Wall Street executives warn that U.S. stocks may experience a correction of more than 10% in the future

ChainCatcher news, according to Golden Ten Data, several CEOs of major Wall Street investment banks have stated that investors should be prepared for a possible market correction of more than 10% in the next 12 to 24 months, emphasizing that such pullbacks are not necessarily a bad thing. Capital Group President and CEO Mike Gitlin pointed out that corporate earnings remain strong, but "valuation is the current challenge." Morgan Stanley CEO Ted Pick and Goldman Sachs CEO Solomon expressed similar views, believing that a significant correction may occur in the future and that such declines are common phenomena in market cycles. Solomon mentioned that valuations of technology stocks are already quite full, but the overall market is not.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

49,999 ETH were transferred from an exchange to an unknown wallet, valued at approximately $175,445,747.

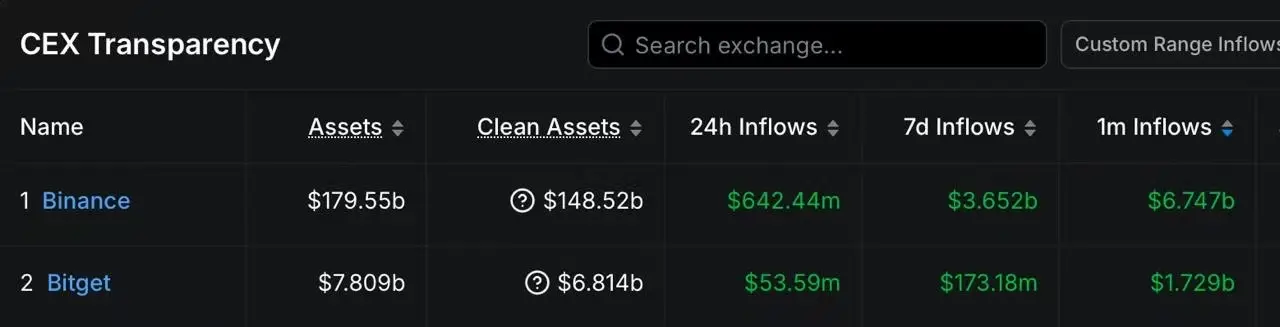

Data: In the past 30 days, the main capital inflows have been to a certain exchange and leading CEXs such as Bitget.