The world's first company with a market capitalization exceeding 5 trillion: Nvidia's brief honeymoon with cryptocurrencies

Author: Aki Wu Shuo Blockchain

Original Title: The World's First Company to Surpass a $5 Trillion Market Cap: A Look Back at Nvidia's Brief Honeymoon with Cryptocurrency

At the end of October 2025, Nvidia's stock price hit a new all-time high, with its market capitalization soaring past the $5 trillion mark, making it the first company in the world to cross this threshold. Since the emergence of ChatGPT at the end of 2022, Nvidia's stock price has increased more than 12-fold. The AI revolution has not only driven the S&P 500 to new highs but has also sparked discussions about a tech valuation bubble. Today, Nvidia's market cap has even surpassed the total size of the entire cryptocurrency market, and in terms of global GDP rankings, Nvidia's market value is second only to the United States and China. Remarkably, this superstar of the AI era once had a "honeymoon period" in the cryptocurrency sector. This article will revisit the ups and downs of Nvidia's involvement in the crypto mining industry and explore why it chose to pivot towards its core AI business.

Crypto Bull Market Frenzy: Gaming GPUs Turn into "Money Printing Machines"

Looking back at Nvidia's development history is to witness a legendary evolution of technological narratives. Founded in 1993, Nvidia started by inventing the GPU (Graphics Processing Unit), riding the wave of the late 1990s PC gaming boom. The GeForce series of graphics cards became a huge success, quickly establishing Nvidia as the dominant force in the GPU market. However, as the gaming market gradually became saturated and growth slowed, Nvidia also faced the challenge of unsold inventory. Fortunately, opportunities favor the prepared—one major turning point was the cryptocurrency boom.

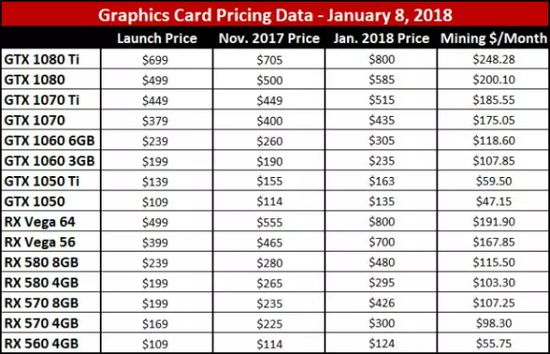

In 2017, the prices of cryptocurrencies such as bitcoin and ethereum soared, sparking a "mining" craze. Because GPUs are well-suited for parallel computing required in mining, miners worldwide scrambled for graphics cards. GPUs became money-printing machines, demand far outstripped supply, and prices skyrocketed. Nvidia thus became one of the biggest winners behind this crypto bull market, reaping huge profits from card sales.

Starting in the second half of 2020, after two years of a crypto winter, the market made a comeback. Bitcoin's price surged from less than $15,000 mid-year to over $60,000 at its peak in early 2021. Ethereum rose from a few hundred dollars to over $2,000. This new wave of soaring coin prices reignited the GPU mining frenzy. Miners snapped up the new generation GeForce RTX 30 series cards, making high-end cards originally intended for gamers extremely scarce, and the market once again fell into a state of "overwhelming demand." When Nvidia launched the RTX 30 series, gamers were delighted by its high performance and value, but as ethereum mining profits soared, the actual market price of these cards skyrocketed. The RTX 3060, with a suggested price of RMB 2,499, was selling for RMB 5,499, and the flagship RTX 3090 was even priced close to RMB 20,000.

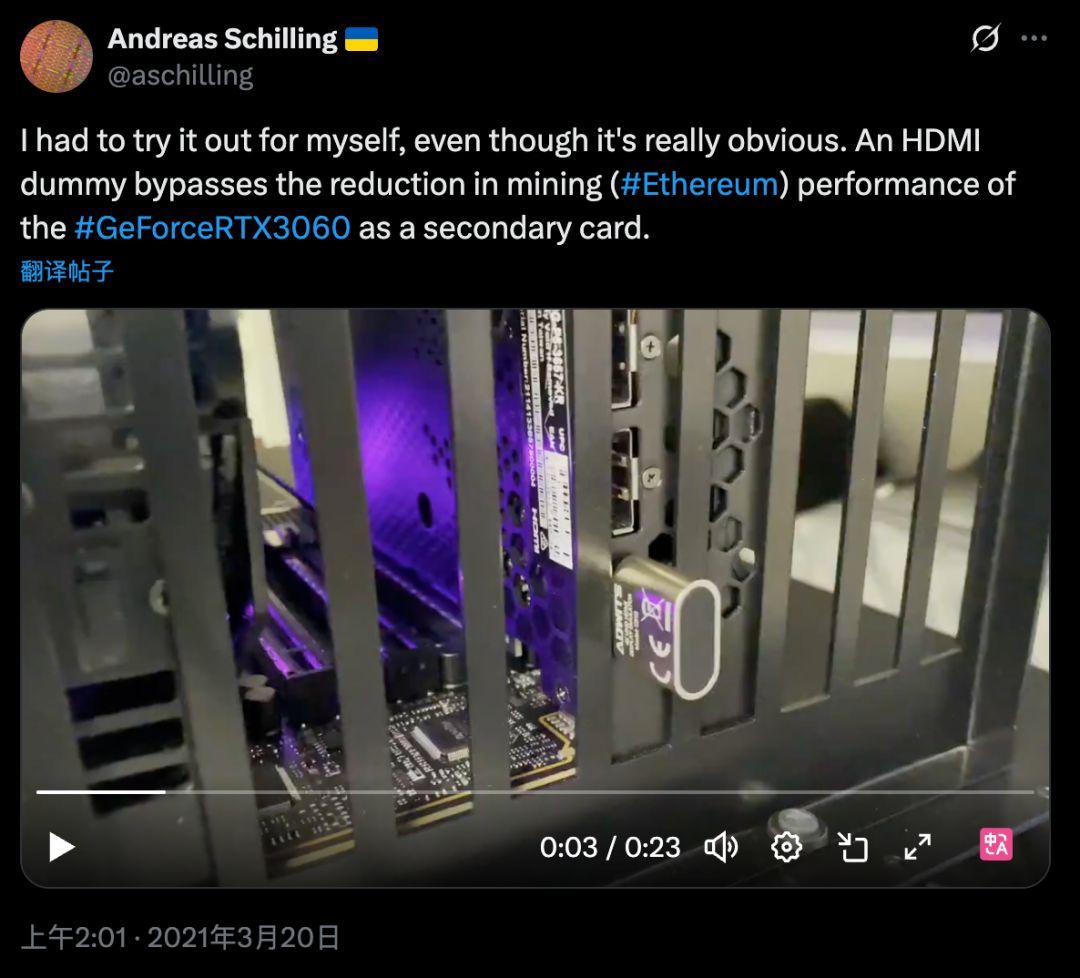

However, the persistent shortage of graphics cards brought the conflict between gamers and miners to the forefront. Nvidia chose a "dual-track" response: on one hand, it reduced the ethereum hash rate for gamer-targeted GeForce cards (starting with the RTX 3060), but this was later found to be a mere stopgap. Miners discovered that by plugging in a "dummy HDMI" to the RTX 3060, the card would think other GPUs were also running as display adapters, thus bypassing multi-card hash rate restrictions and enabling full-speed mining.

On the other hand, Nvidia launched the Cryptocurrency Mining Processor (CMP) series specifically for miners, attempting to "divert" demand. The official blog clearly stated: "GeForce is for gamers, CMP is for professional mining." CMP cards removed display outputs, featured open brackets for better airflow in dense mining rigs, and reduced peak voltage/frequency for energy efficiency. However, because CMP cards lacked display outputs and had shorter warranties, it was harder for miners to exit. In contrast, GeForce cards could be used for mining and then resold to gamers, offering better residual value and liquidity. As a result, the CMP project made a lot of noise but had little impact and eventually faded from view.

According to Nvidia's financial reports, in the first fiscal quarter of 2021, graphics cards used for "mining" accounted for a quarter of shipments, and sales of crypto-specific chips (CMP series) reached $155 million that quarter. Boosted by the crypto boom, Nvidia's revenue for 2021 soared to $26.9 billion, up 61% from the previous year, and its market cap once broke $800 billion.

However, this boom did not last. On May 21, 2021, China's State Council Financial Stability and Development Committee announced a crackdown on bitcoin mining and trading. Subsequently, Xinjiang, Qinghai, Sichuan, and other regions shut down mining farms, and mining operations quickly "hit the brakes." In the same month, bitcoin's hash rate and price both came under pressure, and miners were forced to relocate or liquidate equipment. By September 24, the central bank and multiple departments issued a joint notice classifying all virtual currency-related transactions as illegal financial activities and called for a nationwide "orderly exit from mining," further tightening policy loopholes.

For mining machine operators in Huaqiangbei, such boom-and-bust cycles are nothing new. Those who experienced the "mining disaster" crash of early 2018 still remember it well—some exited the market, but a few persevered through the winter, using unsold machines for self-mining and waiting for the next cycle. As it turned out, the 2020–2021 bull market once again rewarded those who stayed the course.

In September 2022, a milestone event occurred in the crypto industry: the ethereum blockchain completed its "Merge" upgrade, transitioning from Proof of Work (PoW) to Proof of Stake (PoS), eliminating the need for massive GPU mining. This marked the end of the years-long GPU mining era. Without the special demand from crypto miners, the global GPU market quickly cooled, directly impacting Nvidia's performance. In Q3 2022, Nvidia's revenue fell 17% year-on-year to $5.93 billion, with net profit dropping 72% to just $680 million. Nvidia's stock price once fell to around $165 in 2022, nearly halving from its peak, and the former crypto dividend instantly became a performance burden.

Drawing the Line: Nvidia's Breakup with the Mining Industry

Faced with the frenzy of the mining community and complaints from gamers, as well as the problems caused by cyclical profits, Nvidia gradually realized it needed to strike a balance in the crypto mining wave and eventually "draw a clear line." With the bubble risks brought by surging coin prices, the company also suffered in terms of financial compliance. The U.S. Securities and Exchange Commission (SEC) later found that Nvidia failed to adequately disclose the contribution of crypto mining to gaming GPU revenue growth for two consecutive quarters in fiscal 2018, which was deemed improper disclosure. In May 2022, Nvidia agreed to settle with the SEC and paid a $5.5 million fine. This incident prompted Nvidia to reassess its delicate relationship with the crypto industry. While the crypto mining boom brought considerable profits, its volatility and regulatory risks could also harm the company's reputation and performance.

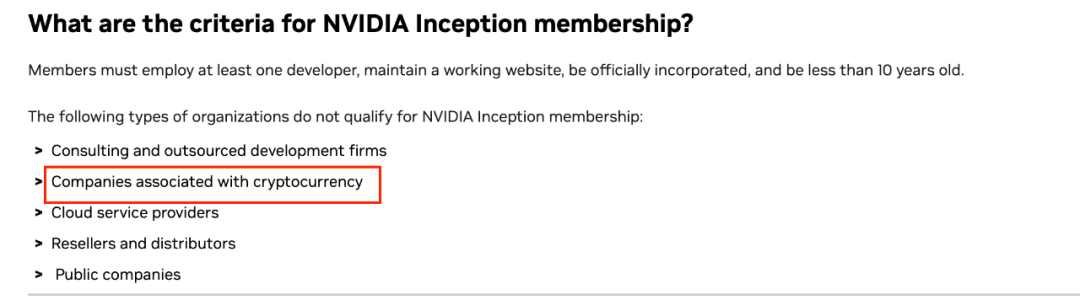

After ethereum switched to PoS in 2022, GPU mining demand plummeted, and Nvidia's gaming GPU business quickly returned to normal supply and demand. Jensen Huang has repeatedly emphasized that the company's future growth will mainly come from artificial intelligence, data centers, autonomous driving, and other fields, rather than speculative businesses like cryptocurrency. After experiencing the highs and lows of the "mining card craze," Nvidia decisively distanced itself from this highly volatile industry, investing more resources into the broader and more socially valuable AI computing landscape. On Nvidia's latest Inception program website for AI startups, it is clearly stated that "ineligible organization types" include "companies related to cryptocurrency," showing Nvidia's clear intent to draw a line with its former crypto partners.

So, after fully embracing the AI industry, does Nvidia's chip business still intersect with the crypto sector? On the surface, since ethereum left the "mining era," the connection between GPUs and traditional crypto mining has greatly diminished. Mainstream coins like bitcoin have long used specialized ASIC miners, and GPUs are no longer the "hot commodity" they once were among crypto miners. However, the two fields are not entirely disconnected, and new points of convergence are emerging in different forms.

Some companies that once focused on crypto mining are now shifting their business to AI computing services, becoming new Nvidia customers. Moreover, traditional bitcoin mining companies are exploring the use of surplus electricity and facilities for AI computing tasks. Some large mining firms have recently replaced some mining-specific chips with GPUs for training AI models. In their view, compared to the volatility of crypto mining, AI training offers a more stable and reliable source of income.

The Biggest Profiteer in the AI Gold Rush—Nvidia, the "Shovel Seller"

In November 2022, OpenAI's ChatGPT burst onto the scene, causing a global sensation for AI large models. For Nvidia, this was undoubtedly another "once-in-a-century" opportunity. The world suddenly realized that powering these "compute-hungry" AI monsters was impossible without Nvidia's GPU hardware.

After ChatGPT went viral, major tech companies and startups rushed into the "large model" race, and the demand for computing power to train AI models exploded. Nvidia keenly recognized the essence: no matter how technology evolves, computing power is always the fundamental currency of the digital world.

Currently, Nvidia holds over 90% of the large model training chip market. The A100, H100, and the new Blackwell/H200 GPUs have become industry standards for AI accelerated computing. With demand far outstripping supply, Nvidia enjoys extraordinary pricing power and profit margins in high-end AI chips. According to Goldman Sachs, from 2025 to 2027, the capital expenditures of just five major cloud providers—Amazon, Meta, Google, Microsoft, and Oracle—are expected to approach $1.4 trillion, nearly triple the previous three years. These massive investments underpin Nvidia's sky-high market value.

But the AI field once experienced a "cost reduction and efficiency improvement" shockwave—the explosive popularity of the open-source large model DeepSeek. The DeepSeek project claimed to have trained the DeepSeek V3 model, which rivals GPT-4 in performance, at an extremely low cost of about $5.576 million, and later launched the ultra-low inference cost R1 model.

This caused a stir in the industry, with many predicting Nvidia's decline, believing that such low-cost AI models would allow small and medium-sized enterprises to deploy large models with fewer GPUs, potentially impacting demand for Nvidia's high-end GPUs. "Will the demand for AI computing power be replaced by an efficiency revolution?" became a hot topic. As a result, Nvidia's stock price once plummeted, closing down about 17% and losing about $589 billion in market value in a single day (one of the largest single-day market cap losses in U.S. stock history).

However, just a few months later, it became clear that these concerns were shortsighted. DeepSeek did not reduce demand for computing power; instead, it triggered a new wave of demand. Its technical approach essentially achieved "computing power democratization"—through algorithmic innovation and model distillation, it greatly lowered the hardware threshold for large models, enabling more organizations and enterprises to afford AI applications. On the surface, it seemed that improved model efficiency meant "less computing power was needed," but in reality, the DeepSeek phenomenon greatly popularized AI applications, causing demand for computing power to grow exponentially. Numerous companies rushed to adopt DeepSeek, sparking a wave of AI applications, with inference computing quickly becoming the new main driver of computing power consumption. This perfectly illustrates the famous "Jevons Paradox"—technological efficiency improvements actually accelerate resource consumption. DeepSeek lowered the AI threshold and boosted applications, resulting in even greater demand for computing resources.

In fact, every time a new AI model is born, it often means a new wave of GPU orders. The more AI innovation there is, the stronger Nvidia becomes, as once again proven in the DeepSeek episode. Nvidia's February 2025 financial report showed data center business far exceeding expectations. On a deeper level, DeepSeek's success is not a threat to Nvidia; rather, it demonstrates that "cost reduction and efficiency improvement" will lead to larger-scale application expansion, thereby driving up total demand for computing power. This time, DeepSeek has become new fuel for Nvidia's computing empire.

As AI pioneer Andrew Ng said: "AI is the new electricity." In the era where AI is electricity, computing power suppliers like Nvidia undoubtedly play the role of the power company. Through massive data centers and GPU clusters, they continuously supply "energy" to various industries, driving intelligent transformation. This is the core logic behind Nvidia's market cap soaring from $1 trillion to $5 trillion in just two years—the global demand for AI computing power has made a qualitative leap, with tech giants worldwide investing in a military-arms-race-like procurement of computing power.

After reaching a $5 trillion market cap, Nvidia's influence and scale have even surpassed the economic impact of many national governments. Nvidia is no longer just a "graphics card" manufacturer that makes games run smoother; it has transformed into the fuel of the AI era, becoming the recognized "shovel seller" in this gold rush. As the company grows, stories of Nvidia employees getting rich continue to circulate in the industry, with many employees' stock holdings even surpassing their annual salaries. Nvidia itself has repeatedly "told" new tech stories, achieving one leap after another: gaming GPUs opened the first door, the mining boom gave it a second growth spurt, and AI has now propelled Nvidia to its true peak.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Whale Moves Recap: Insider Faces Weekly Loss of $40 Million, Copy Traders Suffer Heavy Losses

A hellish market; even insider whales can't withstand it.

ZKsync, highly praised by Vitalik, may truly be undervalued

For a single GPU, ZKsync Airbender not only has the fastest verification speed but also the lowest cost.

I traded perpetual contracts for a month: from dreaming of getting rich overnight to waking up to reality.

Being with people who understand trading can help you stay clear-headed.

The Deep Transformation of TBC-UTXO Architecture: The Underlying Code of the Global Machine Economy Network

UTXO is no longer just a "proof of transfer," but has become a "universal language" for value exchange between machines, serving as a quantum bridge connecting the physical and digital worlds.