Bitget Daily Digest (Nov 10)|Trump Proposes $2,000 Tariff “Dividend” for Every American, Market Sees Potential Boost for Bitcoin; CBOE to Launch Perpetual Bitcoin & Ethereum Futures Contracts

Today’s Outlook

- The Bank of England will launch a stablecoin regulatory consultation on November 10, 2025, aiming to establish a comprehensive regulatory framework by the end of 2026 to address financial stability risks posed by the proliferation of digital currencies.

- The Chicago Board Options Exchange (CBOE) plans to launch perpetual Bitcoin and Ethereum futures contracts starting November 10, 2025, offering US traders long-term digital asset exposure and risk management tools.

- Jack Dorsey’s payment company Square will officially roll out its Bitcoin payment feature on November 10, 2025.

Macro & Hot Topics

- The global cryptocurrency market cap declined, with continued institutional outflows. Over the past 24 hours, the total global crypto market cap fell to approximately $3.39 trillion, a decrease of 1.12%. Bitcoin ETFs saw net outflows of $558 million, the largest daily outflow since October 10; Ethereum ETF redemptions totaled $46.6 million. The Cleveland Fed’s inflation forecast remains at 2.97%, prompting clear risk-off sentiment in the market.

- Trump proposed a $2,000 tariff “dividend” per person, which Besant said may be implemented via tax cuts and other means. The market anticipates this could bolster Bitcoin prices. In October, US companies laid off over 153,000 workers, while the Consumer Confidence Index fell to 50.3, the lowest for this period in more than 20 years.

- About 4.64 million dormant Bitcoins moved this year—valued at over $500 billion.

- Arthur Hayes: The US government’s renewed money printing and welfare distribution may drive up Bitcoin and ZEC.

Market Trends

- BTC is around $105,000, ETH around $3,579, both declining in the short term. Liquidations totaled $349 million in the past 24 hours, mainly from short positions.

- US stocks closed mixed: Dow Jones up 0.16%, S&P 500 up 0.13%, Nasdaq down 0.21%.

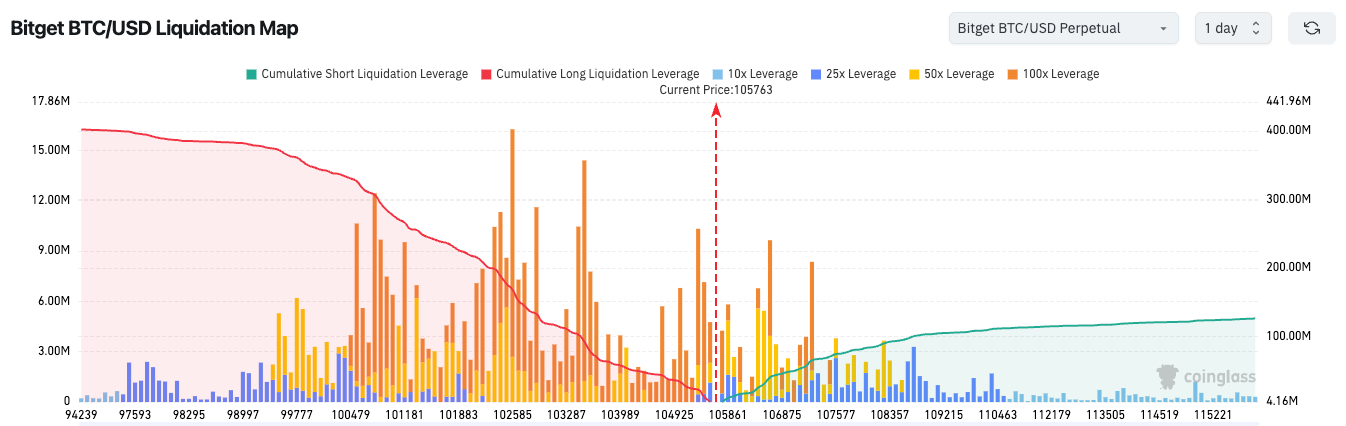

3.Bitget BTC/USDT latest price: $105,718. Heavy liquidation zones are concentrated in long positions around this range for both 50x and 100x leverage; a break below this level could trigger sharp short-term downside.

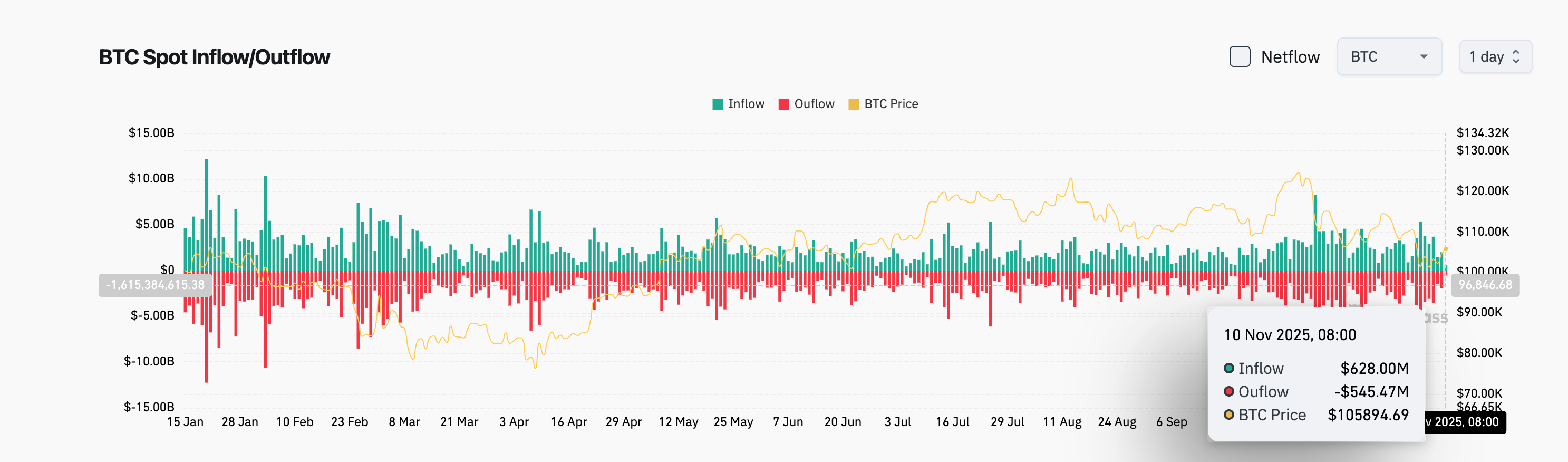

4.In the past 24 hours, BTC spot inflows totaled $628 million, outflows $545 million, net inflow of $83 million.

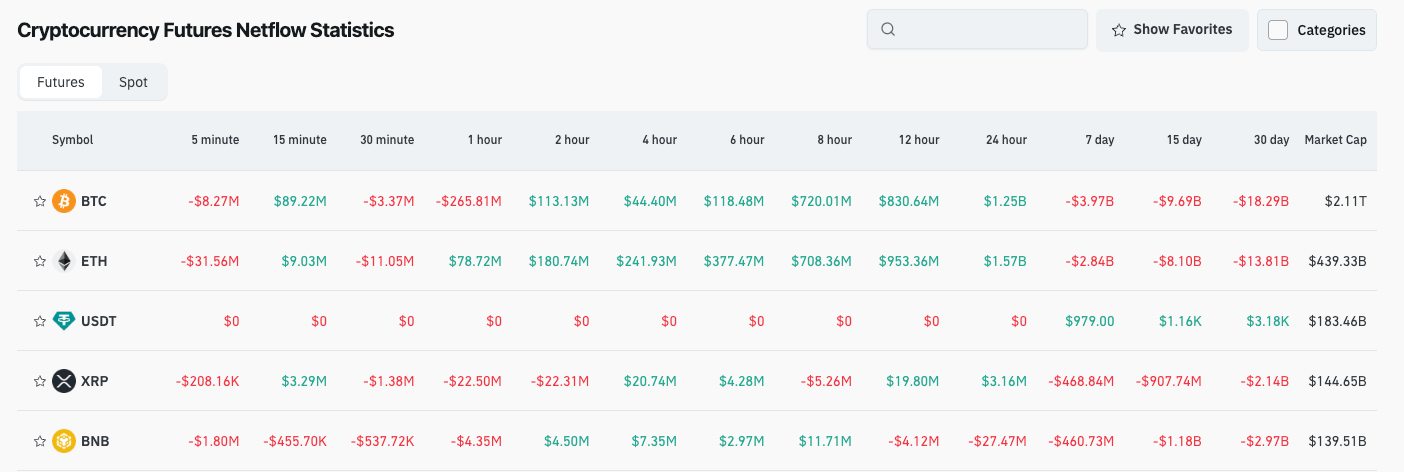

5.Over the past 24 hours, net outflows from contract trading in BTC, ETH, USDT, XRP, BNB, etc., could signal trading opportunities.

News Updates

- Acting CFTC Chairman confirms plans to support leveraged spot crypto trading on regulated exchanges.

- Ledger is considering an IPO or funding round in New York to meet surging global hardware wallet demand.

- Survey: 43% of hedge funds plan to integrate DeFi into their business processes.

- Spanish crypto influencer CryptoSpain arrested for alleged $300 million fraud and money laundering.

Project Developments

- CBOE to launch perpetual Bitcoin and Ethereum futures contracts on November 10, enhancing long-term derivatives tools in digital asset markets.

- Faraday Future has filed a practical patent for a blockchain-based car sharing system, accelerating car/blockchain sector integration.

- Linea will unlock tokens worth $34.4 million on November 10, accounting for 16.44% of its circulating supply.

- Aptos will unlock tokens worth $33.4 million on November 11, accounting for 0.49% of total supply.

- Avalanche to unlock tokens worth $28.2 million on November 13—market watching for potential selling pressure.

- Square to launch Bitcoin payment function on November 10, supporting digital currency use in mainstream payments.

- Yield Basis will migrate to an improved pool contract to correct fee distribution discrepancies.

- Circle Internet to release its financial report this week, which may significantly impact the stablecoin ecosystem and investor sentiment.

- Analysis: Five spot XRP ETFs are now listed on the DTCC website and are expected to launch officially this month.

- 70% of leading Bitcoin mining firms report that their AI or high-performance computing projects have already generated revenue.

Disclaimer: This report is AI-generated and manually reviewed for information accuracy only. It does not constitute any investment advice.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP profit-taking signals ‘weakness’: Will it delay recovery to $3?

Zcash may see ‘violent end’ as ZEC price rallies 1500% in just two months

Bitcoin, ETH ETFs see $1.7B outflow but whale buying softens the price impact

Bitcoin’s next move could shock traders if BTC price breaks above $112K