Bitwise’s Solana ETF Saw $56 Million in First-Day Trading, Best in 2025

The Solana ETF’s explosive $56 million debut signals strong institutional demand, yet SOL’s price decline highlights bearish market pressure and uncertainty for retail investors.

The Solana ETF hit US markets today, and it proved immensely successful. Bitwise’s product saw $56 million in day-one trading volume, making a larger splash than 850+ ETFs launched in 2025.

However, SOL’s actual token price has actually declined today due to other factors. Although the upcoming altcoin ETFs may become lucrative investment opportunities, underlying market trends still look bearish.

Solana ETF Goes Live

The prospect of a Solana ETF has stirred market expectations for months, but the actual launch happened in murky circumstances. After months of false starts and regulatory confusion, the community had a mixed reaction when analysts claimed trading was about to start.

Nonetheless, the first Solana ETFs went live on the markets today, and their baptism by fire proved extremely successful:

Final tally of Day One trading.. $BSOL: $56m$HBR: $8m$LTCC: $1m I can't believe how close I came. ETF sixth sense for the win. Wish there was a for this I'd be rich.

— Eric Balchunas (@EricBalchunas)

Corporate investors have been pouring money into crypto ETFs, and the new Solana products are no exception.

Eric Balchunas, a Bloomberg analyst, claimed that Bitwise’s product had the strongest launch of any ETF in 2025. This includes ETFs based on XRP and non-token-based products alike; around 850 new assets in total.

No Gains for SOL

In other words, this Solana ETF has been a phenomenal success. Bitwise’s product completely eclipsed HBAR and Litecoin ETFs, seeing $56 million in total volume compared to $8 and $1 million, respectively. Nonetheless, however, anticipated gains for Solana have yet to materialize:

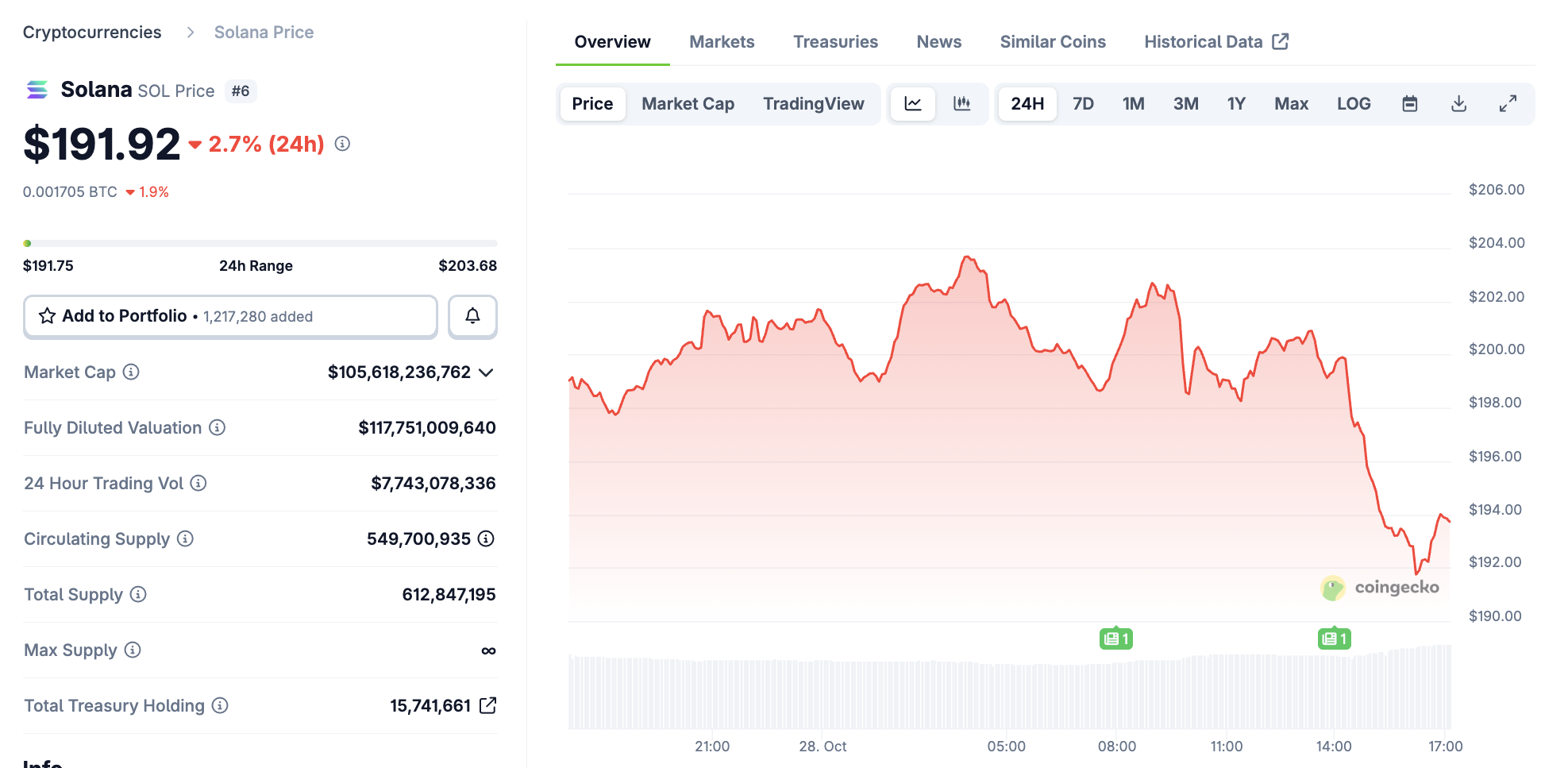

Solana Price Performance. Source:

Coingecko

Solana Price Performance. Source:

Coingecko

This discrepancy between the ETF performance and actual interest in Solana is more than a little worrying. SOL’s price didn’t just ignore the news; it actually decreased significantly.

Analysts suggest that a long squeeze is happening between long-term holders and leverage plays, which may be causing these doldrums. Still, it seems highly bearish that the Solana ETF’s breakout success didn’t influence these dynamics.

The first BTC ETFs brought runaway success for Bitcoin, potentially altering its price cycles forever. If altcoin products don’t have a similar impact, however, it will challenge a lot of vital assumptions.

In other words, this seems like something of a mixed blessing. The Solana ETF has finally reached US markets, and the appetite is very strong. For the time being, though, retail SOL holders might not reap any of the rewards.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Vitalik on Ethereum's Possible Futures (VI): The Splurge

In the design of the Ethereum protocol, about half of the content involves various types of EVM improvements, while the remaining part consists of a variety of niche topics. This is what "prosperity" means.

The New Cycle and Old Rules of Crypto VC

As mergers and acquisitions and IPOs become mainstream exit strategies, and as LP types diversify and fund cycles lengthen, will crypto VCs—especially those in Asia—see a rebound at the bottom of the new cycle?

Vitalik's latest research: How must LSDFi protocols and liquidity change to enhance decentralization and reduce consensus overload?

This article will mainly focus on two major issues currently facing LSDFi protocols and liquidity pools: the centralization risk posed by node operators and the unnecessary consensus burden.

Stellar Price Update: XLM Trades $0.33 — ConstructKoin (CTK) Emerges Among the Best Presale Crypto 2025 Contenders