Morning Brief | The US Senate has passed a procedural vote on the "end government shutdown plan"; About 4.64 million bitcoins have been moved out of dormant wallets this year; Monad token public sale will start on November 17

Overview of major market events on November 10.

Compiled by: ChainCatcher

Key News:

- The US Senate has passed a procedural vote on the "end government shutdown plan"

- Data: "Binance Life" market cap briefly surpassed $200 million, 24-hour increase of 25%

- Coinbase Institutional Report: October sell-off is a bottoming phase before the next rally, not the cycle top

- Trump announces at least $2,000 tariff dividend for Americans, triggering a rise in cryptocurrency prices

- CZ: Do not buy accounts I follow; if found being sold, I will unfollow immediately

- Bank of England proposes a £20,000 cap on individual stablecoin holdings

- Data: About 4.64 million bitcoin have been moved out of dormant wallets this year, worth over $500 billion

What important events happened in the past 24 hours?

US Senate passes procedural vote on "end government shutdown plan"

According to ChainCatcher, the US Senate has officially passed a new continuing appropriations bill, which will fund the government until January 30 to end the government shutdown. All votes have been counted, with 60 in favor and 40 against.

Data: "Binance Life" market cap briefly surpassed $200 million, 24-hour increase of 25%

According to ChainCatcher, possibly driven by market recovery and positive spot expectations, the market cap of "Binance Life" briefly surged to $212 million and is now reported at $200 million, with a 24-hour increase of over 25%. The current average price for the TOP10 holding addresses rose about 35% today, to approximately $0.151.

Other popular meme tokens on the BSC chain saw significant pullbacks after short-term increases. In addition, several addresses made large purchases of "Binance Life" on November 7, but most have sold off after profiting today.

Coinbase Institutional Report: October sell-off is a bottoming phase before the next rally, not the cycle top

According to ChainCatcher, Coinbase Institutional released a monthly report stating that the October sell-off was not the end of the cycle, but rather a necessary adjustment. Excess leverage has been cleared, fundamentals remain solid, and institutional investors are quietly returning. Smart money is gathering around EVM chains, risk-weighted assets (RWA), and yield protocols—indicating that investors are selectively reinvesting risk rather than exiting.

Main conclusions: Leverage levels have improved, but liquidity gaps remain; capital is rotating rather than flooding in—selective investment remains crucial; macro risks persist, but structural demand is strengthening. The institution believes this is a bottoming phase before the next rally, not the cycle top.

RootData: ERA will unlock tokens worth about $4.65 million in one week

According to ChainCatcher, citing token unlock data from Web3 asset data platform RootData, Caldera (ERA) will unlock about 18.08 million tokens worth approximately $4.65 million at 15:00 (UTC+8) on November 17.

Trump announces at least $2,000 tariff dividend for Americans, triggering a rise in cryptocurrency prices

According to ChainCatcher, after US President Trump announced a plan to pay most Americans a tariff dividend of "at least" $2,000, cryptocurrency prices saw a moderate increase.

BTC rose about 1.75% in the past 24 hours to above $103,000; ETH rose about 3.32% to above $3,487. This increase occurred after a generally weak weekly market, and the CoinDesk 20 Index also recovered from a nearly 15% weekly decline. However, experts note that the payment plan requires Congressional approval to be implemented, and current tariff revenues are far below the funds needed for the payments.

Data: James Wynn was liquidated 12 more times in the past 12 hours due to market rebound

According to ChainCatcher, citing Lookonchain monitoring, James Wynn (@JamesWynnReal) was liquidated 12 more times in the past 12 hours due to the market rebound. After experiencing 45 liquidations in the past two months, James Wynn once had a profitable trade, but instead of taking profits, he continued to increase his position and was eventually liquidated again. His account balance is now only $6,010.

CZ: Do not buy accounts I follow; if found being sold, I will unfollow immediately

According to ChainCatcher, Binance founder CZ posted a reminder to community members not to buy accounts he follows, stating that if he finds an account being sold, he will immediately unfollow it. He added that if anyone finds such accounts for sale, they can notify the team ("interns") via private message or comment. CZ stated that his following behavior is random, usually to support active, friendly, and informative people in the community.

Bank of England proposes a £20,000 cap on individual stablecoin holdings

According to ChainCatcher, the Bank of England proposes that 60% of assets backing stablecoins can be held in short-term UK government bonds, and at least 40% must be deposited at the Bank of England.

The Bank of England proposes a £20,000 cap on individual stablecoin holdings, with a £10 million cap for corporate stablecoin holdings.

Stablecoins transitioning from the UK Financial Conduct Authority (FCA) regulatory regime can have up to 95% of their reserve assets invested in short-term government bonds.

Data: About 4.64 million bitcoin have been moved out of dormant wallets this year, worth over $500 billion

According to ChainCatcher, citing Bitcoin.com News, on-chain analyst James Check shared data showing that about 4.64 million BTC (worth over $500 billion) have been moved out of dormant wallets this year. The analyst noted that this has contributed to bitcoin's sideways market trend to some extent.

Arthur Hayes: Bitcoin and ZEC are set to rise

According to ChainCatcher, BitMEX co-founder Arthur Hayes tweeted, "The US government is back to doing what it does best: printing money and handing out benefits. BTC and ZEC are set to rise."

US House Speaker Johnson: Believes there are enough votes to pass the temporary funding bill

According to ChainCatcher, citing Golden Ten Data,US House Speaker Johnson stated that he believes there are enough votes to pass the temporary funding bill.

Brazilian central bank official: Algorithmic stablecoins have been banned

According to ChainCatcher, citing Golden Ten Data, Brazilian central bank official Vivan stated that crypto companies should assess customer suitability before allowing complex crypto-related operations, algorithmic stablecoins have been banned, and the buying and selling of these assets is being prohibited. Agreements reached so far remain valid, but stablecoin activities must cease.

Currently, the tax situation for cryptocurrencies remains unchanged. The definition and time frame for taxing crypto transactions equivalent to foreign exchange trading will be determined by the tax authority.

Coinbase: Monad token public sale will start on November 17

According to ChainCatcher, Coinbase posted on social media that the Monad token public sale will start on November 17.

ChainCatcher previously reported, according to The Wall Street Journal, Coinbase will launch a token sale platform for retail investors, allowing purchases before tokens are listed on its exchange.

Meme Popularity Rankings

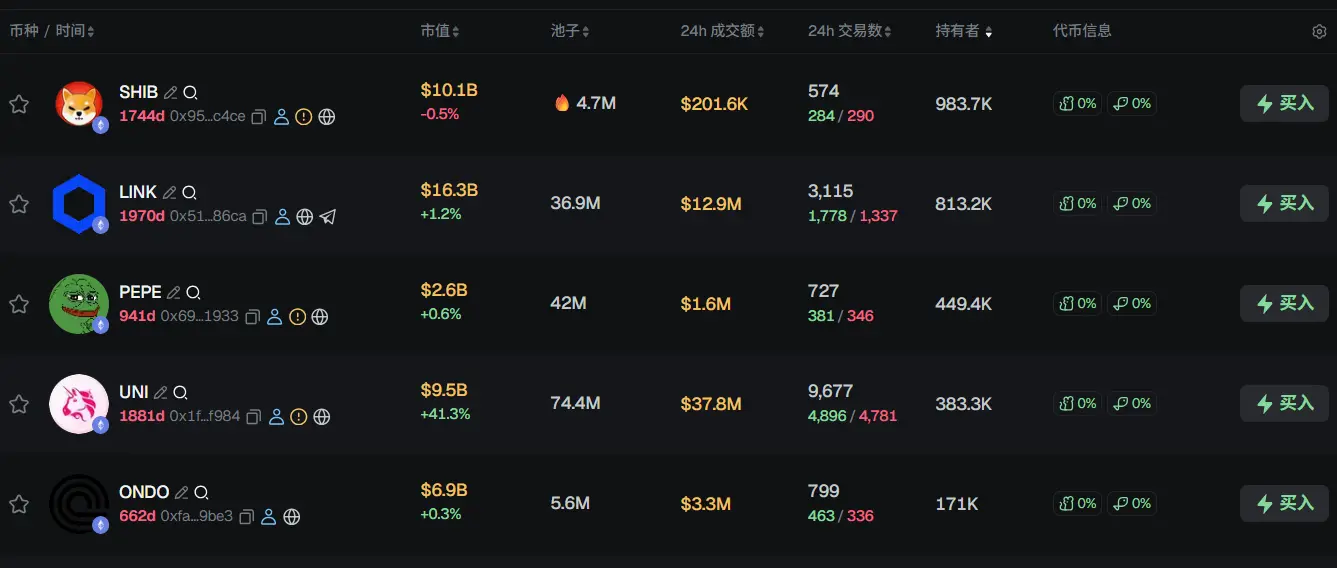

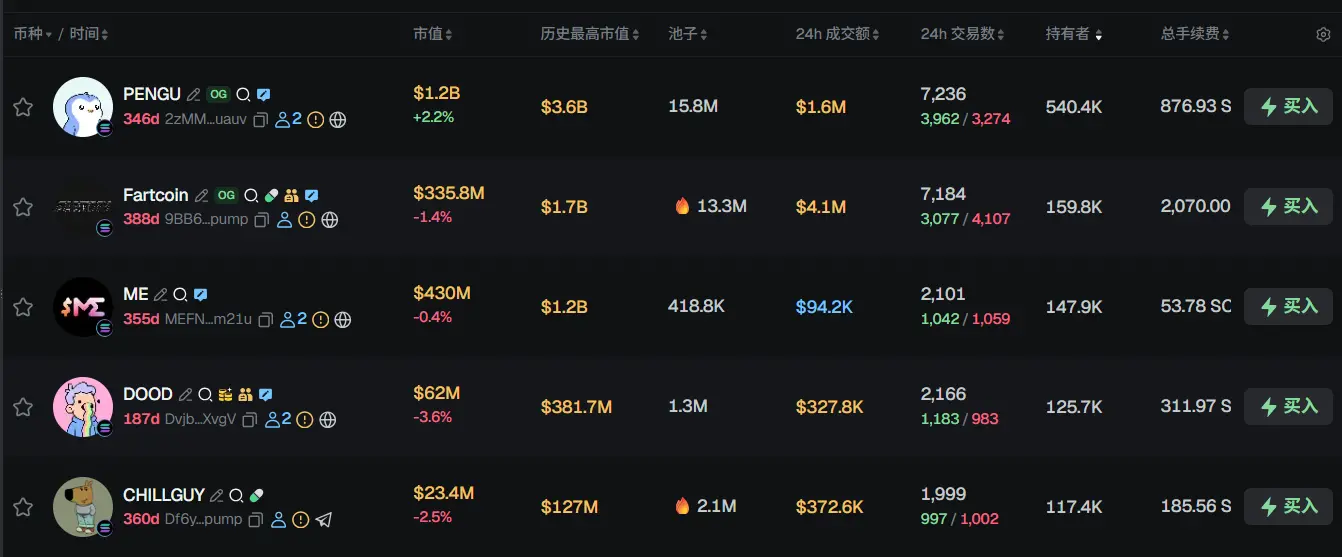

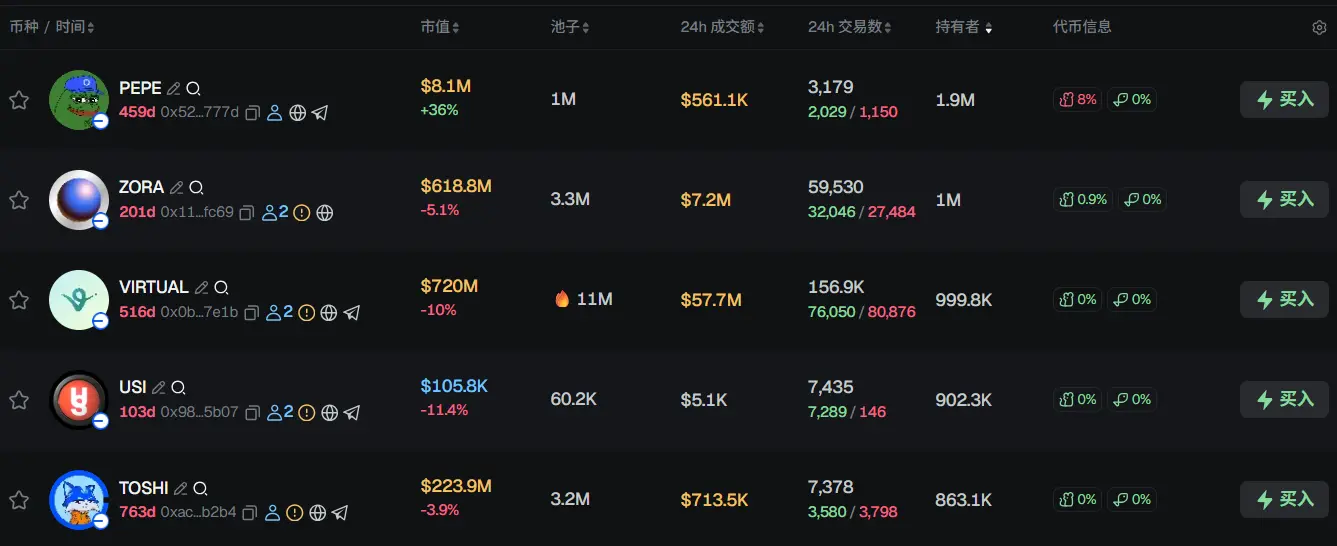

According to data from meme token tracking and analysis platform GMGN, as of 09:00 (UTC+8) on November 11,

The top five popular ETH tokens in the past 24h are: SHIB, LINK, PEPE, UNI, ONDO

The top five popular Solana tokens in the past 24h are: PENGU, Fartcoin, ME, DOOD, CHILLGUY

The top five popular Base tokens in the past 24h are: PEPE, ZORA, VIRTUAL, USI, TOSHI

What are some must-read articles from the past 24 hours?

Stop packaging high-risk financial products as stablecoins

The world of stablecoins has never lacked stories, but what it lacks is respect for risk. In November, stablecoins had another incident.

A so-called "stablecoin" named xUSD crashed on November 4, dropping from $1 to $0.26. As of today, it continues to fall, now at $0.12, evaporating 88% of its market cap.

$8 billion, 50 projects, the next Stream could appear at any time. Before that, remember the simplest common sense: when a product needs to attract you with ultra-high annualized returns, it is definitely not stable.

Who is rewriting the US dollar? The real battleground for stablecoin public chains

In the second half of 2025, the once somewhat abstract concept of stablecoin public chains is illuminated by two sets of very concrete numbers.

On one side is the recent two rounds of Stable deposit plans. The first round's quota was instantly filled by large holders; the second round was oversubscribed, with total deposits exceeding $2.6 billion and over 26,000 participating wallets. This shows that with a clear enough narrative and sufficiently certain assets, liquidity can migrate in a very short time.

On the other side is Plasma, which was the first to issue tokens and open its mainnet. Although its DeFi TVL has declined, it still ranks eighth among all public chains with about $2.676 billion, surpassing SUI, Aptos, OP, and other heterogeneous chains and L2 "big brothers," and is regarded as one of "the strongest projects of this cycle." Its founder, Paul Faecks, took the helm of this chain at just 26 years old, pushing Plasma into the spotlight overnight with a market cap in the billions and a highly "visionary" airdrop plan.

DASH, ZEC, and ICP and other old coins collectively "revived"—is this capital nostalgia or a precursor to a new narrative?

In recent days, the broader market has continued to weaken, yet a group of "old coins" have bucked the trend and surged, creating their own frenzy.

As mainstream narratives lose steam, these long-dormant names have reappeared at the top of the gainers list. They are not the creators of new stories, but shine again amid the ruins of the old era. Some see this as "veterans returning," while others think it's just a temporary curiosity from new capital. In any case, in a period of low liquidity and few hot topics, the unexpected stirrings of old projects have become a mirror reflecting market sentiment.

Rewriting the 2018 script: Will the end of the US government shutdown = a bitcoin price surge?

Looking back at the US government shutdown and bitcoin prices, the 35-day shutdown in 2018-2019 (then the longest on record) occurred at the end of the crypto bear market, with bitcoin falling from about $4,014 to a low of $3,600, a drop of about 6-10%, reflecting the general sell-off of risk assets during economic uncertainty. After the shutdown ended and the government reopened in early 2019, bitcoin rose for seven consecutive days, kicking off a five-month surge of nearly 300%, rebounding from the low to above $5,000.

The current market environment is very different, with institutional funds brought by ETFs, global monetary policy divergence, and uncertainties from the Trump administration—all factors that may make this rebound trajectory different from the past. History can be referenced, but cannot be completely replicated.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Essence of Bitcoin and AI

Liberalism gives vitality to Bitcoin; democratization gives it scale. The network effect is the invisible bridge connecting the two, and also proves that freedom grows through participation.

Trump's pressure works! India's five major refineries suspend orders for Russian oil

Due to Western sanctions and US-India trade negotiations, India significantly reduced its purchases of Russian crude oil in December, with its five major core refineries placing no orders.

Masayoshi Son takes action! SoftBank sells all its Nvidia shares, cashing out $5.8 billions to shift towards other AI investments

SoftBank Group has completely sold its Nvidia holdings, cashing out $5.8 billions. Founder Masayoshi Son is shifting the strategic focus, allocating more resources to the artificial intelligence and chip-related sectors.

Research Report|In-Depth Analysis and Market Cap of Allora Network (ALLO)