Whales Split on Ethereum: Profit-Takers Sell as Bitmine Bets Big With $113 Million Buy

Ethereum whales are reshuffling positions as markets brace for FOMC-related turbulence. Fundstrat’s Bitmine added $113 million in ETH, now holding $13.3 billion total, signaling strong institutional conviction.

An original Ethereum participant has transferred $6 million in ETH to Kraken after eight years, realizing a 12,971x return. Meanwhile, Fundstrat-linked Bitmine added $113 million to its Ethereum holdings, pushing its total to over $13 billion.

These developments highlight a sharp divide among major Ethereum holders. While some whales are shorting, others are buying market bottoms with impressive accuracy, underlining contrasting market sentiment.

Dormant Ethereum Wallet Moves After Eight Years

A wallet became active after nearly eight years, sending 1,500 ETH (about $6 million) to the Kraken exchange.

Originally, the wallet received 20,000 ETH at Genesis, bought for $6,200. At current prices, its remaining holdings are valued at $80.42 million, a 12,971x return.

An #Ethereum participant just woke up after nearly 8 years of dormancy, depositing 1,500 $ETH($6M) to #Kraken for the first time.This OG (0x3690) received 20,000 $ETH at genesis, with a purchase cost of $6.2K, now worth $80.42M — a 12,971x return.

— Lookonchain (@lookonchain) October 29, 2025

The Ethereum public sale occurred in July 2014. Early investors received 2,000 ETH per BTC for about $0.30 each. Over 60 million ETH were sold, raising more than $18 million. The genesis block launched on July 30, 2015, starting Ethereum’s blockchain.

This is one of the rare times that an original participant has moved a large sum after such a long period. These actions often point to profit-taking after years of holding. The wallet still holds 18,500 ETH, suggesting the participant maintains long-term conviction.

Ethereum is trading at around $4,001, with a market cap of $482 billion and a 24-hour trading volume of $35.5 billion.

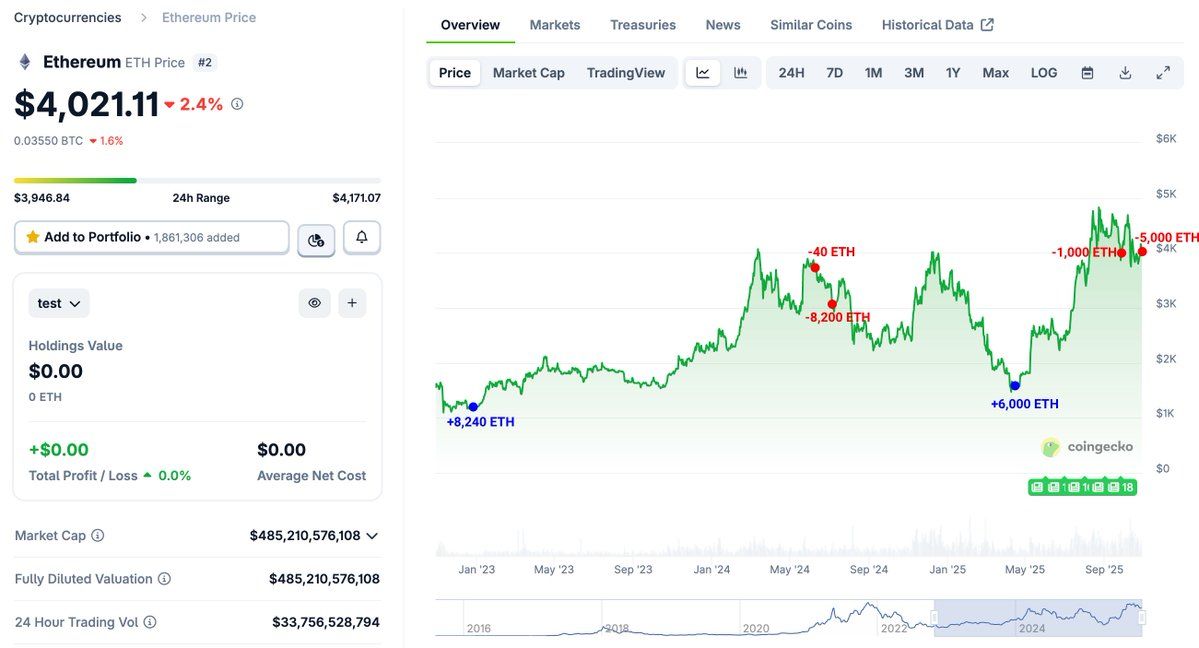

Ethereum (ETH) Price Performance. Source:

Ethereum (ETH) Price Performance. Source:

Institutional Accumulation Intensifies With $113 Million Bitmine Purchase

Elsewhere, Bitmine, associated with Fundstrat and Tom Lee, bought 27,316 ETH worth $113 million. This purchase brings its total holdings to 3.34 million ETH, valued at roughly $13.3 billion. The move marks another sizable accumulation.

Tom Lee's #Bitmine just bought another 27,316 $ETH($113M) and currently holds 3.34M $ETH($13.3B).

— Lookonchain (@lookonchain) October 29, 2025

Tom Lee founded Fundstrat in 2024 and became Chairman of Bitmine Immersion Technologies in June 2025. In just months, Bitmine’s Ethereum and cash holdings grew to $13 billion, making it the largest publicly traded Ethereum treasury company.

Research from Pantera Capital notes that Bitmine’s strategy suggests institutional capital is shifting on-chain, with Ethereum a top choice.

Lee compared Ethereum’s current position to Bitcoin in 2017, saying its ecosystem is entering a phase of rapid institutional adoption.

Bitmine’s approach involves significant Ethereum accumulation, now close to 1% of Ethereum’s supply. Its consistent buying signals a strong, long-term belief in Ethereum’s role in decentralized finance and blockchain infrastructure.

As institutional participation grows, entities like Bitmine are deploying billions. This reflects a larger shift to blockchain assets in treasury strategies, similar to previous trends with Bitcoin.

Whale Traders Split Between Shorting and Precise Bottom Buying

While some whales accumulate, others are taking the opposite view. One trader timed an ETH bottom with outstanding precision, buying twice at exact lows and earning about $29 million. This translates to a 150% gain. The trader bought 8,240 ETH and 6,000 ETH at the market’s nadir, then sold at peaks.

ETH price chart showing precise buy and sell points generating $29M profit.

ETH price chart showing precise buy and sell points generating $29M profit.

Conversely, another whale has aggressively shorted ETH, betting against the asset even as institutional players buy.

The market is down — how's the bulls vs bears battle playing out?Long:• 0xc2a3 (100% win rate) closed all 2,186 $BTC($256.56M) longs with only $1.4M profit.• 0x4e8d (69.23% win rate) partially closed 419.48 $BTC($47.68M) longs at a $327K loss.• Machi Big Brother added…

— Lookonchain (@lookonchain) October 29, 2025

This divergence underlines the uncertain, contrasting outlook on Ethereum’s near-term price direction.

The Ethereum market now presents mixed signals. Large wallets continue making opposing moves, some entering at market bottoms while others take short positions.

This split reveals an ongoing debate around Ethereum’s value, influenced by macroeconomic factors and changing sentiment on decentralized assets.

The gap between institutional accumulation and whale shorting shows Ethereum is at a pivotal point, as major market players prepare for conflicting outcomes in the weeks ahead.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2025 TGE Survival Ranking: Who Will Rise to the Top and Who Will Fall? Complete Grading of 30+ New Tokens, AVICI Dominates S+

The article analyzes the TGE performance of multiple blockchain projects, evaluating project performance using three dimensions: current price versus all-time high, time span, and liquidity-to-market cap ratio. Projects are then categorized into five grades: S, A, B, C, and D. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Mars Finance | "Machi" increases long positions, profits exceed 10 million dollars, whale shorts 1,000 BTC

Russian households have invested 3.7 billion rubles in cryptocurrency derivatives, mainly dominated by a few large players. INTERPOL has listed cryptocurrency fraud as a global threat. Malicious Chrome extensions are stealing Solana funds. The UK has proposed new tax regulations for DeFi. Bitcoin surpasses $91,000. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.