Bitcoin Retreats to $112K as Institutional Demand Fades

Bitcoin unexpectedly dropped 3% despite a positive US-China trade outlook, decoupling from soaring stocks. On-chain data shows weak Spot ETF inflows, suggesting low institutional demand for a major rally.

Bitcoin price dropped by over 3% on Tuesday, falling back to the $112,000 level after briefly topping $116,000. The decline puzzled investors as it occurred during a period marked by positive geopolitical news and record gains in traditional markets.

According to CoinGecko data, Bitcoin was trading near $115,500 on Tuesday at 5:00 PM UTC, but plunged to $112,250 over the following three and a half hours. Ethereum (ETH) saw a sharper decline of approximately 4% during the same period.

Crypto Decouples from Soaring Stocks

The sell-off was counterintuitive to market sentiment. At the time of the crypto drop, the US and China were finalizing preparations for their summit in Korea, with US President Donald Trump expressing hopes for a “fantastic trade agreement.” Media reports even speculated that China might curb fentanyl production in exchange for a potential 10 percentage point reduction in existing US tariffs.

Bolstered by the improving trade outlook, the Nasdaq 100 Index, which typically shows a high correlation with Bitcoin, rose by 0.6%. Similarly, the S&P 500 Index surged 1.23% to hit an all-time high on Tuesday. Only Bitcoin and the broader cryptocurrency market registered weakness.

On-Chain Data Flags Weak Buying Demand

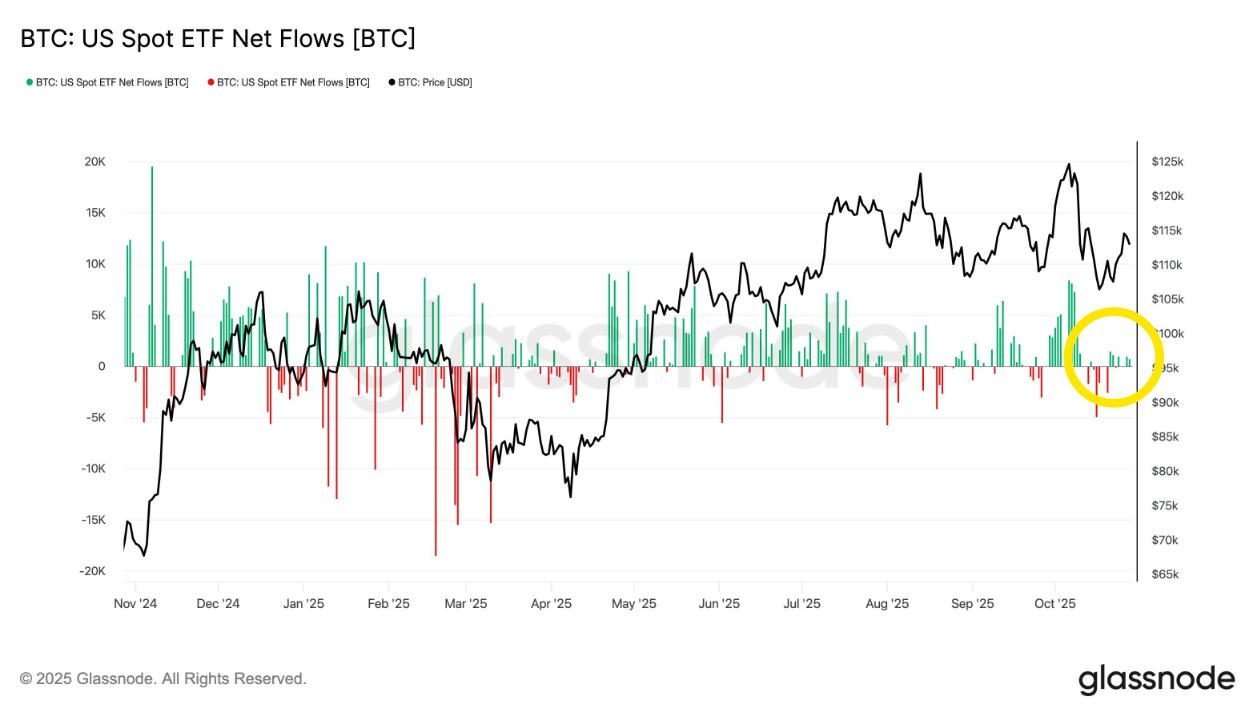

On-chain analysts point to persistently weak buying sentiment as the likely cause for the unexpected drop. While US Spot Bitcoin ETFs—a key barometer for American spot market pressure—saw net inflows of roughly $200 million, this figure is significantly subdued compared to recent accumulation trends.

On-chain data platform Glassnode noted on X that the recent Bitcoin price movement remains firmly tied to US Spot ETF net inflows. “The bounce from $107k coincided with US Spot ETF netflows turning positive,” the firm stated.

BTC: US Spot ETF Net Flows [BTC]. Source: Glassnode

BTC: US Spot ETF Net Flows [BTC]. Source: Glassnode

Inflows Fall Short of Rally Intensity

The core concern is the stagnation of this institutional capital flow. Glassnode highlighted that current inflows “remain <1k BTC/day, significantly lower than >2.5k BTC/day seen at the start of major rallies this cycle.”

The analysts concluded that “Demand is recovering, but not at the intensity of recent rallies.” This suggests that while there is underlying support, the required velocity of institutional capital needed to sustain a push past the $116,000 resistance level is currently lacking, leaving the market susceptible to pullbacks.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2025 TGE Survival Ranking: Who Will Rise to the Top and Who Will Fall? Complete Grading of 30+ New Tokens, AVICI Dominates S+

The article analyzes the TGE performance of multiple blockchain projects, evaluating project performance using three dimensions: current price versus all-time high, time span, and liquidity-to-market cap ratio. Projects are then categorized into five grades: S, A, B, C, and D. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Mars Finance | "Machi" increases long positions, profits exceed 10 million dollars, whale shorts 1,000 BTC

Russian households have invested 3.7 billion rubles in cryptocurrency derivatives, mainly dominated by a few large players. INTERPOL has listed cryptocurrency fraud as a global threat. Malicious Chrome extensions are stealing Solana funds. The UK has proposed new tax regulations for DeFi. Bitcoin surpasses $91,000. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.