Solana Inflows Crash To 6-Month Low As Price Struggles To Cross $200

Solana’s stalled rally and plunging inflows point to fading investor confidence, with the altcoin now battling to defend $183 support after multiple failed breakout attempts.

Solana’s price has been moving sideways over the past few days, struggling to break through the key resistance level at $200.

The altcoin’s inability to maintain upward momentum has led to growing investor caution. As a result, SOL may soon face renewed selling pressure, slowing its recent recovery trend.

Solana Holders Are Backing Out

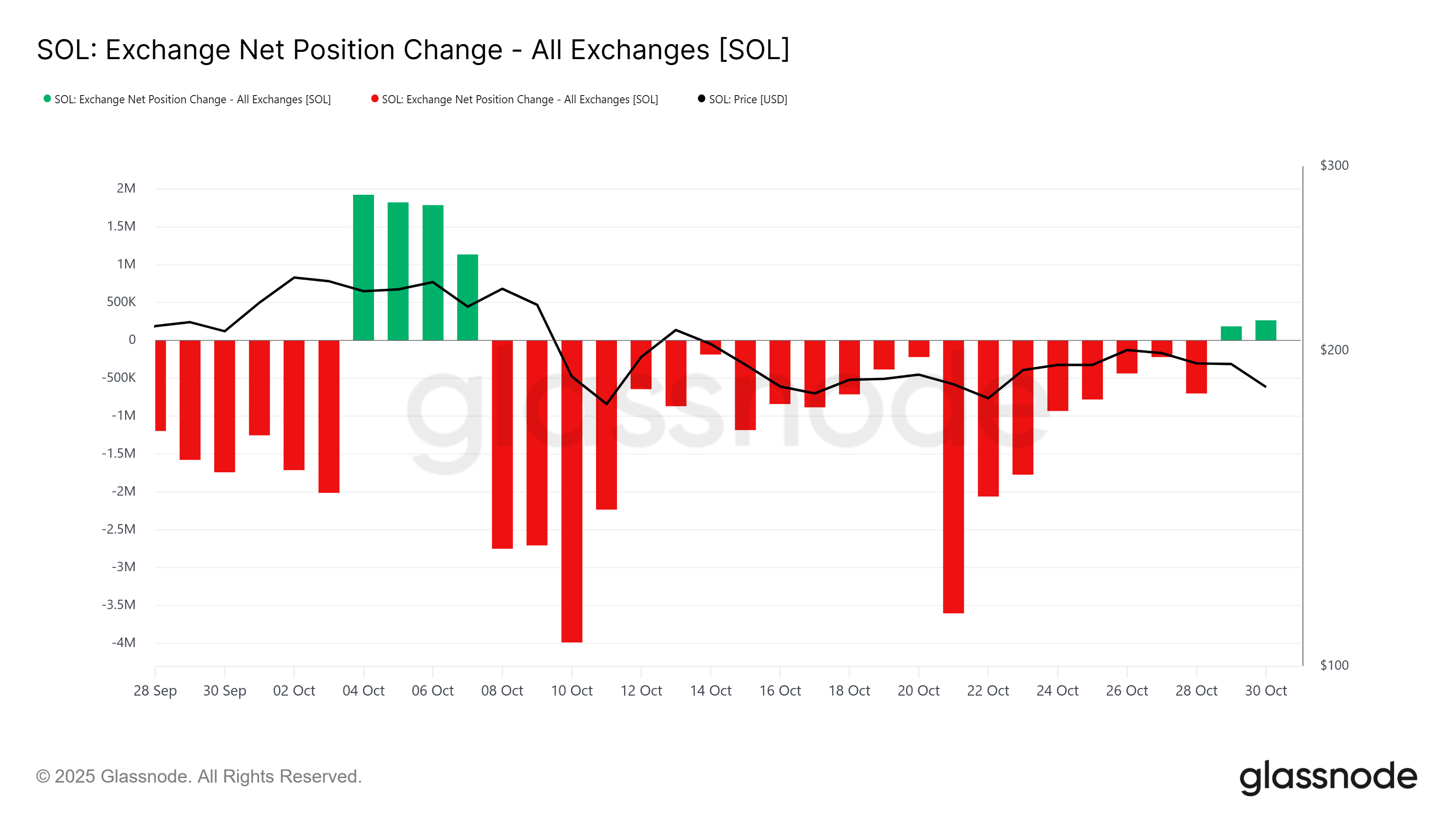

The exchange net position change highlights the first signs of selling activity for Solana in three weeks. The failed attempt to breach the $200 resistance level has triggered some profit-taking among investors, signaling a potential short-term bearish shift.

This selling activity suggests that investor confidence is weakening after a strong run earlier in the month. If selling continues to increase, Solana could face difficulty maintaining its current levels.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

Solana Exchange Net Position Change. Source:

Glassnode

Solana Exchange Net Position Change. Source:

Glassnode

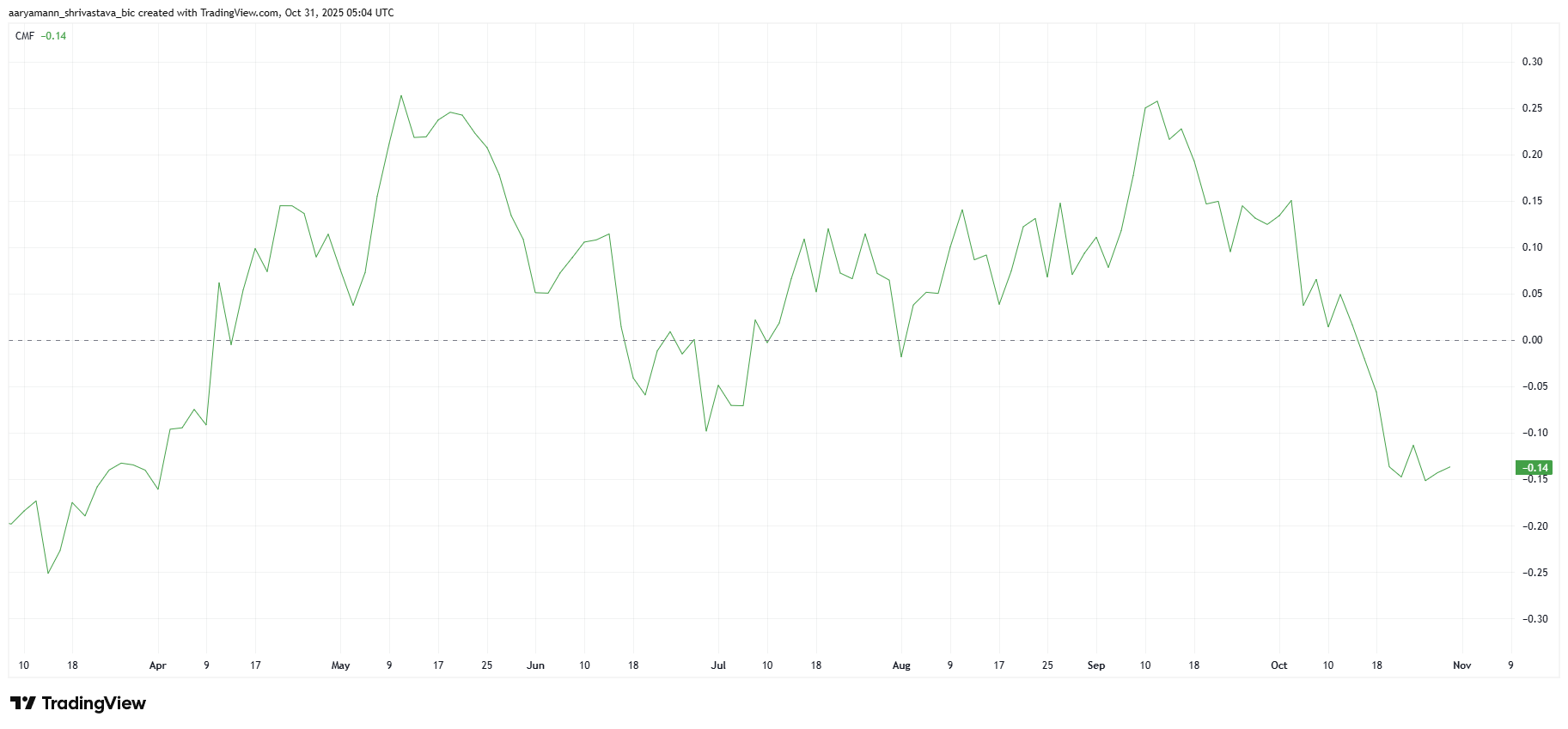

The Chaikin Money Flow (CMF) indicator supports the recent bearish sentiment. Currently at a six-month low, CMF reflects heavy outflows dominating the market for SOL. This indicates that liquidity is leaving the asset, limiting its potential to rebound quickly and adding pressure to its existing resistance levels.

The decline in CMF is particularly concerning, as Solana has been struggling to sustain momentum following multiple failed breakout attempts. Persistent outflows could further weaken price strength and delay recovery, especially if broader market conditions remain uncertain or risk appetite continues to decline.

Solana CMF. Source:

TradingView

Solana CMF. Source:

TradingView

SOL Price Could Lose Crucial Support

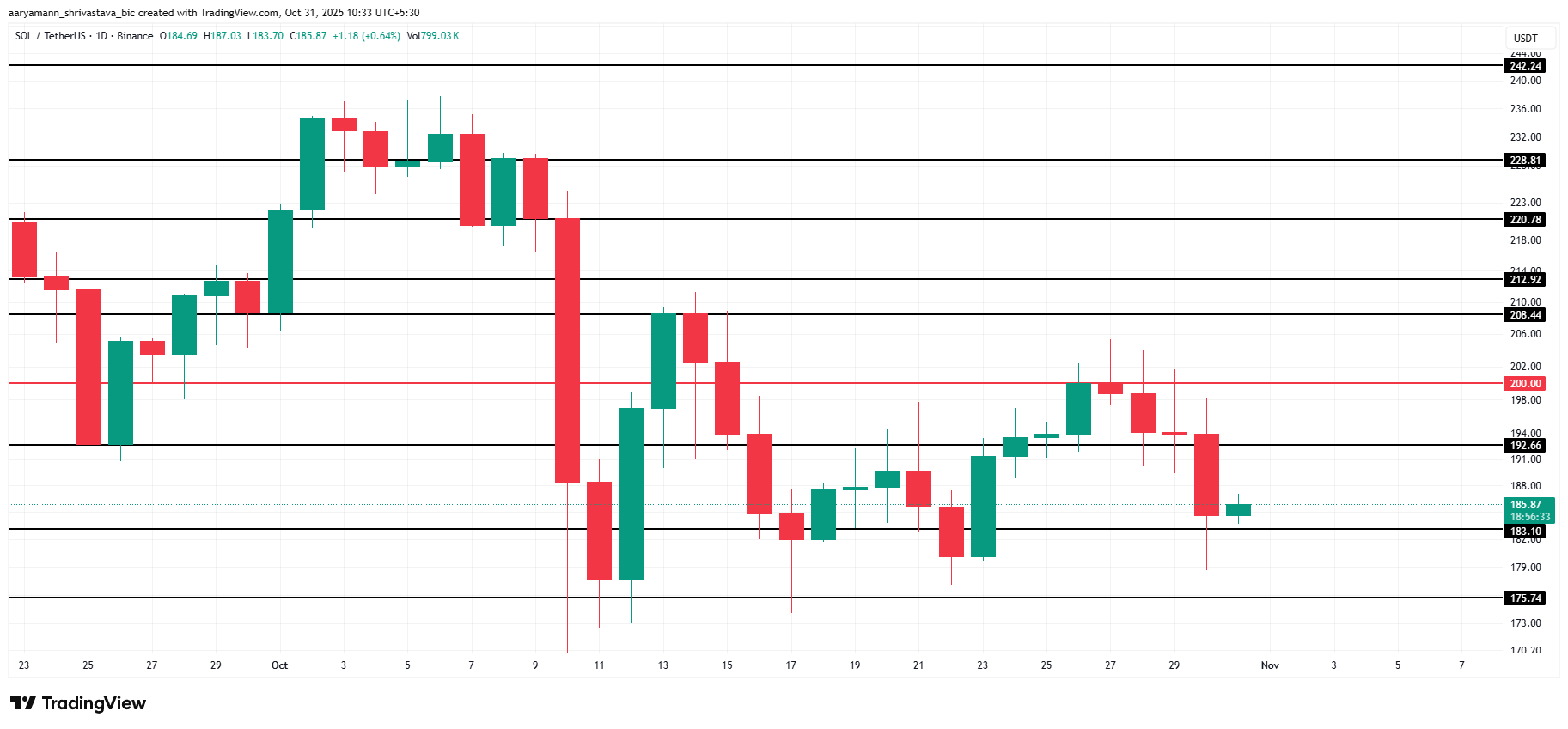

Solana’s price sits at $185, holding slightly above the $183 support level after failing to breach $200. This failure has placed SOL in a vulnerable position, with investors now watching closely for a potential drop below its current range.

If bearish conditions persist, Solana could either consolidate above $175 or decline further. Losing support at $183 could push the price down toward $175, with extended weakness possibly sending SOL to $170 in the coming sessions.

Solana Price Analysis. Source:

TradingView

Solana Price Analysis. Source:

TradingView

However, if Solana rebounds from $183, the altcoin could attempt another breakout toward $200. A successful breach would strengthen bullish momentum and push prices past $208, effectively invalidating the current bearish outlook and signaling a return of investor confidence.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Mars Morning News | Federal Reserve Hawks Speak Out, Asset Price Crash Risk May Become New Obstacle to Rate Cuts

JPMorgan warns that if Strategy is removed from MSCI, it could trigger billions of dollars in outflows. The adjustment in the crypto market is mainly driven by retail investors selling ETFs. Federal Reserve officials remain cautious about rate cuts. The President of Argentina has been accused of being involved in a cryptocurrency scam. U.S. stocks and the cryptocurrency market have both declined simultaneously. Summary generated by Mars AI. This summary is produced by the Mars AI model and its accuracy and completeness are still being iteratively improved.

Citibank and SWIFT complete pilot program for fiat-to-crypto PvP settlement.

Pantera Partner: In the Era of Privacy Revival, These Technologies Are Changing the Game

A new reality is taking shape: privacy protection is the key to driving blockchain toward mainstream adoption, and the demand for privacy is accelerating at cultural, institutional, and technological levels.

Exclusive Interview with Bitget CMO Ignacio: Good Code Eliminates Friction, Good Branding Eliminates Doubt

A software engineer's brand philosophy.