Exploring Bedrock’s uniBTC and brBTC in the Base Ecosystem

Earlier in July this year, Bedrock expanded to Base by bringing our Bitcoin-backed liquid restaking tokens, uniBTC and brBTC, to the network.

If you hold either of these assets, here’s a quick guide to everything you can now do with them in the Base ecosystem.

Why Base Matters for BTCFi

Base is a Layer-2 chain built on Optimism’s OP Stack and backed by Coinbase, known for its user-friendly environment and strong DeFi activity. Over the past months, Base has started witnessing significant growth in its BTC circulation. According to L2BEAT data , Base’s total value secured (TVS) reached $16.67 billion as of October 7, 2025. Within that, the BTC and derivatives segment accounted for $2.88 billion, or 17.3% of the total.

At the start of the year, Base’s TVS was $15.16 billion, and the BTC and derivatives segment made up only $500.95 million, or 3.3%. The increase to $2.88 billion represents a 474.9% growth year to date (YTD), showing how quickly Bitcoin liquidity has expanded on Base.

Seeing this surge, Bedrock identified Base as a natural next step for expansion. By bringing uniBTC to the Base ecosystem, Bedrock gives Bitcoin holders new ways to access DeFi yields through wrapped and restaked BTC assets.

This aligns with Bedrock’s mission to make Bitcoin productive across ecosystems. Its liquid restaking model turns Bitcoin from idle to active, allowing it to be used as collateral, provide liquidity, and participate in DeFi protocols while staying transferable and contributing to network security.

Mint, Unstake, and Bridge uniBTC on Base

Bedrock makes it simple for Bitcoin holders on Base to mint, unstake, and bridge uniBTC through the Bedrock dApp.

⚠️* brBTC is currently available for bridging only. Minting and unstaking will be enabled soon.*

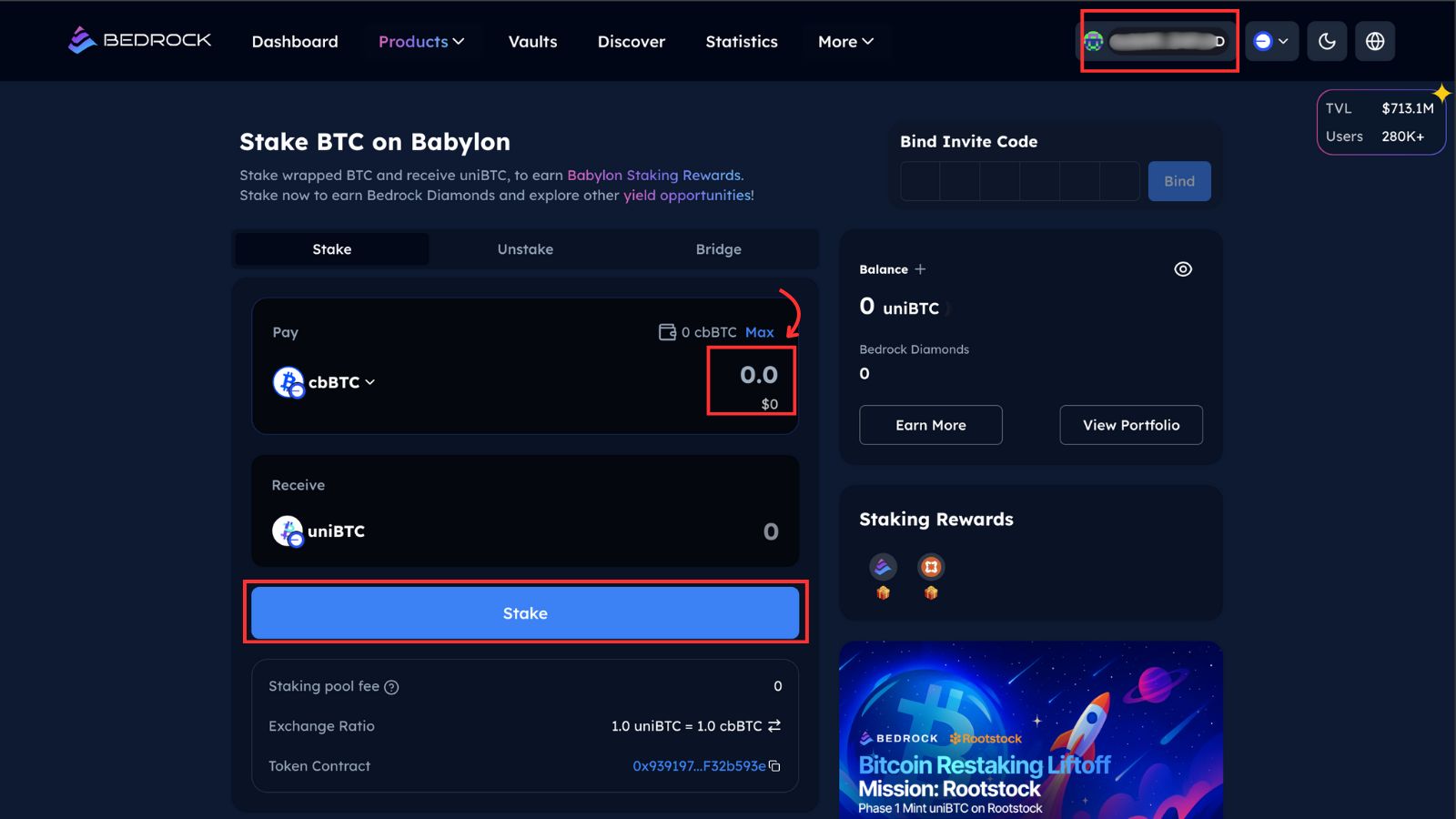

How to Mint uniBTC on Base

-

Visit Bedrock’s dApp and connect your Web3 wallet.

-

Enter the amount of BTC you wish to mint into uniBTC.

Note: Ensure that you hold cbBTC and enough ETH to pay gas fees. -

Click “Stake,” and confirm the transaction. You’ll see your uniBTC appear in your wallet once the transaction is complete.

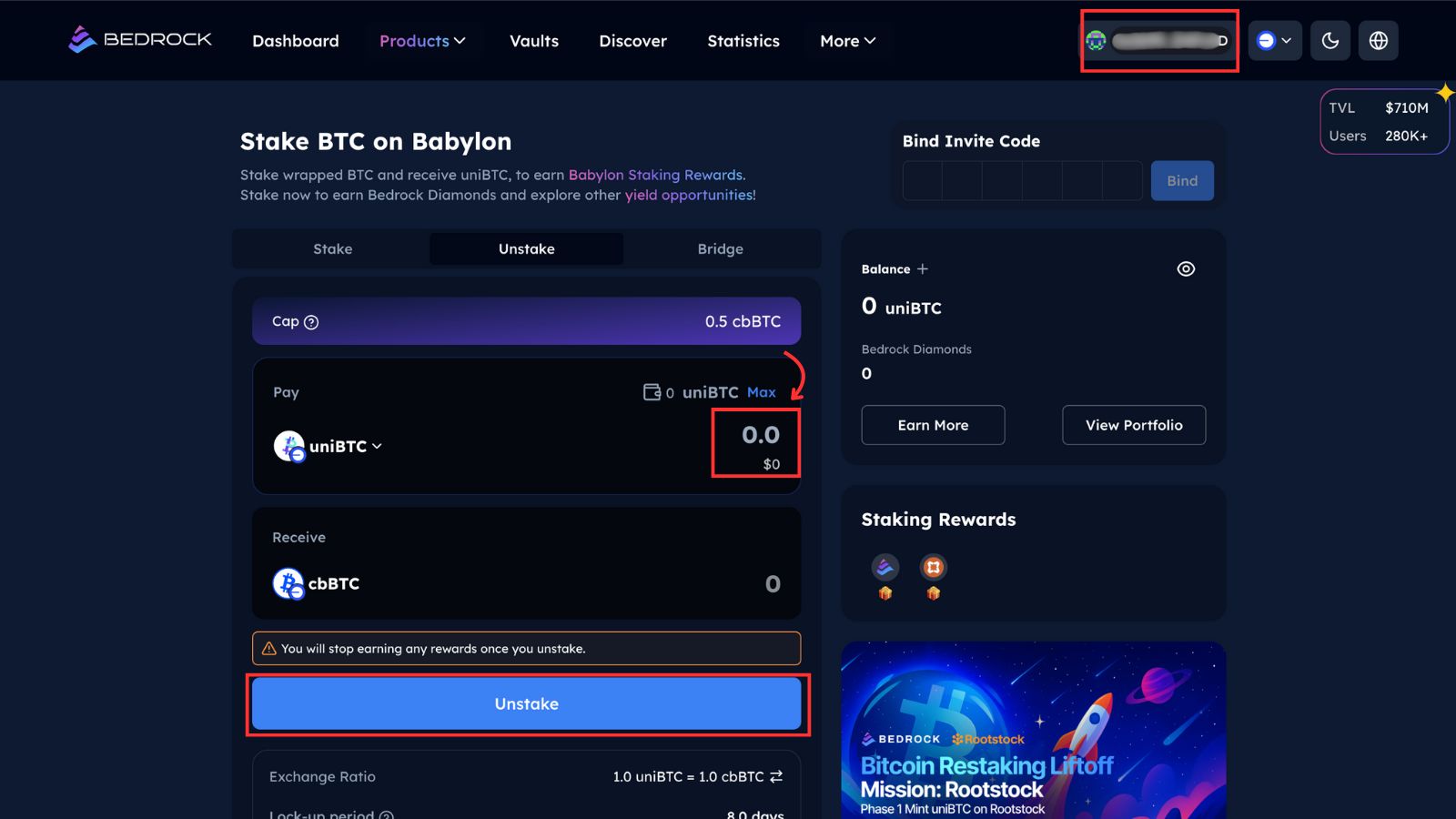

How to Unstake uniBTC on Base

-

Visit Bedrock’s dApp and connect your Web3 wallet where you store your uniBTC on Base.

-

Enter the amount of uniBTC you wish to unstake.

-

Click “Unstake,” and confirm the transaction. Your unstaking request will be subject to an 8-day lock-up period before you can withdraw your assets.

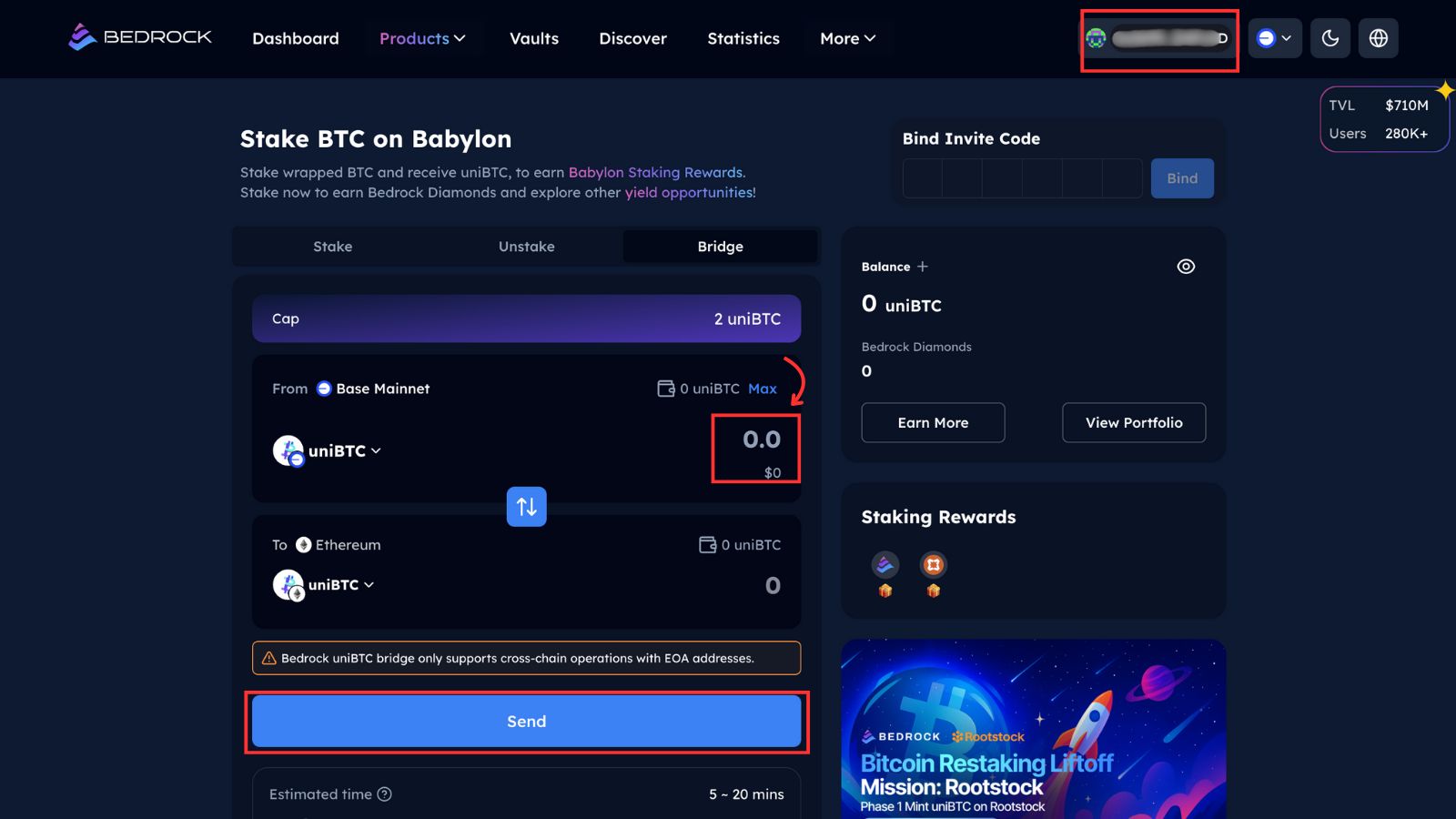

How to Bridge uniBTC

-

Visit Bedrock’s dApp and connect your Web3 wallet where you store your uniBTC on Base.

-

Enter the amount of uniBTC you wish to bridge.

-

Click “Send,” and confirm the transaction.

Note:

• Bridging is currently supported only between Base and Ethereum.

• You can follow the same steps for brBTC bridging.

Put Your uniBTC & brBTC to Work in Base Pools

Once you’ve minted uniBTC, don’t let it sit idle. Several liquidity pools on Base let you earn additional yield from your assets. Each pool provides different exposure and reward structures, letting you choose the one that fits your strategy best.

Some of the current options include:

-

uniBTC-cbBTC on PancakeSwap

-

uniBTC-brBTC on Aerodrome

-

uniBTC-USDC on PancakeSwap

The Road Ahead

Base is just one of the ecosystems where Bedrock brings Bitcoin liquidity to DeFi. We’re continuing to expand across networks that play key roles in the broader DeFi economy — so Bitcoin holders can earn, restake, and transact wherever they choose.

About Bedrock

Bedrock is the first multi-asset liquid restaking protocol, pioneering Bitcoin staking with uniBTC. As the leading BTC liquid staking token, uniBTC enables holders to earn rewards while maintaining liquidity, unlocking new yield opportunities in Bitcoin's $1T market. With a cutting-edge approach to BTCFi 2.0, Bedrock is redefining Bitcoin's role in DeFi, while integrating ETH and DePIN assets into a unified PoSL framework.

Bedrock continues to expand across chains. Following its recent BR deployment to Solana, Bedrock has now brought uniBTC to the network, further broadening access to BTC-backed yield opportunities. This move is part of a wider push to bring Bedrock to more ecosystems in the months ahead.

Official Links

Website | App | Documentation | Blog | X (Twitter) | Discord | Telegram

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

MiCA regulation poorly applied within the EU, ESMA ready to take back control

$674M Into Solana ETF Despite Market Downturn

Here’s What Could Happen if XRP ETFs Reach $10 Billion