DeFi lending protocol Spark invests $100 million into Superstate Fund to diversify yields

Jinse Finance reported that the DeFi lending protocol Spark has allocated $100 million in stablecoin reserves to Superstate's USCC fund, aiming to generate returns through crypto spot and futures arbitrage trading and diversify away from reliance on US Treasury yields. This move comes as US Treasury yields have fallen to a six-month low. Previously, Spark mainly generated returns through tokenized treasury products, but this investment allows it to maintain stable yield opportunities within a compliant framework while expanding its sources of income.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

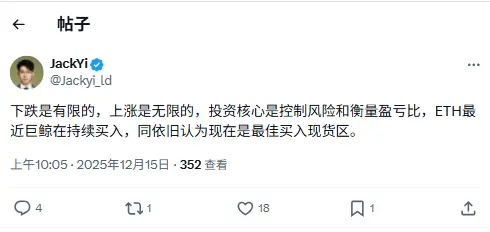

Yilihua: ETH whales are continuing to buy, and I still believe now is the best time to buy spot.

Eric Trump: Bitcoin Has No "Management," No Issues of Corruption, Fraud, or Abuse

Data: Hyperliquid platform whales currently hold $5.517 billions in positions, with a long-short ratio of 0.93.

AI blockchain security platform TestMachine completes $6.5 million financing, led by BlockChange Ventures and others