will prioritize the review of pending ETF applications or if the industry will face further roadblocks.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Deconstructing DAT: Beyond mNAV, How to Identify "Real vs. Fake HODLing"?

There is only one iron rule for investing in DAT: ignore premium bubbles and only invest in those with a genuine flywheel of continuously increasing "crypto per share."

Empowered by AI Avatars, How Does TwinX Create Immersive Interaction and a Value Closed Loop?

1. **Challenges in the Creator Economy**: Web2 content platforms suffer from issues such as opaque algorithms, non-transparent distribution, unclear commission rates, and high costs for fan migration, making it difficult for creators to control their own data and earnings. 2. **Integration of AI and Web3**: The development of AI technology, especially AI Avatar technology, combined with Web3's exploration of the creator economy, offers new solutions aimed at breaking the control of centralized platforms and reconstructing content production and value distribution. 3. **Positioning of the TwinX Platform**: TwinX is an AI-driven Web3 short video social platform that aims to reconstruct content, interaction, and value distribution through AI avatars, immersive interactions, and a decentralized value system, enabling creators to own their data and income. 4. **Core Features of TwinX**: These include AI avatar technology, which allows creators to generate a learnable, configurable, and sustainably operable "second persona", as well as a closed-loop commercialization pathway that integrates content creation, interaction, and monetization. 5. **Web3 Characteristics**: TwinX embodies the assetization and co-governance features of Web3. It utilizes blockchain to confirm and record interactive behaviors, turning user activities into traceable assets, and enables participants to engage in platform governance through tokens, thus integrating the creator economy with community governance.

Aster CEO explains in detail the vision of Aster privacy L1 chain, reshaping the decentralized trading experience

Aster is set to launch a privacy-focused Layer 1 (L1) public chain, along with detailed plans for token empowerment, global market expansion, and liquidity strategies.

Bitcoin Under Pressure Despite Fed Optimism