Currently, the cryptocurrency market features a vast and complex array of tokens, making it a time-consuming and labor-intensive challenge for investors to select potential assets that align with their established strategies.

The "Conditional Token Selection" feature on the AiCoin platform is designed to address this challenge, providing users with a set of efficient and precise crypto asset screening solutions.

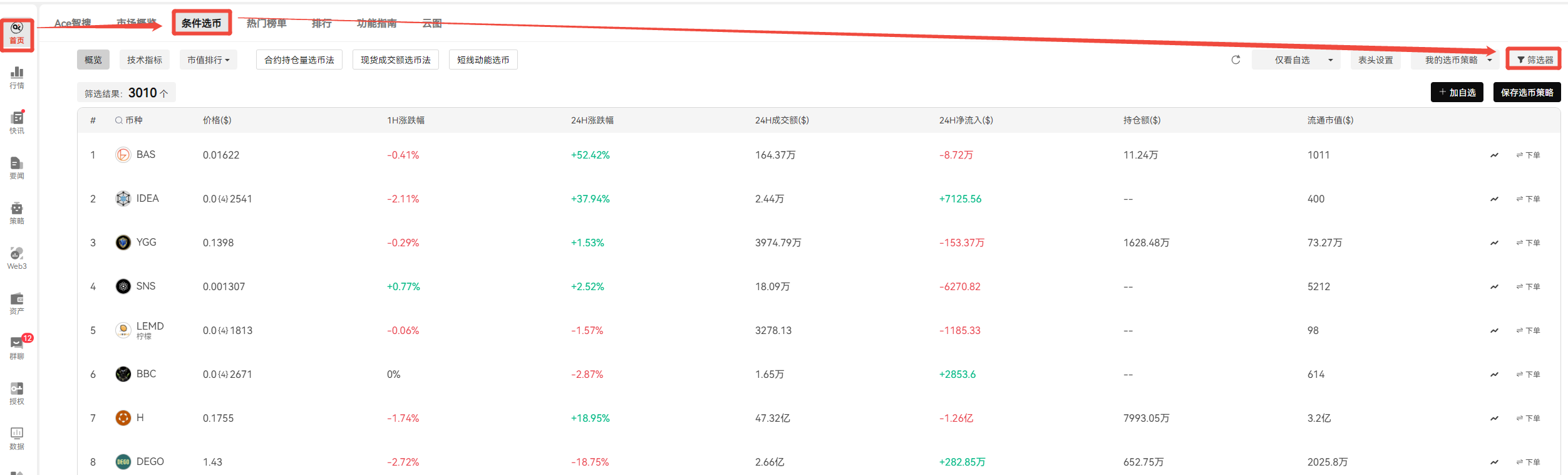

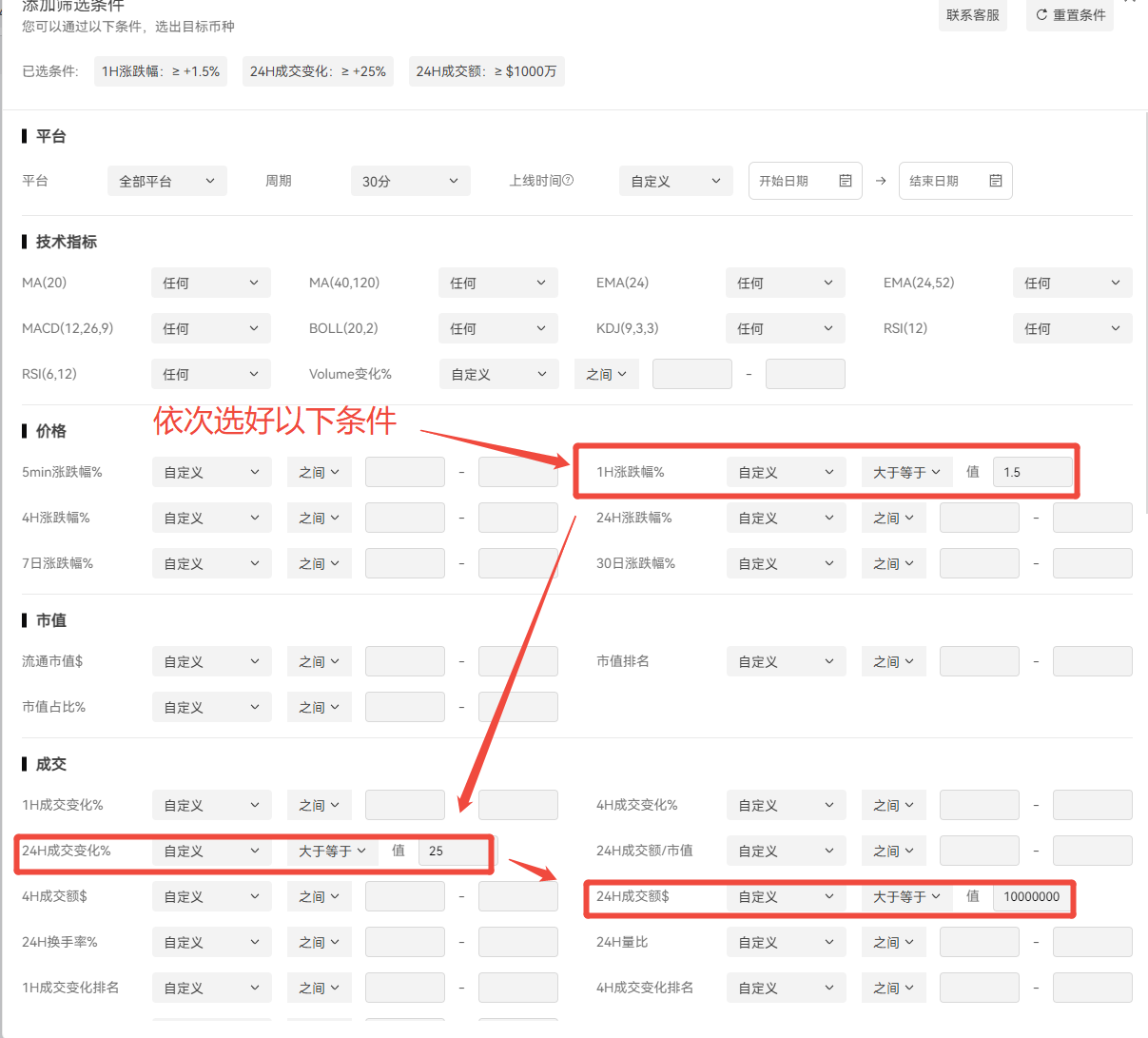

Operation path: Homepage → Conditional Token Selection → Filter

1. Practical Guide to Token Selection: Combining Volume and Price

This article will use the most representative and reliable screening logic: combining volume and price as an example for practical guidance.

The core idea is that asset price fluctuations must be validated by trading volume. When the price effectively breaks through a key resistance level accompanied by a simultaneous surge in trading volume, the reliability of the trend is significantly enhanced, indicating that the market movement is driven by real capital.

1. Example Condition Setting (Capturing Breakouts with Volume):

Price: 1H price change ≥ 1.5% (to capture short-term price strength)

Trading: 24H trading volume change ≥ 25%, and 24H trading amount ≥ 10 million (to capture capital inflow and market attention)

Through the dual verification mechanism of “price breakout + volume surge”, it is possible to effectively identify and exclude false breakouts lacking capital support, ensuring that the captured trends are truly driven by real funds, thereby increasing the success rate of trend trading strategies.

2. Risk Avoidance: The Necessity of Market Cap Thresholds

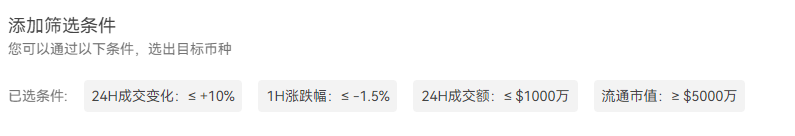

After understanding the underlying logic of the volume-price relationship, further applications can be made, such as identifying opportunities in “declining volume drops”: when the market shows a “declining volume drop” (i.e., price falls but trading volume shrinks significantly), it may indicate institutional adjustments, providing a favorable entry opportunity for potential long positions.

Here, we add the condition “circulating market cap ≥ 50 million USD” to avoid extremely illiquid micro-cap crypto assets.

Experience shows that assets with a circulating market cap below 50 million USD generally lack liquidity, which can lead to significant slippage during trade execution and face a higher risk of delisting. Therefore, setting a reasonable market cap threshold is a necessary prerequisite to ensure that the screened assets have basic market recognition and trading depth.

3. Screening Application and Subsequent Operations

After screening for target tokens, you can further call up the candlestick chart for specific point analysis to assist in formulating entry and exit strategies.

After analysis, investors can add interested tokens to their watchlist or directly save the screening strategy for subsequent tracking and review.

2. Advanced Token Selection Methods: Practical Strategy Ideas

In the field of cryptocurrency investment, choosing the right strategic approach is a key factor in achieving investment goals. AiCoin provides multi-dimensional advanced strategy combinations:

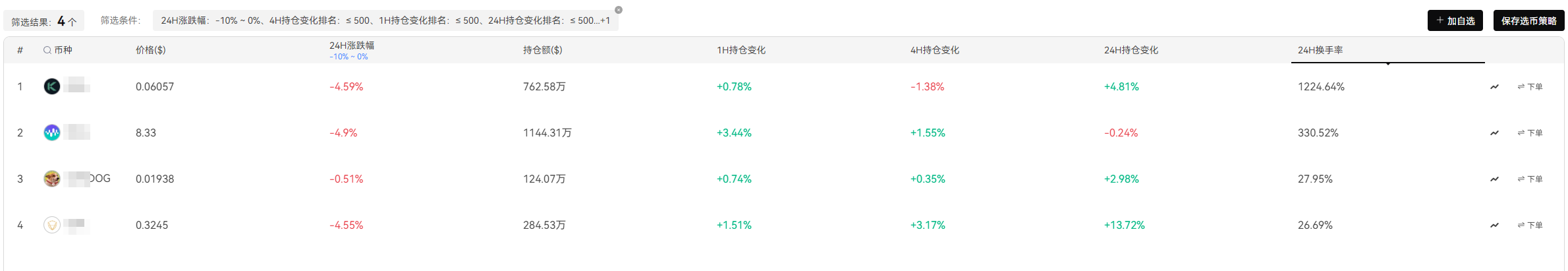

1. Position Change Token Selection Method (Identifying Contract Capital Movements)

Screening idea: Closely monitor tokens with top position changes, but it is recommended to combine with circulating market cap or ranking conditions to filter out low-liquidity micro-cap assets.

Practical application: During bearish market conditions, trend-following opportunities are often hidden. For example, if the 24H price is declining but position change ranks high, it indicates that short contracts are increasing. This indicator can serve as a signal for trend-following short opportunities, or as a reference for judging market rebound trends and making early arrangements.

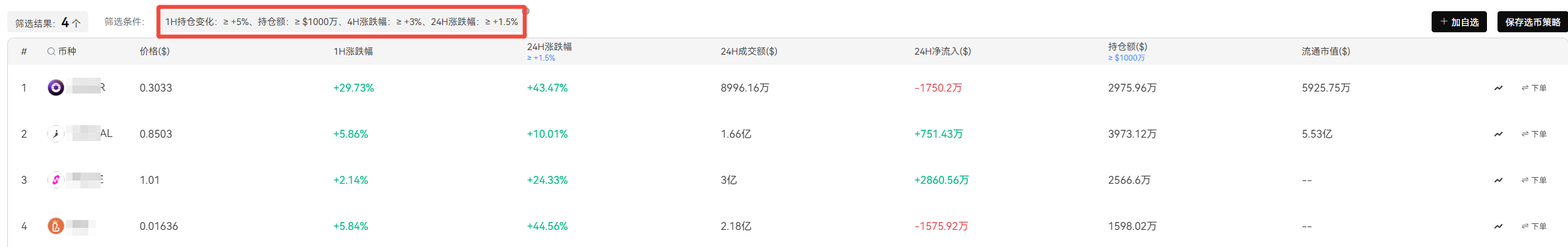

2. Short-term Hotspot Capture Method (Seeking Intraday Gains)

Screening idea: Capture tokens with significant price or trading volume fluctuations in the short term.

For example:

This method aims to quickly capture short-term market hotspots, suitable for obtaining volatility gains in intraday trading (combining with RSI and other technical indicators can further improve the success rate), especially fitting for short-term traders sensitive to market fluctuations.

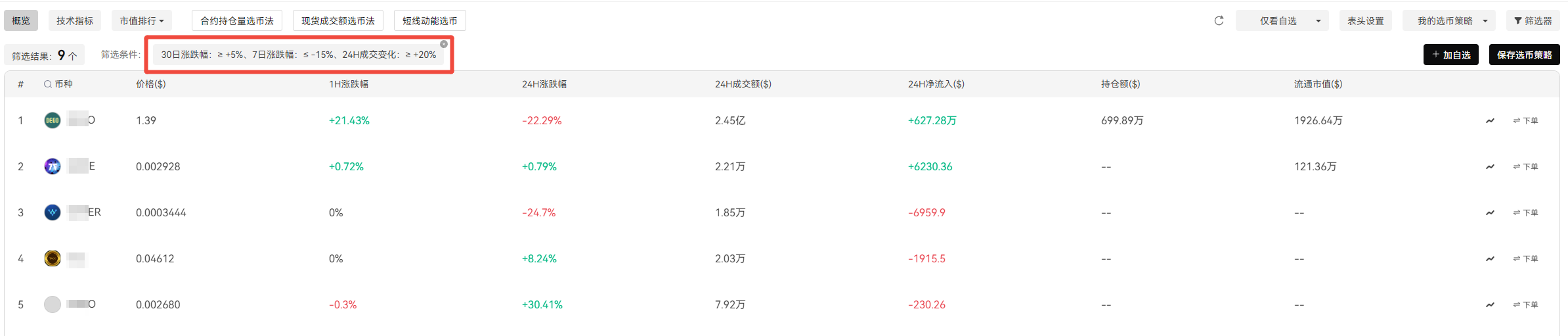

3. Oversold Rebound Screening Method (Low-Cost Bottom Fishing)

Screening idea: Screen for quality tokens that have experienced significant declines but still maintain decent liquidity.

For example:

This strategy aims to screen for quality crypto assets that have been irrationally sold off during market corrections, enabling low-entry positions. Once the market rebounds, such tokens usually have higher potential returns. When relaxing screening constraints, the “trading volume change” condition can be omitted as appropriate.

4. Contract Trend Identification Method (Multi-Timeframe Resonance)

Screening idea: Combine price changes and position changes across different timeframes (such as 4H and 1H) to identify short-term contract trend directions.

For example (short-term bullish):

Taking a short-term bullish trend as an example, if both 4H and 1H periods show gains and 1H position change increases, it indicates the token’s contract is in a short-term uptrend. At this point, candlestick patterns should be combined to further judge whether it is at a swing high or still in an upward move.

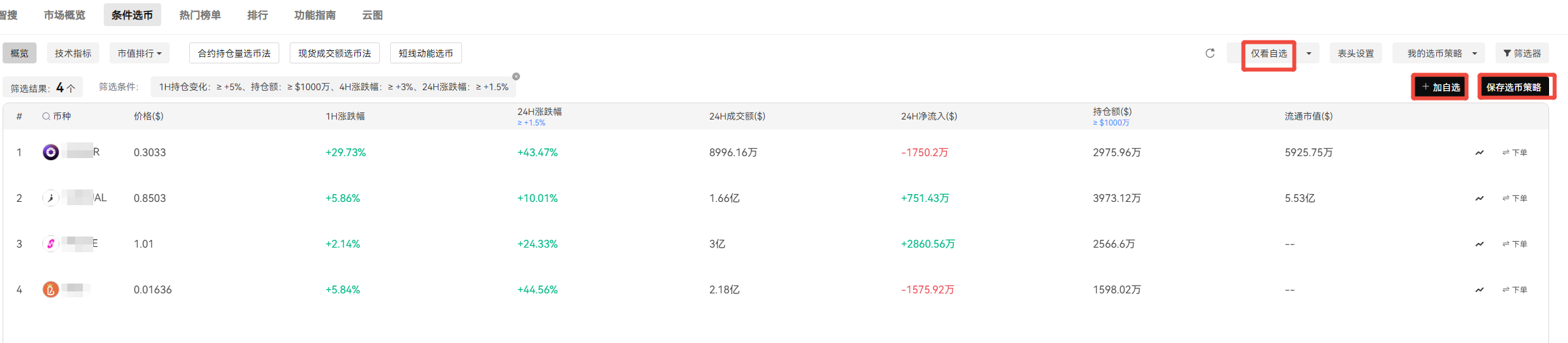

3. Convenient Operations and Personalized Features

1. Practical Tools

“Watchlist Only”: Quickly filter within your watchlist to focus on tokens you already follow.

“Add to Watchlist”: Add potential tokens identified by the filter to your watchlist with one click.

“Save Token Selection Strategy”: Save specific screening strategies for subsequent tracking and review, creating a personalized watchlist.

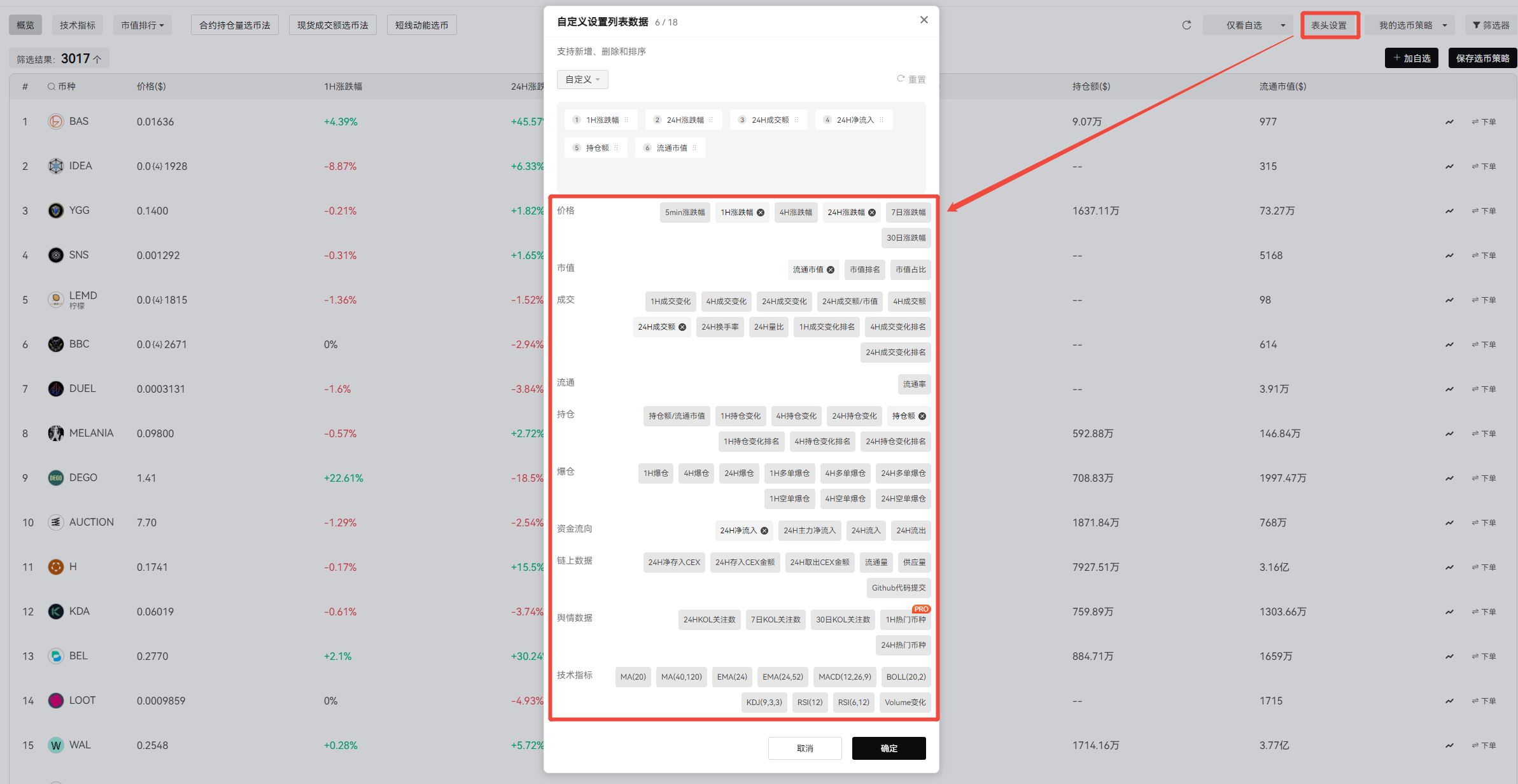

2. Customizable Settings List

This feature fully supports the personalized needs of various investment styles:

Short-term traders: Focus on short-term data such as “5min price change” and “1H trading volume change.”

Value investors: Focus on long-term indicators such as “circulating market cap” and “market cap ratio.”

Technical analysts: Rely on indicators such as “MACD” and “KDJ” to judge trends.

Users can present key data required by their strategies in a customized list, eliminating the need to repeatedly search through complex information, making investment analysis more focused and efficient.

4. Adapting to Market Changes and Risk Management

Given the rapidly changing nature of the cryptocurrency market, the conditional token selection feature relies on real-time data updates to ensure that screening results accurately reflect the latest market dynamics. Investors can flexibly adjust screening conditions according to current market hotspots and trends, enabling agile responses to market changes.

At the same time, precise screening helps investors better diversify risk, avoid blindly following the crowd, and build a more prudent and rational investment portfolio.

Conclusion:

With its comprehensive screening dimensions, high flexibility, efficient decision support, and real-time market responsiveness, AiCoin's conditional token selection feature provides cryptocurrency investors with a powerful and practical analysis tool, dedicated to helping users achieve more stable and efficient investment goals in a complex and ever-changing market environment.

Join our community to discuss and grow stronger together!