Solarpunk is rising in Africa—Is decentralization the future of global infrastructure?

The model for 21st-century infrastructure development is not government-led, not centralized, and does not require large-scale projects spanning 30 years.

The template for 21st-century infrastructure is not government-led, not centralized, and does not require 30-year mega-projects.

Written by: Skander Garroum

Translated by: Chopper, Foresight News

The "Waiting for the Grid" Scam

Here’s a statistic that might make you angry: 600 million people in Sub-Saharan Africa lack reliable electricity. This isn’t due to technical issues, nor because they don’t need it, but because the unit economics of extending the grid to rural areas are simply too poor.

The traditional development model goes roughly like this: Step one, build a centralized power plant; step two, lay hundreds of kilometers of transmission lines; step three, supply electricity to millions of households; step four, collect electricity fees; step five, maintain the entire system permanently.

This model worked well during the electrification of the United States in the 1930s. At that time, labor was cheap, materials were subsidized, and the government could forcibly acquire land for right-of-way. But if you try to supply electricity to a farmer earning just $600 a year, living four hours from the nearest paved road, this method is much less effective.

Let’s look at the data:

- Cost to connect a rural household to the grid: $266 to $2,000

- Average monthly electricity expenditure for rural households: about $10-20

- Investment payback period: 13-200 months (assuming fees are collected smoothly)

- Electricity fee collection rate in rural areas: complicated (difficult to guarantee in practice)

Therefore, utility companies do what any rational actor would do: they stop building where the economics disappear, which happens to be where the population is concentrated.

This has been the unspoken secret in developing regions for 50 years. “We are advancing grid extension projects!” actually means: grid extension is economically impossible, but we have to say this to keep receiving donor funding.

Meanwhile, 1.5 billion people spend up to 10% of their income on polluting fuels like kerosene and diesel. They walk for hours to charge their phones, can’t refrigerate medicine or food, children can’t study after dark, and women inhale cooking smoke daily equivalent to the harm of two packs of cigarettes.

The Miracle of Solar Hardware

While everyone was debating feed-in tariffs and large-scale solar plants, the cost of solar underwent a dramatic transformation.

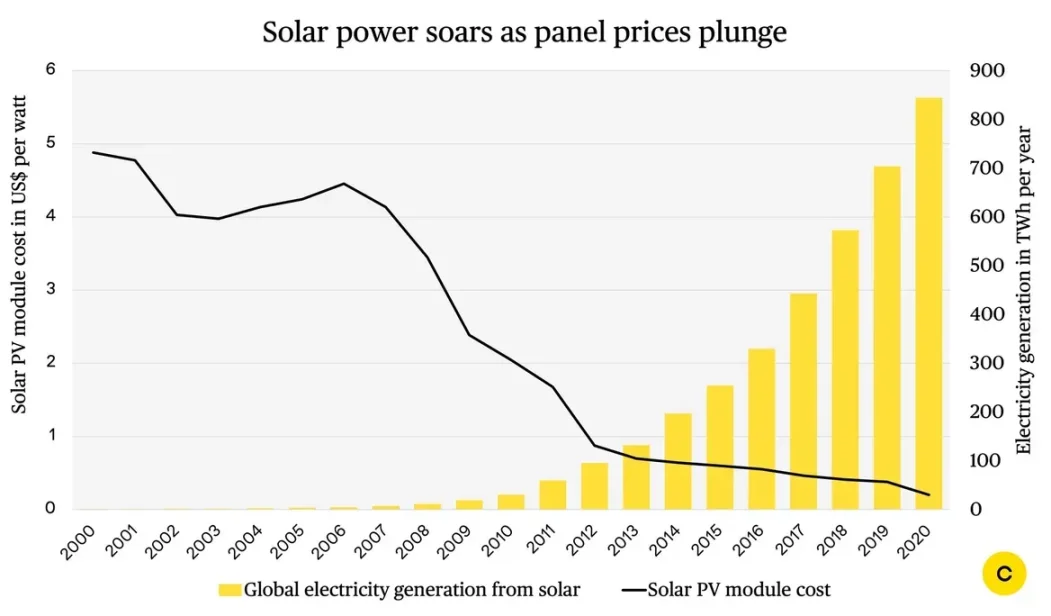

Solar panel price changes:

- 1980: $40/W (watt)

- 2000: $5/W

- 2010: $1.5/W

- 2020: $0.3/W

- 2025: $0.2/W

Prices have dropped 99.5% in 45 years, a Moore’s Law for solar. Even more astonishing is the price change for complete home solar systems.

Evolution of home solar systems:

- 2008: $5,000 (affordable only for wealthy urban Kenyans)

- 2015: $800 (available to middle-class farmers)

- 2025: $120-1,200 (truly benefits smallholder farmers)

Battery costs have also dropped by 90%, inverters have become cheap, and LED bulbs are much more efficient. Chinese manufacturing has advanced rapidly, and African logistics have significantly improved.

These trends converged around 2018-2020, and suddenly, the economics of off-grid solar flipped completely—the hardware problem was solved.

But there remained a huge, seemingly insurmountable barrier: for someone earning $2 a day, a $120 upfront payment is still too expensive.

And this is where the story gets interesting.

The Miracle of Zero Transaction Costs

A brief history: In 2007, Kenyan telecom Safaricom launched the mobile payment platform M-PESA, allowing users to transfer money via SMS.

At the time, everyone thought it would fail: who would transfer money by phone?

By 2025, 70% of Kenyans use mobile payments, not as a supplement to banks, but as a replacement. Kenya ranks first globally in per capita mobile payment transactions.

Its success came from solving a real pain point: Kenyans were already transferring money through informal networks, and M-PESA made it cheaper and safer.

This is crucial: M-PESA created a near-zero transaction cost payment channel, making small payments economically viable.

This completely broke the financing model’s shackles and gave rise to the game-changing “Pay-As-You-Go” (PAYG) model.

From Product to Service: The Breakthrough of the PAYG Model

This is the key to the entire transformation, making all other possibilities a reality. The model logic is as follows:

- Companies (like Sun King, SunCulture) install solar systems for households;

- Users pay about $100 upfront;

- Then, over 24-30 months, pay $40-65 per month;

- The system has a built-in GSM chip for remote connectivity;

- No payment → remote shutdown;

- Continued payment → continued power supply;

- After 30 months → users fully own the system and enjoy free electricity for life.

The magic is: users aren’t buying a $1,200 solar system, but are replacing their weekly $3-5 kerosene expenditure with a $0.21 per day solar subscription (just $1.5 per week, half the cost of kerosene). It’s not only cheaper, but provides brighter lighting, phone charging, radio, and no risk of respiratory disease.

What about default rates? Over 90% of users renew on time.

The reason is simple: this asset is truly useful and delivers value every day. Otherwise, they’d have to return to the era of kerosene lamps in the dark—nobody wants that.

This is the “innovation” everyone overlooks: hardware price drops make the product cheap, the PAYG model makes it accessible, and mobile payments make PAYG economically viable.

Next, let’s look at two cases to see the chemistry when these three combine.

Case 1: Sun King

In 2023, Sun King sold 23 million solar products, serving 40 million customers in 42 countries, and plans to reach 50 million sales by 2026. Its products range from handheld solar lamps to multi-room home solar kits and clean LPG stoves.

Products:

- Handheld solar lamps ($50-120)

- Multi-room home theater systems ($200-500)

- Clean LPG stoves (acquired PayGo Energy)

- Phone charging, backup batteries, lighting

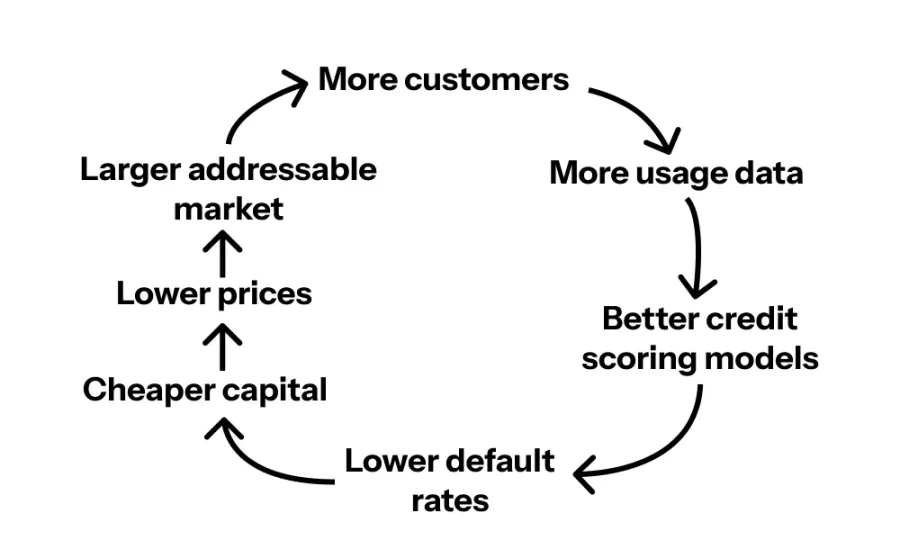

This is a compounding moat—each advance makes the next easier.

Few outside Africa know: Sun King holds over 50% market share in its segment. It’s no longer a startup, but a dominant infrastructure provider.

This is equivalent to a startup holding 50% of the US home solar market, but its influence and total addressable market (TAM) are even greater, because there’s no existing grid as a competitor.

Case 2: SunCulture, $14,000 per Acre Agricultural Transformation

While Sun King focuses on lighting and home electrification, SunCulture targets agricultural productivity, with even more impressive data.

Core issues:

- 95% of farmland in Sub-Saharan Africa relies on rainfall;

- Farmers spend $2 billion a year on diesel water pumps.

SunCulture’s solution:

- Solar irrigation pumps;

- IoT remote monitoring;

- Pay-as-you-go installment payments ($100 upfront, $40-65 per month);

- Free installation, 10-year warranty;

- Includes drip irrigation system.

Actual results:

- Crop yields increased 3-5 times;

- Farmer income rose from $600 to $14,000 per acre;

- After paying off, marginal cost is zero (no diesel needed);

- Year-round irrigation, no seasonal limits;

- Saves 17 hours of manual water hauling per week.

Current scale:

- Over 47,000 systems deployed;

- Serving over 40,000 farmers;

- Over 50% share in the smallholder market;

- Covering 6 countries (Kenya, Uganda, Ethiopia, Côte d'Ivoire, Zambia, Togo).

This is not a charity project, but a rocket growing at high speed.

Now, here comes the even more exciting part:

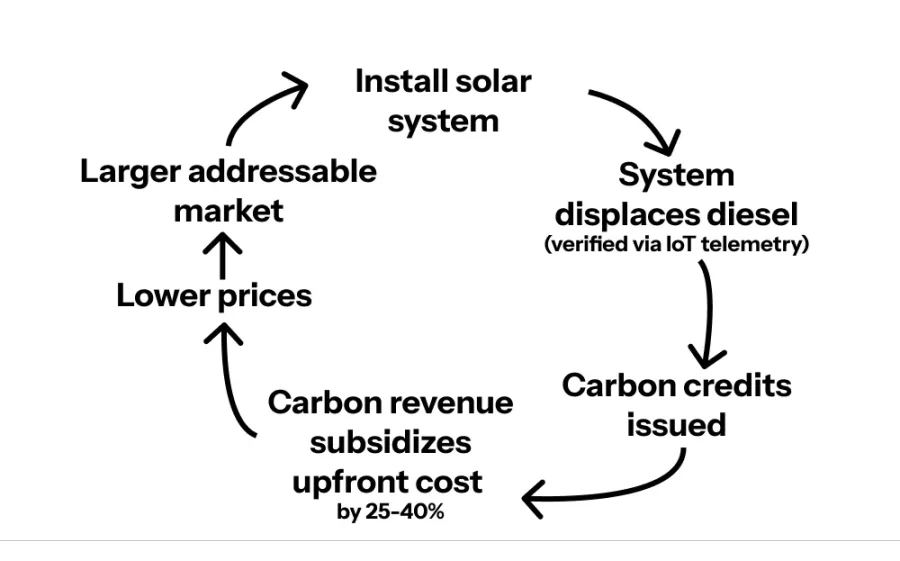

Remember SunCulture’s solar pumps replaced diesel pumps? Each pump reduces 2.9 tons of CO2 emissions per year.

47,000 pumps × 2.9 tons/pump = 136,000 tons of CO2 reduced per year, over 3 million tons in 7 years.

The key is: someone is willing to pay for these emission reductions.

Let Others Pay for Your Infrastructure

Now it’s time for carbon credits. SunCulture is the first African solar irrigation company registered with Verra (the world’s leading carbon standard organization) for carbon credits. Each ton of CO2 reduced can be sold for $15-30 (high-quality agricultural carbon credits, not unreliable forest offsets).

Let’s review this flywheel again, this time with the “turbo boost” of carbon credits:

- Install solar systems;

- Systems replace diesel (verified by IoT telemetry);

- Emission reductions converted to carbon credits;

- Sell credits to companies needing offsets;

- Carbon revenue subsidizes 25-40% of upfront costs;

- Lower costs → target market expands 4-5 times;

- Deploy more systems → generate more carbon credits;

- Repeat cycle.

Even better: some are willing to pay for carbon credits in advance.

British International Investment and SunCulture pioneered “carbon-supported equipment financing”: providing $6.6 million in funding, taking on carbon price volatility risk, giving SunCulture upfront capital, and enabling farmers to buy pumps at 25-40% lower prices.

This is the right model: what was once an external climate impact is now a revenue source; the carbon problem of the Northern Hemisphere subsidizes energy access in the Southern Hemisphere.

The carbon credit mechanism turns climate infrastructure into an asset class, enabling large-scale financing.

So, what happens next?

Why Aren’t These Companies Widespread Yet?

Why is the market so concentrated? Because operating the entire value chain is extremely difficult. You need to have:

- Expertise in hardware manufacturing;

- Supply chain covering dispersed markets;

- Last-mile distribution network (Sun King has 29,500 agents);

- Mobile payment integration capability;

- Credit scoring models for the unbanked;

- IoT/telemetry systems;

- Customer service in 10+ languages;

- Financing capability (equity, debt, securitization);

- Carbon market partnerships;

- Regulatory compliance across 40+ countries.

Most companies can do 2-3 of these, but winners can do them all.

This creates huge entry barriers and long-term moats. New entrants can’t compete with just cheaper panels—the real moat is full value chain execution.

Can This Model Scale?

Let’s do the math and see its potential:

- 600 million people in Sub-Saharan Africa lack reliable electricity;

- 570 million smallholder households in Africa;

- 900 million Africans use traditional stoves.

And this is just Africa—add Asia (1 billion without electricity), and the market size exceeds $300-500 billion.

But the key is: this number severely underestimates the opportunity. Solar systems are just the Trojan horse—the real business is the financial relationship with hundreds of millions of users.

Because what you’re actually building is a digital infrastructure layer that can support:

- Consumer loans (smartphones, motorcycles, appliances);

- Livestock/agricultural financing;

- Insurance products;

- Medical services;

- Educational services;

- Payment processing.

Therefore, the real total addressable market is the entire consumption expenditure of 600 million people about to enter the middle class.

Second-Order Effects After Scaling

Let’s zoom out: what happens when over 100 million people get electricity through this model?

- Children study at night → higher test scores → better jobs;

- Adults work at night → increased income;

- Farmers irrigate year-round → yields up 3-5 times → food security;

- Easy phone charging → access to mobile payments → improved financial inclusion;

- Widespread refrigeration → vaccine storage → disease prevention;

- Widespread refrigeration → longer shelf life for meat and dairy → less food waste;

- Goodbye to kerosene smoke → fewer respiratory diseases;

- Clean stoves → 600,000 fewer deaths from indoor pollution annually;

- Diesel replacement → improved air quality.

Now, Let’s Get to the Point

This is the template for 21st-century infrastructure: not government-led, not centralized, not 30-year mega-projects. Instead, it’s modular, distributed, digitally metered, remotely monitored, pay-as-you-go financed, carbon-subsidized, and deployed by private companies in competitive markets.

20th-century infrastructure model:

- Centralized power generation;

- Government-led;

- Large-scale project financing;

- 30-year construction cycles;

- Monopolistic utilities.

21st-century infrastructure model:

- Distributed/modular;

- Private sector-led;

- Pay-as-you-go financing;

- Deployment in days/weeks;

- Competitive markets.

This will be the way of the future.

Pessimistic Scenario Analysis

What could go wrong?

First, let’s be clear: this is not a panacea—pay-as-you-go solar works for households and smallholders, not for factories or heavy industry, and cannot fully replace the grid.

- Exchange rate risk: companies finance and buy hardware in dollars but collect payments in local currencies like naira/shilling. Currency collapse could destroy unit economics overnight.

- Political/regulatory risk: governments may impose loan restrictions, solar import tariffs, or subsidize the grid/diesel to protect state-owned utilities.

- Default risk: a 10% default rate looks good but is fragile—economic shocks, drought, or political instability could cause defaults to soar.

- Maintenance complexity: panels last 25 years, batteries 5 years, pumps may fail. Building a service network in rural Africa is costly.

- Carbon price volatility: in 2024, carbon credit prices crashed from $30/ton to $5/ton. If 25-40% of affordability relies on carbon revenue, price swings will hit hard.

- Grid competition risk: if governments really push grid construction (unlikely economically, but possible with enough subsidies).

- Supply chain bottlenecks: port congestion, customs delays, tariff swings, Chinese export controls, and last-mile logistics could delay installations, raise costs, and tie up working capital.

Interestingly, Sun King has started manufacturing locally in Africa, which will reduce $300 million in import spending over the next few years.

Optimistic Scenario Analysis

Pessimistic scenarios deserve attention, but let’s explore what happens if this model not only succeeds but explodes in growth.

The Cost Curve Hasn’t Peaked

Solar panel prices have dropped 99.5% in 45 years, but this may only be halfway.

Current status:

- China’s solar manufacturing capacity exceeds 600 GW (1GW = 1 billion W);

- Global annual demand is about 400 GW;

- Overcapacity → imminent price crash.

Future trends:

- Solar panels: $0.2/W → $0.1/W by 2030;

- Batteries: with sodium-ion battery scaling, costs drop another 50%;

- Complete home solar systems: $120-1,200 → $60-600.

A $60 entry-level system expands the target market from 600 million to 2 billion people. This is not just about electrifying rural Africa, but also bringing power to rural India, Bangladesh, Pakistan, Southeast Asia, and Latin America.

Development Finance Institutions Wake Up, Inject Massive Cheap Capital

Currently, these companies’ financing rates are 12-18%. What if development finance institutions truly do their job?

Ideal scenario:

- World Bank, IFC, British International Investment set up dedicated funds;

- Provide “de-risked” loans to mature operators like Sun King, SunCulture;

- Financing costs drop from 15% to 5-7%.

The breakthrough:

- Monthly payments drop 30-40%;

- Target market grows by 200 million+ users;

- Payback period shortens from 30 to 18-24 months;

- Companies deploy 3-5 times faster, with better unit economics.

This is just like what happened after Grameen Bank validated microcredit—billions in cheap capital flooded the market.

Network Effects Are Just Beginning

There’s a key factor everyone underestimates: large-scale social proof.

Growth flywheel:

- Village A: 3 households install solar;

- Neighbors see: kids studying at night, no kerosene smoke, phones always charged;

- Within 12 months, 30 households in Village A install solar;

- Nearby villages hear about it → sales agents flooded with orders;

- Company expands distribution to meet demand.

Data proves it:

- Since 2018, Sun King’s customer acquisition cost has dropped 60%;

- Reason: word of mouth, referral mechanisms—“my cousin has one”;

- In mature markets (like Kenya), over 40% of sales come from referrals.

When 20-30% of households in a region have solar, it becomes the default choice. You’re not an early adopter, but a laggard. This is exactly how mobile phones spread in Africa: after the tipping point, adoption curves grow exponentially.

The grid that never reached rural areas became a gift. While development experts spent 50 years debating how to extend 20th-century infrastructure to rural Africa, something more interesting happened: Africa built the 21st-century version directly.

Modular, distributed, digital, self-financed by users, subsidized by their reduced carbon emissions.

The solar punk future is not science fiction. It’s 23 million solar systems, 40 million beneficiaries, and, more importantly, what infrastructure should look like when you break free from the past.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Showcasing portfolios, following top influencers, one-click copy trading: When investment communities become the new financial infrastructure

The platforms building this layer of infrastructure are creating a permanent market architecture tailored to the way retail investors operate.

Ripple raised another $500 million—are investors buying $XRP at a discount?

The company raised funds at a valuation of $40 billions, but it already holds $80 billions worth of $XRP.

CoinShares: Net outflow of $1.17 billion from digital asset investment products last week.

Crypto Jumps On Trump’s $2,000 Dividend Announcement