Opinion: Uniswap’s Additional 0.15% Fee Doesn’t Seem Wise

The author believes that charging fees to Uniswap Labs instead of UNI not only confirms that UNI is indeed a "meaningless governance token," but also highlights the team's continuous large-scale sell-off of UNI. Despite having sufficient funds, they are sacrificing growth for revenue at this particular point in time, which is truly a puzzling move.

The author believes that charging fees to Uniswap Labs instead of UNI holders not only confirms that UNI is indeed a "meaningless governance token," but also, given that the team has been offloading large amounts of UNI and funding is not an issue, choosing to sacrifice growth for revenue at this point is truly a puzzling move.

Written by: CapitalismLab

Uniswap adding a 0.15% fee does not seem wise. Simply put:

- It only applies to trades made on Uniswap’s official website or official mobile wallet frontends

- It only targets mainstream trading pairs like ETH, WBTC, and stablecoins

- The fees go to Uniswap Labs and are unrelated to $UNI holders

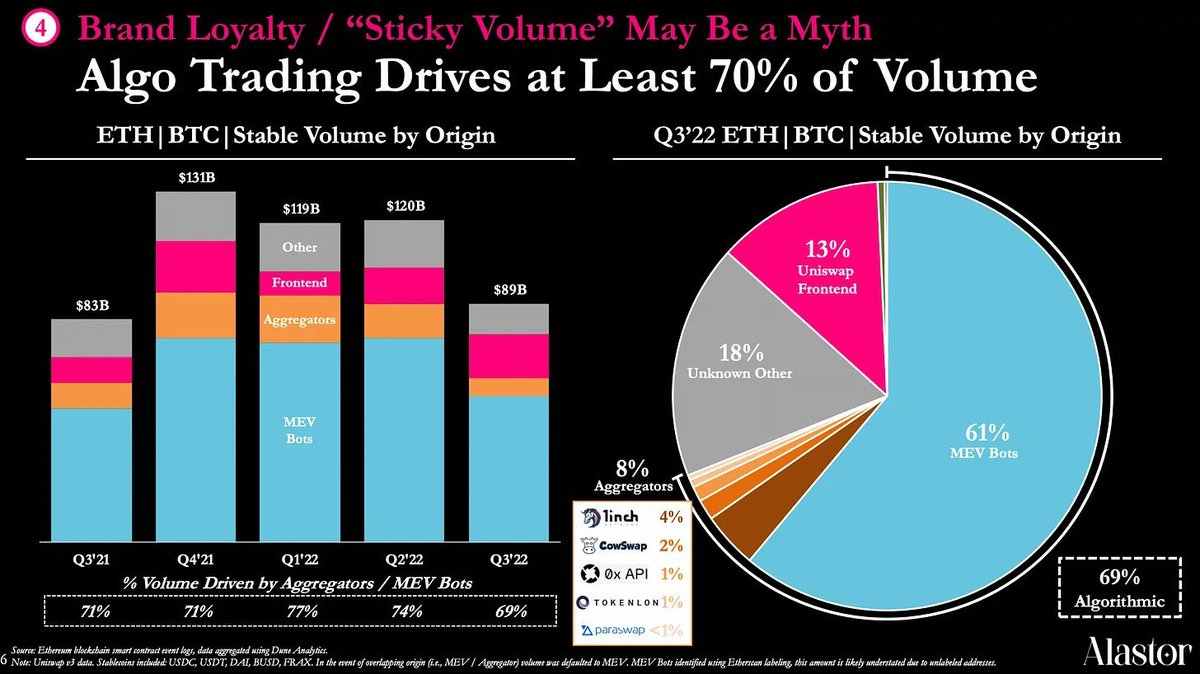

Although Uniswap’s frontend only accounts for 13% of total trading volume, if you exclude MEV arbitrage trades and only consider active trading behavior, its share is still quite high—much higher than aggregators. This is a huge advantage compared to other DEXs.

Many people trading meme coins also prefer to use Uniswap’s frontend directly, since the Gas Fee is cheaper compared to aggregators. Currently, bots have some share, but in terms of DAU, they only account for about 10% of Uniswap’s users.

This time, the fee only targets mainstream trading pairs, but there is uncertainty as to whether it will be extended to other pairs in the future. Users can no longer mindlessly use the Uniswap frontend, which will undoubtedly damage the user experience, reduce frontend usage, and push more people toward aggregators. This is not good for Uniswap’s competitiveness.

Some may argue that Metamask swap also takes a cut, but on one hand, Uniswap’s frontend is not comparable to Metamask, and on the other hand, there are fewer complete newbies using Uniswap, making it harder to collect this kind of “IQ tax.”

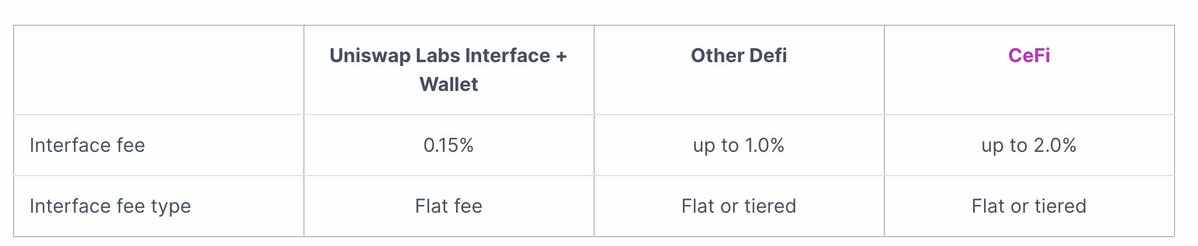

Looking at the fee structure, it is also very high. Uniswap itself made a clearly misleading comparison chart. In reality, the main spot trading channel, Binance, only charges 0.1%, and there are significant discounts for BNB holders and VIPs, not to mention that Uniswap’s LPs also charge fees (ranging from 0.05% to 1%).

Charging fees to Uniswap Labs instead of $UNI not only confirms that $UNI is indeed a "meaningless governance token," but also, given that the team has been offloading large amounts of $UNI and funding is not an issue, choosing to sacrifice growth for revenue at this point is truly a puzzling move.

In summary, this currently appears to be an unwise move. For regular users, the best thing to do is to use aggregators more and the Uniswap frontend less.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Radpie - The upcoming "Convex" for RDNT

Since the Penpie $PNP IDO launch, its price once surged 5x. Riding on this momentum, Magpie announced it will continue to launch the "Convex" for Radiant $RDNT—Radpie—in the subDAO model. With multiple narratives supporting it, will Radpie be able to replicate or even surpass the returns of PNP?

Litecoin, HBAR ETFs by Canary Capital Triumph in Vital Nasdaq Listing Stage

Amidst a Favorable Regulatory Climate, Canary Capital Advances in the Crypto ETF Space with Litecoin and HBAR Filings

Explosive Interest in MegaETH Layer-2 ICO: $360M Pledged in Mere Minutes

Final Allocations to be Determined by Community Engagement Metrics, Following Rapid Oversubscription

Massive Buybacks Lead to 1.29B PUMP Withdrawal from Pump.fun Rally

Whale Sparks Market Activity by Withdrawing Over a Billion Tokens as Pump.fun's Buybacks Surpass $150 Million