XRP Whales’ $500 Million Accumulation Pushes Price Past $2.5

XRP’s price surge past $2.50 follows massive whale accumulation exceeding $500 million, boosting investor confidence and signaling potential upside toward $3.00 if momentum holds.

XRP has witnessed a sharp increase in price as strong investor support, particularly from whales, drives renewed bullish momentum.

The altcoin’s recent recovery follows a notable accumulation phase, with large holders leading the charge. Their activity has strengthened market confidence and also helped push XRP’s price above $2.50.

XRP Holders Are Lifting The Load

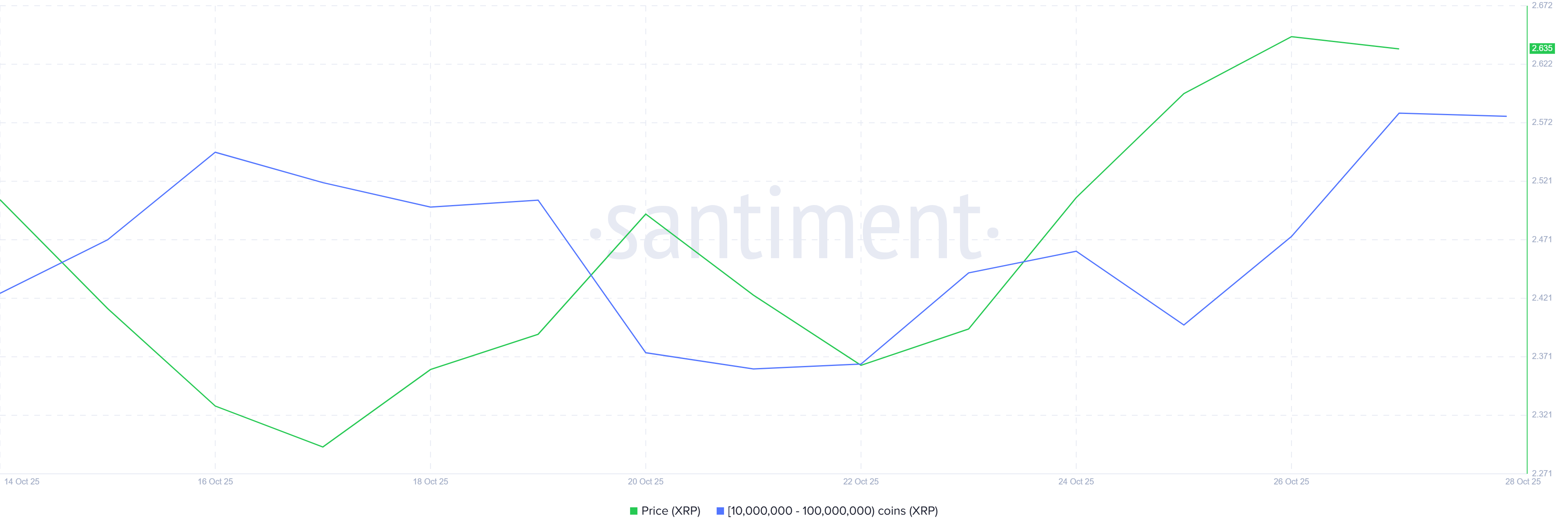

XRP whales have played a key role in fueling the asset’s upward movement. On-chain data shows that addresses holding between 10 million and 100 million XRP accumulated over 190 million tokens in the past week. This accumulation, valued at more than $505 million, reflects growing confidence in XRP’s long-term potential.

The buying spree followed a recent price dip, signaling that large holders are buying the correction instead of exiting positions. Such activity often indicates strong conviction among institutional and high-net-worth investors.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

XRP Whale Holding. Source:

XRP Whale Holding. Source:

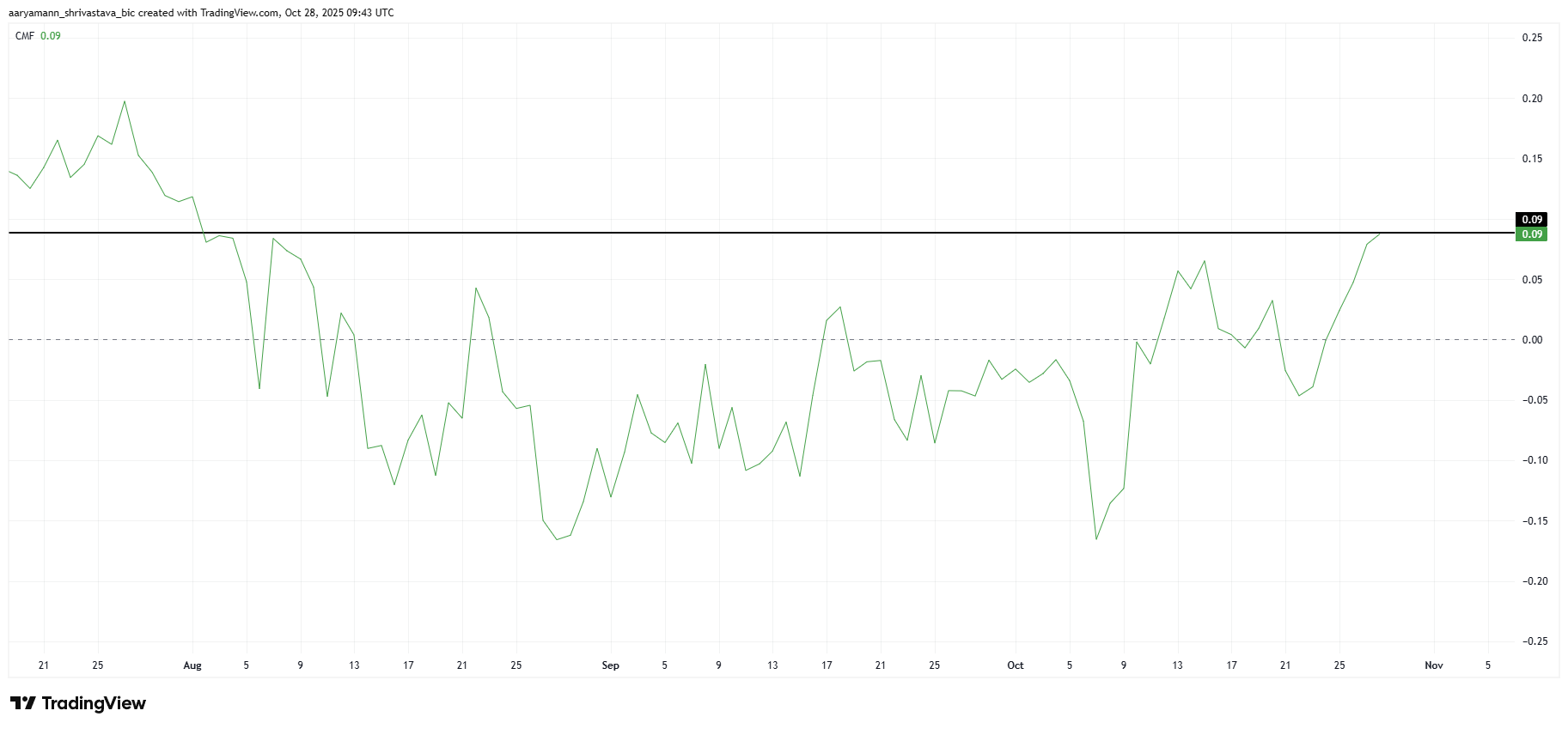

The broader market momentum for XRP is also showing signs of improvement. The Chaikin Money Flow (CMF), a key indicator of capital inflows and outflows, has recorded a notable spike over the past few days. The CMF now sits near a three-month high, confirming growing investor participation across both whale and retail cohorts.

A rising CMF typically indicates increasing buying pressure, and XRP’s recent readings confirm that inflows outweigh outflows. This shift suggests that market participants are positioning for continued upside.

XRP CMF. Source:

XRP CMF. Source:

XRP Price Needs To Secure Support

At the time of writing, XRP trades at $2.65, attempting to establish $2.64 as a new support floor. The token has climbed more than 12% in the past week, marking one of its strongest short-term rallies in months.

If bullish sentiment continues, XRP could extend its rise toward the $2.75 resistance level. Investor support, particularly from whales, may help drive the asset closer to the $3.00 mark, signaling a broader recovery phase.

XRP Price Analysis. Source:

XRP Price Analysis. Source:

However, if XRP faces renewed selling or bearish market cues, it could retrace to $2.54 or even $2.35. Such a decline would invalidate the current bullish outlook and suggest short-term exhaustion among investors.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Government Shutdown While the White House is Being Renovated: Who is Paying for Trump's $300 Million "Private Banquet Hall"?

U.S. President Trump has approved the demolition of the White House East Wing to build a large banquet hall funded by private donors, including Trump himself and several companies from the technology, defense, and crypto industries. This move has sparked controversy and criticism for allegedly using power to raise funds. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.

Powell Turns Hawkish: December Rate Cut Far from Certain, Government Shutdown May Force Fed to Hit the Brakes | Golden Ten Data

The Federal Reserve has cut interest rates by another 25 basis points and announced the end of quantitative tightening in December. During the press conference, Powell emphasized the necessity of "slowing the pace of rate cuts," prompting the market to quickly adjust its expectations and causing risk assets to decline across the board.

Bloomberg: $263 million in political donations ready as the crypto industry ramps up for the US midterm elections

This amount is nearly twice the maximum SPAC Fairshake invested in 2024, and slightly exceeds the total spending of the entire oil and gas industry in the previous election cycle.

PEPE Price Chart Signals Oversold Zone Reversal as RSI Turns Upward