From "resistance" to "collateral": Why did JPMorgan suddenly embrace Bitcoin?

Original Source: Blockchain Knight

Original Title: JPMorgan Plans to Accept Bitcoin as Loan Collateral—What’s the Deeper Meaning?

After years of tense relations between cryptocurrency and traditional finance, a symbolic shift is emerging within the world’s largest bank.

According to reports, JPMorgan is preparing to allow institutional clients to use bitcoin and ethereum as collateral for cash loans.

This means that borrowers at the bank can pledge these two largest cryptocurrencies by market cap, with the relevant assets held by approved third-party custodians such as Coinbase.

The plan is expected to launch by the end of 2025.

This move is somewhat ironic. The financial giant’s CEO, Jamie Dimon, is a well-known cryptocurrency critic who previously described bitcoin as a “fraud.”

But the growing demand from the emerging crypto industry has forced him to support the company’s launch of related products.

A New Chapter for Digital Collateral

JPMorgan’s move could quietly rewrite the boundaries between digital assets and the regulated credit market.

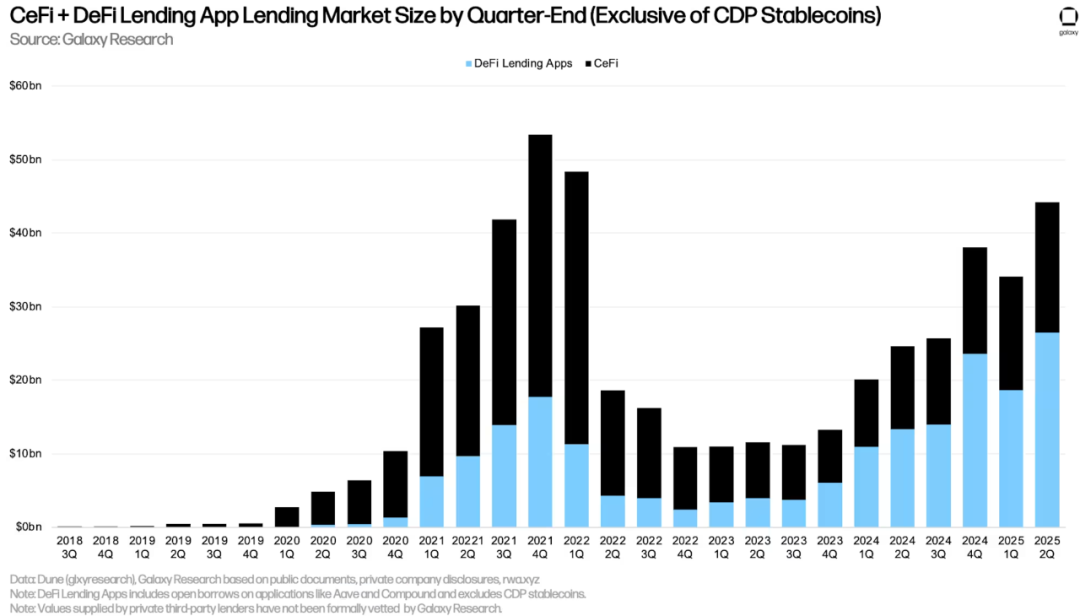

According to Galaxy Research data, as of June 30, the total outstanding loans in centralized finance reached $17.78 billions, up 15% month-on-month and 147% year-on-year.

Including decentralized lending, the total balance of crypto-collateralized credit in Q2 2025 reached $53.09 billions, marking the third-highest record in history.

These figures reflect a structural shift: as digital asset prices rise, lending activity increases in tandem.

This trend has narrowed credit spreads, making loans more attractive to traders and corporate treasury departments.

In addition, companies have begun to use crypto-collateralized loans to finance operations, using digital asset-backed debt as an alternative to equity issuance.

Against this backdrop, JPMorgan’s entry is less an experiment and more a decisive move to “catch up with peers” in this emerging industry.

In this regard, crypto researcher Shanaka Anslem Perera estimates that this model could unlock $1 billions to $2 billions in instant lending capacity for hedge funds, corporate treasury departments, and large asset management firms.

These institutions seek dollar liquidity without having to sell their crypto tokens.

In practice, this means companies can now raise funds with digital assets, following a process similar to borrowing against US Treasuries or blue-chip stocks.

The Significance of JPMorgan’s Move

Although crypto-collateralized lending is already common in decentralized finance (DeFi) protocols and smaller centralized finance lenders, JPMorgan’s participation “institutionalizes” this model.

The bank’s entry marks that digital assets have matured enough to meet the global financial industry’s standards for compliance, custody, and risk management.

Matt Sheffield, CIO of SharpLink, a finance company focused on ethereum, believes this development could reshape how asset management companies and funds manage their balance sheets.

He said: “So far, many traditional financial institutions that rely on bank transactions have had to choose between holding spot ethereum and other positions.”

“But the world’s largest investment bank is now set to change that. By lending against positions held by third-party custodians, institutions can build more profitable portfolios and enhance the value of their collateral assets.”

Meanwhile, this decision also strengthens JPMorgan’s overall layout in the crypto space.

Over the past two years, the bank has built the blockchain-based settlement network Onyx, processed billions of dollars in tokenized payments, and explored digital asset repo transactions.

Accepting bitcoin and ethereum as loan collateral completes the “issuance-settlement-credit” closed loop, with all three links relying on blockchain infrastructure.

Based on this, Sheffield predicts that this move will trigger a “competitive chain reaction” among large banks. He points out:

“This will set off a wave. For large institutions, the deterrent of ‘first mover’ is strong. Once the risks are reduced, other banks will follow suit—if they don’t act, they’ll lose competitiveness.”

Currently, competitors such as Citigroup and Goldman Sachs have expanded their digital asset custody and repo businesses; BlackRock has included tokenized Treasuries (BUIDL) in its fund ecosystem; and Fidelity has doubled the staff of its institutional crypto division this year.

Opportunities and Challenges Coexist

Although Wall Street’s acceptance of digital assets continues to rise, challenges remain.

Banks entering this market must contend with the inherent volatility of cryptocurrencies, uncertainty in regulatory capital treatment, and persistent counterparty risk—all of which limit their ability to expand crypto-collateralized lending.

US regulators have yet to issue clear capital weighting guidelines for digital collateral, forcing institutions to rely on conservative internal models. Even with third-party custodians managing custody risk, regulatory oversight is expected to remain strict.

Nevertheless, the industry’s development trajectory is clear: digital assets are gradually being integrated into the architecture of the global credit market.

Bitcoin analyst Joe Consoerti stated that these moves indicate: “The global financial system is slowly reconfiguring collateral around the highest-quality asset known to mankind.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitwise Launches Solana Staking ETF on NYSE Offering Direct SOL Exposure and Staking Rewards

Democrat Ro Khanna Proposes Crypto and Stocks Trading Ban for Elected Officials

AI Agents Can Now Access Wallets—Is It Safe?

AI agents may soon control crypto wallets via Coinbase’s x402 protocol. Is this the future, or a security risk?What Is the x402 Protocol?Safety Concerns and Questions

Markets Expect Fed Rate Cut This Wednesday

Traders price in a 97.8% chance of a 25bps Fed rate cut this Wednesday, according to CME data.Why This Matters for Crypto and StocksLooking Ahead to Wednesday’s Fed Meeting