Peter Brandt Warns Bitcoin May Mirror 1970s Soybean Crash

Bitcoin’s recent price action is drawing comparisons to one of the most dramatic commodity bubbles in modern history. Veteran trader Peter Brandt says the cryptocurrency’s chart now resembles the 1970s soybean market—an era defined by a sharp boom-and-bust cycle.

In brief

- Veteran trader Peter Brandt says Bitcoin’s chart is forming a rare broadening top, hinting at a potential market peak.

- Brandt compares Bitcoin’s setup to the 1970s soybean market, which saw a 50% drop after a similar pattern emerged.

- Despite warnings, analysts like Arthur Hayes predict Bitcoin could still surge to $250,000 before the cycle ends.

- Bitcoin remains up 62% year-over-year and above its 200-day average, but fear grows amid tariffs and market pullbacks.

Brandt Sees Bitcoin Flashing Warning Signs of Exhaustion and Deep Correction

The 1970s were marked by extreme volatility across global markets, with commodities such as soybeans soaring before collapsing as supply outpaced demand. Brandt now warns that Bitcoin may be showing similar signs of exhaustion ahead of a potential downturn.

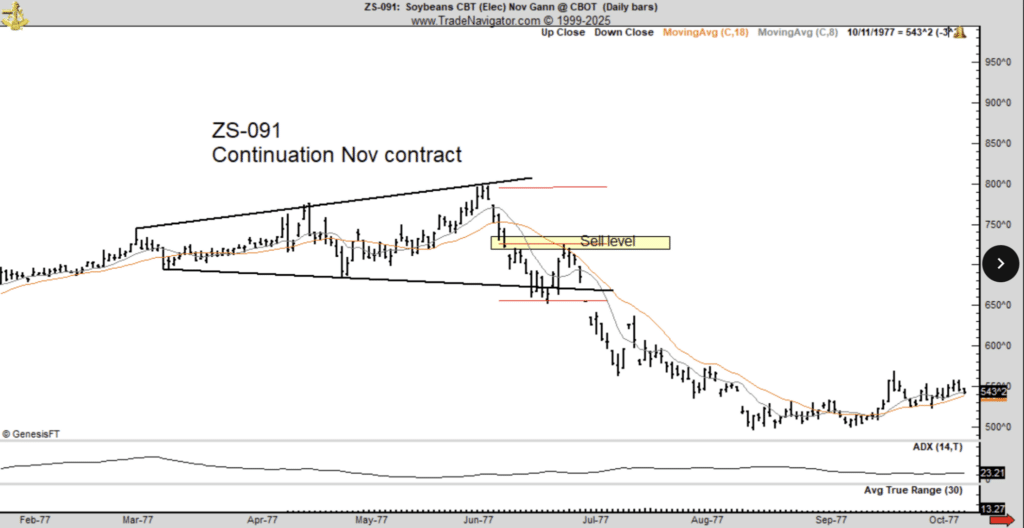

The market veteran explained that Bitcoin’s chart appears to be forming a rare broadening top—a pattern historically associated with major market peaks. He drew parallels to the 1970s soybean market , which saw a similar formation before prices fell by roughly 50%.

Bitcoin is forming a rare broadening top on the charts. This pattern is famous for tops. In the 1970s, Soybeans formed such a top, then declined 50% in value.

Peter Brandt

Brandt warned that if the pattern repeats, Bitcoin could face a deep correction—potentially dropping to around $60,000.

He also cautioned that such a move would hurt not only retail investors but also major corporate holders such as Michael Saylor’s firm, MicroStrategy, whose stock (MSTR) has fallen 10.13% over the past month. The decline comes as Bitcoin-heavy firms face growing pressure from shrinking net asset values.

Bitcoin Fundamentals Remain Firm Despite Tariff-Driven Market Fear

Despite Brandt’s bearish stance, several prominent analysts expect the opposite outcome. Many argue that Bitcoin’s current structure still points to an upcoming rally that could drive the asset to new all-time highs. BitMEX co-founder Arthur Hayes, for instance, has suggested that Bitcoin could reach as high as $250,000 before the current market cycle ends.

This optimism partly stems from historical trends. Data from CoinGlass shows that Bitcoin’s fourth quarter is typically its strongest, with average returns of 78.49% . October, in particular, has historically been one of Bitcoin’s best-performing months.

Key market metrics indicate that Bitcoin remains in a relatively strong position:

- Current Price: Bitcoin is trading around $108,832 after a relatively quiet intraday session.

- Yearly Performance: The asset has increased by 62% over the past year, demonstrating steady growth despite recent volatility.

- Market Standing: It has outperformed 89% of the top 100 crypto assets, though it still trails behind Ethereum in overall gains.

- Technical Position: Bitcoin remains above its 200-day simple moving average, indicating an ongoing bullish trend.

- Trading Activity: The coin has logged 16 green days in the past 30, underscoring continued buying interest among investors.

Even so, sentiment has recently soured following U.S. President Donald Trump’s new tariff announcement. Broader financial markets have entered a pullback, pushing crypto sentiment into the “Extreme Fear” zone. The Crypto Fear & Greed Index showed a score of 25 on Wednesday, indicating heightened caution among traders.

Macro Data Could Spark Rally, Say Market Analysts

On X (formerly Twitter), crypto trader AlphaBTC noted that Bitcoin must hold its recent higher lows and attempt another push toward the monthly open, where it faced rejection in the prior session.

Some analysts remain optimistic about Bitcoin’s outlook. David Hernandez, a crypto investment specialist at 21Shares, said the upcoming U.S. Consumer Price Index (CPI) report could trigger a rebound if inflation shows signs of cooling. He noted that such a scenario could quickly reopen Bitcoin’s window for upward movement.

Michaël van de Poppe, founder of MN Trading Capital, echoed that sentiment, suggesting that gold’s recent 5.5% drop could mark the start of a rotation back into Bitcoin and altcoins. Meanwhile, Citi analysts said MicroStrategy’s stock could still benefit if Bitcoin climbs to $181,000 within the next 12 months —keeping hopes alive for another major rally.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

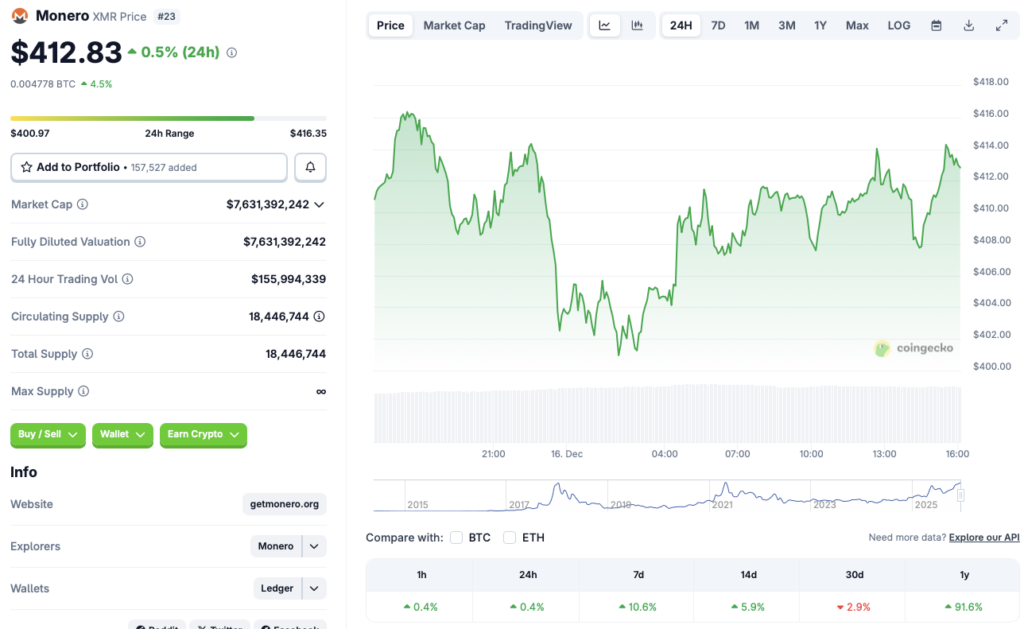

Monero bucks the market trend and continues to strengthen: What are the reasons?

Bank of America Urges Onchain Transition for U.S. Banks